Canada Anaemia Drugs Market

Canada Anemia Drugs Market Size, Share, and COVID-19 Impact Analysis, By Type (Sickle Cell Anemia, Plastic Anemia, and Iron-Deficiency Anemia), By Therapy (Oral Iron Therapy, Red Blood Cell Transfusion, Parental Iron Therapy, and Other Therapy Types), and Canada Anemia Drugs Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Anaemia Drugs Market Size Insights Forecasts to 2035

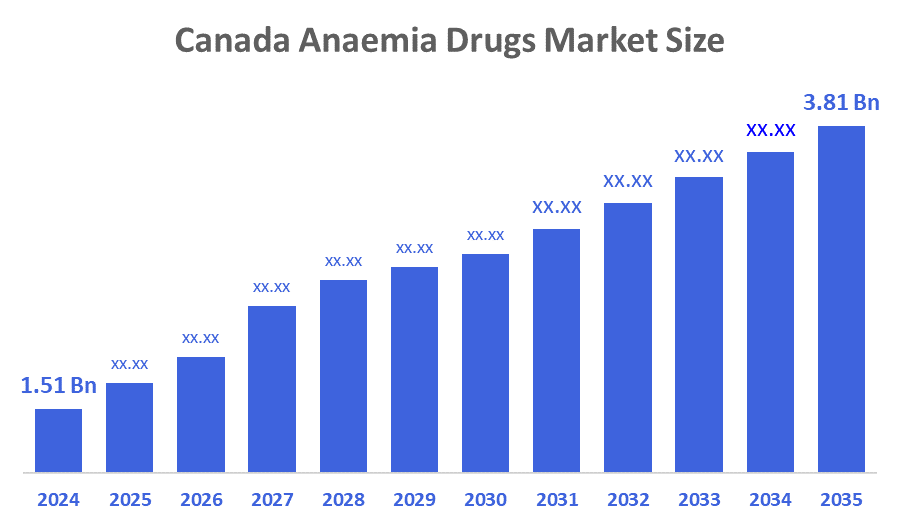

- The Canada Anaemia Drugs Market Size was estimated at USD 1.51 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.78% from 2025 to 2035

- The Canada Anaemia Drugs Market Size is Expected to Reach USD 3.81 Billion by 2035

According to a Research Report Published by Decisions Advisors and Consulting, The Canada Anaemia Drugs Market Size is anticipated to Reach USD 3.81 Billion by 2035, Growing at a CAGR of 8.78% from 2025 to 2035. Research and development associated with anaemia medications, as well as increased awareness of anaemia across the country, boost the market growth with produce novel market opportunities. Anaemia medications are in greater need as a result of the increasing recognition of anaemia and its causes. Further, patient associations and healthcare providers are contributing to this in certain ways.

Market Overview

The market for anaemia medications in Canada is a sector of the pharmaceutical industry devoted to the research, development, manufacturing, and delivery of therapies for anaemia, a haematological disorder marked by a deficit of red blood cells or haemoglobin. Anaemia can be caused by a variety of things, such as medications, chronic illnesses, genetic disorders, and nutritional deficiencies. Further, reduced hematocrit and red blood cell counts are typically linked to haemoglobin deficiency. Anaemia, which includes sickle cell anaemia and thalassemia, is a genetic or acquired condition that affects the synthesis of haemoglobin. The causes and symptoms of the more than 400 different types of anaemia that have been identified vary. The precise origin and degree of the anaemia determine the preferred anaemia medication. The market share of anaemia medications is anticipated to rise over the next decade for a range of reasons, including an ageing population, a lack of nutrient-dense foods, and an increase in the prevalence of chronic illnesses such as diabetes, cancer, and kidney disease. Approximately 3.5 billion Canadians suffer from anaemia, making it a prevalent illness.

Canada and Ontario signed a deal to invest more than $535 billion to make it easier for individuals to get drugs for rare diseases, get diagnosed early, and get screened. This will lead to better outcomes for patients, even those with rare diseases that involve anaemia.

The first province to publicly compensate Ojjaara for treating myelofibrosis in adults with moderate to severe anaemia is Quebec. One of the more common myeloproliferative neoplasms (MPNs) is myelofibrosis, a rare blood cancer. Myelofibrosis is estimated to affect 1,400–2,177 people in Canada.

Report Coverage

This research report categorises the market for the Canada anaemia drugs market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada anaemia drugs market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada anaemia drugs market.

Driving Factors

One of the primary factors propelling the market for anaemia medications is the rising incidence of anaemia. Anaemia is more common in Canada's ageing population. Over the next 20 years, Canada's senior population, those 65 and older, is expected to grow by 68% which opens new market opportunities. The market for Canadian anaemia drugs is driven by the high demand due to the rising incidence of anaemia, particularly iron deficiency anaemia and anaemia associated with chronic illnesses like cancer and chronic kidney disease (CKD). The market growth is also supported by the ageing population and growing awareness of the negative effects of anaemia on quality of life. Moreover, innovative erythropoiesis-stimulating agents (ESAs), intravenous iron formulations, and newly developed oral hypoxia-inducible factor prolyl hydroxylase inhibitors (HIF-PHIs) are examples of technological developments that are changing treatment regimens with patient compliance that boost the market expansion. Besides, increased screening initiatives and strong partnerships between biopharmaceutical firms and healthcare providers give a rapid pace of market development.

Restraining Factors

However, the adverse effects of prescription medications for anaemia are anticipated to impede market growth. The market for anaemia medications in Canada is constrained by several kinds of issues, chief among them being treatment restrictions, financial obstacles, and difficulties with patient adherence.

Market Segmentation

The Canada anaemia drugs market share is classified into type and therapy.

- The sickle cell anaemia segment held a significant share in 2024 and is anticipated to grow at a rapid pace over the forecast period.

The Canada anaemia drugs market is divided by type into sickle cell anaemia, aplastic anaemia, and iron-deficiency anaemia. Among these, the sickle cell anaemia segment held a significant share in 2024 and is anticipated to grow at a rapid pace over the forecast period. Haemoglobin, the protein in red blood cells that carries oxygen, is damaged in sickle cell anaemia, a genetic disorder. Haemoglobin molecules take on abnormal, hard forms in sickle cell anaemia, resulting in deformed and easily degraded red blood cells. Anaemia can result in which can cause pain, damage to organs, and other issues.

- The oral iron therapy segment dominated the market in 2024 and is projected to grow at a significant CAGR during the forecast period.

The Canada anaemia drugs market is segmented by therapy into oral iron therapy, red blood cell transfusion, parental iron therapy, and other therapy types. Among these, the oral iron therapy segment dominated the market in 2024 and is projected to grow at a significant CAGR during the forecast period. It is frequently used to treat iron deficiency anaemia, a condition in which the body lacks iron and cannot produce enough healthy red blood cells. The purpose of the supplements is to restore iron reserves, which enables the bone marrow to produce more red blood cells and raise haemoglobin levels.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada anaemia drugs market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Apotex Inc.

- Pharmascience Inc.

- Sanofi Canada

- Sun Pharmaceutical Industries Ltd. (Sun Pharma Canada Inc.)

- Gilead Sciences Canada, Inc.

- Lupin Pharma Canada Ltd.

- JAMP Pharma

- Others

Recent Developments:

- In March 2025, Accrufer (ferric maltol) is now available in Canada as a prescription oral treatment for iron deficiency anaemia (IDA). This marks the introduction of a new oral iron therapy option for Canadian patients who struggle with traditional iron supplements.

- In November 2024, Health Canada approved Ferinject (ferric carboxymaltose) for the intravenous treatment of iron deficiency anaemia in adults and pediatric patients (≥1 year old), and for iron deficiency in adult patients with heart failure (NYHA class II/III).

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada anaemia drugs market based on the below-mentioned segments:

Canada Anaemia Drugs Market, By Type

- Sickle Cell Anaemia

- Plastic Anaemia

- Iron-Deficiency Anaemia

Canada Anaemia Drugs Market, By Therapy

- Oral Iron Therapy

- Red Blood Cell Transfusion

- Parental Iron Therapy

- Other Therapy Types

FAQ

Q: What is the size and forecast of the Canada anaemia drugs market?

A: The Canadian anaemia drugs market was valued at USD 1.51 billion in 2024 and is expected to grow to USD 3.81 billion by 2035, with a CAGR of approximately 8.78% during 2025-2035.?

Q: What types of anaemia are most prevalent in Canada?

A: The market segments anaemia into sickle cell anaemia, aplastic anaemia, and iron-deficiency anaemia. Sickle cell anaemia holds a significant share, driven by its genetic nature and severe impact on haemoglobin and red blood cells.?

Q: What therapies dominate the market?

A: Oral iron therapy is the leading therapy segment, widely used for iron-deficiency anaemia treatment due to ease of administration and effectiveness. Other therapies include red blood cell transfusions and parenteral iron therapy.?

Q: What are the key growth drivers?

A: Drivers include the rising prevalence of anaemia, particularly among Canada’s ageing population and patients with chronic diseases such as cancer and chronic kidney disease. Technological advancements like erythropoiesis-stimulating agents, intravenous iron formulations, and new oral hypoxia-inducible factor prolyl hydroxylase inhibitors improve treatment efficacy and compliance. Increased screening and collaborations between pharmaceutical companies and healthcare providers also fuel growth.?

Q: What limits market growth?

A: Restraining factors include side effects from anaemia medications, treatment access barriers, financial constraints, and patient non-adherence.?

Q: Who are the key market players?

A: Major companies include Apotex Inc., Pharmascience Inc., Sanofi Canada, Sun Pharmaceutical Industries, Gilead Sciences Canada, Lupin Pharma Canada, and JAMP Pharma.?

Q: What recent developments have impacted the market?

A: Recent drug approvals include Accrufer (ferric maltol) oral therapy and Ferinject (ferric carboxymaltose) intravenous therapy approved by Health Canada in 2024 and 2025, enhancing treatment options for iron deficiency anaemia patients.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 243 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |