Canada Content Services Platforms Market

Canada Content Services Platforms Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution, and Services), By Deployment Model (Cloud, and On-premises), and Canada Content Services Platforms Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Content Services Platforms Market Size Insights Forecasts to 2035

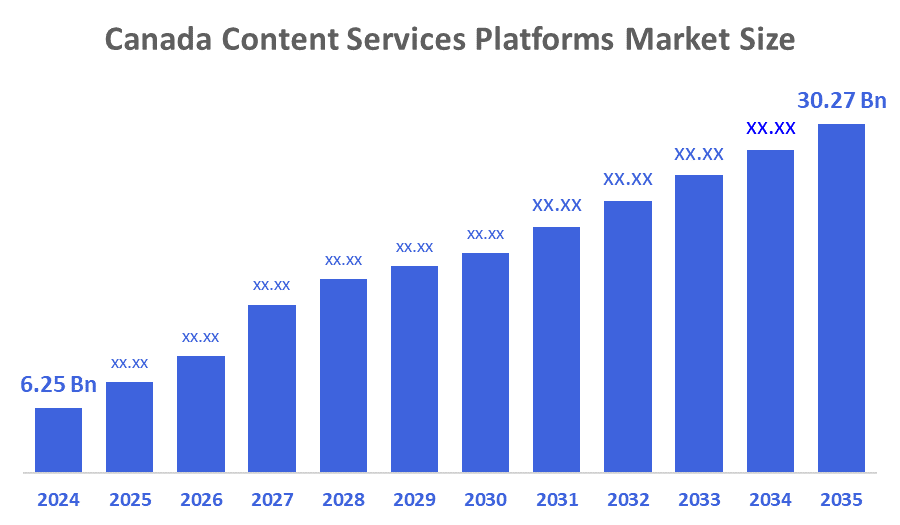

- The Canada Content Services Platforms Market Size was estimated at USD 6.25 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 15.42% from 2025 to 2035

- The Canada Content Services Platforms Market Size is Expected to Reach USD 30.27 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Canada Content Services Platforms Market Size is anticipated to Reach USD 30.27 Billion by 2035, Growing at a CAGR of 15.42% from 2025 to 2035. The increasing need for improved material security, simplified business processes, and the increasing use of social, mobile, analytics, and cloud (SMAC) technologies are some of the factors driving the CSP market's expansion. Furthermore, it is expected that the demand for efficient legal content management and businesses' increasing awareness of the advantages of content services will speed up market expansion.

Market Overview

The market for Canada content services platforms (CSP) is the collection of software programs that oversee, distribute, and manage enterprise content for a range of business purposes, facilitating operational agility, compliance, and digital transformation. The integrated software programs known as Content Services Platforms (CSPs) are made to organise, store, and make it easier for businesses to share digital content. With cutting-edge features like analytics, mobile access, and automated workflows, CSPs prioritise facilitating smooth access and collaboration over traditional enterprise content management (ECM) systems. They enable companies to streamline their content-related operations, guaranteeing adherence to legal mandates and improving operational effectiveness. CSPs let users access a variety of content types from any location, including emails, documents, photos, and videos. Online streaming services that make more than CAD 25 million a year are required by the government's revised regulations under the Online Streaming Act (formerly Bill C-11) to donate 5% of their earnings to Canadian and Indigenous content funds. In order to support digital content creation and distribution services nationwide, this regulatory framework generates an estimated CAD 200 million in new funding annually, which is targeted at industries such as local news, French-language media, Indigenous content, and media created by equity-deserving groups.

Report Coverage

This research report categorises the market for the Canada content services platforms market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada content services platforms market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada content services platforms market.

Driving Factors

The market is expanding as a result of the growing need for workflow efficiency. Further, to increase productivity, organisations look for tools that facilitate collaboration, automate tasks, and streamline content management. This is encouraging the use of these platforms as crucial tools for streamlining operations and workflows pertaining to content. The market grew steadily as businesses realised how important effective content management was and looked for ways to meet their changing requirements. Furthermore, incorporating AI and automation features into content services platforms enables intelligent content classification, automated workflows, and advanced analytics, all of which boost overall productivity. Adoption of content services platforms is becoming more and more important for efficient content management and retention strategies as businesses continue to digitise their operations.

Restraining Factors

Concerns about data security and privacy pose serious obstacles to the market for content service platforms, as costs and complexity are increased by the requirement for strict security measures and compliance with data protection laws. Further, higher priority on protecting their data and keeping control over content security; these worries deter some companies from implementing content service platforms.

Market Segmentation

The Canada content services platforms market share is classified into component and deployment model.

- The services segment held a significant share in 2024 and is anticipated to grow at a rapid pace during the forecast period.

The Canada content services platforms market is segmented by component into solution, and services. Among these, the services segment held a significant share in 2024 and is anticipated to grow at a rapid pace during the forecast period. The segment growth is being driven by the growing use of content services platforms, including document & records management, workflow management & case management, data capture, information security & governance, content reporting & analytics, and others, because of their many advantages. Platforms for content services offer flexible solutions for digital work, lessen information silos and content sprawl, enhance security and accessibility, improve customer and employee user experiences, and increase productivity by facilitating the sharing of content.

- The cloud segment held a substantial market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canada content services platforms market is divided by deployment model into cloud, and on-premises. Among these, the cloud segment held a substantial market share in 2024 and is expected to grow at a significant CAGR during the forecast period. As more businesses look for scalable and affordable solutions for managing digital content, the trend toward cloud-based content services platforms (CSPs) is expected to pick up speed. This is due to the need for safe, effective, and seamless data access; many companies will be switching from conventional on-premises content management systems (CMS) to cloud-based alternatives. Digital content is managed, allowing businesses to take advantage of cutting-edge technologies that improve workflow and collaboration.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Canada content services platforms market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BBTV (BroadbandTV)

- Klyck.io

- MediaEdge Communications

- Agility CMS

- OpenText

- AODocs Canada

- Thinkmax

- Coveo

- Others

Recent Developments:

- In October 2025, CanXP AI officially launched Canada's first sovereign AI ecosystem, marking a major milestone in the country’s digital independence and data privacy strategy. CanXP AI aims to provide Canadians with private, reasonably priced, and locally governed AI services. All of its infrastructure is owned by Canadians; data never leaves the nation and is never used to train models outside of it.

- In May 2025, AdCellerant formally entered the Canadian market by introducing its acclaimed advertising platform to media outlets and agencies in the country. This action is a significant turning point in its global expansion plan. The growth of AdCellerant is consistent with more general trends in AI-driven campaign optimisation, localised digital marketing, and platform-as-a-service models for media firms.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada Content Services Platforms Market based on the below-mentioned segments:

Canada Content Services Platforms Market, By Component

- Solution

- Services

Canada Content Services Platforms Market, By Deployment Model

- Cloud

- On-premises

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 176 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |