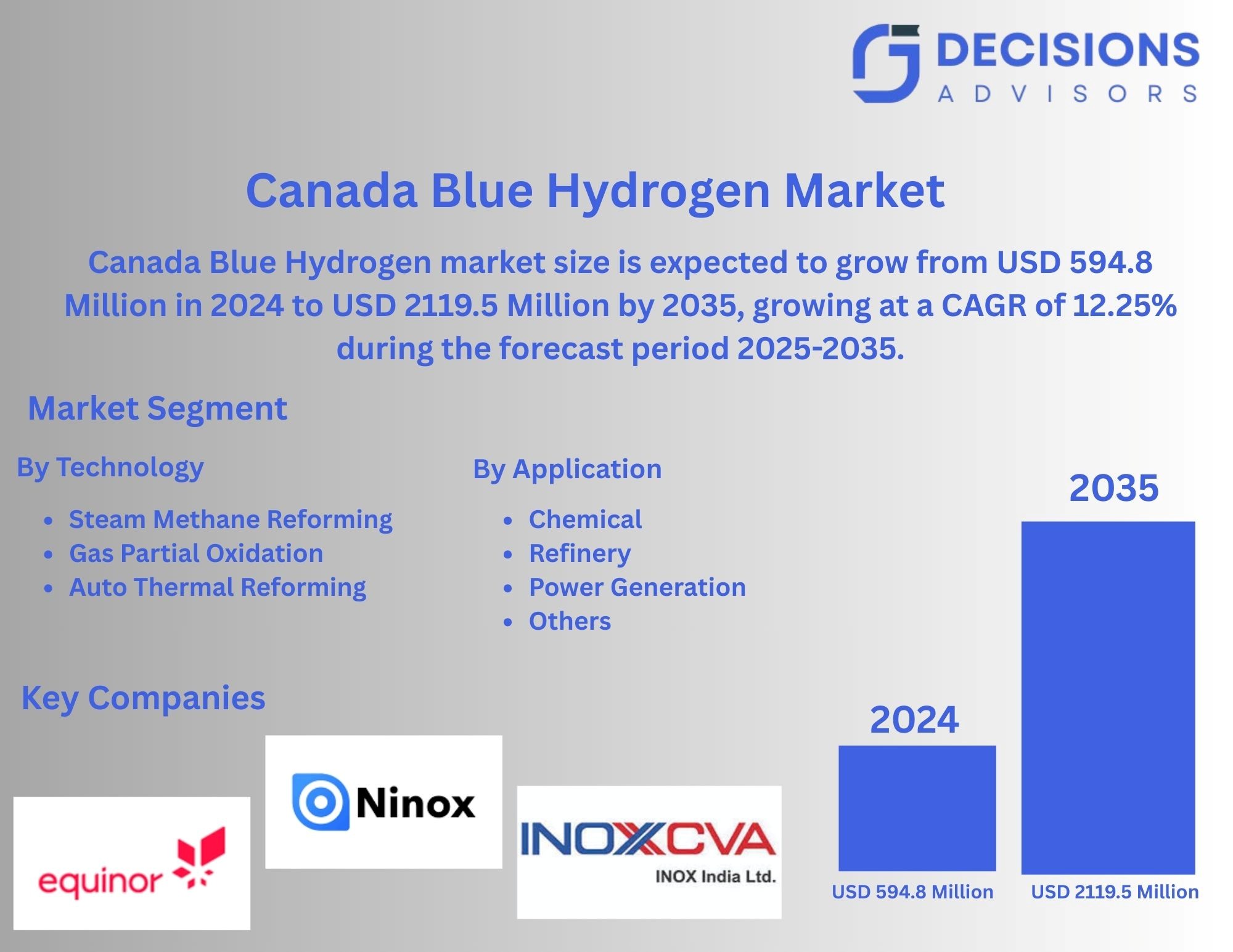

Canada Blue Hydrogen Market

Canada Blue Hydrogen Market Size, Share, and COVID-19 Impact Analysis, By Technology (Steam Methane Reforming, Gas Partial Oxidation, and Auto Thermal Reforming), By Application (Chemical, Refinery, Power Generation, and Others), and Canada Blue Hydrogen Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Blue Hydrogen Market Size Insights Forecasts to 2035

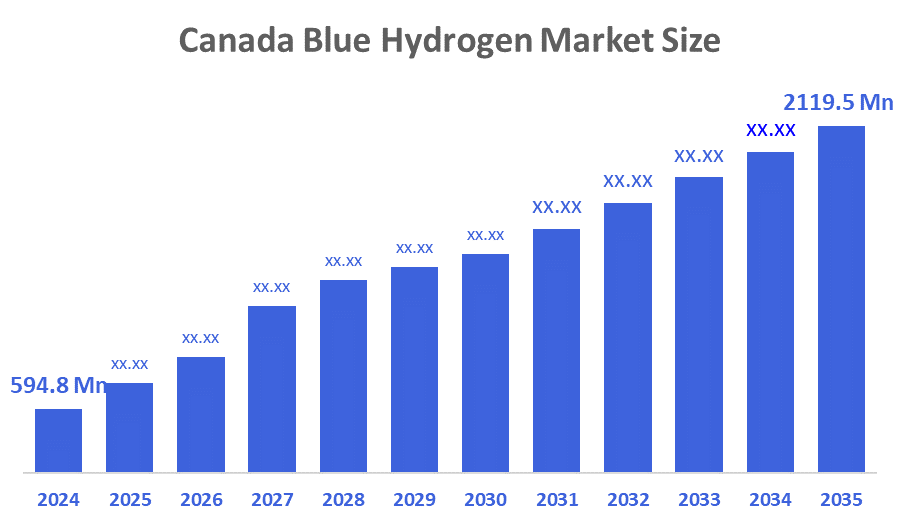

- The Canada Blue Hydrogen Market Size Was Estimated at USD 594.8 Million in 2024.

- The Market Size is Growing at a CAGR of 12.25% between 2025 and 2035.

- The Canada Blue Hydrogen Market Size is Anticipated to Reach USD 2119.5 Million by 2035.

According to a Research Report Published by Decisions Advisors & Consulting, The Canada Blue Hydrogen Market is anticipated to hold USD 2119.5 Million by 2035, Growing at a CAGR of 12.25% from 2025 to 2035. Canada’s blue hydrogen market offers strong opportunities driven by rising clean energy demand, increasing carbon capture deployment, government net-zero policies, industrial decarbonization needs, and growing investments in hydrogen infrastructure and export-oriented projects.

Market Overview

The Canada blue hydrogen market refers to the production of hydrogen using natural gas with integrated carbon capture, utilization, and storage (CCUS) technologies to significantly reduce emissions. This market is expanding rapidly as Canada advances its clean energy transition and strengthens its commitment to net-zero targets by 2050. Blue hydrogen is becoming a key component in decarbonizing hard-to-abate sectors such as heavy industry, transportation, power generation, and chemical production. The country’s abundant natural gas reserves, supportive government policies, and growing investments in CCUS infrastructure further enable large-scale development. Increasing industrial demand, export potential, and partnerships between energy companies and technology providers enhance market growth. Overall, blue hydrogen is positioned as a strategic low-carbon solution within Canada’s emerging hydrogen economy.

Report Coverage

This research report categorizes the market for the Canada blue hydrogen market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada blue hydrogen market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada blue hydrogen market.

Driving Factors

Decarbonization goals, CCUS growth, industrial demand, government support, export potential.

The Canada blue hydrogen market is primarily driven by the country’s strong focus on decarbonization and achieving net-zero emissions by 2050. Abundant natural gas reserves and expanding carbon capture, utilization, and storage (CCUS) infrastructure support large-scale, cost-effective blue hydrogen production. Growing demand from industries such as refining, chemicals, steel, and heavy transport accelerates adoption. Government incentives, strategic hydrogen roadmaps, and increasing investments from energy companies further stimulate market growth. Additionally, rising export opportunities to global clean-hydrogen-importing regions enhance long-term market prospects.

Restraining Factors

High costs, CCUS gaps, methane concerns, regulatory delays, green hydrogen competition.

The Canada blue hydrogen market faces challenges due to high capital costs associated with carbon capture facilities and hydrogen production infrastructure. Limited availability of large-scale CCUS networks in certain regions can slow deployment. Public concerns related to methane leakage, environmental impacts, and long-term CO? storage reliability also pose barriers.

Opportunities

CCUS expansion, export demand, infrastructure growth, incentives, industrial decarbonization opportunities.

The Canada blue hydrogen market offers substantial opportunities through growing investments in CCUS hubs, large-scale hydrogen production facilities, and low-carbon industrial clusters. Rising global demand for clean hydrogen especially from Europe and Asia creates strong export potential. Expansion of hydrogen pipelines, storage solutions, and fuel infrastructure further supports market growth. Canada’s supportive government policies, tax incentives, and funding programs encourage private sector participation. Additionally, blue hydrogen provides an immediate, scalable pathway for decarbonizing heavy industry, transportation, and power sectors, strengthening long-term market prospects.

Market Segmentation

The Canada blue hydrogen market share is classified into technology and application.

- The steam methane reforming segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canada blue hydrogen market is segmented by technology into steam methane reforming, gas partial oxidation, and auto thermal reforming. Among these, the steam methane reforming segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. SMR remains the most widely used and cost-effective hydrogen production method, and when combined with advanced carbon capture technologies, it becomes a scalable and economically viable pathway for low-carbon hydrogen. Canada’s abundant natural gas resources and expanding CCUS infrastructure further strengthen the dominance and growth prospects of the SMR segment.

- The refinery segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canada blue hydrogen market is segmented by application into chemical, refinery, power generation, and others. Among these, the refinery segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Refineries require large volumes of hydrogen for processes such as hydrocracking and desulfurization, making them early and high-demand adopters of blue hydrogen. As emissions regulations tighten and companies push toward cleaner refining operations, the shift from grey to blue hydrogen accelerates. Growing CCUS integration and decarbonization mandates further strengthen this segment’s expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada blue hydrogen market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Equinor ASA

- Ninox

- INOX India Pvt Ltd

- Iwatani Corp

- Air Liquide SA

- Linde PLC

- Shell PLC

- Exxon Mobil Corp

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Europe, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada blue hydrogen market based on the following segments:

Canada Blue Hydrogen Market, By Technology

- Steam Methane Reforming

- Gas Partial Oxidation

- Auto Thermal Reforming

Canada Blue Hydrogen Market, By Application

- Chemical

- Refinery

- Power Generation

- Others

FAQ’s

Q: What is the Canada blue hydrogen market size?

A: Canada blue hydrogen market size is expected to grow from USD 594.8 Million in 2024 to USD 2119.5 Million by 2035, growing at a CAGR of 12.25% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: The Canada blue hydrogen market is primarily driven by the country’s strong focus on decarbonization and achieving net-zero emissions by 2050.

Q: What factors restrain the Canada blue hydrogen market?

A: The Canada blue hydrogen market faces challenges due to high capital costs associated with carbon capture facilities and hydrogen production infrastructure.

Q: How is the market segmented by technology?

A: The market is segmented into technology into steam methane reforming, gas partial oxidation, and auto thermal reforming.

Q: Who are the key players in the Canada blue hydrogen market?

A: Key companies include Equinor ASA, Ninox, INOX India Pvt Ltd, Iwatani Corp, Air Liquide SA, Linde PLC, Shell PLC, and Exxon Mobil Corp.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 163 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |