Canada Base Oil Market

Canada Base Oil Market Size, Share, and COVID-19 Impact Analysis, By Type (Mineral Oil, Synthetic Oil, and Bio-Based Oil), By Grade (Group I, Group II, Group III, Group IV, and Others), and Canada Base Oil Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Base Oil Market Insights Forecasts to 2035

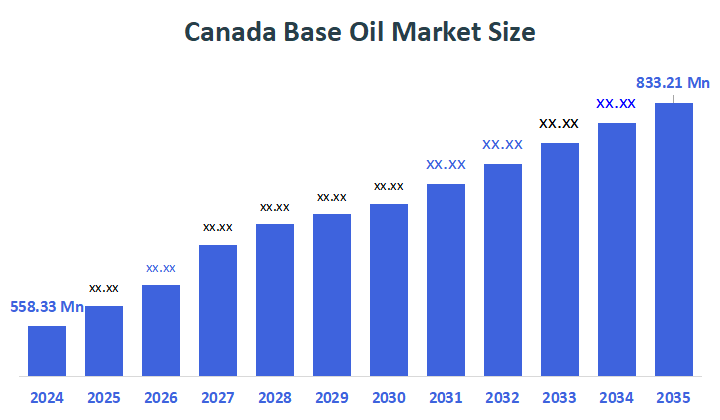

- The Canada Base Oil Market Size was estimated at USD 558.33 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.71% from 2025 to 2035

- The Canada Base Oil Market Size is Expected to Reach USD 833.21 Million by 2035

According to a research report published by Decisions Advisors, the Canada Base Oil Market is anticipated to reach USD 833.21 million by 2035, growing at a CAGR of 3.71% from 2025 to 2035. The market is driven by stricter emission regulations (BS-VI), increasing demand for high-performance lubricants, and the automobile industry's move toward premium Group II/III base oils. Further, sustainability initiatives by the government and cost-effective refining technologies that influence the production of eco-friendly base oils encourage local production.

Market Overview

The base oil industry is the segment of the Canadian chemical and energy industry that produces, imports, and distributes base oils and refined petroleum products. They are used as the primary raw material in lubricants such as engine oils, transmission fluids, hydraulic oils, greases, and industrial lubricants. The four essential physical characteristics of base oil pour point, volatility, aniline point, and viscosity limitations and index determine how well it will function in service. The base oil helps to protect the bearings, piston rings, and other engine parts that require continuous lubrication. Crude oil is processed for base oils extraction. Synthetic ester oil, virgin base oil, PAO oil, and naphthenic base oil are forms of base oil that are commercially accessible. Greases, industrial gear lubricants, engine oils, transmission oils, and other lubricating oils are made from base oils. They are employed in the manufacturing, engineering, automotive, and industrial sectors.

The Canadian federal government increased investments in the base oil industry through more comprehensive oil and gas initiatives in Budget 2025. For example, Natural Resources Canada received $50 million over five years for the Critical Minerals Sovereign Fund, which indirectly supports the production chains for lubricants and refining.

$371.8 million for the First and Last Mile Fund to increase energy infrastructure connections. Additional steps indicate a policy change, such as the possibility of lifting the oil and gas emissions cap if carbon capture increases, financing for the Major Projects Office to expedite national-interest projects like LNG Canada Phase 2, and tax breaks like CCUS ITC to draw private investment into base oil-producing with low-emission oil operations.

Report Coverage

This research report categorises the market for the Canada base oil market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada base oil market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada base oil market.

Driving Factors

The base oil market is experiencing development due to the increasing automotive and robust manufacturing industries across the Canadian territory that require lubricants for machinery and vehicle maintenance. Additionally, the rising need for energy efficiency and sustainability pushes the demand for high-quality base oils. Moreover, technological developments in production processes enable the manufacturing of superior base oils and increased market standards. The kind of base oil used for refining and/or the procedure of base oil manufacturing could alter the quality of a lubricant. Furthermore, rigorous environmental rules pushing the usage of eco-friendly lubricants further boost market growth.

Petro-Canada Lubricants launched SENTRON SP 30, a first-of-its-kind SAE 30 stationary gas engine oil designed for high-performance stationary gas engines.

Restraining Factors

The Canadian base oil market is hampered by environmental laws, high refining costs, import dependency, competition from bio-based alternatives, and diminishing demand from the automobile sector.

Market Segmentation

The Canada base oil market share is classified into type and grade.

- The synthetic oil segment held a significant share in 2024 and is projected to grow at a significant CAGR over the forecast period.

The Canada base oil market is segmented by type into mineral oil, synthetic oil, and bio-based oil. Among these, the synthetic oil segment held a significant share in 2024 and is projected to grow at a significant CAGR over the forecast period. The segment growth is driven by the requirement for excellent lubrication in current high-performance engines working under harsh circumstances. Moreover, its low-viscosity lubricants are necessary for these cars to operate as efficiently as possible; the popularity of electric and hybrid vehicles adds to the rising need for base oils.

- The group I segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The Canada base oil market is segmented by grade into group I, group II, group III, group IV, and others. Among these, the group I segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This is because of their affordability, ease of processing, high viscosity index, low volatility, and lubricating properties, which have led to an increase in their application in rail, automotive, and marine lubricants. Additionally, Group I products have a viscosity between 80 and 120, fewer than 90% saturates, and a sulfur concentration of more than 0.03%. This group is recognised by its minimal number of aromatic chemicals and paraffinic makeup.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada base oil market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Petro-Canada Lubricants?

- Imperial Oil

- Shell Canada Limited

- Stolt Tank?

- Recochem

- Topco Oilsite Products Ltd

- Source Energy Services?

- Bioriginal

- Others

Recent Developments:

- In January 2025, Petro-Canada Lubricants has been considering maintenance activities at its base oils unit in Mississauga, Ontario, which is one of the largest and most advanced base oil refineries in North America. Over 1 billion litres yearly, generating some of the cleanest base oils globally (99.9% purity).

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada base oil market based on the below-mentioned segments:

Canada Base Oil Market, By Type

- Mineral Oil

- Synthetic Oil

- Bio-Based Oil

Canada Base Oil Market,

- Group I

- Group II

- Group III

- Group IV

- Others

FAQ

- What is the projected market size and growth rate?

- The Canadian base oil market was valued at USD 558.33 million in 2024 and is expected to reach USD 833.21 million by 2035, growing at a CAGR of 3.71% from 2025 to 2035.

- What drives the market growth?

- Growth stems from stricter emission regulations like BS-VI, rising demand for high-performance lubricants, automotive shift to premium Group II/III base oils, government sustainability initiatives, and cost-effective refining for eco-friendly oils.

- What are the main market segments?

- By type: Mineral oil, synthetic oil (largest share in 2024, driven by high-performance engines and EVs), bio-based oil.

- By grade: Group I (dominant in 2024 for affordability and use in automotive/marine), Group II, Group III, Group IV, others.

- Who are the key companies?

- Major players include Petro-Canada Lubricants, Imperial Oil, Shell Canada Limited, Stolt Tank, Recochem, Topco Oilsite Products Ltd, Source Energy Services, and Bioriginal.

- What recent developments occurred?

- Petro-Canada Lubricants launched SENTRON SP 30 SAE 30 engine oil and planned January 2025 maintenance at its Mississauga refinery, producing over 1 billion litres of 99.9% pure base oil annually.

- What government support exists?

- Budget 2025 includes $50 million over five years for Natural Resources Canada's Critical Minerals Sovereign Fund, $371.8 million for the First and Last Mile Fund, and incentives like CCUS ITC for low-emission base oil production.

- What are the restraining factors?

Challenges include environmental laws, high refining costs, import dependency, bio-based alternatives, and declining automotive demand.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 170 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |