Canada Automotive Steel Wheel Market

Canada Automotive Steel Wheel Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Passenger Cars, Light Commercial Vehicles), By Material (Alloy, Carbon Fiber), By Rim Size (Below 15 Rim Size, 16-18 Rim Size), and Canada Automotive Steel Wheel Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Automotive Steel Wheel Market Insights Forecasts to 2035

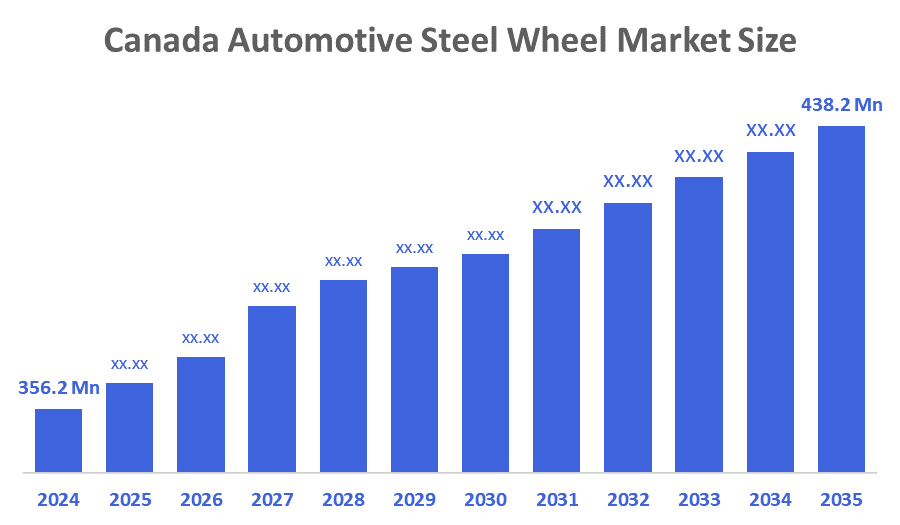

- The Canada Automotive Steel Wheel Market Size Was Estimated at USD 356.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 1.9% from 2025 to 2035

- The Canada Automotive Steel Wheel Market Size is Expected to Reach USD 438.2 Million by 2035

According to a research report published by Decision Advisior & Consulting, the Canadian Automotive Steel Wheel Market size is anticipated to reach USD 438.2 Million by 2035, growing at a CAGR of 1.9% from 2025 to 2035. The market is driven by a rising need in the automobile sector for affordable and long-lasting wheel solutions. Steel wheels are prevalent in many car sectors due they are stronger, more durable, and more affordable than wheels made of other substances.

Market Overview

Automobile steel wheels are cylindrical rims that have tyres attached to them. Contrary to the alloy wheel, these rims are more robust and less expensive. Steel wheels contribute to the vehicle's total weight and ease of mobility. The automotive industry has been forced to innovate and upgrade. One popular form of wheel utilized on automobiles is the steel wheel. Usually composed of steel or other metallic alloys, it serves a variety of purposes.

In 2021, ZEV registrations reached a significant milestone, accounting for 5.2% of all new registrations. In Canada's three biggest provinces, 1.6 million new cars were registered in 2021; Quebec accounted for 42.8% of all new ZEV registrations, British Columbia for 27.7%, and Ontario for 22.9%.

A new federal investment in project finance for manufacturer Stellantis to modernize assembly plants and increase electric vehicle manufacturing was announced by the Canadian prime minister. The Canadian government said in a statement that it is contributing up to USD 423 million to this project. Additionally, the Canadian government of Ontario is contributing up to USD 380.37 million towards the project.

Report Coverage

This research report categorizes the market for the Canada automotive steel wheel market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada automotive steel wheel market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada automotive steel wheel market.

Driving Factors

The automotive steel wheel market in Canada is driven by the due to their lightweight construction, energy efficiency, and aesthetic appeal. This is a primary factor driving the vehicle steel wheel industry. Due to growing middle-class populations, better road systems, and urbanization. Steel wheels are more resilient and seldom break or bend. Additionally, the time needed to produce steel wheels has drastically decreased, and their craftsmanship has improved over the last few years. As a result, the entire procedure becomes economical.

Restraining Factors

The automotive steel wheel market in Canada is majorly restricted due to alloy wheels are becoming more and more popular, especially in high-end and luxury car categories. Growing geopolitical conflicts are having an enormous effect on the automobile steel wheel industry by disrupting supply chains, affecting international trade, and driving up the price of raw materials. The unpredictability of material expenses makes it difficult for producers to maintain stable pricing tactics, which could lead to decreased profit margins and increased operational risks.

Market Segmentation

The Canadian automotive steel wheel market share is categorised by vehicle type, material, and rim size.

- The light commercial vehicles segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian automotive steel wheel market is segmented by vehicle type into passenger cars, light commercial vehicles. Among these, the light commercial vehicles segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by the light commercial vehicle (LCV) accounted for the largest market share of 70.46% in 2021. The wheels of a light commercial vehicle are considered an essential part since they need to be strong enough to sustain both the weight of the vehicle and the strain on the axle. Many LCVs have wheels made of steel.

- The alloy segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on material, the Canadian automotive steel wheel market is segmented into alloy, carbon fiber. Among these, the alloy segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by Alloy accounted for the largest market share of 87.50% in 2021. Alloy wheels are lighter than steel wheels; they can accelerate more fast and put less stress on the suspension, making them more aesthetically pleasing. Additionally, alloy wheels provide more customization choices.

- The 16-18 rim size segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian automotive steel wheel market is segmented by rim size into below 15 rim size, 16-18 rim size. Among these, the 16-18 rim size segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by 16-18 accounted for the largest market share of 46.51% in 2021. A car with 16–18 alloy tyres will feel a little sportier, indicating that its steering will feel sharp and the cornering and stability will typically feel better. Larger rims also tend to make the car seem finer.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada automotive steel wheel market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Wheel Xpert

- Fastco Canada

- Elite Wheel & Tire

- Simcoe Parts Services

- Opti Distribution

- Brannon Steel

- WheelWiz

- Cat Steel Products

- Egar Tool and Die

- Venture Steel Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2025, Fastco Canada, a Canadian-owned leader in aftermarket alloy wheels, announces the acquisition of the ENVY wheel brand, further expanding its portfolio of innovative, high-quality wheel solutions built for Canadian roads and conditions.

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Dedcision Advisior has segmented the Canada Automotive Steel Wheel Market based on the below-mentioned segments:

Canada Automotive Steel Wheel Market, By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

Canada Automotive Steel Wheel Market, By Material

- Alloy

- Carbon Fiber

Canada Automotive Steel Wheel Market, By Rim Size

- Below 15 Rim Size

- 16-18 Rim Size

FAQ’s

Q: What is the Canadian automotive steel wheel market size?

A: The Canada Automotive Steel Wheel Market size is expected to grow from USD 356.2 million in 2024 to USD 438.2 million by 2035, growing at a CAGR of 1.9% during the forecast period 2025-2035

Q: What is a automotive steel wheel, and its primary use?

A: Automobile steel wheels are cylindrical rims that have tyres attached to them. Contrary to the alloy wheel, these rims are more robust and less expensive. Steel wheels contribute to the vehicle's total weight and ease of mobility. Globally, the automotive industry has been forced to innovate and upgrade. One popular form of wheel utilized on automobiles is the steel wheel.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the due to their lightweight construction, energy efficiency, and aesthetic appeal. This is a primary factor driving the vehicle steel wheel industry. because of growing middle-class populations, better road systems, and urbanization. Steel wheels are more resilient and seldom break or bend. Additionally, the time needed to produce steel wheels has drastically decreased, and their craftsmanship has improved over the last few years.

Q: What factors restrain the Canadian automotive steel wheel market?

A: The Market is restrained by the alloy wheels are becoming more and more popular, especially in high-end and luxury car categories. Growing geopolitical conflicts are having an enormous effect on the automobile steel wheel industry by disrupting supply chains, affecting international trade, and driving up the price of raw materials.

Q: How is the market segmented by vehicle type?

A: The market is segmented into passenger cars, light commercial vehicles.

Q: Who are the key players in the Canadian automotive steel wheel market?

A: Key companies include Wheel Xpert, Fastco Canada, Elite Wheel & Tire, Simcoe Parts Services, Opti Distribution, Brannon Steel, WheelWiz, Cat Steel Products, Egar Tool and Die, and Venture Steel Inc.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 201 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |