Brazil Water Bottle Market

Brazil Water Bottle Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Spring Water, Mineral Water, Purified Water, Sparkling Water, Alkaline Water, Flavored Water, Functional Water), By Packaging (Plastic Bottles, Glass Bottles, Cans, Tetra Paks, and Cartons), and Brazil Water Bottle Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Water Bottle Market Insights Forecasts to 2035

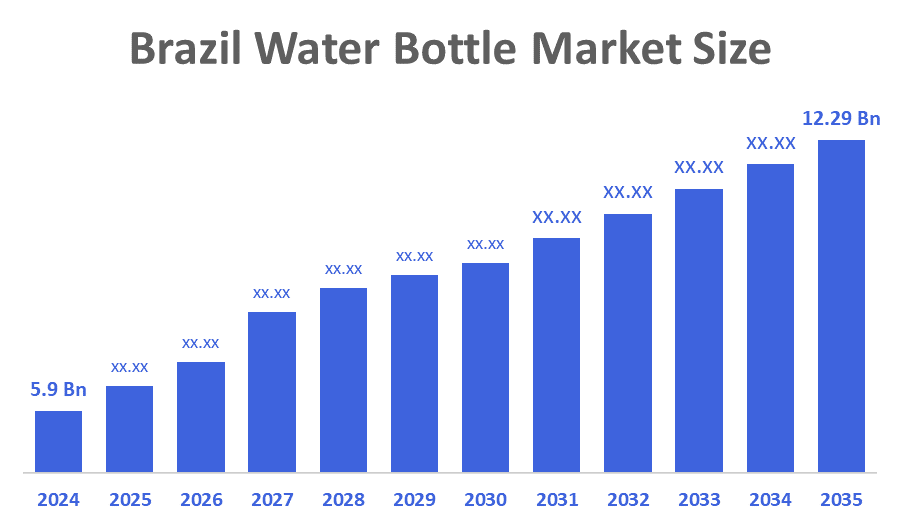

- The Brazil Water Bottle Market Size Was Estimated at USD 5.9 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.9% from 2025 to 2035

- The Brazil Water Bottle Market Size is Expected to Reach USD 12.29 Billion by 2035

According to a research report published by Decision Advisior & Consulting, the Brazil Water Bottle Market size is anticipated to reach USD 12.29 billion by 2035, growing at a CAGR of 6.9% from 2025 to 2035. The Brazil water bottle market is driven by rising health and fitness awareness, increasing demand for reusable and eco-friendly products, growing outdoor and sports activities, urbanization, and expanding e-commerce channels offering wider product availability and convenience.

Market Overview

A water bottle is a container used to hold water or drinks so people can carry them easily. It is made from materials like plastic, steel, or glass and helps people stay hydrated at home, school, work, travel, or during exercise. Additionally, the growth of the Brazilian water bottle market is supported by rising health awareness, increasing preference for reusable bottles, environmental concerns over plastic waste, growth in sports and fitness activities, urban lifestyles, and easy availability of bottles through online and retail stores. For instance, in 2024, more than 6.621 million visitors selected Brazilian locations for their vacations or work-related travels, surpassing the previous record from 2018, when 6.6 million international tourists came. With the country’s famous beaches, rainforests, and vibrant cities attracting millions of tourists every year, the need for bottled water is high.

Government regulations governing the bottling and distribution of drinking water play a significant role in shaping the bottled water processing market in Brazil. Policies related to water quality standards, packaging requirements, and labeling regulations ensure consumer safety and product integrity. Additionally, initiatives promoting access to clean drinking water in underserved regions drive market demand and expansion. Furthermore, Technology innovation in the Brazil water bottle market includes smart bottles that track water intake, insulated bottles with advanced temperature control, lightweight and durable materials, leak-proof designs, and eco-friendly manufacturing. These innovations improve convenience, hygiene, durability, and support healthier hydration habits.

Report Coverage

This research report categorizes the market for the Brazil water bottle market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil water bottle market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil water bottle market.

Driving Factors

The Brazil water bottle market is driven by rising health and hydration awareness among consumers, increasing participation in sports, fitness, and outdoor activities, and growing concern about environmental sustainability. The shift away from single-use plastic toward reusable bottles supports market growth. Urbanization, busy lifestyles, and the need for portable drinking solutions further boost demand. In addition, product innovations such as insulated, lightweight, and smart water bottles enhance consumer appeal. Expanding e-commerce platforms and retail availability across Brazil also contribute significantly to market growth.

Restraining Factors

The Brazil water bottle market is restrained by the availability of low-cost single-use plastic bottles, price sensitivity among consumers, and limited awareness of premium or smart bottles. Fluctuating raw material prices, competition from unorganized local manufacturers, and concerns over product durability also limit market growth.

Market Segmentation

The Brazil water bottle market share is categorized by product type and packaging.

- The purified water segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil water bottle market is segmented by product type into spring water, mineral water, purified water, sparkling water, alkaline water, flavored water, and functional water. Among these, the purified water segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by its affordability, wide availability, and strong consumer trust in its safety and quality. It is commonly used for daily consumption by households, offices, and commercial spaces. Growing urbanization, concerns about tap water quality, and increasing demand for reliable drinking water further support the high consumption of purified bottled water across Brazil.

- The plastic bottles segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil water bottle market is segmented by packaging into plastic bottles, glass bottles, cans, tetra pak, and cartons. Among these, the plastic bottles segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to its low cost, lightweight nature, and convenience for transportation and storage. They are widely used by manufacturers and preferred by consumers for daily and on-the-go consumption. Strong distribution across retail outlets, availability in multiple sizes, and suitability for single-use and bulk packaging further support the dominance of plastic bottles in Brazil.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil water bottle market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Coca-Cola FEMSA Brasil

- PepsiCo Brasil

- Nestlé Waters Brasil

- Danone Brasil

- Ambev

- Minalba Brasil

- Grupo Edson Queiroz (Indaiá)

- Grupo Petrópolis

- Heineken Brasil

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent News

- In June 2024, Canmaker Trivium Packaging teamed up with Spa Mineral Saúde pelo Água to launch Brazil's first mineral water in aluminum bottles.

- In January 2024, Minalba Brasil, a beverage entity of the Edson Queiroz Group (GEQ), released Indaiá mineral water in 269 ml aluminum cans, available in both sparkling and still options. The cans featured Braille information on the lid, an initiative designed to enhance accessibility for more than 6.5 million people with visual disabilities in Brazil.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decision Advisior has segmented the Brazil water bottle market based on the below-mentioned segments:

Brazil Water Bottle Market, By Product Type

- Spring Water

- Mineral Water

- Purified Water

- Sparkling Water

- Alkaline Water

- Flavored Water

- Functional Water

Brazil Water Bottle Market, By Packaging

- Plastic Bottles

- Glass Bottles

- Cans

- Tetra Paks

- Cartons

FAQ’s

1. What is driving the growth of the Brazil water bottle market?

- Rising health awareness, demand for safe drinking water, urbanization, and preference for convenient hydration solutions are key growth drivers.

2. Which product type dominates the market?

- Purified water dominates due to its affordability, wide availability, and consumer trust in quality and safety.

3. Which packaging type is most widely used?

- Plastic bottles dominate because they are lightweight, low-cost, and easy to transport and store.

4. What trends are shaping the market?

- Growing demand for eco-friendly packaging, functional and flavored water, and innovative bottle designs is influencing market trends.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 199 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |