Canada Coated Steel Market

Canada Coated Steel Market Size, Share, and COVID-19 Impact Analysis, By Product (Galvanized, Pre-Painted, Others), By End User (Automotive, Building & Construction, Appliances, and Others), and Canada Coated Steel Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Coated Steel Market Insights Forecasts to 2035

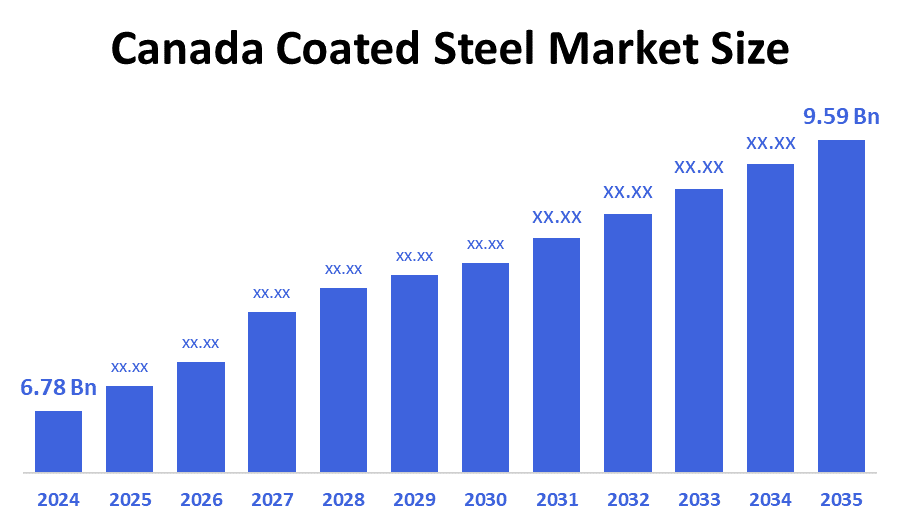

- The Canada Coated Steel Market Size Was Estimated at USD 6.78 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.2% from 2025 to 2035

- The Canada Coated Steel Market Size is Expected to Reach USD 9.59 Billion by 2035

According to a research report published by decision advisor & Consulting, the Canadian Coated Steel Market size is anticipated to reach USD 9.59 Billion by 2035, growing at a CAGR of 3.2% from 2025 to 2035. The market is driven by increasing demand from the packaging, automotive, consumer appliance, and construction sectors, all of which depend on coated steel for its unique blend of durability, corrosion resistance, and design flexibility.

Market Overview

The phrase coating refers to the process of applying an organic coating, either decorative or protective, on a steel substrate that is supplied in coil form. Pre-painted steel is another term for coated steel. Coated steel is durable and lightweight; it is utilized extensively in the automotive sector. These attributes are critical to the safety and fuel efficiency of vehicle manufacturing. Coated steel offers environmentally friendly alternatives for a variety of industries, including construction and the automotive sector, while also reducing waste and conserving natural resources. To enhance the performance of durable coatings, major industry participants are also funding R&D projects, which are driving market expansion.

For steel derivative products, Canada will impose a 25% levy on their entire value. This legislation, which goes into effect in December 2025, will initially apply to a list of steel derivative items made in Canada. Canada is a net importer of steel, and its principal steel producers, which have historically exported more than half of their production, of which more than 90% is sent to the United States, have suffered a 24% annual decline in exports, which has decreased demand and income.

The tariff rate quotas for steel goods that were put in place in June 2025 are being strengthened by the government. The Strategic Innovation Fund will receive up to $1 billion from the government to promote the steel industry's shift to new business ventures and to bolster local supply chains. By using recycled steel in coil coating applications, the adverse environmental effect of steel production is reduced, and the growth of the sustainable building industry is aided.

Report Coverage

This research report categorizes the market for the Canada coated steel market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada coated steel market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada coated steel market.

Driving Factors

The coated steel markets in Canada are driven by the increasing demand for infrastructure construction and development. Increasing urbanization is causing new homes and companies to be constructed. Coated steel is strong, adaptable, and corrosion-resistant; it is used in construction. Coated steel is widely used due to the necessity for sturdy, corrosion-resistant cars. Coated steel is used in the automobile sector to make lighter vehicles that consume less fuel and produce lower emissions. The material is ideal for lightweight, structurally sound cars, given its remarkable strength-to-weight ratio. While coated steel offers durable, lightweight materials that enhance vehicle performance and fuel efficiency, it is crucial for the manufacturing of automobiles. Vehicle lifespans are increased, and maintenance costs are decreased, attributable to the protective coatings on steel components that stop rust and corrosion.

Restraining Factors

The coated steel market in Canada is majorly restrained by the changes in raw material prices are a problem for the coated steel industry. The whole industry value chain is impacted by changes in market prices. The price volatility of raw materials, such as steel and chemicals used in coatings, can affect businesses' cost structure and profitability. Another challenge is increasing rivalry from alternative materials, such as aluminium and plastic composites, which offer similar benefits but may be lighter or less expensive in some circumstances.

Market Segmentation

The Canadian coated steel market share is categorised by product and end user.

- The galvanized segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian coated steel market is segmented by product into galvanized, pre-painted, others. Among these, the galvanized segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by galvanized steel is corrosion-resistant thanks to its zinc coating, which has allowed it to hold a considerable market share. Galvanized steel is used in the automotive, appliance, and construction sectors. Its dominance stems from its adaptability, affordability, and resistance to corrosion, making it essential in the automotive and construction industries.

- The building & construction segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the Canadian coated steel market is segmented into automotive, building & construction, appliances, and others. Among these, the building & construction segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by the construction industry, which uses coated steel for structural components, roofing, siding, and infrastructure projects. The long-term reliability and corrosion resistance of coated steel make it the favored option.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada coated steel market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Taylor Steel

- Arcelor Mittal Dofasco

- Maksteel Powered

- Crawford Metal

- Tree Island Steel

- Steel Canada Roofing and Siding

- Global Steel

- Sixpro

- Cast Steel Products

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2025, ArcelorMittal reported a growth in its quarterly earnings at a 13% rate of USD 1.65 billion, and the company also estimated an increase in demand for the product that may grow 2.5% to 3.5%.

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Canada Coated Steel Market based on the below-mentioned segments:

Canada Coated Steel Market, By Product

- Galvanized

- Pre-Painted

- Others

Canada Coated Steel Market, By End User

- Automotive

- Building & Construction

- Appliances

- Others

FAQ’s

Q: What is the Canadian coated steel market size?

A: The Canada Coated Steel Market size is expected to grow from USD 6.78 billion in 2024 to USD 9.59 billion by 2035, growing at a CAGR of 3.2% during the forecast period 2025-2035.

Q: What is coated steel, and its primary use?

A: The phrase coating refers to the process of applying an organic coating, either decorative or protective, on a steel substrate that is supplied in coil form. Pre-painted steel is another term for coated steel. Coated steel is durable and lightweight; it is utilized extensively in the automotive sector. These attributes are critical to the safety and fuel efficiency of vehicle manufacturing.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the growing need for infrastructure development and building. New businesses and residences are being built as a result of growing urbanization. Coated steel is utilized in construction because it is robust, versatile, and resistant to corrosion. The need for robust, corrosion-resistant vehicles has led to the widespread use of coated steel.

Q: What factors restrain the Canadian coated steel market?

A: The Market is restrained by the changes in raw material prices are a problem for the coated steel industry. The whole industry value chain is impacted by changes in market prices. The price volatility of raw materials, such as steel and chemicals used in coatings, can affect businesses' cost structure and profitability. Another challenge is increasing rivalry from alternative materials, such as aluminium and plastic composites, which offer similar benefits but may be lighter or less expensive in some circumstances.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 201 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |