Brazil Water Purifier Market

Brazil Water Purifier Market Size, Share, and COVID-19 Impact Analysis, By Type (Gravity Purifiers, RO Purifiers, UV Purifier, Sediment Filter, Water Softener, and Others), By Application (Retail Stores, Direct Sales, and Online), and Brazil Water Purifier Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Water Purifier Market Size Insights Forecasts to 2035

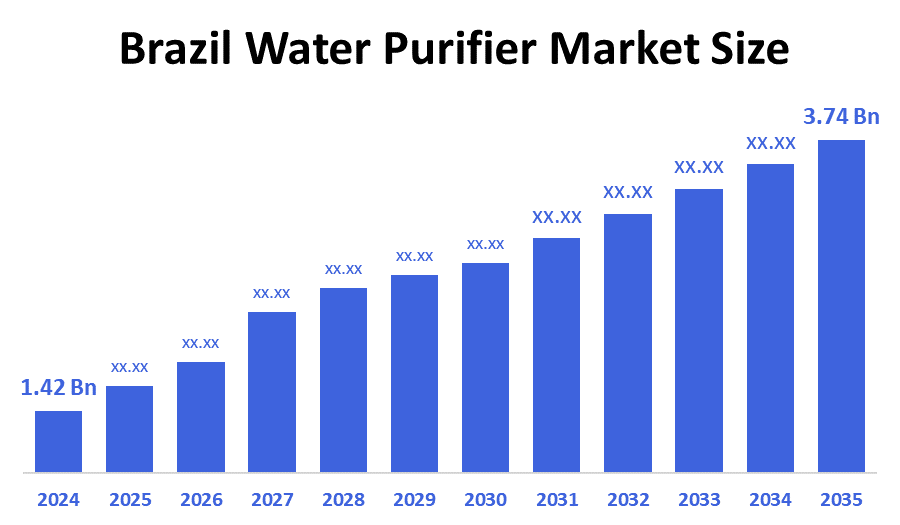

- The Brazil Water Purifier Market Size was estimated at USD 1.3 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.28 % from 2025 to 2035

- The Brazil Water Purifier Market Size is Expected to Reach USD 3.12 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Brazil Water Purifier Market Size is anticipated to Reach USD 3.12 Billion by 2035, Growing at a CAGR of 8.28 % from 2025 to 2035. The Water purifier market is driven by increasing costs of bottled water, growing use of rental & subscription water purifiers, an expanding eCommerce presence for these companies, an increasing presence of hospitality and health care services, and more awareness surrounding the long-term cost saving benefits of using an in-home water purifier system.

Market Overview

The Water purifier market consists of various products, systems, and technologies produced, distributed, and sold worldwide that remove physical, chemical, or biological contaminants from water. These services provide safe, clean, and drinkable water for homes, businesses, industries, and municipalities. Additionally, there are also opportunities to create sustainable, low-power systems for residential and commercial use, reduce plastic waste, and appeal to younger, environmentally savvy consumers looking for a clean drinking supply with little or no negative impact on the environment. Additionally, the national sanitation plan PLANSAB developed by the government of Brazil seeks to provide clean drinking water to people across Brazil primarily in rural and underserved communities. With investments into water infrastructure supporting increased demand for water purification systems. Furthermore, all these initiatives will fuel the growth of the water purifier market in Brazil, providing many opportunities for water purifier manufacturers and suppliers to target their growing consumer base.

Report Coverage

This research report categorizes the market for the Brazil water purifier market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil water purifier market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil water purifier market.

Driving Factors

The Brazil water purifier industry is driven by growing public health and clean drinking water concerns caused by urban pollution, Industry wastes, and Waterborne diseases, to name a few. Rapid city development, population increases, middle class disposable income, and higher demand levels increase workload on the industry. Additionally, the technological innovation in RO, UV, and activated carbon filtration technologies as well as new innovations such as internet connected systems, smart appliances, and renewable manufacturing, make these products highly efficient, affordable, and eco-friendly. Furthermore, government campaigns promoting the use of safe drinking water, all these developments directly impact the growth of the Brazilian water purification market across the residential, commercial, and industrial markets.

Restraining Factors

The Brazil water purifier industry is restrained by High initial investment, plus ongoing upkeep, are the barriers to obtaining a water purifier in Brazil, especially for those who live in low and middle-income areas. Rural areas have inadequate infrastructure, frequent power outages, and low-quality water making it even more difficult to purchase a purifier. Additionally, low consumer education, mistrust regarding whether a water purifier will do what it is designed to do, and the presence of cheaper options on the market have also hindered growth in this sector.

Market Segmentation

The Brazil water purifier market share is classified into type and application.

- The RO purifiers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil water purifier market is segmented by type into gravity purifiers, RO purifiers, UV purifier, sediment filter, water softener, and others. Among these, the RO purifiers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due urbanization, growing health awareness, increased disposable incomes, and the overall rise in water contamination and total dissolved solids levels, are creating a surge in interest for the continued introduction of technologically advanced types of water purification products and specifically RO purifiers. The continued growth of Smart Home adoption and an improved after-sales service network are helping to support this trend.

- The retail stores segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil water purifier market is segmented by application into retail stores, direct sales, and online. Among these, the retail stores segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is due to people's desire for a place to test products before they buy or use them, and the availability of professional advice straight away, instant availability of products, financing made easy, point of sale installation bundled together with servicing; and the increased presence of the retail market, particularly in urban and semi-urban centres support continued growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil water purifier market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Orenzetti S.A.

- IBBL (Industria Brasileira de Bebedouros Ltda.)

- Esmaltec S.A.

- Hidro Filtros do Brasil

- Ceramica Stefani S.A.

- Colormaq (Comercio Eletronico Ltda.)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil Water Purifier Market based on the below-mentioned segments:

Brazil Water Purifier Market, By Type

- Gravity Purifiers

- RO Purifiers

- UV Purifiers

- Sediment Filter

- Water Softener

- Others

Brazil Water Purifier Market, By Distribution Channel

- Retail Stores

- Direct Sales

- Online

FAQ’s

Q: What is the Brazil water purifier market size?

A: Brazil Water Purifier Market size is expected to grow from USD 1.3 billion in 2024 to USD 3.12 billion by 2035, growing at a CAGR of 8.28% during the forecast period.

Q: Who are the key players in the Brazil water purifier market?

A: Orenzetti S.A., IBBL (Indústria Brasileira de Bebedouros Ltda.), Esmaltec S.A., Hidro Filtros do Brasil, Cerâmica Stefani S.A., Colormaq (Comercio Eletronico Ltda.), and Others are the key players in the Brazil water purifier market.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 211 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |