Canada Cable Assembly Market

Canada Cable Assembly Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Power Cable Assemblies, Data Cable Assemblies, Signal Cable Assemblies, Ribbon Cable Assemblies, Custom Cable Assemblies, Coaxial Cable Assemblies, Others), By Industry Vertical (Automotive, Telecommunications, Consumer Electronics, Aerospace & Defence, Others) and Canada Cable Assembly Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Cable Assembly Market Insights Forecasts to 2035

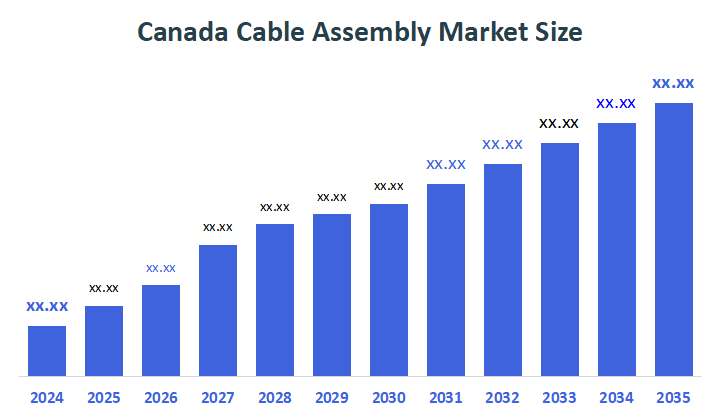

- The Canada Cable Assembly Market Size is Expected to Grow at a CAGR of Around 5.3% from 2025 to 2035

- The Canada Cable Assembly Market Size is expected to hold a significant share by 2035

According to a research report published by Decisions Advisors, the Canadian Cable Assembly Market size is anticipated to reach USD 4235.6 million by 2035, growing at a CAGR of 12.8% from 2025 to 2035. The market is driven by a growing need for efficient connectivity options across the automotive, aerospace, telecommunications, and health care sectors.

Market Overview

A cable assembly is an ordered bundle of cables or wires incorporated into a single, cohesive unit, generally including one or more connectors at the ends. These assemblies are designed to reliably carry electrical power, signals, or data while preserving an organised and streamlined system. The result of a growth in the need for high-performance cables, which are needed for data transmission, power, and communication. 5G technology further relies on sophisticated cable assemblies such as fibre optics, coaxial cables, and hybrid cables to enable high-speed connections, low latency, and greater data volumes.

From June 2024 to May 2025, the world shipped 586 shipments of cable wire to Canada. These shipments, which were made by 63 exporters to 75 buyers in Canada, represented a 48% increase over the previous year. 1,444 shipments of cable wire were imported by Canada during that time. Foreign exporters delivered these imports to 134 Canadian consumers, representing a growth rate of percent over the previous year.

In October 2025, Nexans strengthened its presence in PWR-Connect in Canada by signing an agreement to buy Electro Cables Inc. The cable assembly market environment is being further shaped by the growth of fibre-optic integration, EMI/EMC shielding, high voltage cables, and IoT-enabled smart connections brought about by technological advancements.

Report Coverage

This research report categorizes the market for the Canada cable assembly market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada cable assembly market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada cable assembly market.

Driving Factors

The cable assembly market in Canada is driven by the rising demand for reliable and high-performance connection solutions across varied industries such as automotive, aerospace, telecommunications, and consumer electronics. The market for cable assemblies is being shaped by an increasing emphasis on environmental responsibility. The need for solid connections that can endure the demands of automotive settings, hence encouraging manufacturers to focus on durability and performance in their cable assembly solutions. by improvements in technology, which need increasingly sophisticated cable arrangements to allow high-speed data transmission and networking.

Restraining Factors

The cable assembly market in Canada is majorly restrained by price increases relative to wire harnessing, increased supply, and a lack of product differentiation. Several local merchants produce unbranded products or use the brands of well-known vendors and sell low-quality products. Convenience and high-speed data transmission are provided by alternatives, which may eventually replace cables and pose a serious threat to the future expansion and demand of the cable assembly market.

Market Segmentation

The Canadian cable assembly market share is categorised by product type and industry vertical.

- The power cable assemblies segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian cable assembly market is segmented by product type into power cable assemblies, data cable assemblies, signal cable assemblies, ribbon cable assemblies, custom cable assemblies, coaxial cable assemblies, others. Among these, the power cable assemblies segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by due to increasing needs across power transmission, automation in industry, and projects to improve infrastructure. the rise of green energy efforts, which demand dependable and efficient energy transmission technologies.

- The automotive segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on industry vertical, the Canadian cable assembly market is segmented into automotive, telecommunications, consumer electronics, aerospace & defence, others. Among these, the automotive segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by due to the rapid popularity of electric cars (EVs), developments in automotive electronics, and the integration of smart technology. The increased demand for electric vehicles (EVs), which require complicated cable harnesses for power delivery, battery management.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada cable assembly market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Data Cable

- ProEV

- Cablek industries

- Active Electronic

- Cable Gold Inc

- EDAC Connectors

- X-Act Technologies Ltd

- DME Prolink

- Melitron Corporation

- Cable Serv

- Amphenol CTI

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada Cable Assembly Market based on the below-mentioned segments:

Canada Cable Assembly Market, By Product Type

- Power Cable Assemblies

- Data Cable Assemblies

- Signal Cable Assemblies

- Ribbon Cable Assemblies

- Custom Cable Assemblies

- Coaxial Cable Assemblies

- Others

Canada Cable Assembly Market, By Industry Vertical

- Automotive

- Telecommunications

- Consumer Electronics

- Aerospace & Defence

- Others

FAQ’s

Q: What is the Canadian cable assembly market size?

A: The Canada Cable Assembly Market size is growing at a CAGR of 5.3% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the rising demand for reliable and high-performance connection solutions across varied industries such as automotive, aerospace, telecommunications, and consumer electronics. The market for cable assemblies is being shaped by an increasing emphasis on environmental responsibility.

Q: What factors restrain the Canadian cable assembly market?

A: The Market is restrained by the price increases relative to wire harnessing, increased supply, and a lack of product differentiation. Several local merchants produce unbranded products or use the brands of well-known vendors and sell low-quality products.

Q: How is the market segmented by product type?

A: The market is segmented into power cable assemblies, data cable assemblies, signal cable assemblies, ribbon cable assemblies, custom cable assemblies, coaxial cable assemblies, others.

Q: Who are the key players in the Canadian cable assembly market?

A: Key companies include Data Cable, ProEV, Cablek industries, Active Electronics, Cable Gold Inc., EDAC Connectors, X-Act Technologies Ltd, DME Prolink, Melitron Corporation, Cable Serv, and Amphenol CTI.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 160 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |