Canada Cold Chain Monitoring Market

Canada Cold Chain Monitoring Market Size, Share, and COVID-19 Impact Analysis, By Application (Pharmaceuticals, Food and Beverages, Chemicals, Healthcare, and Agriculture), By Product Type (Hardware, Software, and Services), and Canada Cold Chain Monitoring Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Cold Chain Monitoring Market Size Insights Forecasts to 2035

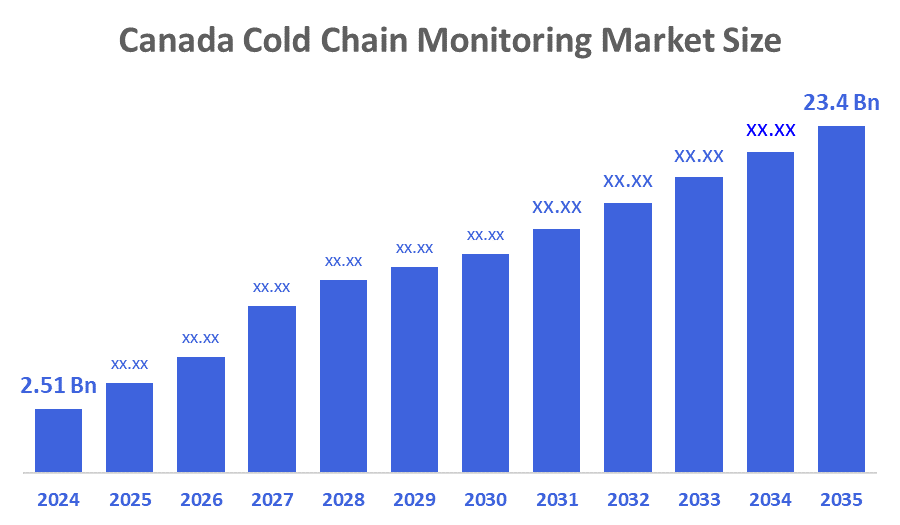

- The Canada Cold Chain Monitoring Market Size Was Estimated at USD 2.51 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 22.5% from 2025 to 2035

- The Canada Cold Chain Monitoring Market Size is Expected to Reach USD 23.4 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Canadian Cold Chain Monitoring Market Size is anticipated to Reach USD 23.4 Billion by 2035, Growing at a CAGR of 22.5% from 2025 to 2035. The market is driven by the more stringent government laws governing the transportation and storage of pharmaceuticals. Growing government and corporate investments in the construction of refrigerated warehouses, together with initiatives to prevent food and other temperature-sensitive items from spoiling.

Market Overview

Pharmaceutical items require efficient temperature monitoring technology since they are highly susceptible to temperature changes. Temperature monitoring devices are also used to keep the temperature constant throughout shipping while preserving the quality of the goods. Rising demand from customers for perishable and fragile items and the requirement to maintain the proper temperature have led to a significant expansion of the business. By installing effective cold chain monitoring systems, businesses are putting more of an emphasis on cutting waste in the supply chain.

Health Canada's compliance requirements for temperature-sensitive items and the Canadian government's investment in healthcare infrastructure are what propel industry expansion. Cold chain operators must adhere to Good Distribution Practices (GDP) to ensure product quality, avoid problems, and maintain the integrity of sensitive medications, all of which support a robust cold chain ecosystem.

A significant player in the Canadian cold-chain monitoring market, DHL Supply Chain offers a variety of logistics services for temperature-sensitive goods. The company offers complete solutions to preserve the integrity of the cold chain, including transportation, warehousing, and state-of-the-art monitoring systems.

Report Coverage

This research report categorizes the market for the Canada cold chain monitoring market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada cold chain monitoring market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada cold chain monitoring market.

Driving Factors

The cold chain monitoring markets in Canada are driven by the implementation of IoT and blockchain technologies, regulatory bodies' orders to maintain exact temperature and humidity controls during storage and transportation to prevent product degradation, especially for temperature-sensitive goods, and the growing number of collaborations between cold chain logistics providers and tech firms have all made it easier to develop integrated solutions. By combining robotics, artificial intelligence, and automated systems, automation and smart warehousing are revolutionising the healthcare cold chain storage sector. This can streamline inventory management, decrease human error, and increase demand for vaccines and biologics.

Restraining Factors

The cold chain monitoring market in Canada is majorly restrained by high implementation costs, systems need hefty expenditures for installation, training, and continuous maintenance, sensors and software updates are required to stay on top of regulatory changes, maintaining supply chain temperature stability, sensor replacement, and systems produce enormous volumes of data that need to be securely stored, analyzed, and reported on.

Market Segmentation

The Canadian cold chain monitoring market share is categorised by application and product type.

- The food and beverages segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian cold chain monitoring market is segmented by application into pharmaceuticals, food and beverages, chemicals, healthcare, and agriculture. Among these, the food and beverages segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by demand in the food and beverage industry for cold chain monitoring systems. Cold chain monitoring systems are therefore necessary to efficiently track and gather information on perishable food items, as well as to take remedial measures and minimise any possible harm.

- The hardware segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on product type, the Canadian cold chain monitoring market is segmented into hardware, software, and services. Among these, the hardware segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by the real-time data, including location and temperature, which is gathered via hardware monitoring equipment. These tools can be used by businesses to keep an eye on the cold chain and make informed decisions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada cold chain monitoring market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cold Chain Science Enterprises

- Conestoga Cold Storage

- Rivercity Innovations

- Geotab

- Lynden International Logistics Co.

- ColdStar Solutions Inc.

- Medair Time Critical Express

- VersaCold Logistics Services

- National Cold Chain Inc.

- CryoLogistics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In September 2024, the Kuehne and Nagel is the leading logistics company, announced the opening of a new temperature-controlled fulfilment centre for its partner, Medtronic.

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada Cold Chain Monitoring Market based on the below-mentioned segments:

Canada Cold Chain Monitoring Market, By Application

- Pharmaceuticals

- Food and Beverages

- Chemicals

- Healthcare

- Agriculture

Canada Cold Chain Monitoring Market, By Product Type

- Hardware

- Software

- Services

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 163 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |