Canada Confectionery Market

Canada Confectionery Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Hard-boiled Sweets, Mints, Gums and Jellies, Chocolate, Caramels and Toffees, Medicated Confectionery, Fine Bakery Wares, and Others), By Age Group (Children, Adult, and Geriatric), By Price Point (Economy, Mid-range, Luxury), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Pharmaceutical and Drug Stores, Online Stores, and Others), and Canada Confectionery Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Confectionery Market Size Insights Forecasts to 2035

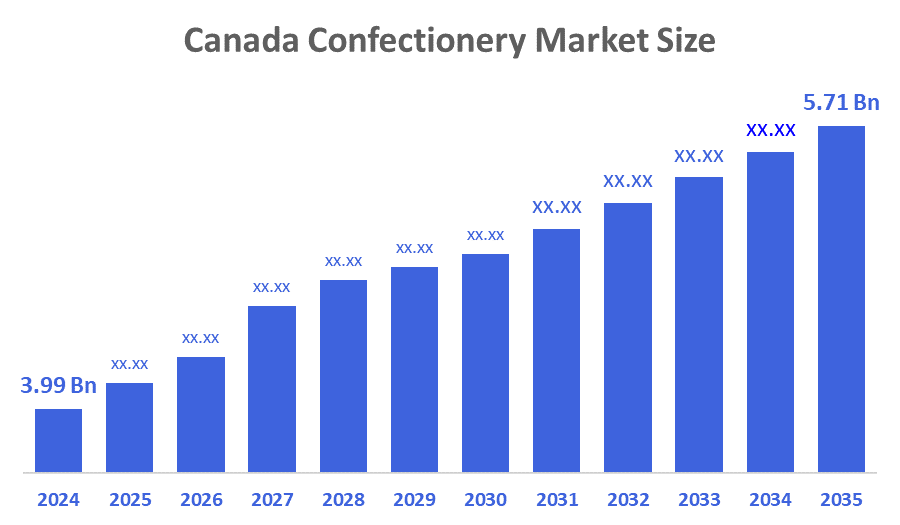

- The Canada Confectionery Market Size Was Estimated at USD 3.99 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.31% from 2025 to 2035

- The Canada Confectionery Market Size is Expected to Reach USD 5.71 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Canada Confectionery Market Size is anticipated to Reach USD 5.71 Billion by 2035, Growing at a CAGR of 3.31% from 2025 to 2035. The confectionery market in Canada is driven by consumer preferences for high-end goods, healthier substitutes, and festive sweets. Strong retail networks, growing e-commerce penetration, and a surge in demand for utilitarian and artisan sweets all boost the sector.

Market Overview

The market for confections includes foods that have a comparatively high amount of sugar. The variety of flavors, colors, and other substances that go into making candy gives it its distinct flavor, texture, and look. The four subdivisions that comprise this sector are ice cream, cakes and preserved pastries, chocolate confections, and sugar confections. Development is often encouraged by varying consumer preferences, eating patterns, and degrees of health awareness and understanding. In particular, confections are popular as gifts and pleasures.

By requiring companies to get a license and adhere to safety regulations for manufacturing, labelling, and commerce, the Safe Food for Canadians Act (SFCA) governs the confectionery industry in Canada.

Funding from the Canadian government enables Chocolate Lamontagne to increase its production capacity. Companies and groups that are a source of pride in their communities are acknowledged and supported by the Canadian government. The Healthy Eating Strategy of the government is the main force behind Health Canada's programs that affect the confectionery sector. Restricting marketing to children, enhancing consumer nutrition information, and pushing the food sector to lower sodium and sugar are the main goals of these regulations.

The Canadian confectionery markets are growing steadily as a result of shifting consumer preferences for upscale products, healthier options, and a wide variety of both classic and modern candies. Additionally, there is an increasing market demand for wellness-focused and organic products.

Report Coverage

This research report categorizes the market for the Canada Confectionery Market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada Confectionery Market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada Confectionery Market.

Driving Factors

The confectionery markets in Canada are expanding steadily due to shifting consumer preferences for upscale products, more nutritious alternatives, and a wide variety of classic and modern confections. Additionally, the market is witnessing a surge of patronage for organic and wellness-focused products. increased demand for non-GMO, gluten-free, and healthy cookies and snacks. Additionally, as ethical and ecologically conscious consuming practices become more significant, there is an increasing desire for sweets that are made locally and responsibly.

Restraining Factors

The confectionery market in Canada is mostly restrained by heightened consumer knowledge of the harmful consequences of excessive sugar intake. People are consuming fewer sugary foods as concerns about diabetes, dental decay, obesity, and other lifestyle-related diseases have increased. The average yearly price of the raw materials varies from low to high, as a result, which causes an excess or understock to be produced and sold as sugar and chocolate products. Consequently, it is expected that shifts in raw material prices will lower demand generally during the coming years.

Market Segmentation

The Canada confectionery market share is classified into product type, age group, price point, and distribution channel.

- The chocolate segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canada confectionery market is segmented by product type into hard-boiled sweets, mints, gums and jellies, chocolate, caramels and toffees, medicated confectionery, fine bakery wares, and others. Among these, the chocolate segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The industry is being driven by increasing people's knowledge of chocolate's health benefits, including the antioxidants and potential cardiovascular advantages. Additionally, the market is enlarged due to the rising demand for artisanal and premium dark chocolates among wealthy consumers seeking pleasure and sophistication.

- The adult segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Canada confectionery market is segmented by age group into children, adults, and geriatric. Among these, the adult segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The market for adult confections is fueled by richer and more complex flavor profiles that appeal to discerning consumers looking for new flavors, as demand for these flavors grows. Exquisite goods like artisanal nuts or cocoa beans from a single origin, as well as complicated and delicious tastes like dark chocolate with hints of exotic fruit or spice, are frequently appealing to buyers in this market.

- The economy segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on price point, the Canada confectionery market is segmented into economy, mid-range, and luxury. Among these, the economy segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast. Numerous important elements that affect both production and customer behavior are the main drivers of the confectionery market's economic sector. First and foremost, customers' price sensitivity is important, particularly in emerging countries and among cost-conscious groups. Second, the price and accessibility of raw materials have a direct effect on candy production costs.

- The supermarket and hypermarket segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canada confectionery market is segmented by distribution channel into supermarkets and hypermarkets, convenience stores, pharmaceutical and drug stores, online stores, and others. Among these, the supermarket and hypermarket segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to the growth in the online delivery channel, the industry's supremacy is ascribed to the rise in pandemic-induced purchasing patterns. Customers shifted their eating habits from food service to supermarkets as a result of cafe and restaurant closures and an increase in remote working, although stricter safety restrictions strengthened the market for both online and local shopping.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada Confectionery Market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Karma Candy Inc.

- Purdys Chocolatier

- Candy Ville

- Canada Cotton Candy

- Regal Confections

- Exclusive brands

- Splendid Chocolates

- The Maple Treat Corporation

- Scholtens Inc.

- Euro-Excellence

- Original Foods Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In September, 2025, Purdy’s Chocolatier introduced its New Pistachio Crunch. This bar features a pistachio white chocolate center with crispy kataifi pastry, enrobed in milk or dark chocolate, and topped with pistachio pieces. It was released for International Chocolate Day on September 13, 2025.

- In August 2025, Regal Foods is set to boost its popular Baklawa range with the launch of three innovative, trend-inspired flavours: Dubai Style Chocolate, Caramelised Biscuit, and Choco Nut, each a limited edition and a market-first.

- In May 2025, Lindt & Sprungl introduced LINDOR Vegan Truffles in Canada, made with oat chocolate to mimic the rich flavor of milk chocolate. Found in Original and Dark Chocolate varieties, the launch is in response to strong demand among Canadian vegans looking for luxurious, plant-based chocolate without sacrificing texture or flavor.

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada Confectionery Market based on the below-mentioned segments:

Canada Confectionery Market, By Product Type

- Hard-boiled Sweets

- Mints

- Gums and Jellies

- Chocolate

- Caramels and Toffees

- Medicated Confectionery

- Fine Bakery Wares

- Others

Canada Confectionery Market, By Age Group

- Children

- Adult

- Geriatric

Canada Confectionery Market, By Price Point

- Economy

- Mid-range

- Luxury

Canada Confectionery Market, By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmaceutical and Drug Stores

- Online Stores

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 171 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |