Canada AI in Video Surveillance Market

Canada AI in Video Surveillance Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware, Software, and Services), By Deployment (Cloud-based, and On Premise), and Canada AI in Video Surveillance Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada AI in Video Surveillance Market Size Insights Forecasts to 2035

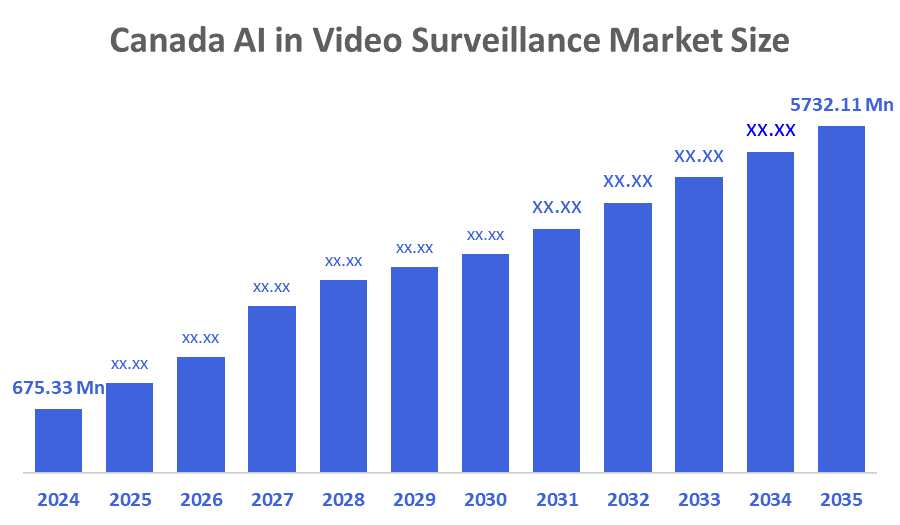

- The Canada AI in Video Surveillance Market Size was estimated at USD 675.33 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 21.46% from 2025 to 2035

- The Canada AI in Video Surveillance Market Size is Expected to Reach USD 5732.11 Million by 2035

According to a Research Report Published by Decisions Advisors and Consulting, The Canada AI in Video Surveillance Market Size is anticipated to Reach USD 5732.11 Million by 2035, Growing at a CAGR of 21.46% from 2025 to 2035. The demand for sophisticated surveillance systems that can efficiently monitor and safeguard both public and private areas is rising. They provide scalability, remote access, and lower infrastructure costs than on-premises systems, making cloud-based video surveillance systems widely accepted.

Market Overview

The industry supporting artificial intelligence (AI) in video surveillance across Canada is a subsegment of the security and technology field that is devoted to integrating AI algorithms and analytics into video surveillance systems. Further, it provides real-time identification of threats, automatic alerts, and sophisticated analytics while maintaining compliance with Canadian security legislation. These solutions surpass conventional camera monitoring. The sophisticated video analytics algorithms have been made possible by the quick development of deep learning and artificial intelligence technologies. These algorithms increase the overall efficacy of surveillance systems by automatically identifying and categorising objects, people, and activities in video feeds with high accuracy. AI-powered video surveillance systems can reduce costs for businesses by automating numerous tasks that would otherwise need human intervention.

In the 2025 budget and larger digital strategy, the Canadian government is investing heavily in AI, including AI applications in video surveillance. In order to improve Canada's capacity for AI innovation and security, the 2025 federal budget allots $925.6 million for the construction of independent public AI infrastructure.

Additionally, $656.9 million is allocated to the commercialisation of dual-use military and civilian technologies, such as AI-powered surveillance, with a focus on cybersecurity and digital intelligence innovation.

Report Coverage

This research report categorises the market for the Canada AI in video surveillance market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada AI in video surveillance market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada AI in video surveillance market.

Driving Factors

The Canadian AI in the video surveillance market is propelled by several factors, such as rising concerns about public safety and security in the commercial, residential, and institutional sectors. The industry growth is being driven by technological advancements in IP-based cameras and cloud-based Video Surveillance as a Service (VsaaS), which provide scalability, flexible management, and remote accessibility. Further, market growth is accelerated by government programs that support cybersecurity infrastructure upgrades and smart city initiatives. Besides, wide adoption is aided by the growth of IoT networks and high-speed internet in large cities like Vancouver, Toronto, and Montreal.

With AI improving real-time threat detection, lowering false alarms, and facilitating proactive incident prevention, Canada has more than 12 million surveillance cameras in a variety of locations, including retail stores, residential condos, and industrial sites. British Columbia and Ontario are the provinces that have adopted AI at the fastest scales.

Restraining Factors

Despite being a popular choice for security solutions, the Canadian market for AI video surveillance is hindered by factors such as stringent privacy laws (PIPEDA), high implementation costs, and public opposition to surveillance development.

Market Segmentation

The Canada AI in video surveillance market share is classified into component and deployment.

- The hardware segment held a substantial market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canada AI in video surveillance market is divided by component into hardware, software, and services. Among these, the hardware segment held a substantial market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to it mainly consists of storage systems (such as Network Video Recorders, or NVRs), IP-based cameras (which outnumber analogue cameras), and edge AI-enabled camera chipsets that enable on-site real-time analytics processing. Further, technology trends with ultra-high-definition resolution (4K and higher) and embedded AI for object detection, behaviour analysis, license plate recognition, and facial recognition are becoming increasingly popular.

- The cloud-based segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The Canada AI in video surveillance market is divided by deployment into cloud-based, and on premise. Among these, the cloud-based segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. The increasing use of cloud-based AI systems, which provide remote accessibility, real-time monitoring, and centralised management for businesses with dispersed locations, is the main factor propelling the Canadian AI in video surveillance market. This feature improves operational flexibility and incident response, especially with the rise in remote and mobile work. AI surveillance technologies are becoming more widely used in Canada due to growing security concerns, government smart city initiatives, and the need for scalable, privacy-compliant surveillance systems in both the public and commercial sectors.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Canada AI in video surveillance market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- VXG Inc. (Video Experts Group)

- March Networks

- Teledyne FLIR (Canada division)

- Avigilon (Motorola Solutions subsidiary)

- Others

Recent Developments:

- In September 2025, March Networks, a Canadian leader in intelligent security solutions, introduced the AI3 Counting Camera. In addition to providing 360-degree surveillance and business intelligence analytics, this device incorporates a generative AI-powered Smart Search tool that uses visual cues and natural language for quicker, more accurate investigations, lowering false alarms, and simplifying incident response.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada AI in video surveillance market based on the below-mentioned segments:

Canada AI in Video Surveillance Market, By Component

- Hardware

- Software

- Services

Canada AI in Video Surveillance Market, By Deployment

- Cloud-based

- On Premise

FAQ

Q: What is the current size and forecast for the Canadian AI in the video surveillance market?

A: The market was valued at approximately USD 675.33 million in 2024 and is expected to grow at a CAGR of 21.46% to reach USD 5,732.11 million by 2035.

Q: What does the market encompass?

A: The market includes hardware (such as IP cameras, Network Video Recorders, AI-enabled edge chipsets), software (video analytics, AI algorithms), and services. Deployment models include cloud-based and on-premise systems.

Q: What are the growth drivers?

A: Rising security concerns, adoption of AI-powered real-time threat detection, growing use of IP and cloud-based VSaaS systems for remote, scalable management, government smart city and cybersecurity initiatives, and expansion of IoT and high-speed internet infrastructure in urban centres drive the market.

Q: What are the key segments?

A: The hardware segment held the largest market share in 2024, and the cloud-based deployment segment dominates and is expected to grow strongly due to flexible management and remote access benefits.

Q: What challenges affect the market?

A: Privacy laws (PIPEDA), high system implementation costs, and public opposition to increased surveillance present challenges.

Q: Who are the prominent market players in Canada?

A: Key companies include VXG Inc. (Video Experts Group), March Networks, Teledyne FLIR (Canada division), and Avigilon (Motorola Solutions subsidiary).

Q: What recent developments have occurred?

A: In September 2025, March Networks launched its AI3 Counting Camera with 360-degree surveillance and generative AI Smart Search, enabling faster, more accurate investigations and reducing false alarms.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 168 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |