Brazil Vacuum Blood Collection Tube Market

Brazil Vacuum Blood Collection Tube Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Gel and Clot Activator Tube, Heparin Tubes, EDTA Tubes, Glucose Tubes, Serum Separating Tubes, and ERS Tubes) By Application (Biochemical Test, Blood Routine Examination, Coagulation Testing, Blood Segmentation Testing, and Others), and Brazil Vacuum Blood Collection Tube Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Vacuum Blood Collection Tube Market Size Insights Forecasts to 2035

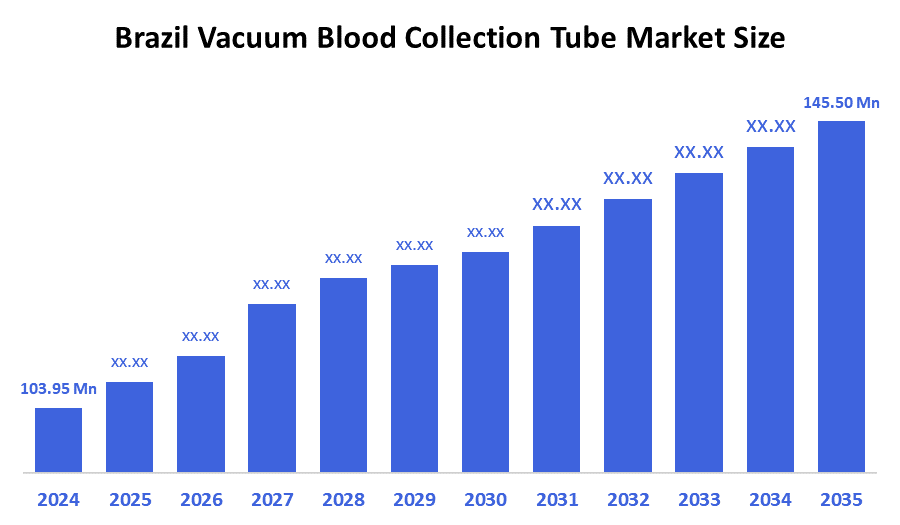

- The Brazil Vacuum Blood Collection Tube Market Size was estimated at USD 108.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.31% from 2025 to 2035

- The Brazil Vacuum Blood Collection Tube Market Size is Expected to Reach USD 139.5 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Germany Cryptocurrency Market Size is anticipated to Reach USD 139.5 Million by 2035, Growing at a CAGR of 2.31% from 2025 to 2035. The Brazil vacuum blood collection tube market is driven by increase an aging population, the increasing adoption of preventative healthcare, expanding point-of-care testing, an increase in the awareness of early disease detection through education and marketing, the growth of medical tourism, an increase in demand for analytical tools from Research Institutions and biopharmaceutical clinical trials.

Market Overview

Vacuum blood collection systems include vacuum-blood collection tubes made from pre-sterilized glass and plastic materials and containing rubber stoppers at one end. When used in conjunction with a needle holder, vacuum collection systems allow for accurate blood sampling from the vein for laboratory testing. Additionally, there are many opportunities for growth in the Brazilian vacuum blood collection tube market because of an increasing number of diagnosis tests, more dollars spent on public healthcare, streamlining of regulations, increased demand for safe enhanced tubes, potential for local manufacture, and compatible products with automated systems. The Brazilian practice of using vacuum blood collection tubes is supported by a few government programs including increased public healthcare budgets through SUS, centralization of procurement for diagnostic testing, diagnostic expansion initiatives, and manufacture incentives, and a less complicated ANVISA registration process for medical devices.

Report Coverage

This research report categorizes the market for the Brazil vacuum blood collection tube market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil vacuum blood collection tube market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil vacuum blood collection tube market.

Driving Factors

The Brazil Vacuum blood collection tube market is driven by the increasing need for diagnostic tests resulting from an increasing number of chronic illnesses and infectious diseases, the increased number of hospitals and private labs, increased government spending on healthcare through SUS, increased consumer access to routine health checkups. Other factors driving the growth of this market include advancements in technology that have improved automated laboratory systems, a preference for safety-engineered and contamination-free tubes, and a more efficient ANVISA regulatory process which encourages the greater use of vacuum blood collection tubes across different types of healthcare facilities.

Restraining Factors

The Brazil vacuum blood collection tube market is restrained by significant import dependence, price sensitivity regarding public health purchases, and compliance costs associated with complying with ANVISA's regulations. The lack of domestic manufacturing, issues related to transportation, and competition from low-cost suppliers all limit potential profit margins and slow down the adoption of premium and innovative tube products.

Market Segmentation

The Brazil vacuum blood collection tube market share is classified into type and application.

- The serum separating tube segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil vacuum blood collection tube market is segmented by type into serum separating tube, plasma separation tube, EDTA tube, rapid serum tube, coagulation tube, and others. Among these, the serum separating tube segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven because they are necessary for performing routine biochemical, immunological, and serological testing. Serum separator tubes offer greater quality of serum, increased processing speed, and a higher compatibility with automated laboratory equipment compared to other types of tubes. As a result, they are chosen as a preferred materials by most large private diagnostic laboratories and public hospitals that operate under the Unified Health System.

- The serology and immunology segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil vacuum blood collection tube market is segmented by application into serology and immunology, blood routine examination, coagulation tests, genetic studies, blood sugar assay, and others. Among these, the serology and immunology segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is due to an increase in the number of people affected by infectious diseases and chronic conditions, more preventive health assessments, more widespread implementation of testing through the Federal Government's Public Health Programme, a greater demand for testing by the large commercial laboratories, and an increase in the use of automated immunoassay systems in hospitals and commercial laboratories.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil vacuum blood collection tube market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Becton, Dickinson, and Company

- Greiner Bio?One International GmbH

- Terumo Corporation

- Sarstedt AG & Co. KG

- Nipro Corporation

- Cardinal Health

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil Vacuum Blood Collection Tube Market based on the below-mentioned segments:

Brazil Vacuum Blood Collection Tube Market, By Type

- Serum Separating Tube

- Plasma Separation Tube

- EDTA Tube

- Rapid Serum Tube

- Coagulation Tube

- Others

Brazil Vacuum Blood Collection Tube Market, By Application

- Serology and Immunology

- Blood Routine Examination

- Coagulation Tests

- Genetic Studies

- Blood Sugar Assay

- Others

FAQ’s

Q: What is the Brazil vacuum blood collection tube market?

A: Brazil vacuum blood collection tube market size is expected to grow from USD 108.5 million in 2024 to USD 139.5 million by 2035, growing at a CAGR of 2.31% during the forecast period.

Q: The Brazil vacuum blood collection tube market covered in which segments?

A: The Brazil vacuum blood collection tube market is segmented by type into serum separating tube, plasma separation tube, EDTA tube, rapid serum tube, coagulation tube, and others and application into serology and immunology, blood routine examination, coagulation tests, genetic studies, blood sugar assay, and others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 213 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |