Canada Compressed Gas Market

Canada Compressed Gas Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Nitrogen, Oxygen, Hydrogen, and Carbon Dioxide), By Distribution Channel (On-Site, Bulk, and Cylinder), and Canada Compressed Gas Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

Canada Compressed Gas Market Insights Forecasts to 2035

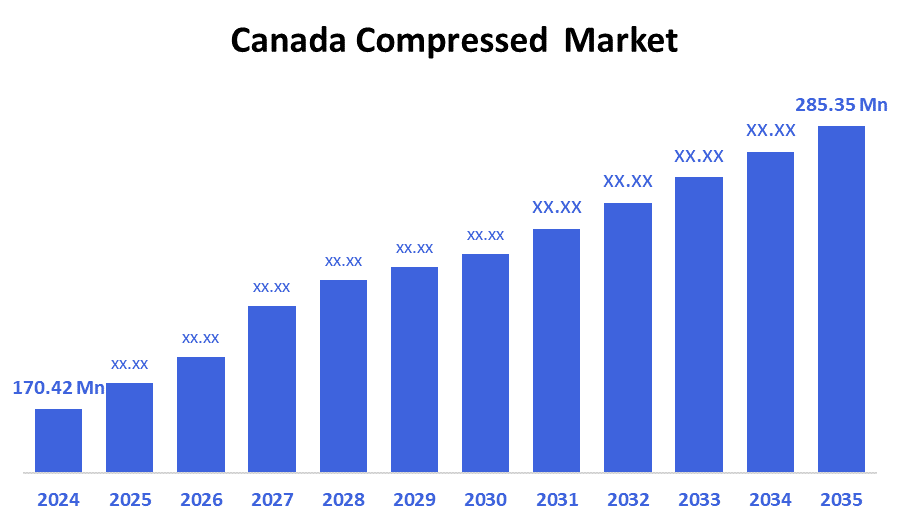

- The Canada Compressed Gas Market Size was estimated at USD 170.42 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.80% from 2025 to 2035

- The Canada Compressed Gas Market Size is Expected to Reach USD 285.35 Million by 2035

The Canada Compressed Gas Market is anticipated to reach USD 285.35 million by 2035, growing at a CAGR of 4.80% from 2025 to 2035. The global drive for cleaner energy solutions is one of the main factors contributing to this increase in demand. For example, compressed natural gas (CNG) is becoming more and more popular in the transportation industry as a fuel substitute for gasoline and diesel. Further, to cut greenhouse gas emissions and comply with more stringent environmental regulations, governments and businesses are boosting such CNG infrastructure across the country. Comparably, compressed hydrogen is becoming more and more popular as a crucial part of the hydrogen economy, especially in energy storage and vehicle fuel cell technology.

Market Overview

The Canadian compressed gas sector encompasses all activities pertaining to high-pressure gases that are kept for use in a variety of industries, usually in cylinders, tanks, or pipelines. These gases are compressed to enable effective transportation, storage, and controlled release. They can be naturally occurring (such as natural gas) or produced industrially (such as oxygen or nitrogen). They make it possible to store and transport gases that would otherwise take up large volumes at atmospheric pressure. Compressed gases such as compressed natural gas (CNG), hydrogen, and compressed air are frequently used. Compressed gases are essential in laboratory and industrial settings for energy applications. Compressed gases, such as oxygen cylinders used in medical treatments, are also widely used in laboratories and healthcare facilities for research and medical purposes. Further, statistics and related information showcase the market development. For instance, in 2023, Canada's energy sector spent $92 billion on capital projects. In 2023, the largest energy sector capital expenditure was in oil and gas extraction ($39.2 billion), followed by electrical power generation and distribution ($27.6 billion). There were 120 energy projects worth $180 billion in construction and 223 major energy projects worth $294 billion planned (announced, reviewed, or approved) in 2023. A total of $159 billion was spent on 233 clean technology projects.

Report Coverage

This research report categorises the market for the Canada compressed gas market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada compressed gas market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada compressed gas market.

Driving Factors

The market for Canada's compressed gas is influenced by the excellent foundation of enormous natural gas reserves and an established distribution system across Canada. Besides, the adoption of compressed natural gas (CNG) and other compressed gases is encouraged by the federal government's aggressive promotion of cleaner transportation fuels to meet climate targets. The requirement for cleaner fuels like nitrogen, oxygen, and hydrogen gases used in the manufacturing, healthcare, and industrial sectors has also increased due to stricter emission reduction laws and environmental regulations. Moreover, improvements in safety and efficiency brought about by technological developments in gas storage, testing, and delivery systems also spur market growth.

Restraining Factors

Despite its growth potential, the Canadian compressed gas market is constrained by several factors, such as strict safety procedures and expensive infrastructure investments with high storage pressure requirements, related safety hazards. Further, market growth is hampered by regulatory complexity and disparate provincial standards, with slight compliance with production costs and supply chain interruptions and price volatility for raw materials.

Market Segmentation

The Canada compressed gas market share is classified into product type and distribution channel.

- The oxygen segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Canada compressed gas market is segmented by product type into nitrogen, oxygen, hydrogen, and carbon dioxide. Among these, the oxygen segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. One of the most accepted compressed gases is oxygen, essential to the industrial and medical industries. Compressed oxygen is crucial in the medical field for respiratory therapy, emergency care, and surgery, especially for patients with chronic obstructive pulmonary disease (COPD) or other respiratory disorders and other hospital life-support systems. Besides, it facilitates combustion at high temperatures, and it is essential in industrial processes like brazing, cutting, and welding.

- The on-site segment held a significant share in 2024 and is projected to grow at a rapid pace over the forecast period.

The Canada compressed gas market is divided by distribution channel into on-site, bulk, and cylinder. Among these, the on-site segment held a significant share in 2024 and is projected to grow at a rapid pace over the forecast period. This is due to employing specific equipment like gas turbines or air separation units (ASUs); on-site generation produces compressed gases right at the client's address. Businesses like steel production, petrochemicals, and healthcare facilities that use a lot of gas frequently prefer this distribution method. For instance, on-demand gas production from nitrogen or oxygen generators guarantees constant access and does not interfere with the necessity for transport.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Canada compressed gas market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CGT Compressed Gas Technologies Inc.

- TerraVest Industries Inc.

- Praxair Canada Inc.

- Air Liquide Canada Inc.

- Linde Canada Inc.

- Messer Canada Inc.

- Air Products Canada Ltd.

- Others

Recent Developments:

- In June 2025, Terramont Infrastructure Partners acquired a majority stake in Bull Moose Capital Ltd., Canada’s largest provider of natural gas compression and power generation solutions. This strategic move strengthens Terramont’s footprint in North America’s midstream infrastructure sector and signals substantial confidence in Canada’s energy innovation landscape.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Canada compressed gas market based on the below-mentioned segments:

Canada Compressed Gas Market, By Product Type

- Nitrogen

- Oxygen

- Hydrogen

- Carbon Dioxide

Canada Compressed Gas Market, By Distribution Channel

- On-Site

- Bulk

- Cylinder

FAQ

- What is the current size of the Canadian Compressed Gas Market?

The market size was estimated at USD 170.42 million in 2024.

- What is the expected growth rate of the market?

The market is projected to grow at a CAGR of approximately 4.80% from 2025 to 2035.

- What will be the market size by 2035?

- The market is expected to reach USD 285.35 million by 2035.

- Which product segment dominated the market in 2024?

The oxygen segment dominated due to its extensive use in medical and industrial applications.

- Which distribution channel held a significant market share in 2024?

The on-site generation segment held a significant share, favoured for industries requiring continuous and reliable gas supply.

- What are the main factors driving market growth?

Drivers include Canada’s large natural gas reserves, government promotion of cleaner fuels like CNG, stricter environmental regulations, and technological advancements in gas storage and delivery.

- Who are some key companies in the Canadian Compressed Gas Market?

Key players include CGT Compressed Gas Technologies Inc., TerraVest Industries Inc., Praxair Canada Inc., Air Liquide Canada Inc., Linde Canada Inc., Messer Canada Inc., and Air Products Canada Ltd.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 176 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |