Canada Automotive Stainless Steel Tube Market

Canada Automotive Stainless Steel Tube Market Size, Share, and COVID-19 Impact Analysis, By Grade (200 Series, 300 Series, 400 Series, 500 Series, and Others), By Product (Welded Tube, Seamless Tube, and Others), By Application (Diesel Spark Plugs, Motor Block Reheating, DPF Systems, EGR Systems, and Others), and Canada Automotive Stainless Steel Tube Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Automotive Stainless Steel Tube Market Insights Forecasts to 2035

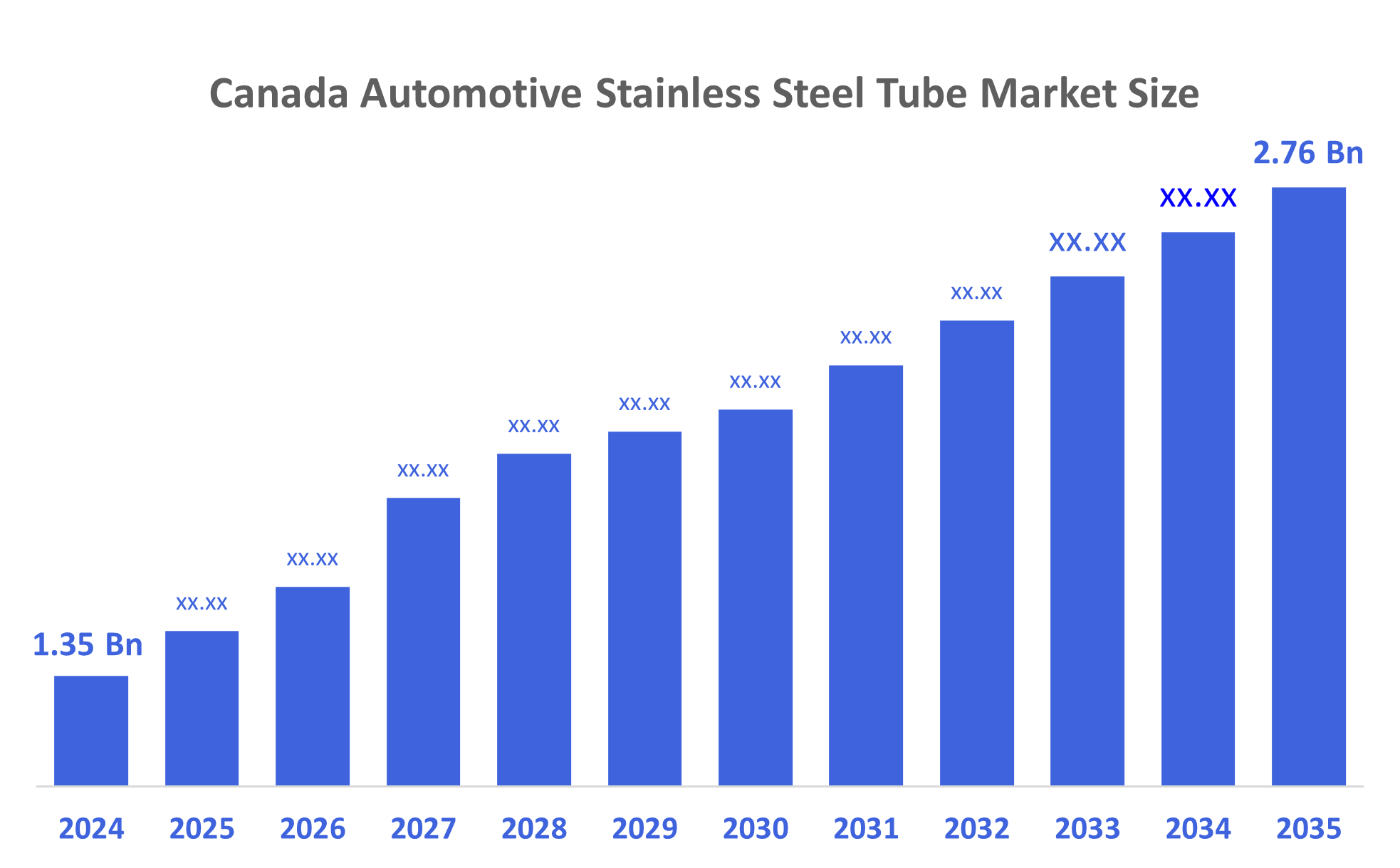

- The Canada Automotive Stainless Steel Tube Market Size Was Estimated at USD 1.35 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.72% from 2025 to 2035

- The Canada Automotive Stainless Steel Tube Market Size is Expected to Reach USD 2.76 Billion by 2035

According to a research report published by Decisions Advisors, The Canadian Automotive Stainless Steel Tube Market Size is Anticipated to Reach USD 2.76 Billion by 2035, Growing at a CAGR of 6.72% from 2025 to 2035. The market is driven by an increasing need for lightweight products in automotive applications, the enforcement of strict emission regulations, recent technological advancements, and the expansion of product applications in electric vehicles (EVs).

Market Overview

Automotive stainless-steel tube refers to tubing designed specifically for the automotive industry. Corrosion resistance, durability, and malleability are just a few of its attributes. Extrusion, welding, and seamless procedures are used to create automotive stainless-steel tubes. Fuel and brake lines, exhaust systems, cooling lines, airbag deployment, turbocharger systems, hydraulic lines, instrumentation, and heating, ventilation, and air conditioning (HVAC) systems are just a few of the many applications for it.

The automotive stainless steel tube market concentration contains a total of 53 importers, and the value of these imports is 24,875,511, and their cumulative percent of imports is 80.29. The Canadian government announced that Canada would impose, starting March 13, 2025, a 25% surtax on an additional $29.8 billion worth of US?origin goods

Strategic alliances with Tier 1 suppliers and vehicle OEMs (Original Equipment Manufacturers) present opportunities. By meeting the unique requirements of the automotive sector, such as the provision of specially made stainless steel tubes for particular car models, these collaborations can provide new sources of income. Additionally, funding research and development to produce novel alloys and enhance the performance attributes of stainless-steel tubes, like weight reduction and corrosion resistance.

Report Coverage

This research report categorizes the market for the Canada automotive stainless steel tube market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada automotive stainless steel tube market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada automotive stainless steel tube market.

Driving Factors

The automotive stainless steel tube markets in Canada are driven by a growth of manufacturing capacity to satisfy the automobile industry's rising need for cutting-edge materials. The need for specialist stainless steel tubes in parts like exhaust systems and powertrains is expected to increase as hybrid and electric vehicles become more popular. Advancements in technology to enhance the production processes, including better heat treatment and welding techniques, can provide a company with a competitive edge in the sector. In the automotive industry, stainless steel helps extend the life of components, ensuring that vehicles remain in better condition even in impacting environmental conditions.

Restraining Factors

The automotive stainless steel tube market in Canada is majorly restrained by the high cost of manufacturing stainless steel tubes, which are obtained from rare metals like titanium, nickel, and chromium during the fabrication of stainless-steel alloys, which has hampered the use of stainless-steel tubes in automobiles. Furthermore, the market's expansion is constrained by the availability of aluminium, a less expensive raw material substitute. Although shifts to secondary and recycled raw materials are being used as mitigation techniques, there are still issues with quality control and technological obstacles that call for regular investments in process optimization and innovation.

Market Segmentation

The Canadian automotive stainless steel tube market share is categorised by grade, product, and application.

- The 300 series segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian automotive stainless steel tube market is segmented by grade into 200 series, 300 series, 400 series, 500 series, and others. Among these, the 300 series segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by the 300 series grade's exceptional durability makes it ideal for automotive parts exposed to chemicals, road salts, and other corrosive materials. It is also well known for its durability and ability to withstand cyclic loading, fluctuations in temperature, and mechanical stress without breaking or deteriorating.

- The welded tube segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on product, the Canadian automotive stainless steel tube market is segmented into welded tube, seamless tube, and others. Among these, the welded tube segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven due to its affordability and simple manufacturing method, which requires fewer stages and produces less waste. Additionally, the technique of producing welded tubes gives manufacturers more control over the dimensions and specifications, allowing for the creation of tubes with a range of shapes, widths, and thicknesses to meet the various demands of the automobile sector.

- The diesel spark plugs segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian automotive stainless steel tube market is segmented by application into diesel spark plugs, motor block reheating, DPF systems, EGR systems, and others. Among these, the diesel spark plugs segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by construction with stainless steel tubing that guarantees effective operation in a diesel engine's harsh environment. Diesel spark plugs are more dependable and long-lasting due to the inherent strength, resistance to corrosion, and capacity to tolerate high temperatures of stainless steel.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada automotive stainless steel tube market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Autotube Ltd

- Scan Tube Steel Service

- Brokel Stainless Ltd

- Bend All Automotive

- Brannon Steel

- Maksteel powered

- PinAcle Stainless Steel

- Diversified Ulbrich of Canada

- Valbruna ASW

- ATH Stainless Steel

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada Automotive Stainless Steel Tube Market based on the below-mentioned segments:

Canada Automotive Stainless Steel Tube Market, By Grade

- 200 Series

- 300 Series

- 400 Series

- 500 Series

- Others

Canada Automotive Stainless Steel Tube Market, By Product

- Welded Tube

- Seamless Tube

- Others

Canada Automotive Stainless Steel Tube Market, By Application

- Diesel Spark Plugs

- Motor Block Reheating

- DPF Systems

- EGR Systems

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |