Canada Adhesion Promoter Market

Canada Adhesion Promoter Market Size, Share, and COVID-19 Impact Analysis, By Type (Silane, Maleic Anhydride, Chlorinated Polyolefins, Titanate & Zirconate, and Others), By Application (Plastics & Composites, Paints & Coatings, Rubber, Adhesives, Metals, and Others), and Canada Adhesion Promoter Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Adhesion Promoter Market Insights Forecasts to 2035

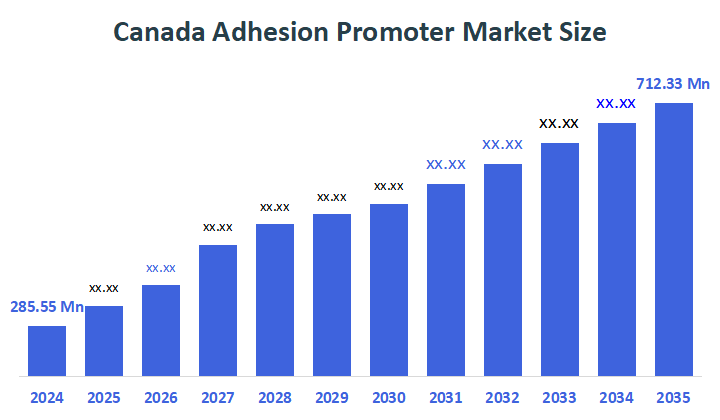

- The Canada Adhesion Promoter Market Size was estimated at USD 285.55 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.67% from 2025 to 2035

- The Canada Adhesion Promoter Market Size is Expected to Reach USD 712.33 Million by 2035

According to a Research Report Published by Decisions Advisors, the Canada Adhesion Promoter Market is anticipated to reach USD 712.33 million by 2035, growing at a CAGR of 8.67% from 2025 to 2035. Market growth is mainly propelled by the increasing needs of the automotive industry, continuous advancements in surface treatment technologies, and an ongoing transition towards sustainable products due to regulatory influences.

Market Overview

The Canadian adhesion promoter market pertains to the category of speciality chemicals aimed at enhancing adhesion between various materials like plastics, metals, composites, coatings, and paints. These additives play a vital role in sectors such as automotive, packaging, construction, and electronics, where robust adhesion is crucial for longevity and efficiency. Adhesion promoters, also known as coupling agents, enhance bonding between organic polymers and inorganic surfaces by engaging with their interface. Adhesion promoters function chemically and physically at organic–inorganic interfaces to unite these contrasting materials. Moreover, the market factors involve regulatory incentives for low-VOC and eco-friendly formulations, an increase in the use of lightweight materials, and the demand for robust, dependable bonds in intricate, multi-material assemblies that are characteristic of modern Canadian manufacturing settings. Consequently, these agents enhance the bonding capacity between a coating and a substrate. Adhesion promoters modify the physical and chemical interactions at the interface, creating a compatibility link that enhances adhesion. In addition, adhesion promoters can safeguard the bonds from being compromised by different environmental elements, including heat and humidity.

Report Coverage

This research report categorises the market for the Canada adhesion promoter market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada adhesion promoter market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada adhesion promoter market.

Driving Factors

The Canadian market for adhesion promoters is growing due to the increasing need for high-quality bonding agents in the automotive, packaging, construction, and electronics industries. Further, market growth is increasing due to environmental issues and tighter governmental regulations; industries are moving towards eco-friendly alternatives. The usage of water-based and bio-based adhesion promoters is increasing since they satisfy performance and regulatory criteria, enhancing their market growth. The surge of electric vehicles (EVs) offers a notable chance for market expansion. Adhesion promoters play a crucial role in joining different materials, like metals and plastics, utilised in battery systems, interior components, and structural elements.

Restraining Factors

The Canadian adhesion promoter market encounters significant limiting factors like elevated production expenses, strict environmental regulations, and low awareness among end-users, which together hinder adoption despite robust demand in the automotive, packaging, and construction industries.

Market Segmentation

The Canada adhesion promoter market share is classified into type and application.

- The silane segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The Canada adhesion promoter market is divided by type into silane, maleic anhydride, chlorinated polyolefins, titanate & zirconate, and others. Among these, the silane segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This is due to the rising demand for silane in different uses like paints & coatings and rubber. Silane served as a coating on filler particles within composite materials, aiding in their adhesion to a resin matrix. Moreover, it is commonly utilised as a coupling agent to enhance the stability of composite materials by bonding fibres to specific polymers. Further, the increasing need for high-performance materials that demonstrate resistance to moisture, temperature, and chemicals, substantial growth in the silane segment.

- The paints & coatings segment held a significant revenue share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The Canada adhesion promoter market is segmented by application into plastics & composites, paints & coatings, rubber, adhesives, metals, and others. Among these, the paints & coatings segment held a significant revenue share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. These materials are primarily utilised for creating precision-engineered items, thanks to beneficial product characteristics such as chemical resistance, low weight, and flexibility. Coatings and paints are expected to offer promising prospects for these promoters in construction and building materials. Significant product penetration is primarily due to increasing awareness about improved binding capabilities following the use of the product. The rising demand for architectural, automotive, and industrial coatings will remain a key driving factor in various applications.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada adhesion promoter market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Normac Adhesive Products, Inc.

- Bond Tech Industries

- Durafil?

- Ellsworth Canada

- Petro-Canada

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada adhesion promoter market based on the below-mentioned segments:

Canada Adhesion Promoter Market, By Type

- Silane

- Maleic Anhydride

- Chlorinated Polyolefins

- Titanate & Zirconate

- Others

Canada Adhesion Promoter Market, By Application

- Plastics & Composites

- Paints & Coatings

- Rubber

- Adhesives

- Metals

- Others

FAQ

Q: What is the expected growth of the Canadian adhesion promoter market?

A: The market is expected to grow from USD 285.55 million in 2024 to USD 712.33 million by 2035, at a CAGR of 8.67% during 2025-2035.?

Q: What are the main types of adhesion promoters used in Canada?

A: Key types include silane (the dominant segment), maleic anhydride, chlorinated polyolefins, titanate & zirconate, and others. Silane is widely used in paints, coatings, and rubber due to its properties of enhancing stability, moisture resistance, and chemical durability.?

Q: Which application sectors drive the market?

A: Major applications include plastics & composites, paints & coatings (significant revenue share), rubber, adhesives, and metals. Growth in the paints & coatings sector is driven by demand for architectural, automotive, and industrial coatings.?

Q: What are the growth drivers for the Canadian market?

A: Growth is supported by increasing needs for high-quality bonding agents in automotive, packaging, construction, and electronics industries; regulatory incentives for low-VOC and eco-friendly formulations; rising use of lightweight materials; and the surge in electric vehicles, which require adhesion promoters for battery systems and structural components.?

Q: What are the challenges faced by the market?

A: Challenges include high production costs, stringent regulations, limited awareness among end-users, safety compliance, and competition from alternative technologies.?

Q: Who are the key market players in Canada?

A: Leading companies include Normac Adhesive Products, Inc., Bond Tech Industries, Durafil, Ellsworth Canada, and Petro-Canada.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 170 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |