Brazil Urinary Tract Infection Testing Market

Brazil Urinary Tract Infection Testing Market Size, Share, and COVID-19 Impact Analysis, By Infection Type (Urethritis, Cystitis, Pyelonephritis), Test Type (Urinalysis, Urine Cultures, Susceptibility Testing), and Brazil Urinary Tract Infection Testing Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Urinary Tract Infection Testing Market Insights Forecasts to 2035

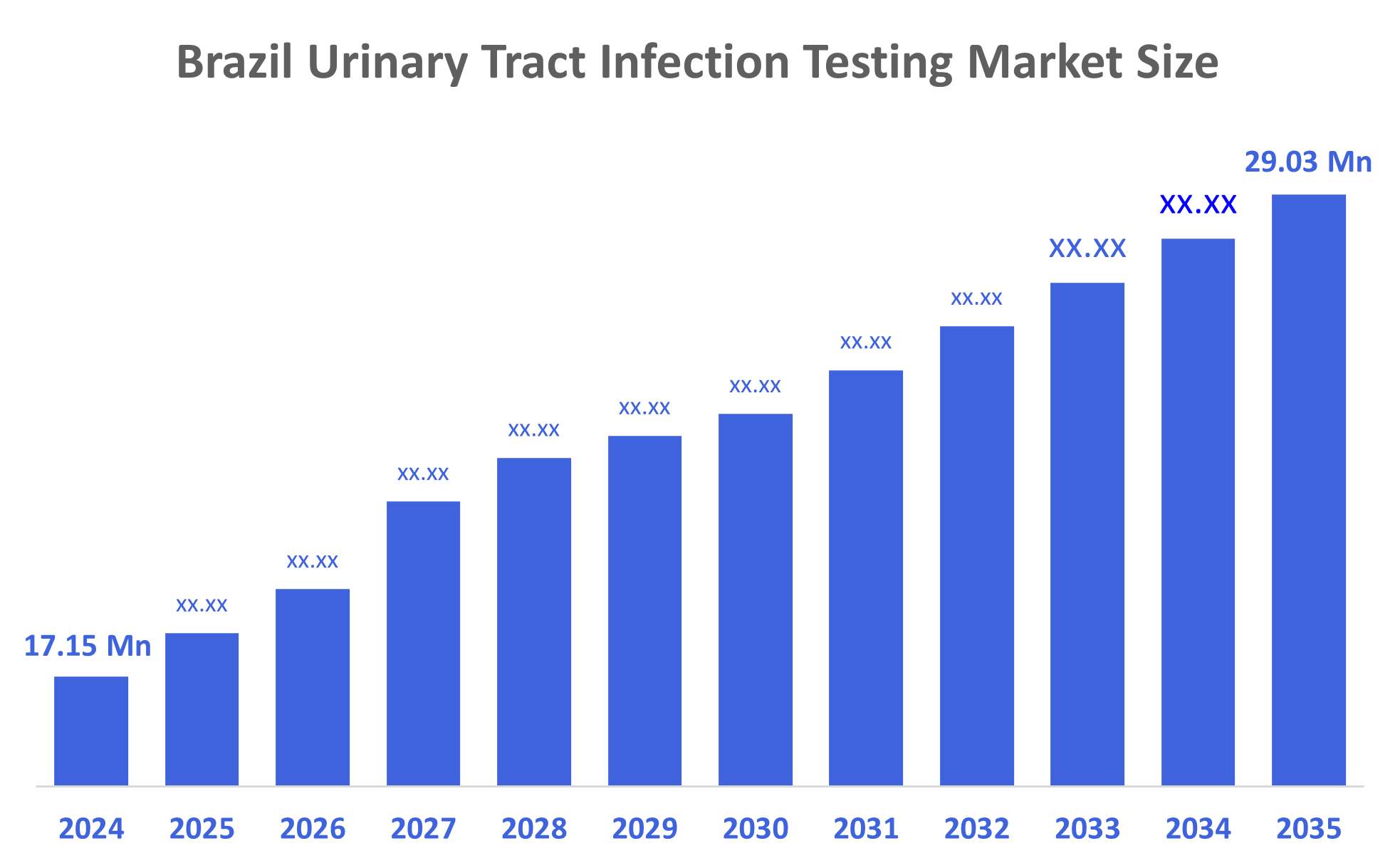

- The Brazil Urinary Tract Infection Testing Market Size Was Estimated at USD 17.15 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.9% from 2025 to 2035

- The Brazil Urinary Tract Infection Testing Market Size is Expected to Reach USD 29.03 Million by 2035

According to a research report published by Decisions Advisors, The Brazil Urinary Tract Infection Testing Market Size is Anticipated to Reach USD 29.03 Million by 2035, Growing at a CAGR of 4.9% from 2025 to 2035. The Brazil urinary tract infection (UTI) testing market is driven by rising UTI cases, better awareness about early diagnosis, expanding healthcare access, improved laboratory technology, and growing use of rapid testing methods that help doctors detect infections quickly and begin treatment faster.

Market Overview

Urinary Tract Infection (UTI) testing refers to medical tests that check urine to find out if harmful bacteria are causing an infection in the urinary system. It includes simple urine checks and lab tests that help doctors confirm the infection and decide the right treatment for patients. Additionally, the Brazil urinary tract infection testing market is growing due to rising UTI cases, better public awareness, increasing use of rapid diagnostic kits, expanding healthcare infrastructure, and improved access to laboratory services. Higher demand for early and accurate detection also supports market growth, especially in urban and primary care settings. Furthermore, the Brazilian government has been focusing on strengthening public health services, which include increased support for diagnostic testing, especially for infectious diseases like UTIs. This has led to higher testing volumes and a growing number of diagnostic laboratories equipped with modern urine analyzers. Government initiatives also emphasize early diagnosis and prevention, which further drives market growth.

Additionally, Brazil’s National Plan for Antimicrobial Resistance Prevention and Control works in coordination with the Ministry of Health to strengthen diagnostic capacity and ensure appropriate use of antibiotics, which includes supporting expanded UTI testing to combat rising resistance rates. There is a growing focus on integrating advanced technologies, such as rapid multiplex molecular tests and AI-driven diagnostics, into public health systems to improve the accuracy and speed of UTI detection. Furthermore, Brazil’s UTI testing market is advancing with molecular diagnostics, automation, AI, and point-of-care devices, enabling rapid, accurate, and decentralized testing. These technologies improve diagnostic speed, accuracy, and accessibility, supporting better patient outcomes and driving market growth through enhanced workflow efficiency and remote monitoring capabilities.?

Report Coverage

This research report categorizes the market for the Brazil urinary tract infection testing market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil urinary tract infection testing market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil urinary tract infection testing market.

Driving Factors

The Brazil urinary tract infection testing market is driven by the rising incidence of UTIs across all age groups, especially among women and older adults. Growing awareness about early diagnosis, improved access to healthcare facilities, and government efforts to strengthen primary care also support demand. The increasing adoption of rapid diagnostic kits, point-of-care testing solutions, and advanced laboratory technologies enhances accuracy and speeds up detection. Additionally, expanding private laboratories, improving insurance coverage, and the need to reduce antibiotic misuse further encourage timely UTI testing, boosting overall market growth.

Restraining Factors

The Brazil urinary tract infection testing market faces restraints such as limited access to advanced diagnostics in rural areas, high costs of specialized tests, and delays in laboratory processing. Low awareness in remote regions, inconsistent healthcare infrastructure, and reliance on self-medication also reduce the demand for timely and proper UTI testing.

Market Segmentation

The Brazil urinary tract infection testing market share is categorized by infection type and test type.

- The cystitis segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil urinary tract infection testing market is segmented by infection type into urethritis, cystitis, and pyelonephritis. Among these, the cystitis segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the most common type of UTI, particularly among women, who experience higher infection rates due to anatomical factors. Bladder infections occur more frequently than urethritis and pyelonephritis, resulting in a higher volume of diagnostic testing. The symptoms of cystitis, such as pain during urination and frequent urge to urinate, encourage quicker medical consultation, increasing testing demand. Additionally, public health awareness campaigns and improved access to primary care help promote early detection, further boosting the dominance of the cystitis segment.

- The residential segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil urinary tract infection testing market is segmented by test type into urinalysis, urine cultures, and susceptibility testing. Among these, the residential segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to the fastest, simplest, and most cost-effective method for initial UTI detection. Healthcare providers rely on it as a first-line test due to its ability to quickly identify signs of infection, such as bacteria, leukocytes, and nitrites. Its availability in clinics, hospitals, and primary care centers makes it widely accessible across urban and semi-urban regions. Since most patients with UTI symptoms undergo urinalysis before more advanced tests like cultures or susceptibility testing, it generates the highest testing volume, ensuring its leading market share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil urinary tract infection testing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Roche Diagnostics

- Siemens Healthineers

- Bio-Rad Laboratories

- Thermo Fisher Scientific

- Abbott Laboratories

- Becton, Dickinson and Company (BD)

- bioMérieux

- Quidel Corporation

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

June 2023: Sysmex Corporation introduced a new testing system in Europe, referred to as ‘the System,’ for the quick identification of antimicrobial susceptibility. Using urine samples from individuals suspected of suffering from UTIs, the System determines if bacteria are present or absent and evaluates the efficacy of antimicrobials.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil urinary tract infection testing market based on the below-mentioned segments:

Brazil Urinary Tract Infection Testing Market, By Infection Type

- Urethritis

- Cystitis

- Pyelonephritis

Brazil Urinary Tract Infection Testing Market, By Test Type

- Urinalysis

- Urine Cultures

- Susceptibility Testing

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 225 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |