Canada Cell Culture Supplements Market

Canada Cell Culture Supplements Market Size, Share, and COVID-19 Impact Analysis, By Product (Serum-based Supplements, Protein-based & Recombinant Supplements, Chemically Defined Supplements, and Others), By Application (Biopharmaceutical Manufacturing, Cell & Gene Therapy, Drug Discovery, and Others), and Canada Cell Culture Supplements Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Cell Culture Supplements Market Size Insights Forecasts to 2035

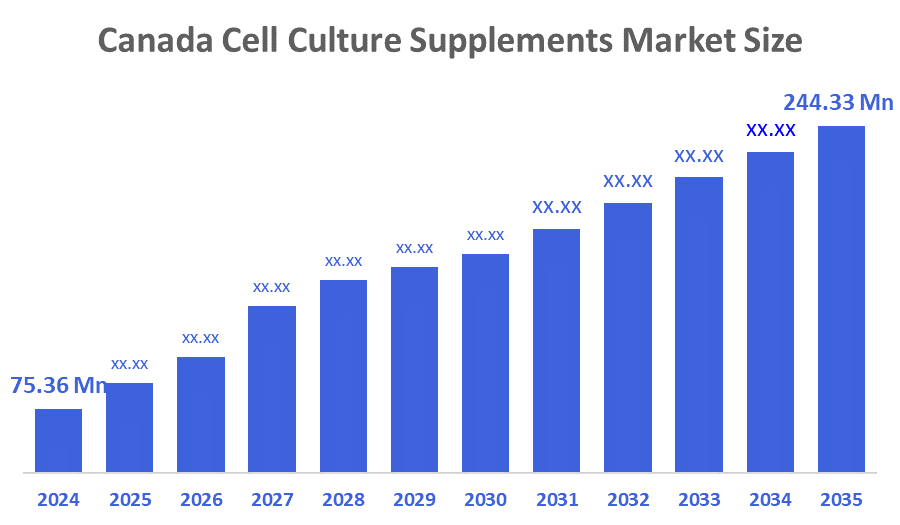

- The Canada Cell Culture Supplements Market Size was estimated at USD 75.36 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 11.29% from 2025 to 2035

- The Canada Cell Culture Supplements Market Size is Expected to Reach USD 244.33 Million by 2035

According to a Research Report Published by Decisions Advisors and Consulting, The Canada Cell Culture Supplements Market Size is anticipated to Reach USD 244.33 Million by 2035, Growing at a CAGR of 11.29% from 2025 to 2035. Rapid vaccine platforms, growing biologics pipelines, and the commercialisation of cell and gene therapies that need consistent, repeatable media supplementation all contribute to growth. In Canada, the shift from serum-based to chemically defined formulations is enhancing regulatory preparedness and batch-to-batch consistency, which influences the market development. Further, market expansion across research and GMP environments will be accelerated by investments in bioprocess scale-up, single-use technologies, and regional sourcing.

Market Overview

The industry in Canada that supplies specific nutrients, growth factors, and additives to support and improve the growth, viability, and productivity of cultured cells in research, biopharmaceutical production, and advanced therapies is known as the cell culture supplements market. Serums, growth factors, vitamins, amino acids, lipids, and protective agents are among the additives used in the Canadian cell culture supplements market to maximise cell viability, growth, and productivity in cell culture media. Discovery research, diagnostics, biopharmaceutical production of monoclonal antibodies, vaccines, and advanced therapies are just a few of the many uses for these supplements. Supplements affect downstream purification yields, product quality, and metabolic profiles. Further, shorten the time it takes to develop processes, vendors are increasingly providing bundled solutions that include media, protocols, and analytics.

Report Coverage

This research report categorises the market for the Canada cell culture supplements market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada cell culture supplements market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada cell culture supplements market.

Driving Factors

The market for cell culture supplements in Canada is growing as in vitro production is scaled up by biopharma, vaccine manufacturers, and advanced therapy developers. With the goal of increasing consistency, safety, and regulatory acceptance, there is a growing need in Canada for chemically defined and serum-free supplements. For complicated biologics, growth factors, cytokines, and speciality additives are facilitating increased cell viability and productivity in Canada. The use of GMP-grade, visible supplement portfolios is being accelerated in Canada by cell and gene therapy programs. In Canada, the use of high-performance supplements that work with single-use workflows is growing due to automation and a closed-system culture. In Canada, CMO/CRO alliances and vendor consolidation are simplifying supply and technical assistance for process development.

Restraining Factors

The main operational issues facing Canada's cell culture supplement market that need to be strategically addressed to guarantee supply stability, legal compliance, product uniformity, cost effectiveness, and the development of a trained workforce.

Market Segmentation

The Canada cell culture supplements market share is classified into product and application.

- The protein-based & recombinant supplements segment held a substantial share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Canada cell culture supplements market is segmented by product into serum-based supplements, protein-based & recombinant supplements, chemically defined supplements, and others. Among these, the protein-based & recombinant supplements segment held a substantial share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growing need for well-defined, high-performance supplements that provide scalability, safety, and consistency particularly in the production of biopharmaceuticals and regenerative medicine is what is driving this expansion. The industry's move toward chemically defined and animal-free culture systems, recombinant proteins such as insulin, transferrin, and growth factors, is preferred because it can lower variability and remove the risks associated with animal-derived components.

- The cell & gene therapy segment held a significant share in 2024 and is projected to grow at a rapid pace during the forecast period.

The Canada cell culture supplements market is divided by application into biopharmaceutical manufacturing, cell & gene therapy, drug discovery, and others. Among these, the cell & gene therapy segment held a significant share in 2024 and is projected to grow at a rapid pace during the forecast period.

The segment growth is fueled by growing investments in cutting-edge treatments, the rise in cancer and genetic disorders, and the expanding use of personalised medicine. Furthermore, the need for specialised supplements that improve the safety and effectiveness of cell and gene therapy products is growing faster due to developments in cell culture technologies and regulatory support for novel therapeutics.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Canada cell culture supplements market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- STEMCELL Technologies Inc.

- BioVectra Inc.

- NanoXplore Inc.

- Precision Biomonitoring Inc.

- SQI Diagnostics Inc.

- Others

Recent Developments:

- In June 2025, STEMCELL Technologies acquired Cellular Highways Ltd from TTP Group, expanding its capabilities in advanced cell sorting technologies. The largest biotechnology company in Canada, STEMCELL Technologies. Based close to Cambridge, UK, Cellular Highways is a biotechnology company that specialises in cutting-edge cell sorting technologies for use in drug discovery, cell and gene therapy, and general cell research, particularly in situations where cells are delicate.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada Cell Culture Supplements Market based on the below-mentioned segments:

Canada Cell Culture Supplements Market, By Product

- Serum-based Supplements

- Protein-based & Recombinant Supplements

- Chemically Defined Supplements

- Others

Canada Cell Culture Supplements Market, By Application

- Biopharmaceutical Manufacturing

- Cell & Gene Therapy

- Drug Discovery

- Others

FAQ

- What was the market size of the Canada Cell Culture Supplements Market in 2024?

The market size was estimated at around USD 75.36 million in 2024.

- What is the expected market size by 2035?

The market is expected to grow to USD 244.33 million by 2035.

- What is the forecasted CAGR from 2025 to 2035?

The Canada Cell Culture Supplements Market is projected to grow at a CAGR of 11.29% during this period.

- What are the main product segments in the market?

Key product segments include serum-based supplements, protein-based & recombinant supplements, chemically defined supplements, and others. The protein-based & recombinant supplements segment held a substantial market share in 2024.

- Which application segments are significant in the market?

Applications include biopharmaceutical manufacturing, cell & gene therapy, drug discovery, and others. The cell & gene therapy segment has a significant and rapidly growing share.

- What are the primary driving factors for market growth?

Growth drivers include the expansion of biologics pipelines, rapid vaccine platforms, commercialisation of cell and gene therapies requiring consistent media supplementation, and the shift towards chemically defined formulations, enhancing regulatory readiness and batch consistency.

- Who are some key players in the Canada Cell Culture Supplements Market?

Key companies include STEMCELL Technologies Inc., BioVectra Inc., NanoXplore Inc., Precision Biomonitoring Inc., and SQI Diagnostics Inc.

- What are recent developments in the market?

In June 2025, STEMCELL Technologies acquired Cellular Highways Ltd, enhancing its advanced cell sorting technology portfolio for drug discovery and cell and gene therapy applications.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 281 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |