Canada Bio Acetic Acid Market

Canada Bio Acetic Acid Market Size, Share, and COVID-19 Impact Analysis, By Source (Biomass, Cornstarch, and Others), By Application (Vinyl Acetate Monomer, Acetate Esters, Purified Terephthalic Acid, Acetic Anhydride, and Others), and Canada Bio Acetic Acid Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

Canada Bio Acetic Acid Market Insights Forecasts to 2035

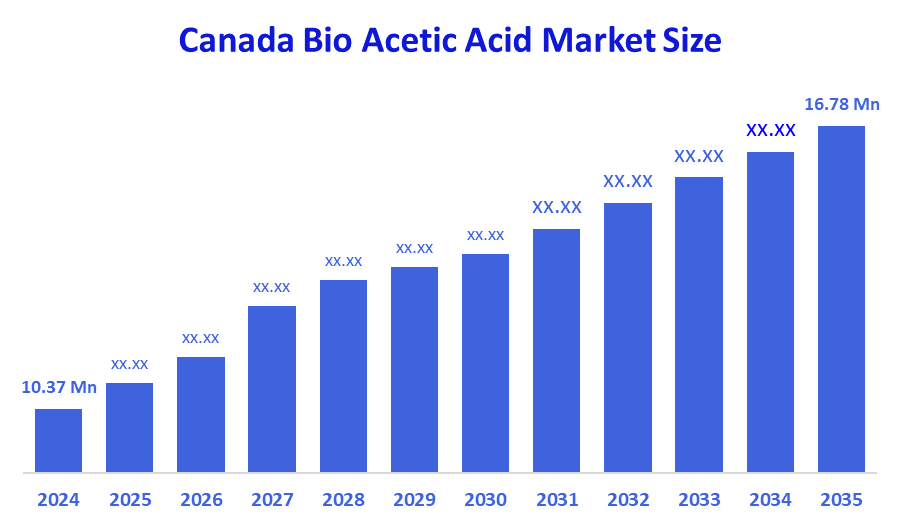

- The Canada Bio Acetic Acid Market Size was estimated at USD 10.37 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.47% from 2025 to 2035

- The Canada Bio Acetic Acid Market Size is Expected to Reach USD 16.78 Million by 2035

According to a research report published by Spherical Insights & Consulting, the Canada Bio Acetic Acid Market is anticipated to reach USD 16.78 million by 2035, growing at a CAGR of 4.47% from 2025 to 2035. The increasing awareness and emphasis on reducing carbon footprints whereas industries brought a shift towards more sustainable & eco-friendly manufacturing processes. The demand for efficient transportation and storage solutions for transporting these hazardous substances safely and in compliance with strict regulations is being driven by the growth of the bio-acetic acid sector.

Market Overview

The segment of the Canadian chemical industry devoted to the manufacture, distribution, and use of acetic acid derived from renewable biological sources, such as biomass, agricultural waste, and fermentation processes, is known as the bio acetic acid market. A sustainable substitute for petroleum-based acetic acid, bio-acetic acid finds many uses in textiles, solvents, and polymer production. In addition, bio-acetic acid's increasing global popularity can be attributed to its versatility in a variety of applications, such as textiles, pharmaceuticals, and food and beverages. Furthermore, it is used as a chemical reagent in the synthesis of a variety of chemical compounds, such as vinegar, vinyl acetate monomer, esters, acetic anhydride, and a variety of polymer products. Further, a $370 million federal investment to increase biofuel production in Canada has been announced by the government. The initiative, which is included in the budget for 2025, intends to boost Canadian competitiveness in the face of disruptions in international trade while bolstering domestic agriculture, particularly canola-based biofuels. In addition, it will introduce new non-reimbursable contributions up to one million dollars in all sectors, including agriculture, and extend reimbursement timelines.

Report Coverage

This research report categorises the market for the Canada bio acetic acid market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada bio acetic acid market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada bio acetic acid market.

Driving Factors

The market for Canada bio acetic acid is influenced by the market expansion is driven by consumer demand for environmentally friendly and sustainable products in sectors like bioplastics, pharmaceuticals, and food and beverage. Moreover, wider adoption has been facilitated by technological developments in fermentation processes, such as grain and sugar fermentation, which have increased production efficiency and cost-effectiveness. In addition to extending application areas beyond food preservation into speciality chemicals and pharmaceuticals, government policies and programs support industries that influence the growth of the Canadian market. Further, market expansion and production scalability are fueled by the availability of renewable biomass feedstocks.

Restraining Factors

Despite significant growth, the market faces some hurdles, such as the high cost of production and the dominance of petrochemical alternatives. Maintenance cost, high-yield production required to satisfy industrial demand, is further complicated by the reliance on agricultural biomass feedstocks (such as corn starch), which introduces supply constraints, including feedstock variability influenced by seasonal outputs and climatic events.

Market Segmentation

The Canada bio acetic acid market share is classified into source and application.

- The biomass segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Canada bio acetic acid market is segmented by source into biomass, cornstarch, and others. Among these, the biomass segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. For sustainable acetic acid production, biomass fermentation uses renewable feedstocks like organic waste, lignocellulosic materials, and agricultural residues. Their ability of this approach to lessen dependency on fossil fuel-based feedstocks, reduce carbon emissions, and promote the circular economy makes it popular. Green chemistry adoption and growing regulatory support spur this segment expansion.

- The vinyl acetate monomer segment held a substantial market share in 2024 and is projected to grow at a significant CAGR during the forecast period.

The Canada bio acetic acid market is segmented by application into vinyl acetate monomer, acetate esters, purified terephthalic acid, acetic anhydride, and others. Among these, the vinyl acetate monomer segment held a substantial market share in 2024 and is projected to grow at a significant CAGR during the forecast period. This segmental growth is driven by its extensive use in the manufacturing of adhesives, films, textiles, paints, coatings, and other end-use products is which is responsible for this growth. Several well-known polymers and resins are made using VAM as a crucial raw material. Additionally, it is employed to create high-performance adhesives and emulsions that are used in the construction, automotive, and packaged food sectors.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Canada bio acetic acid market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Alphachem Limited

- A&K Petrochem

- CCC (Canadian Construction Consultants)

- A&C Ltd.

- Sodrox Chemicals Ltd.

- ORICA Canada Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Canada Bio Acetic Acid Market based on the below-mentioned segments:

Canada Bio Acetic Acid Market, By Source

- Biomass

- Cornstarch

- Others

Canada Bio Acetic Acid Market, By Application

- Vinyl Acetate Monomer

- Acetate Esters

- Purified Terephthalic Acid

- Acetic Anhydride

- Others

FAQ

- What was the estimated market size of the Canadian Bio Acetic Acid Market in 2024?

The estimated market size was USD 10.37 million in 2024.

- What is the expected market size by 2035?

The market is expected to reach USD 16.78 million by 2035.

- What is the forecast CAGR during 2025-2035?

The market is forecasted to grow at a CAGR of 4.47% during the period 2025 to 2035.

- What are the major sources for bio acetic acid production in Canada?

The bio acetic acid market in Canada is segmented by source into biomass, cornstarch, and others. The biomass segment dominated the market in 2024 and is projected to grow significantly.

- What are the main application segments?

The market is segmented by application into vinyl acetate monomer, acetate esters, purified terephthalic acid, acetic anhydride, and others. The vinyl acetate monomer segment held a significant market share in 2024 and is predicted to grow rapidly.

- What are the key growth drivers?

Growth drivers include increasing consumer demand for eco-friendly and sustainable products, technological improvements in fermentation processes, government support and policies favouring bio-based industries, and availability of renewable biomass feedstocks.

- Who are the major companies operating in Canada’s bio acetic acid market?

Key players include Alphachem Limited, A&K Petrochem, Canadian Construction Consultants (CCC), A&C Ltd., Sodrox Chemicals Ltd., and ORICA Canada Inc., and Others.

- What are the major end-user industries for bio acetic acid?

Key end-user industries include textiles, pharmaceuticals, food and beverages, and chemical manufacturing sectors.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 170 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |