Canada 3D Printing Metals Market

Canada 3D Printing Metals Market Size, Share, and COVID-19 Impact Analysis, By Product (Titanium, Nickel, Stainless Steel, Aluminium, and Others), By Process (Powder, Filament), By Application (Aerospace & Defence, Automotive, Medical & Dental, and Others), and Canada 3D Printing Metals Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada 3D Printing Metals Market Insights Forecasts to 2035

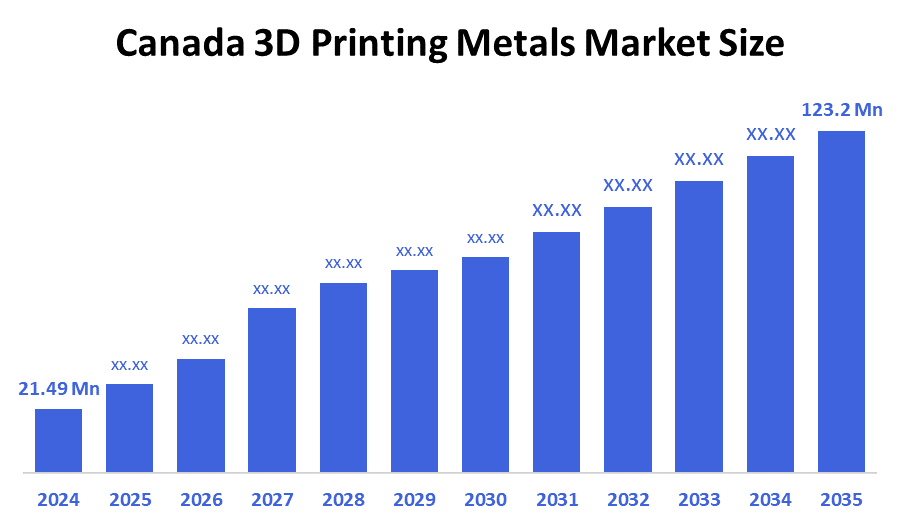

- The Canada 3D Printing Metals Market Size Was Estimated at USD 21.49 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 17.2% from 2025 to 2035

- The Canada 3D Printing Metals Market Size is Expected to Reach USD 123.2 Million by 2035

According to a research report published by Decision Advisior & Consulting, the Canadian 3D Printing Metals Market size is anticipated to reach USD 123.2 million by 2035, growing at a CAGR of 17.2% from 2025 to 2035. The market is driven by the growing demand for intricate, high-performance, lightweight components. Healthcare and automotive are next in line for adoption, after aerospace and defence. It is anticipated that further improvements in printing and metal powder manufacturing techniques would lower costs and increase acceptance in Canada.

Market Overview

Metal additive manufacturing, or 3D printing metals, uses powdered metals like titanium, nickel alloys, aluminium, and stainless steel to create components layer by layer. This technique is being used by Canadian industry for everything from medical implants to turbine blades. In contrast to conventional manufacturing, 3D printing allows the creation of intricate geometries while minimizing material waste.

The Department of National Defence and Halifax's Dalhousie University will collaborate in May 2025 to prolong the life of Canada's aging naval fleet. The initiative produces essential components for ships, such as submarines, using an industrial-grade version of 3D printing. In January 2025, Guy Bourassa, CEO and Director of Scandium Canada Ltd., discussed the company's unique position in the scandium market and its most recent technological developments.

The aerospace, automotive, and healthcare industries will all heavily utilize the Canadian 3D printing metals market by 2031. Accessibility will be increased by lowering costs through economies of scale and enhanced powder production technology. The market ecology will probably be strengthened by government-backed R&D initiatives and more venture capital funding.

Report Coverage

This research report categorizes the market for the Canada 3D printing metals market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada 3D printing metals market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada 3D printing metals market.

Driving Factors

The 3D printing metals markets in Canada are driven by the need for robust, lightweight, and fuel-efficient components. Metal additive manufacturing has significant advantages for engine and turbine components. Demand is being increased by increased air traffic and defence modernization. Treatment results are enhanced by the capacity to create devices tailored to each patient. The demand for implants is rising due to ageing populations and an increase in orthopedic and dental disorders. The advantages of flexibility, on-demand production, and less material waste are in line with the objectives of smart manufacturing. The usage of 3D printing metals in cooling systems, battery housings, and structural components is growing. EV performance depends on reduced vehicle weight since it increases efficiency and range.

Restraining Factors

The 3D printing metals market in Canada is majorly restrained by the expensive running costs prevent broader usage. Even if costs are progressively dropping, affordability is still a problem. Lack of consistent standards and certifications. Mass adoption is hampered by this, especially in industries with strict regulations like aerospace and healthcare. There are adoption barriers in Canada due to a lack of qualified workers. Businesses must make significant investments in education and training. It is still challenging to scale operations without trained personnel. Production timetables may be impacted by logistical or raw material supply disruptions.

Market Segmentation

The Canadian 3D Printing Metals market share is categorised by product, process and application.

- The titanium segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian 3D printing metals market is segmented by product into titanium, nickel, stainless steel, aluminium, and others. Among these, the titanium segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by due to the need for titanium-based product segments will rise as a result of their non-corrosive qualities and resilience to challenging conditions. The ability of conventional polymer 3D printers to create semi-metallic objects when paired with polymers or filaments is expected to propel market expansion.

- The powder segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on process, the Canadian 3D printing metals market is segmented into powder, filaments. Among these, the powder segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by raw materials' physical and chemical characteristics, which need to be precisely identified and described. Future demand for metal dust is probably going to rise as a result. The 3D-printed metal particles must be very small, often between 15 and 75 μm, in order to have a fine print on the finished product release.

- The aerospace & defence segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian 3D printing metals market is segmented by application into aerospace & defence, automotive, medical & dental, and others. Among these, the aerospace & defence segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by due to it is the leading application in the 3D printing metals market due to the strong need for high-performance materials that can endure harsh environments. The industry uses cutting-edge 3D printing technology to produce parts for missiles, aircraft, and other vital defence equipment where accuracy and dependability are crucial.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada 3D printing metals market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 123Proto

- Agile Manufacturing Inc

- Axis Prototype

- AON 3D

- Calgary 3D Printing

- Proto3000

- Forge Labs

- Custom Prototypes

- Precision ADM

- PyroGenesis Canada Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, Sixpenny Additive, launched Canadian metal additive manufacturing company, was named the first distributor and integration partner for Meltio’s innovative wire-laser metal 3D printing industrial systems in Canada.

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Decision Advisior has segmented the Canada 3D Printing Metals Market based on the below-mentioned segments:

Canada 3D Printing Metals Market, By Product

- Titanium

- Nickel

- Stainless Steel

- Aluminium

- Others

Canada 3D Printing Metals Market, By Process

- Powder

- Filament

Canada 3D Printing Metals Market, By Application

- Aerospace & defence

- Automotive

- Medical & Dental

- Others

FAQ’s

Q: What is the Canadian 3D printing metals market size?

A: The Canada 3D Printing Metals Market size is expected to grow from USD 21.49 million in 2024 to USD 123.2 million by 2035, growing at a CAGR of 17.2% during the forecast period 2025-2035.

Q: What is 3D printing metals, and its primary use?

A: Metal additive manufacturing, or 3D printing metals, uses powdered metals like titanium, nickel alloys, aluminium, and stainless steel to create components layer by layer. This technique is being used by Canadian industry for everything from medical implants to turbine blades. In contrast to conventional manufacturing, 3D printing allows the creation of intricate geometries while minimizing material waste.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the requirement for durable, lightweight, and fuel-efficient components has led to the 3D printing of metals in Canada. Engine and turbine components can benefit greatly from metal additive manufacturing. Increased air travel and defence modernization are driving up demand. The ability to design devices specifically for each patient improves treatment outcomes.

Q: What factors restrain the Canadian 3D printing metals market?

A: The Market is restrained by the expensive running costs prevent broader usage. Even if costs are progressively dropping, affordability is still a problem. lack of consistent standards and certifications. Mass adoption is hampered by this, especially in industries with strict regulations like aerospace and healthcare. There are adoption barriers in Canada due to a lack of qualified workers.

Q: How is the market segmented by product?

A: The market is segmented into titanium, nickel, stainless steel, aluminium, and others.

Q: Who are the key players in the Canadian 3D printing metals market?

A: Key companies include 123Proto, Agile Manufacturing Inc., Axis Prototype, AON 3D, Calgary 3D Printing, Proto3000, Forge Labs, Custom Prototypes, Precision ADM, and PyroGenesis Canada Inc.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 199 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |