Canada Companion Animal Cardiac Drugs Market

Canada Companion Animal Cardiac Drugs Market Size, Share, and COVID-19 Impact Analysis, By Product (Pimobendan, Spironolactone and Benazepril Hydrochloride, Furosemide, and Others), By Indication (Congestive Heart Failure, Myocardial (Heart Muscle) Disease, Arrhythmias, and Others), and Canada Companion Animal Cardiac Drugs Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

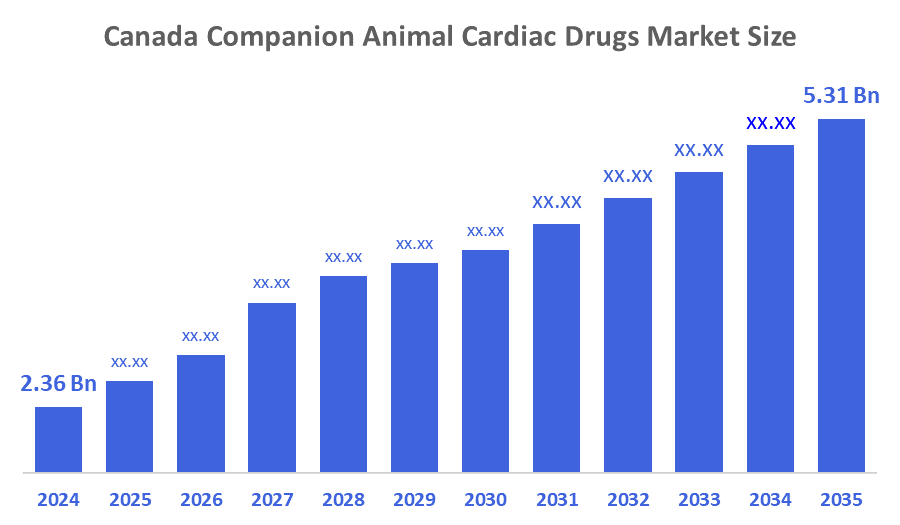

Canada Companion Animal Cardiac Drugs Market Size Insights Forecasts to 2035

- The Canada Companion Animal Cardiac Drugs Market Size was estimated at USD 2.36 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.65% from 2025 to 2035

- The Canada Companion Animal Cardiac Drugs Market Size is Expected to Reach USD 5.31 Billion by 2035

According to a Research Report Published by Decisions Advisors and Consulting, The Canada Companion Animal Cardiac Drugs Market Size is anticipated to Reach USD 5.31 Billion by 2035, Growing at a CAGR of 7.65% from 2025 to 2035. The expansion of veterinary healthcare services across major regions, growing pet owner awareness of cardiovascular health, and the rising prevalence of cardiac disorders in dogs and cats are expected to propel growth during this time. The creation of sophisticated cardiac treatments, such as beta-blockers, ACE inhibitors, antiarrhythmic drugs, and diuretics specifically designed for companion animals, supports market expansion.

Market Overview

The Canada companion animal cardiac drugs market refers to the industry focused on the production and application of the pharmaceutical products designed to treat cardiovascular disorders in pets, including dogs, cats, and other small animals, is known as the companion animal cardiac drugs market. The branch of veterinary medicine that deals with the diagnosis, treatment, and management of heart-related conditions in animals, mostly dogs and cats. Chronic heart failure, hypertension, arrhythmias, valvular heart disease, and dilated cardiomyopathy are among the conditions that these drugs target. Several drug classes, including ACE inhibitors, beta-blockers, diuretics, calcium channel blockers, antiarrhythmic agents, and vasodilators, are included in the medications. The most common class, ACE inhibitors, is frequently recommended as first-line therapies due to their capacity to enhance blood flow, relax blood vessels, and lessen cardiac workload.

Report Coverage

This research report categorises the market for the Canada companion animal cardiac drugs market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada companion animal cardiac drugs market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada companion animal cardiac drugs market.

Driving Factors

The Canadian companion animal heart medicines market expansion is driven by several factors, such as the consistent demand for efficient cardiac drugs is the rising incidence of cardiac conditions in dogs and cats, such as valvular diseases and congestive heart failure. Pet owners' growing knowledge of cardiovascular health and early detection is encouraging prompt veterinary consultations and the start of treatment. The rise in drug use is supported by the growth of veterinary healthcare services, such as specialised cardiology care in clinics and hospitals. The industry has grown as a result of public awareness campaigns run by groups like Humane Canada and the Canadian Veterinary Medical Association (CVMA), which have raised awareness of symptoms like lethargy and persistent coughing.

Restraining Factors

The Canadian companion animal cardiac drugs market is restricted due to financial limitations and operational difficulties with diagnosis and compliance. Despite the increasing incidence of canine heart disease, these compliance problems further limit the market's potential by resulting in inconsistent drug purchases and worse patient outcomes.

Market Segmentation

The Canada companion animal cardiac drugs market share is classified into product and indication.

- The pimobendan segment dominated the market in 2024 and is anticipated to grow at a significant CAGR over the forecast period.

The Canada companion animal cardiac drugs market is segmented by product into pimobendan, spironolactone and benazepril hydrochloride, furosemide, and others. Among these, the pimobendan segment dominated the market in 2024 and is anticipated to grow at a significant CAGR over the forecast period. This is due to the accepted method of treating congestive heart failure, especially in canines with myxomatous mitral valve disease (MMVD) and dilated cardiomyopathy (DCM). Its dual mechanism provides better therapeutic benefits than conventional treatments because both inodilators increase cardiac contractility while also lowering vascular resistance. Pimobendan, supported by strong clinical evidence and widely endorsed in veterinary guidelines, improves the quality of life for affected pets and extends survival time.

- The congestive heart failure segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period.

The Canada companion animal cardiac drugs market is divided by indication into congestive heart failure, myocardial (heart muscle) disease, arrhythmias, and others. Among these, the congestive heart failure segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period. In 2025, congestive heart failure (CHF) is responsible for 38% of the market, making it its most common diagnosis. This is driven by the high incidence of chronic heart failure (CHF) in elderly pets, especially dogs. The need for related cardiac medications has increased as a result of the accelerated management and therapeutic interventions for CHF brought about by the growing use of sophisticated diagnostic tools and individualised treatment plans.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Canada companion animal cardiac drugs market, along with a comparative evaluation based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ceva Animal Health Canada

- Elanco Canada

- Zoetis Canada

- Bimeda Canada

- Grey Wolf Animal Health

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada Companion Animal Cardiac Drugs Market based on the below-mentioned segments:

Canada Companion Animal Cardiac Drugs Market, By Product

- Pimobendan

- Spironolactone and benazepril hydrochloride

- Furosemide

- Others

Canada Companion Animal Cardiac Drugs Market, By Indication

- Congestive Heart Failure

- Myocardial (Heart Muscle) Disease

- Arrhythmias

- Others

FAQ

- What is the size of the Canadian companion animal cardiac drugs market in 2024?

- The market was valued at approximately USD 2.36 billion in 2024.

- What is the expected growth rate and market size by 2035?

- The market is projected to grow at a CAGR of 7.65% from 2025 to 2035, reaching around USD 5.31 billion by 2035.

- What are the key product segments in the market?

- The product categories include pimobendan, spironolactone and benazepril hydrochloride, furosemide, and others. Pimobendan dominated the 2024 market due to its effectiveness in treating congestive heart failure, especially in dogs with myxomatous mitral valve disease and dilated cardiomyopathy.

- What are the major indications treated by companion animal cardiac drugs in Canada?

- Indications include congestive heart failure (38% market share in 2025), myocardial (heart muscle) disease, arrhythmias, and others. Congestive heart failure is the most common diagnosis.

- Which companies are key players in this market?

- Major companies include Ceva Animal Health Canada, Elanco Canada, Zoetis Canada, Bimeda Canada, and Grey Wolf Animal Health.

- What are the main growth drivers for the market?

- Growth drivers include increased incidence of cardiac diseases in pets, rising pet owner awareness, expansion of veterinary healthcare services (including specialised cardiology clinics), and public awareness campaigns by groups like Humane Canada and the Canadian Veterinary Medical Association.

- What restrains market growth?

- Restraining factors include financial limitations of pet owners, challenges with diagnosis and treatment compliance, leading to inconsistent drug usage and poorer patient outcomes.

- What are the key market trends?

- Increased use of sophisticated diagnostic tools and individualised treatment plans, the emergence of telemedicine and online sales channels, and rising pet insurance coverage support market expansion.

- How is the market segmented geographically?

- The market sees growth across Canada, with particular emphasis on provinces investing in veterinary healthcare infrastructure. Canada is among the fastest-growing markets in North America.

- What are the competitive strategies observed in the market?

- Companies engage in product launches, partnerships, joint ventures, mergers and acquisitions, and innovation in drug formulations to strengthen market position.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 241 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |