Global Brewers Spent Grain Flour Market

Global Brewers Spent Grain Flour Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Grain Type (Barley, Wheat, and Other Grains), By Form (Dried Flour and Pellets/Mixed Feed Blocks), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Brewers Spent Grain Flour Market Summary, Size & Emerging Trends

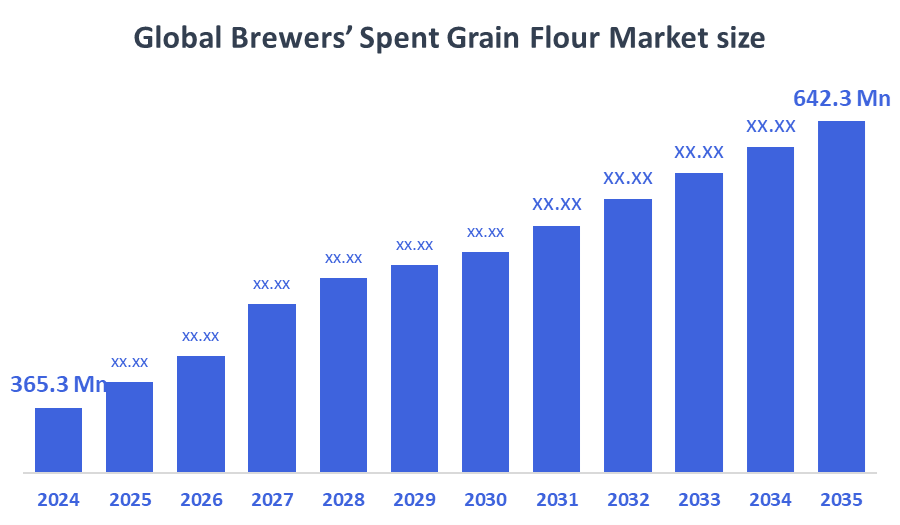

According to Decision Advisors, The Global Brewers’ Spent Grain Flour Market Size is Expected to Grow from USD 365.3 Million in 2024 to USD 642.3 Million by 2035, at a CAGR of 5.26% during the forecast period 2025-2035. The market is witnessing strong growth due to rising demand for sustainable, upcycled food ingredients and increasing consumer interest in high-fibre, protein-rich flours.

Key Market Insights

- Europe is expected to account for the largest share of the brewers’ spent grain flour market during the forecast period.

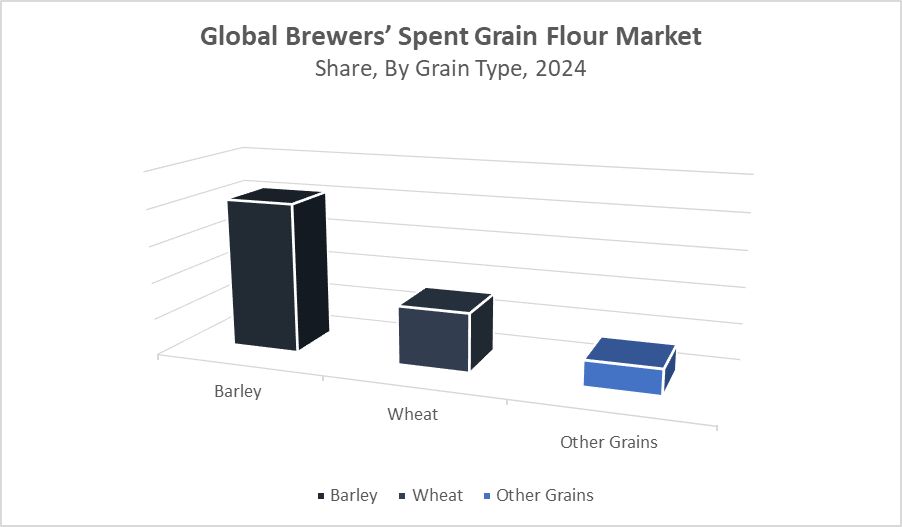

- Barley-based grain dominates in terms of type, driven by its prevalence in global beer production.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 365.3 Million

- 2035 Projected Market Size: USD 642.3 Million

- CAGR (2025-2035): 5.26%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Brewers’ Spent Grain Flour Market

Brewers’ spent grain flour is a high-fiber, protein-rich flour made from the leftover grain used during beer brewing, primarily barley. Once considered waste, this byproduct is now repurposed as a valuable upcycled ingredient in animal feed, functional foods, baked goods, and nutritional supplements. Its appeal lies in both its environmental sustainability and nutritional benefits. As consumers and manufacturers increasingly prioritize clean-label and zero-waste products, brewers’ spent grain flour is gaining traction across multiple industries. Technological improvements in drying and milling have enhanced product stability, shelf life, and taste, allowing it to be seamlessly incorporated into diverse applications. Its use supports circular economy models, reducing food waste while contributing to the development of healthier and eco-conscious food systems worldwide. The market is poised for significant, long-term growth.

Brewers’ Spent Grain Flour Market Trends

- Increasing use of upcycled flour in baked goods, snack bars, and high-fiber crackers.

- Growth of clean-label and circular food economy boosting demand for waste-derived ingredients.

- Partnerships between breweries and food startups to convert brewing byproducts into commercial food-grade flour.

- Development of organic and certified formulations to cater to premium product segments.

Brewers’ Spent Grain Flour Market Dynamics

Driving Factors: Growing demand for sustainable and functional ingredients

The growing demand for sustainable and functional ingredients in both human food and animal nutrition is driving market expansion. Brewers’ spent grain flour provides a cost-effective, high-fibre, and protein-rich solution that aligns with health and eco-conscious consumer trends. With global beer production steadily increasing, raw material availability is consistent. Additionally, the global shift toward circular economy practices and food waste reduction is accelerating the adoption of upcycled products like spent grain flour across food processing and nutraceutical sectors.

Restraint Factors: Supply variability tied to seasonal beer production

One of the primary restraints is the high moisture content in raw brewers’ spent grain, which makes drying and preservation energy-intensive and costly. If not dried promptly, the grain is prone to spoilage, limiting shelf life and posing logistical hurdles. Additionally, supply variability tied to seasonal beer production and brewery scale may disrupt consistent output. These challenges are particularly limiting for small or emerging processors with less access to advanced drying, milling, and storage infrastructure.

Opportunity: Emerging technologies in dehydration

Emerging technologies in dehydration, micronisation, and fermentation are making spent grain flour more versatile and appealing across food and supplement markets. Improved taste profiles and extended shelf life are unlocking new applications in high-protein snacks, plant-based food products, and dietary supplements. As consumer interest in clean-label and upcycled ingredients grows, brewers’ spent grain flour is gaining ground. Moreover, emerging markets with increasing brewery activity and sustainability mandates present fertile ground for market penetration and long-term expansion.

Challenges: Scaling operations while preserving product consistency

Maintaining uniform product quality across diverse brewery sources is a key challenge due to natural variations in grain type and brewing methods. Scaling operations while preserving product consistency and nutrition requires investment in infrastructure and quality control systems. Additionally, regulatory hurdles for human-grade applications vary by region and may slow entry into food markets. Lastly, the market faces strong competition from established plant-based flours and protein alternatives, which may limit rapid market adoption and brand differentiation.

Global Brewers’ Spent Grain Flour Market Ecosystem Analysis

The brewers’ spent grain flour market ecosystem consists of breweries supplying raw material, processing firms handling drying and milling, and end-users like animal feed manufacturers, bakeries, and health food brands. Distributors play a vital role in reaching broader markets. Regulatory bodies oversee safety and compliance, especially for human consumption. Close collaboration among these players ensures efficient upcycling, consistency in quality, and innovation in product development. This integrated ecosystem supports sustainable practices, cost efficiency, and expansion of functional, eco-friendly food solutions globally.

Global Brewers’ Spent Grain Flour Market, By Grain Type

Barley holds the largest market share, contributing to over 55% of the brewers’ spent grain flour segment. This dominance stems from barley’s widespread use in global beer production, making it the most abundant source of spent grain. Barley-based spent grain flour is rich in dietary fibre, protein, and essential nutrients, making it highly desirable for baked goods, animal feed, and nutritional supplements. Its consistent availability and balanced nutritional profile support its strong position across both food and non-food applications.

Wheat-derived spent grain flour is an emerging segment, gaining popularity in speciality bakeries and regional craft breweries. While less dominant than barley, it offers a lighter taste and a slightly different fibre-protein ratio, making it attractive for applications requiring a milder flavour or softer texture. Its use is expanding in artisan breads, breakfast products, and functional foods. As consumer interest in diverse and regionally sourced ingredients grows, wheat spent grain flour is carving out a niche in premium and clean-label offerings.

Global Brewers’ Spent Grain Flour Market, By Form

Dried flour holds the dominant position in the brewers’ spent grain flour market, accounting for over 60% of the total market share. Its popularity is driven by a long shelf life, low moisture content, and ease of transportation and storage, making it highly versatile across various industries. Dried flour is widely adopted in the bakery, snack food, and nutritional supplement sectors, where consistent quality and shelf stability are crucial. It allows for seamless formulation into high-fibre, protein-rich products, aligning with the clean-label and upcycled ingredient trends in global food manufacturing.

Pellets and mixed feed blocks represent a steadily growing segment, particularly within the livestock and aquaculture industries. These formats offer advantages such as easy bulk handling, compact storage, and reduced spoilage risk, while retaining the essential nutrients found in brewers’ spent grain. This form is especially suited for commercial feed operations, providing a cost-effective, sustainable alternative to traditional feed inputs. As animal nutrition moves toward circular and eco-friendly practices, the demand for pelleted spent grain products continues to gain traction, particularly in regions with large-scale animal farming.

Europe holds the largest market share, accounting for approximately 33% of the global brewers’ spent grain flour market.

This leadership is fueled by the region’s mature brewing industry, especially in countries like Germany, the UK, and Belgium, where beer production is high and consistent. Moreover, stringent recycling and waste management regulations, alongside early adoption of circular economy models, have encouraged the transformation of brewing byproducts into functional food and feed ingredients. The region's focus on sustainability, clean-label nutrition, and food innovation continues to support steady market expansion.

Asia Pacific is the fastest-growing region, projected to grow at a CAGR of 11% during the forecast period.

Rapid growth in beer production, especially in China, India, and Australia, is generating a large volume of spent grain, driving supply-side availability. Simultaneously, rising health awareness and demand for high-fibre, functional, and sustainable food ingredients are pushing adoption in the region. Emerging breweries, increasing urbanisation, and a growing interest in upcycled and plant-based nutrition make the Asia Pacific a dynamic and highly promising market for brewers’ spent grain flour in both food and feed applications.

WORLDWIDE TOP KEY PLAYERS IN THE BREWERS’ SPENT GRAIN FLOUR MARKET INCLUDE

- Malteurop

- DSM

- Anheuser-Busch Companies LLC

- Leiber GmbH

- Briess Malt & Ingredients

- Kerry Group

- ReGrained

- Bühler Group

- WonderGrains

- Maltivor

- Others

Product Launches in Brewers’ Spent Grain Flour Market

- In January 2024, Maltivor introduced a premium line of brewers’ spent grain flours in distinct variants: “amber,” “blonde,” and “dark roast.” These variations cater to the artisan bakery and specialty snack food segments, offering options with unique flavor profiles, color, and nutritional content. By targeting brands focused on upcycled ingredients and sustainability, Maltivor positions itself as a pioneer in clean-label innovation. The product line supports circular economy goals while addressing consumer demand for functional, eco-conscious baking ingredients.

- In March 2024, WonderGrains launched a high-protein baking mix containing 40% brewers’ spent grain flour, aimed at health-conscious consumers seeking sustainable alternatives to traditional flour blends. The mix is tailored for home bakers and health food brands, combining nutritional benefits with environmental responsibility. The product aligns with trends in plant-based nutrition, upcycling, and protein fortification, and reflects growing consumer interest in functional flours that reduce waste and enhance dietary value.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the brewers’ spent grain flour market based on the below-mentioned segments:

Global Brewers’ Spent Grain Flour Market, By Grain Type Barley

- Wheat

- Other Grains

Global Brewers’ Spent Grain Flour Market, By Form

- Dried Flour

- Pellets/Mixed Feed Blocks

Global Brewers’ Spent Grain Flour Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: What is the market size of the Global Brewers’ Spent Grain Flour Market in 2025?

A: The Global Brewers’ Spent Grain Flour Market size is projected to reach approximately USD 530 million in 2025, up from USD 365.3 million in 2024.

Q: What is the forecasted CAGR of the Global Brewers’ Spent Grain Flour Market from 2025 to 2035?

A: The market is expected to grow at a CAGR of 5.26% during the forecast period 2025–2035.

Q: What is the revenue potential of brewers’ spent grain flour in the Asia–Pacific region by 2030?

A: The Asia–Pacific brewers’ spent grain flour market is projected to surpass USD 1 billion by 2030, driven by rising health awareness and increased beer production.

Q: Who are the top 10 companies operating in the Global Brewers’ Spent Grain Flour Market?

A: Key players include Malteurop, DSM, Anheuser-Busch Companies LLC, Leiber GmbH, Briess Malt & Ingredients, Kerry Group, ReGrained, Bühler Group, WonderGrains, and Maltivor.

Q: Which startups are disrupting the Brewers’ Spent Grain Flour Market?

A: Startups such as ReGrained, WonderGrains, and Maltivor are innovating with clean-label, upcycled, and functional flour products aimed at health-conscious consumers and sustainable food systems.

Q: Can you provide company profiles for the leading brewers’ spent grain flour producers?

A: Yes. For instance, Maltivor offers premium flours in variants like amber and dark roast, targeting artisan bakeries, while WonderGrains launched a high-protein baking mix with 40% spent grain content for health-focused markets.

Q: What are the main drivers of growth in the Brewers’ Spent Grain Flour Market?

A: Major growth drivers include the increasing demand for sustainable, upcycled ingredients, rising health consciousness, growth in global beer production, and the push toward circular economy practices.

Q: What challenges are limiting the adoption of brewers’ spent grain flour products?

A: Key restraints include supply variability, high drying costs, short shelf life if not processed properly, and regulatory hurdles for human-grade applications across regions.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 234 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |