Canada Algae Oil Market

Canada Algae Oil Market Size, Share, and COVID-19 Impact Analysis, By Type (DHA-Rich Algae Oil, EPA-Rich Algae Oil, and Combined EPA-DHA Oil), By Source (Microalgae, Macroalgae (Seaweed), and Genetically Modified Algae), By Extraction Method (Solvent Extraction, Cold Pressed, Enzymatic Extraction, and Supercritical Fluid Extraction), and Canada Algae Oil Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

Canada Algae Oil Market Insights Forecasts to 2035

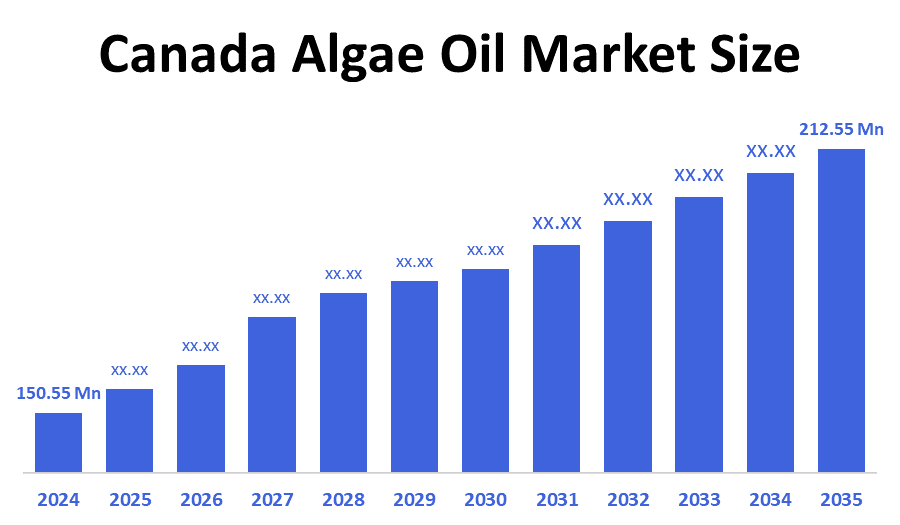

- The Canada Algae Oil Market Size was estimated at USD 150.55 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.18% from 2025 to 2035

- The Canada Algae Oil Market Size is Expected to Reach USD 212.55 Million by 2035

According to a research report published by Spherical Insights & Consulting, the Canada Algae Oil Market is anticipated to reach USD 212.55 million by 2035, growing at a CAGR of 3.18% from 2025 to 2035. The growing use of algae oil as an anti-ageing agent is driving the market, as the rate of population ageing is rising internationally. Additionally, the encouraging market momentum is directed by industry participants' proactive approach, which involves significant investments in expanding production capacities.

Market Overview

The Canadian algae oil market refers to the industry focused on the production, application, and the increasing need for plant-based omega-3s (DHA & EPA), clean-label nutrition, and sustainable biofuel alternatives contribute to the steady growth. Algae oil is an animal-free source of omega-3 fatty acids, such as eicosapentaenoic acid (EPA) and docosahexaenoic acid (DHA), and is utilised in dietary supplements, functional foods, infant nutrition, cosmetics, and renewable energy. For the sake of those with retinitis pigmentosa, it helps lower cholesterol, reduce inflammation, lower the risk of stroke, and improve vision. It is used with other fatty acids to fortify baby and infant formulas because it has substantial amounts of vitamins and minerals. Additionally, it serves as a stabilising agent in the manufacturing of pet food, ice cream, and other dietary supplements. In the industrial sector, new uses of algae oil are being investigated with the goal of lowering carbon emissions, conserving water, and saving energy. The market moves toward clearly defined growth thanks to the government's strong initiatives and investments.

Health Canada has informed Corbion Biotech, Inc. (formerly TerraVia Holdings, Inc.) that it does not object to the use of High Oleic Algae Oils (HOAOs) derived from genetically modified strains of Prototheca moriformis S2532 and S6697 in food. In accordance with its Guidelines for the Safety Assessment of Novel Foods, the Department carried out a thorough evaluation of these HOAOs. The internationally recognised principles for determining the safety of foods with novel characteristics form the basis of these guidelines.

Report Coverage

This research report categorises the market for the Canada algae oil market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada algae oil market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada algae oil market.

Driving Factors

The market for Canadian algae oil is driven by the growing consumer demand for sustainable and plant-based omega-3 substitutes, particularly in food and nutraceutical applications. Further, the rising health consciousness and ageing populations are driving innovation in algae-derived dietary supplements. The rise in algae oil due to its high yield potential, a quick growth cycle, and its requiring little land or water, Canadian biofuel producers are making significant investments in algae oil technologies to support renewable energy goals, which boosts the market development. The innovations in algae cultivation and oil extraction are being accelerated by government-backed research and funding initiatives. Also, skincare and cosmetic products based on algae oil are starting to appear in the country's beauty and personal care market. Canadian agricultural researchers and biotech companies are working together and influence the market expansion.

Canada has officially approved algal oil as a salmon feed ingredient for the first time, marking a major milestone in aquaculture sustainability. It is anticipated that this approval will hasten the use of algae-based feed components in Canadian aquaculture.

Restraining Factors

Despite the algae oil having great potential in the health and sustainability sectors, its mainstream adoption is slowed by cost, awareness, regulatory obstacles, scalability, competition, and sensory issues.

Market Segmentation

The Canada algae oil market share is classified into type, source, and extraction method.

- The DHA-rich algae oil segment held a substantial share in 2024 and is anticipated to grow at a notable CAGR over the forecast period.

The Canada algae oil market is divided by type into DHA-rich algae oil, EPA-rich algae oil, and combined EPA-DHA oil. Among these, the DHA-rich algae oil segment held a substantial share in 2024 and is anticipated to grow at a notable CAGR over the forecast period. The growing consumer awareness of the health benefits of omega-3 fatty acids, concerns about fish oil's sustainability, and growing uses in food, feed, infant formula, and dietary supplements are all driving Canada's DHA-rich algae oil market. Besides, innovation in sustainable and vegan ingredients and rising demand for functional foods are important factors influencing the segment expansion.

- The microalgae segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Canada algae oil market is segmented by source into microalgae, macroalgae (seaweed), and genetically modified algae. Among these, the microalgae segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Its more affordable and sustainable oil supply is credited with the expansion. Compared to macroalgae, which have an oil content of 1–5%, microalgae offer an oil content of 35–65% of dry mass. Companies prefer microalgae over macroalgae as a source of algae oil because of the high percentage of oil.

- The solvent extraction segment held the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canada algae oil market is differentiated by extraction method into solvent extraction, cold pressed, enzymatic extraction, and supercritical fluid extraction. Among these, the solvent extraction segment held the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of its high yield efficiency, scalability, and affordability; it is most commonly utilised in Canada. DHA/EPA-rich algae oil can be produced on a large scale for commercial use using common solvents like ethanol or hexane. Further, it is preferred by manufacturers who supply the food, nutraceutical, and biofuel industries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada algae oil market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an in-depth analysis of the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for evaluating the overall competition in the market.

List of Key Companies

- Corbion N.V.

- DSM-Firmenich

- Cellana Inc.

- Cargill Inc.

- AlgaeCytes Ltd.

- Qualitas Health (iWi)

- SABIC (through algae bioplastics collaboration)

- Algatech Ltd.

- Veramaris (joint venture by DSM and Evonik)

- Bioprocess Algae LLC

- Others

Recent Developments:

- In July 2025, Mara Renewables, a biotech company, secured USD $9.1 million in July 2025 to expand production of its algae-based omega-3 DHA. The funding came from S2G Investments and will help scale sustainable, fish-free omega-3 solutions for human and animal nutrition.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2035. decision advisior has segmented the Canada algae oil market based on the below-mentioned segments:

Canada Algae Oil Market, By Type

- DHA-Rich Algae Oil

- EPA-Rich Algae Oil

- Combined EPA-DHA Oil

Canada Algae Oil Market, By Source

- Microalgae

- Macroalgae (Seaweed)

- Genetically Modified Algae

Canada Algae Oil Market, By Extraction Method

- Solvent Extraction

- Cold Pressed

- Enzymatic Extraction

- Supercritical Fluid Extraction

FAQ

Q: What is the market size and growth forecast for the Canadian algae oil market?

A: The Canadian algae oil market was estimated at USD 150.55 million in 2024 and is projected to grow at a CAGR of 3.18% from 2025 to 2035, reaching USD 212.55 million by 2035.

Q: What types and sources segment the market?

A: The market is segmented by type into DHA-rich algae oil, EPA-rich algae oil, and combined EPA-DHA oil. The DHA-rich segment held a substantial share due to its application in functional foods, supplements, and infant formulas. By source, microalgae led in 2024 due to higher oil content and sustainable cultivation advantages compared to macroalgae (seaweed) and genetically modified algae.

Q: What are the common extraction methods?

A: Extraction is primarily by solvent extraction, which held the largest revenue share due to scalability and affordability, followed by cold pressing, enzymatic, and supercritical fluid extraction.

Q: What drives market growth?

A: Key drivers include increasing demand for sustainable and plant-based omega-3 fatty acids, rising health awareness, especially among ageing populations, growing applications in dietary supplements, nutraceuticals, cosmetics, and biofuels. Government-backed research and investments accelerate innovation in algae cultivation and oil extraction technologies.

Q: What are the challenges?

A: High production costs, limited scalability, regulatory hurdles, competition with traditional fish oils, and sensory acceptance impact market expansion.

Q: Who are the key players?

A: Leading companies include Corbion N.V., DSM-Firmenich, Cellana Inc., Cargill Inc., AlgaeCytes Ltd., Qualitas Health (iWi), SABIC, Algatech Ltd., Veramaris (a joint venture between DSM and Evonik), and Bioprocess Algae LLC.

Q: Are there recent developments?

A: Mara Renewables secured $9.1 million in July 2025 to expand sustainable algae-based omega-3 DHA production for human and animal nutrition, reflecting strong investor confidence and growing demand.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 198 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |