Brazil Ultrasound Devices Market

Brazil Ultrasound Devices Market Size, Share, and COVID-19 Impact Analysis, By Application (Anesthesiology, Cardiology, Gynecology/Obstetrics, Radiology, Other), By Technology (2D Ultrasound Imaging, 3D and 4D Ultrasound Imaging), By Type (Stationary Ultrasound, Portable Ultrasound), and Brazil Ultrasound Devices Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Ultrasound Devices Market Insights Forecasts to 2035

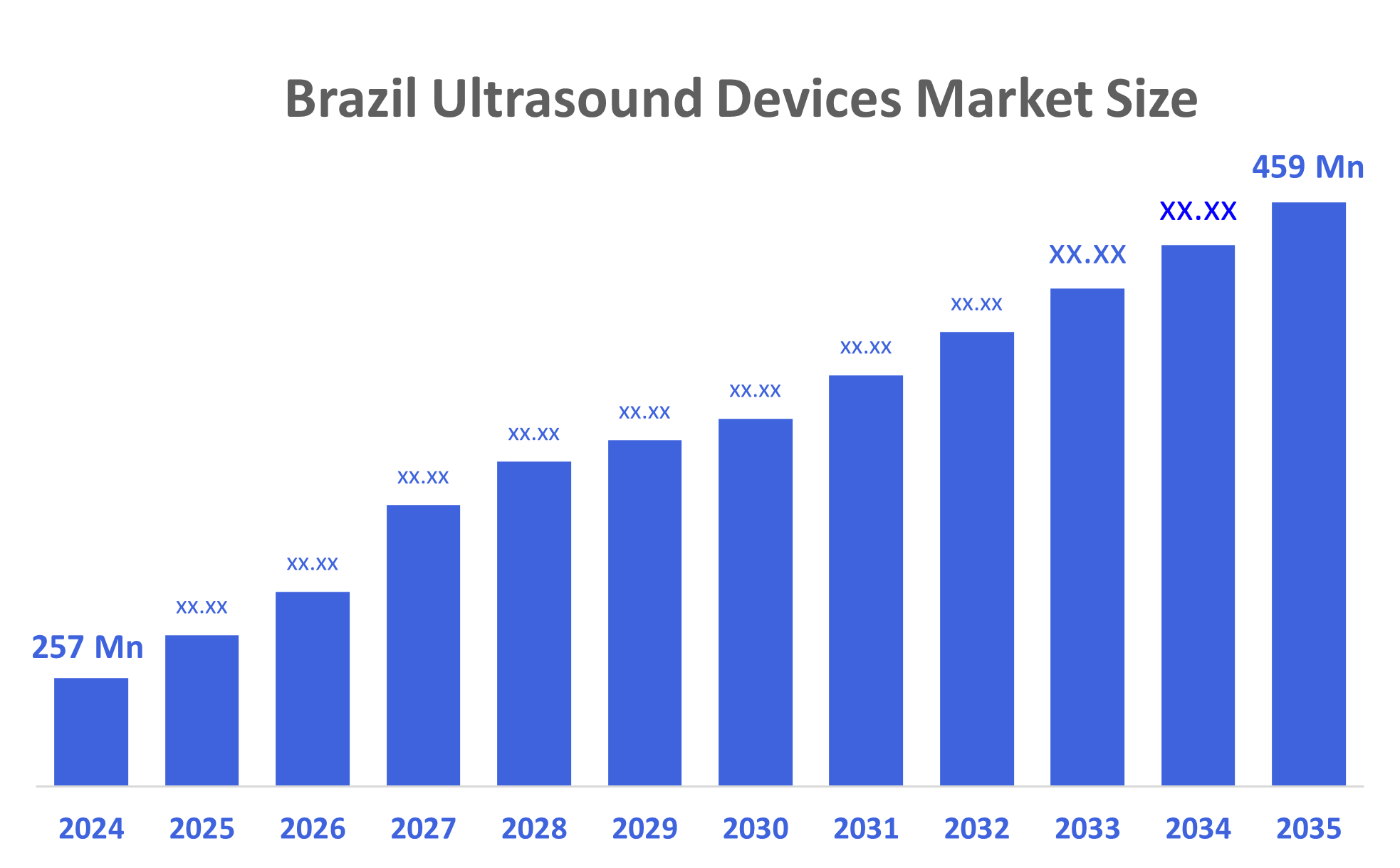

- The Brazil Ultrasound Devices Market Size Was Estimated at USD 257 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.4% from 2025 to 2035

- The Brazil Ultrasound Devices Market Size is Expected to Reach USD 459 Million by 2035

According to a research report published by Decisions Advisors, The Brazil Ultrasound Devices Market Size is Anticipated to Reach USD 459 Million by 2035, Growing at a CAGR of 5.4% from 2025 to 2035. The market is growing rapidly, driven by expanding healthcare infrastructure and rising demand for non-invasive diagnostic solutions. Technological advancements, including portable and AI-integrated systems, are increasingly adopted, thereby contributing positively to market growth. Early diagnosis across various medical fields, rising healthcare expenditure, a growing aging population in the country, and ongoing advancements in medical technology represent some of the key factors driving the market.

Market Overview

Ultrasound devices are used to diagnose the imaging of the patient's body by the use of very high-frequency sound waves, which allow for live images of the person's organs, tissues, and blood vessels to flow to the physician for observation. Some applications in diagnostic medicine include: An ultrasound device is a safe, non-invasive, and radiation-free device that gives doctors immediate access to quick, accurate visualisation of internal organs and tissues to facilitate diagnosis and treatment. In addition, in Brazil, one of the major factors contributing to the expansion of the ultrasound devices market is the amount of financial resources made available by the Government; through the (Ministry of Health) Federal Government's commitment to supporting the use of new technologies through funding for primary health care and the expansion of Public Health Diagnostic Services, the introduction of newer, advanced diagnostic equipment and overall, the promotion of maternal health, the improvement of Primary Care, and Early Disease Detection. Newer ultrasound technologies available in Brazil include Portable Hand-held Devices, AI Imaging, 3D-4D Ultrasound, and Wireless Devices for Remote Medical Diagnostics, which enable higher-quality images to be obtained, increased speed, greater access, and ultimately allow for more extensive use in both urban and low-resource health systems. An example of this is the Rede D`Or, not to make Radiology more effective and to improve patient access to Radiology by using Imaging 360 solutions; New and expanding governmental programs continue to drive increased use of innovative and cost-effective ultrasound technologies throughout Brazil. Some of the example programs that are being implemented today.

Report Coverage

This research report categorizes the market for the Brazil ultrasound devices market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil ultrasound devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil ultrasound devices market.

Driving Factors

Driving factors in the Brazil ultrasound devices market include rapid adoption of new technologies such as portable ultrasound systems, AI-based image enhancement, and advanced 3D/4D imaging. Growing demand for point-of-care diagnostics, rising focus on early disease detection, and expansion of tele-ultrasound services also support market growth. Additionally, increasing investments in healthcare infrastructure and the shift toward minimally invasive diagnostic trends further accelerate ultrasound adoption across hospitals and clinics.

Restraining Factors

Restraining factors in the Brazil ultrasound devices market include high equipment costs, budget limitations in public hospitals, and uneven access to advanced technologies in rural regions. Shortages of skilled sonographers, maintenance challenges, and slower replacement cycles also hinder widespread adoption, limiting the pace of technological upgrades across healthcare facilities.

Market Segmentation

The Brazil ultrasound devices market share is categorized by application, technology, and type.

- The gynecology/obstetrics segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil ultrasound devices market is segmented by application into anesthesiology, cardiology, gynecology/obstetrics, radiology, and other. Among these, the gynecology/obstetrics segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by ultrasound is an essential tool in maternal and fetal healthcare. Brazil has a high number of annual pregnancies, and government-supported prenatal programs require frequent imaging for fetal growth monitoring, anomaly detection, and pregnancy risk assessment. Both public and private hospitals prioritize maternal diagnostics, increasing the demand for high-accuracy and portable ultrasound systems. The cultural emphasis on routine prenatal check-ups further strengthens the segment’s leading position.

- The 2D ultrasound imaging segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil ultrasound devices market is segmented by technology into 2D ultrasound imaging, 3D, and 4D ultrasound imaging. Among these, the 2D ultrasound imaging segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to remaining the most affordable, accessible, and versatile technology for routine diagnostics. It provides reliable, real-time imaging for prenatal care, cardiac assessments, abdominal scans, and emergency evaluations. Hospitals and clinics, especially in resource-limited areas, prefer 2D systems due to lower costs, easier maintenance, and widespread operator familiarity, making it the primary choice despite advancements in 3D and 4D imaging.

- The stationary ultrasound segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil ultrasound devices market is segmented by type into stationary ultrasound and portable ultrasound. Among these, the stationary ultrasound segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to large hospitals and diagnostic centers that rely on high-performance, full-featured systems for accurate imaging across specialties such as radiology, cardiology, and obstetrics. These devices provide superior image quality, advanced functionalities, and better workflow integration. Their durability, suitability for high patient volumes, and compatibility with comprehensive diagnostic procedures keep them preferred over portable options, despite growing interest in mobility-focused solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil ultrasound devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GE Healthcare

- Siemens Healthineers

- Philips Healthcare

- Canon Medical Systems

- Fujifilm Sonosite

- Samsung Medison

- Mindray Medical

- Esaote S.p.A.

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments and News

- In July 2024, Philips Foundation and SAS Brasil launched an innovative lab in Brazil focusing on digital health education and ultrasound training for remote communities. The initiative aims to train 3,600 healthcare workers, enhance access to specialized care, and promote policy changes to improve primary healthcare services across the country.

- In May 2024, CARPL.ai and Philips announced their partnership to enhance radiology diagnostics in Brazil, addressing the shortage of radiologists. Their integration of AI with Philips' imaging solutions aims to boost efficacy and patient outcomes. This collaboration was highlighted at the 54th Jornada Paulista de Radiologia, focusing on expedited diagnosis and workflow optimization.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil ultrasound devices market based on the below-mentioned segments:

Brazil Ultrasound Devices Market, By Application

- Anesthesiology

- Cardiology

- Gynecology/Obstetrics

- Radiology

- Other

Brazil Ultrasound Devices Market, By Technology

- 2D Ultrasound Imaging

- 3D and 4D Ultrasound Imaging

Brazil Ultrasound Devices Market, By Type

- Stationary Ultrasound

- Portable Ultrasound

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 225 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |