Canada Carbon Steel Market

Canada Carbon Steel Market Size, Share, and COVID-19 Impact Analysis, By Type (Low Carbon Steel, Medium Carbon Steel, and High Carbon Steel), By Application (Shipbuilding, Construction, Automotive, and Other), and Canada Carbon Steel Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Carbon Steel Market Insights Forecasts to 2035

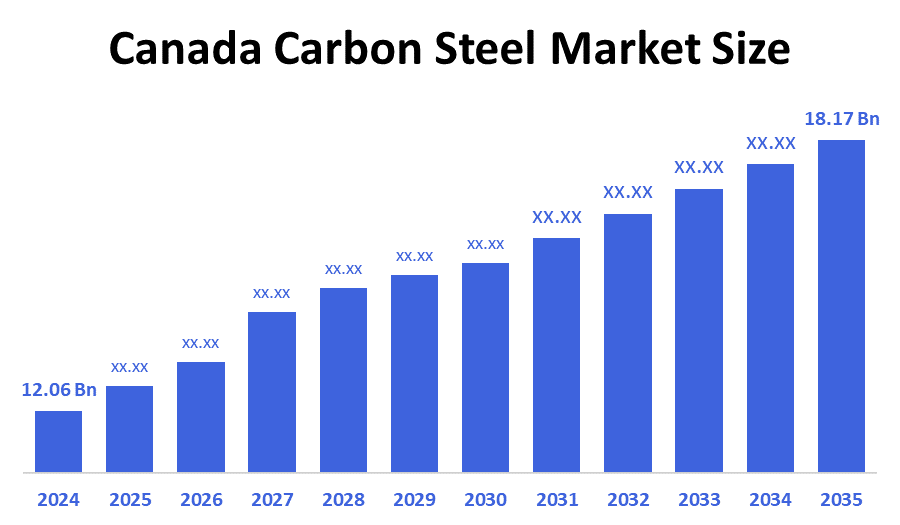

- The Canada Carbon Steel Market Size Was Estimated at USD 12.06 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.8% from 2025 to 2035

- The Canada Carbon Steel Market Size is Expected to Reach USD 18.17 Billion by 2035

According to a research report published by decision advisor & Consulting, the Canadian Carbon Steel Market size is anticipated to reach USD 18.17 billion by 2035, growing at a CAGR of 3.8% from 2025 to 2035. The market is driven by industrial applications on a large such as power plants, transportation, chemical processing, marine structures, and petroleum extraction and refining. Carbon steel is the most widely used engineering and construction component. Compared to stainless steel, carbon steel is more likely to corrode while having a higher tensile strength and toughness.

Market Overview

Carbon steel is a typical kind of steel composed of an iron and carbon alloy. It has a larger carbon content, a lower melting point, and more longevity than stainless steel. The product's composition includes essential elements, including durability, ductility, and hardness. The expanding usage of electric arc furnaces, the adoption of automation and artificial intelligence in production processes, and the shift in market trends toward environmentally friendly production processes are all contributing factors. The price volatility of raw materials, including scrap metal and iron ore, makes market dynamics even more complex.

In February 2022, Ontario invested in clean steelmaking technology to boost sustainable auto manufacturing and reduce emissions. In January 2025, Westcap Mgt. Ltd. invested in Inland Steel Products Inc., a leading metal recycler in Western Canada, to accelerate Inland Steel's growth plan, enhancing its infrastructure and logistics capabilities. Strategic alliances also strengthen supply chains and foster innovation, supporting long-term industry growth. With Canada's push toward EVs, demand for lightweight, strong steel is growing for battery cases and frames. As per Statista Canada, over 264,000 ZEVs were sold in Canada in 2024.

During this time, Canada imported 25,982 cargoes of steel. 1,474 Canadian consumers received these imports from overseas exporters, representing a growth rate of percentage over the previous 12 months. Between June 2024 and May 2025, the world sent 7,010 cargoes of steel to Canada. 431 exporters sold these goods to 544 Canadian buyers, which is an 8% increase over the previous 12 months.

Report Coverage

This research report categorizes the market for the Canada carbon steel market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada carbon steel market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada carbon steel market.

Driving Factors

The carbon steel markets in Canada are driven by due to its strength and durability. High-carbon steel is utilized in automobile parts like springs, gears, and engine parts that need to be strong. Rising product consumption is a result of the maintenance and replacement of current infrastructure and industrial facilities. A demand spike was brought on by widespread infrastructure construction in many areas. Governments are making significant investments in energy, transportation, and urban development projects, all of which need large quantities of carbon steel to be built. Rebar and structural sections are needed for the expanding construction activities in Edmonton and Calgary. Every year, the 200 MW of clean, renewable electricity produced by the Bekevar Wind Energy Project in Saskatchewan powers 100,000 homes.

Restraining Factors

The carbon steel market in Canada is majorly restrained by the foreign trade dynamics are impacted by environmental rules, which frequently lead to import or export limitations for the goods. Some countries impose restrictions or taxes on imported steel to ensure compliance with environmental standards and protect local companies. Product manufacture is impacted by the cost and availability of basic resources, particularly coal and iron ore. Variations in raw material prices affect the profitability of enterprises and lead to market instability.

Market Segmentation

The Canadian carbon steel market share is categorised by type and application.

- The low carbon steel segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian carbon steel market is segmented by type into low carbon steel, medium carbon steel, and high carbon steel. Among these, the low-carbon steel segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by low carbon steel has less than 0.25% carbon by weight. Low-carbon steel can be shaped into flat sheets and structural beams, among other forms. It can form cold, and it is malleable and ductile. It is inexpensive when compared to its alternatives.

- The shipbuilding segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the Canadian carbon steel market is segmented into shipbuilding, construction, automotive, and other. Among these, the shipbuilding segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by due to its mechanical characteristics and low pricing. Although carbon steel is a major component of the shipbuilding industry, its growth is waning, and aluminium alloys are gaining popularity as substitutes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada carbon steel market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Brannon Steel

- Crawford Metal

- AltaSteel

- Tree Island Steel

- Taylor Steel

- Global Steel

- CMS Steelpro

- Cast Steel Products

- Russell Metals

- Venture Steel Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2025, Canada launched an anti-dumping investigation into carbon and alloy steel wire imports from multiple countries.

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. decision advisor has segmented the Canada Carbon Steel Market based on the below-mentioned segments:

Canada Carbon Steel Market, By Type

- Low Carbon Steel

- Medium Carbon Steel

- High Carbon Steel

Canada Carbon Steel Market, By Application

- Shipbuilding

- Construction

- Automotive

- Other

FAQ’s

Q: What is the Canadian carbon steel market size?

A: The Canada Carbon Steel Market size is expected to grow from USD 12.06 billion in 2024 to USD 18.17 billion by 2035, growing at a CAGR of 3.8% during the forecast period 2025-2035.

Q: What is carbon steel, and its primary use?

A: Carbon steel is a typical kind of steel composed of an iron and carbon alloy. It has a larger carbon content, a lower melting point, and more longevity than stainless steel. The product's composition includes essential elements, including durability, ductility, and hardness. The expanding usage of electric arc furnaces, the adoption of automation and artificial intelligence in production processes, and the shift in market trends toward environmentally friendly production processes are all contributing factors

Q: What are the key growth drivers of the market?

A: Market growth is driven by the due to its strength and durability; high carbon steel is utilized in automobile parts like springs, gears, and engine parts that need to be strong. Rising product consumption is a result of the maintenance and replacement of current infrastructure and industrial facilities. demand spike brought on by widespread infrastructure construction in many areas.

Q: What factors restrain the Canadian carbon steel market?

A: The Market is restrained by the foreign trade dynamics are impacted by environmental rules, which frequently lead to import or export limitations for the goods. Some countries impose restrictions or taxes on imported steel to ensure compliance with environmental standards and protect local companies. Product manufacture is impacted by the cost and availability of basic resources, particularly coal

Q: How is the market segmented by type?

A: The market is segmented into low carbon steel, medium carbon steel, and high carbon steel.

Q: Who are the key players in the Canadian carbon steel market?

A: Key companies include Brannon Steel, Crawford Metal, AltaSteel, Tree Island Steel, Taylor Steel, Global Steel, CMS Steelpro, Cast Steel Products, Russell Metals, and Venture Steel Inc.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 223 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |