Global Busbar Trunking Market

Global Busbar Trunking Market Size, Share, and COVID-19 Impact Analysis, By Conductor (Copper, Aluminum), By Insulation (Air Insulated, Sandwich Insulated), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Busbar Trunking Market Summary

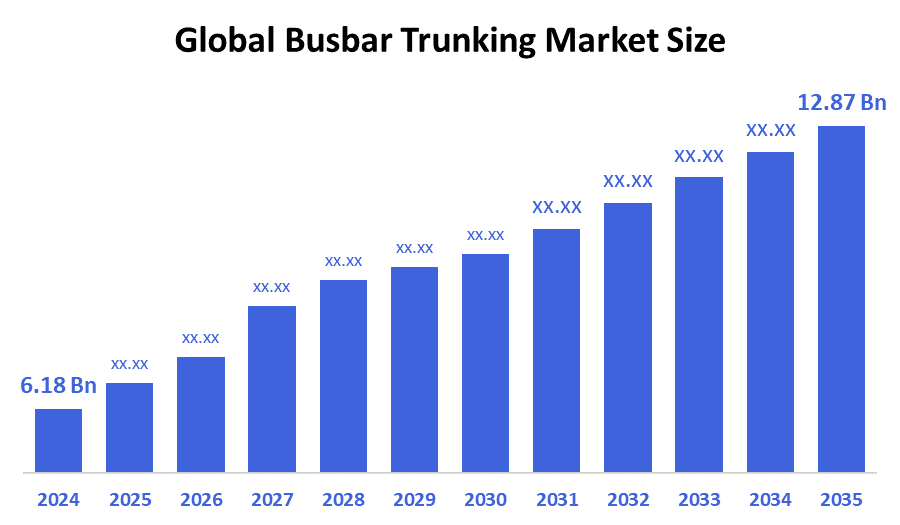

The Global Busbar Trunking Market Size Was Estimated At USD 6.18 Billion in 2024 and is Projected to Reach USD 12.87 Billion in 2035, Growing at a CAGR of 6.9% from 2025 to 2035. The market for busbar trunking is expanding as a result of factors such as the need for more effective power distribution, a rise in construction, the rising use of smart grids, energy efficiency laws, industrial automation, and shorter installation times.

Key Regional and Segment-Wise Insights

- In 2024, Asia Pacific held the largest revenue share of 35.18%, dominating the busbar trunking market.

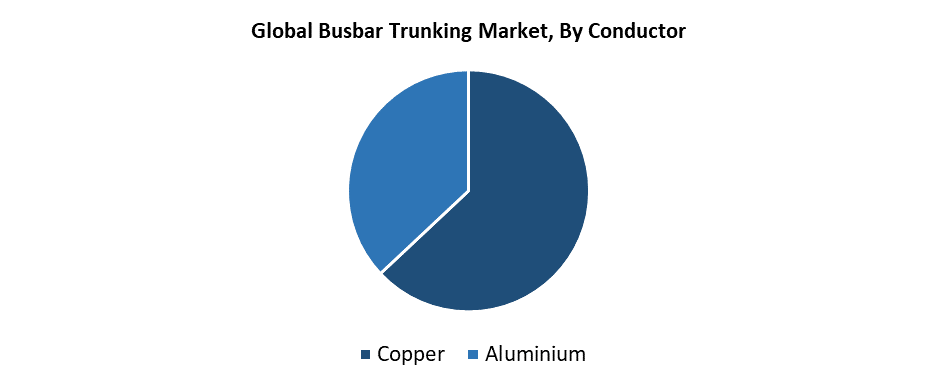

- In 2024, the copper segment had the biggest revenue share of 63.14%, and dominated the market by conductor.

- With a 66.25% revenue share in 2024, the sandwich insulated segment led the market based on insulation.

Global Busbar Trunking Market Forecast and Revenue Outlook

- 2024 Market Size: USD 6.18 Billion

- 2035 Projected Market Size: USD 12.87 Billion

- CAGR (2025-2035): 6.9%

- Asia Pacific: Largest market in 2024

Busbar trunking systems are available as protected busbars, which serve as a power distribution system in the market. Modern busbar trunking systems function as adaptable and efficient power distribution alternatives that replace conventional cable systems. Busbar trunking systems serve residential, commercial, and industrial facilities because they deliver reliable and efficient power distribution solutions. The main drivers of market expansion include fast urban growth and increasing electricity needs, together with worldwide infrastructure development. The implementation of busbar trunking systems becomes necessary for industries because they require safer, compact power distribution systems that consume less energy. Busbar trunking systems prove beneficial for data centers, manufacturing plants, and large commercial buildings due to their easy installation process, minimal upkeep, and ability to support substantial electrical loads.

The market expansion continues to accelerate because of advancements in busbar trunking system technology. The performance and reliability of systems improve through the combination of modular designs with smart monitoring technology, which connects to IoT platforms and automated building controls. Governments worldwide implement laws and programs that focus on energy efficiency improvement, together with sustainable infrastructure development. The market for sophisticated electrical distribution systems, such as busbar trunking, expands because energy-saving regulations, green building standards, and smart city development projects support their adoption.

Conductor Insights

The Busbar Trunking Market is led by the copper segment with the largest revenue share of 63.14% in 2024. The main reason behind copper's market leadership stems from its outstanding electrical conductivity, together with its high thermal resistance and mechanical strength, which make it perfect for power distribution applications. The adoption of copper busbars stands at the forefront for essential operations in data centers and industrial settings, along with commercial establishments that need superior performance and safety management. Over time, copper provides the most economical solution because it requires less maintenance and stands up to wear and tear. Copper-based busbar trunking systems keep their market dominance because increasing demands for advanced electrical infrastructure in fast-growing industrial and urban areas drive their adoption.

The aluminum segment of the busbar trunking market is anticipated to experience substantial growth throughout the projected timeframe. Aluminum stands as an economical and lightweight alternative to copper for extensive power distribution projects, which drives its market expansion. Aluminum maintains excellent performance and reliability levels because engineers continue to develop advanced designs and technology, even though it has slightly less electrical conductivity than copper. Commercial, industrial and residential spaces increasingly choose aluminum busbars because they are cost-effective and require minimal installation time and exhibit corrosion resistance with proper maintenance. The worldwide expansion of infrastructure projects and electrification programs in developing nations will generate substantial demand for aluminum busbar trunking systems. The expanding market will achieve both growth and increased diversity through this development.

Insulation Insights

The sandwich insulated segment dominated the busbar trunking market with the largest revenue share of 66.25% in 2024. The sandwich insulation systems control the market through their compact design and superior safety features, along with their efficient heat management capabilities. The sealed and robust construction of sandwich insulation minimizes short circuit risks while enhancing fire resistance and allows greater current capacity in smaller air-insulated system footprints. These advantages make it suitable for essential infrastructure projects and commercial buildings as well as high-rise constructions and industrial manufacturing plants. The growing interest in power distribution solutions that save space and energy has boosted the market dominance of sandwich-insulated busbar trunking systems.

During the forecast period, the air-insulated segment of the busbar trunking market will experience significant growth. The segment grows mainly because it provides affordable prices alongside design versatility, together with simple maintenance procedures. The air-insulated busbar system finds applications in industrial plants, warehouses, and utility buildings when available space does not present a limitation. The simple layout of this system makes it the preferred choice because it enables straightforward system expansion and customization. The rising utilization of air-insulated systems within medium- and low-voltage power distribution networks across developing nations drives increasing market demand. As international industrialization alongside infrastructure growth expands, the air-insulated market will experience stable growth because it offers an economical option against sandwich-insulated systems.

Regional Insights

The North American market for busbar trunking grows significantly because commercial, industrial, and residential facilities require reliable power distribution systems. The region's focus on electrical infrastructure renewal alongside rapid data center and smart building expansion drives busbar trunking system usage. The market demand grows because of energy efficiency regulations, along with rising awareness about fire safety and space optimization strategies. Market expansion continues because renewable energy projects increase alongside investments in sustainable building practices. Smart grid technology advancements and automated electrification efforts in North America will maintain the region's position as a leading force in the worldwide busbar trunking market.

Asia Pacific Busbar Trunking Market Trends

The Asia Pacific busbar trunking market led the global with a largest revenue share of 35.18% in 2024. The main reasons behind this market leadership stem from the quick urbanization process, together with industrial growth and large-scale infrastructure construction in Chinese, Indian, and Southeast Asian territories. The region's developing construction business and growing need for reliable power distribution, combined with increased investments in smart cities and renewable energy projects have propelled busbar trunking system adoption. The market expansion receives support from governmental initiatives that focus on energy efficiency and electrical grid modernization. The Asia Pacific region dominates the market because it hosts major industrial hubs and has a rising demand for advanced electrical systems.

Europe Busbar Trunking Market Trends

The European Busbar Trunking Market continues to expand because the region prioritizes sustainable development along with efficient energy systems and electrical infrastructure modernization. Modern power distribution technologies, including busbar trunking systems receive support from strict regulations that promote fire safety and environmentally friendly building standards. The market demand expands through the region's increasing investments in digital infrastructure along with smart grids and renewable energy integration programs, especially in the UK, France, and Germany. Market growth continues because of the rising number of commercial and industrial structure renovations. European manufacturers adapt cutting-edge technology through the implementation of modular systems and IoT-enabled monitoring to achieve better system performance and flexibility. The combination of these factors enables Europe to drive the worldwide growth of busbar trunking systems.

Key Busbar Trunking Companies:

The following are the leading companies in the busbar trunking market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- LARSEN & TOUBRO

- DBTS Industries Sdn Bhd

- Eaton

- General Electric Company

- GODREJ & BOYCE MANUFACTURING COMPANY LIMITED (Godrej Enterprises)

- Siemens AG

- LEGRAND SA

- Schneider Electric

- Legrand North and Central America, LLC

- Others

Recent Developments:

- In March 2025, ABB announced a USD 120 million investment to expand its low-voltage electrification product manufacturing operations in the United States. Of that amount, USD 80 million will be used to construct a new 320,000 square foot facility in Selmer, Tennessee, which is expected to open by Q4 2026, and USD 40 million will be used to double its Senatobia, Mississippi plant by Q2 2026. These extensions would meet the growing demand from data centers, utilities, and commercial infrastructure by increasing manufacturing capacity by more than 50% and creating 250 new jobs at both sites.

- In March 2021, Tai Sin Electric Limited expanded its product portfolio beyond conventional cabling with the introduction of a new busbar trunking system. With operational voltages up to 690 V and insulation voltages up to 1,000 V, the system has been locally tested and approved to IEC 61439-6. Its current capabilities range from 250 A to 5,000 A (aluminum) and 250 A to 6,300 A (copper). It runs at 50-60 Hz, supports 3P3W, 3P4W, and 3P5W combinations, and has IP 66/68 protection ratings.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the busbar trunking market based on the below-mentioned segments:

Global Busbar Trunking Market, By Conductor

- Copper

- Aluminum

Global Busbar Trunking Market, By Insulation

- Air Insulated

- Sandwich Insulated

Global Busbar Trunking Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 216 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |