Canada Ayurveda Veterinary Medicine Market

Canada Ayurveda Veterinary Medicine Market Size, Share, and COVID-19 Impact Analysis, By Product (Pharmaceuticals, Nutritional Supplements, and Feed Additives), By Route of Administration (Oral, Topical, and Others), and Canada Ayurveda Veterinary Medicine Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Ayurveda Veterinary Medicine Market Size Insights Forecasts to 2035

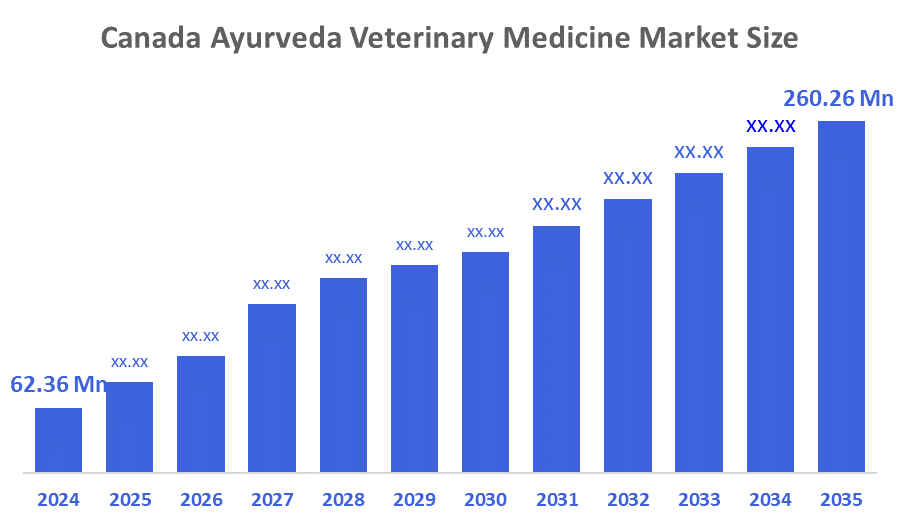

- The Canada Ayurveda Veterinary Medicine Market Size was estimated at USD 62.36 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 13.87% from 2025 to 2035

- The Canada Ayurveda Veterinary Medicine Market Size is Expected to Reach USD 260.26 Million by 2035

According to a Research Report Published by Decisions Advisors and Consulting, The Canada Ayurveda Veterinary Medicine Market Size is anticipated to Reach USD 260.26 Million by 2035, Growing at a CAGR of 13.87% from 2025 to 2035. The growing need for natural and holistic animal care, rising concerns about antimicrobial resistance (AMR), and the launch of government programs and regulatory approvals are key factors driving the market's expansion. A combination of well-established Ayurvedic healthcare companies and up-and-coming animal health startups make up the moderately concentrated and rapidly growing Ayurvedic veterinary medicine market.

Market Overview

The Canada ayurvedic veterinary medicine market is a category within the wider veterinary medical industry that focuses on integrative, herbal, and natural treatments for companion and production animals based on Ayurvedic principles. It integrates traditional Indian medicine with contemporary animal healthcare procedures that are controlled under Canada’s natural health product frameworks. The purchases for animal healthcare are being influenced by global wellness and herbal therapy trends. The growing preference for holistic, nature-based approaches to animal wellness over artificial chemical treatments. This shift encourages a greater need for herbal, free of antibiotics, and animal wellness-focused Ayurvedic veterinary medications. It boosts the retail shelf presence of herbal veterinary supplements, promotes veterinarian adoption, and promotes the development of new products for managing stress, skin care, gastrointestinal health, and immunity strengthening. The Canadian government is making large investments in veterinary health and innovation. These expenditures involve initiatives to enhance livestock health and access to veterinary services, which could contribute to specialities such as Ayurvedic veterinary medicine.

The Canadian Agricultural Partnership, for instance, Canada and Ontario have committed $4 million to improve veterinary availability, which includes telemedicine and mobile healthcare services in rural regions. This could help complementary veterinary treatments, such as Ayurveda, be accepted and incorporated more broadly. ?

Report Coverage

This research report categorises the market for the Canada ayurveda veterinary medicine market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada ayurveda veterinary medicine market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada ayurveda veterinary medicine market.

Driving Factors

The growing desire among consumers and veterinarians for safe, natural, and comprehensive animal health solutions is the main factor propelling the Canada ayurvedic veterinary medicine market. Adoption of Ayurvedic-based medicines as plant-derived, residue-free substitutes for conventional chemical drugs is driven by growing concerns about antimicrobial resistance (AMR) and the adverse effects of drugs. The market expansion is influenced by government regulations supporting herbal veterinary products and programs encouraging antibiotic stewardship. The growing acceptance and use of polyherbal formulations that target immunity, digestion, skin health, and stress relief are fueled by awareness campaigns, online educational initiatives, and joint research between veterinary professionals and Ayurvedic companies drives the market expansion. Clinical validation and standardisation technologies increase the efficacy of products and open up new market growth opportunities.

Restraining Factors

However, there are challenges because universal licensing regulations are inconsistent, and there are no standardised approval frameworks. Ayurvedic veterinary products can be substituted by conventional allopathic veterinary medications, nutraceuticals, probiotics, and homoeopathic remedies. Antibacterial drugs are often used by gardeners because they produce results promptly, but concerns about immunity and contaminants are making consumers turn to herbal alternatives.

Market Segmentation

The Canada ayurveda veterinary medicine market share is classified into product and route of administration.

- The pharmaceuticals segment held a significant share in 2024 and is anticipated to grow at a rapid pace over the forecast period.

The Canada ayurveda veterinary medicine market is divided by product into pharmaceuticals, nutritional supplements, and feed additives. Among these, the pharmaceuticals segment held a significant share in 2024 and is anticipated to grow at a rapid pace over the forecast period. This is driven by the growing desire for natural, safe, and efficient substitutes for prescription medications. Both livestock and companion animals can benefit from the herbal formulations, anti-inflammatory, antimicrobial, and immunity-boosting products in this category. The use of pharmaceuticals is accelerated by growing awareness of antibiotic resistance, regulatory support for herbal veterinary remedies, and the expansion of preventive healthcare practices.

- The oral segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The Canada ayurveda veterinary medicine market is segmented by route of administration into oral, topical, and others. Among these, the oral segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This is because of its affordability, simplicity of use, and demonstrated ability to boost immunity, productivity, and general health; the oral route is recommended. Adoption is further fueled by government programs encouraging sustainable animal care as well as growing awareness among farmers and pet owners about natural, residue-free alternatives. Furthermore, the majority of vitamin-mineral formulations, digestive aids, immunity boosters, and herbal feed supplements are taken orally and are frequently used for both companion and livestock animals.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Canada ayurveda veterinary medicine market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ceva Animal Health Canada

- Vetster

- Wilder Harrier Montreal

- Zoetis Canada Kirkland,

- Vetoquinol Canada

- Virbac Canada

- Phibro Animal Health Canada

- IDEXX Laboratories Canada

- Others

Recent Developments:

- In February 2023, Bioved Pharmaceuticals, Inc. launched its own line of Shwan Ayurved science-based natural products for animal health. This is a big step forward for Ayurveda-based products in the Canadian veterinary market. This line of products uses plant-based ingredients and Ayurvedic principles to help animals, in response to the growing need for safe, natural, and long-lasting treatments for pets and farm animals.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada ayurveda veterinary medicine market based on the below-mentioned segments:

Canada Ayurveda Veterinary Medicine Market, By Product

- Pharmaceuticals

- Nutritional Supplements

- Feed Additives

Canada Ayurveda Veterinary Medicine Market, By Route of Administration

- Oral

- Topical

- Others

FAQ

- What is the current market size of the Canadian Ayurveda Veterinary Medicine Market?

The market size was estimated at approximately USD 62.36 million in 2024.

- What is the expected market size and growth by 2035?

The market is projected to reach about USD 260.26 million by 2035, growing at a CAGR of 13.87% from 2025 to 2035.

- What drives this market’s growth?

Growth is driven by increasing demand for natural and holistic animal health solutions, rising concerns about antimicrobial resistance (AMR), growing government programs and regulatory approvals supporting herbal veterinary products, and rising consumer and veterinary professional acceptance of Ayurveda-based formulations.

- What are the key product segments?

The market is segmented into pharmaceuticals, nutritional supplements, and feed additives. The pharmaceuticals segment held a significant share in 2024 and is expected to grow rapidly due to demand for safe, herbal substitutes for prescription meds.

- What are the main routes of administration?

The market segments include oral, topical, and others, with the oral segment dominating in 2024. Oral administration is preferred for its affordability, ease of use, and proven benefits for immunity and general health.

- Who are the key companies in this market?

Leading companies include Ceva Animal Health Canada, Vetster, Wilder Harrier Montreal, Zoetis Canada Kirkland, Vetoquinol Canada, Virbac Canada, Phibro Animal Health Canada, and IDEXX Laboratories Canada.

- Are there any recent product launches or developments?

In February 2023, Bioved Pharmaceuticals, Inc. launched its Shwan Ayurved science-based natural products line targeting animal health, marking a significant advancement for Ayurveda in the Canadian veterinary market.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 248 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |