Canada Electric Steel Market

Canada Electric Steel Market Size, Share, and COVID-19 Impact Analysis, By Product (Grain-Oriented, Non-Grain Oriented), By Application (Transformers, Motors, Inductors, and Others), and Canada Electric Steel Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Electric Steel Market Insights Forecasts to 2035

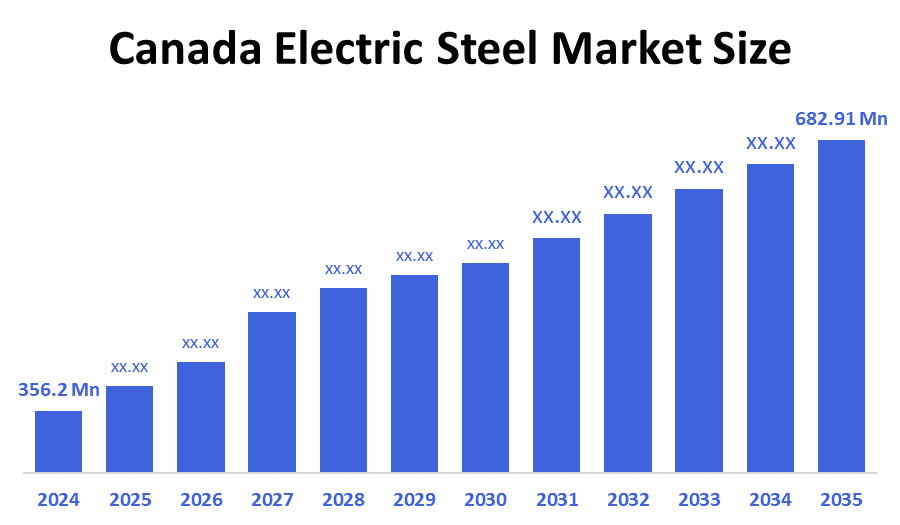

- The Canada Electric Steel Market Size Was Estimated at USD 356.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.1% from 2025 to 2035

- The Canada Electric Steel Market Size is Expected to Reach USD 682.91 Million by 2035

According to a research report published by Decision Advisior & Consulting, the Canadian Electric Steel Market size is anticipated to reach USD 682.91 million by 2035, growing at a CAGR of 6.1% from 2025 to 2035. The market is driven by its crucial role of transformers, generators, and motors due to its capacity to lower power loss. Electrical steel's ferromagnetic qualities, which enable it to intensify the magnetic effects of current-carrying coils, give it its special qualities.

Market Overview

Electrical steel, referred to as silicon steel or lamination steel, is an essential component used in the production of generators, electric motors, transformers, and other electrical devices. The manufacturing, research, and deployment of specialist steel products intended for use in electrical applications are the main objectives of the electrical steel market. Due to its exceptional magnetic qualities, it is essential for the effective operation of electrical equipment. These materials are necessary to increase energy efficiency, lower losses, and enable compact designs in electric devices.

Algoma Steel Inc. is receiving a $400 million loan from the federal government through the Large Enterprise Tariff Loan (LETL) program. The US government levied a 50% tariff on Canadian steel imports in June 2025. The initiative, which intends to boost demand for Canadian steel and improve the competitive price of Ontario steel products, saw increases from Algoma Steel Group Inc., Russel Metals Inc., and Stelco Holdings Inc.

In 2021, ArcelorMittal and the Canadian government announced their plan to invest CAD$1.765 billion in decarbonization technologies at the Hamilton mill of ArcelorMittal Dofasco. Within the next seven years, the planned improvements will cut yearly CO2 emissions at ArcelorMittal's Hamilton, Ontario operations by about 3 million tonnes, or roughly 60% of emissions.

The growing need for energy-efficient systems, improvements in manufacturing technologies, and the rise of the electric vehicle and renewable energy industries are all factors contributing to the Canada electrical steel market's potential for substantial growth.

Report Coverage

This research report categorizes the market for the Canada electric steel market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada electric steel market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada electric steel market.

Driving Factors

The electric steel markets in Canada are driven by the need for energy-efficient solutions, as is the need for electrical steel with better magnetic qualities. For applications like transformers, grain-oriented electrical steels (GOES) are especially sought after. The market for electrical steel, especially grain-oriented steel for transformers, is expanding in Canada due to the country's increasing need for renewable energy infrastructure and power system development. As more individuals opt for electric vehicles (EVs), there is an increasing demand for high-efficiency electric motors. These advancements are contributing to the growth of Canada's electrical steel industry by improving product quality and expanding application areas.

Restraining Factors

The electric steel market in Canada is majorly restrained by the cost swings for these resources, which are frequently caused by market demand or disruptions in the global supply chain, raising the cost of production. As potential substitutes for batteries and transformers, innovative copper materials and rare-earth magnet technologies are being researched. This may have an impact on the market for conventional electrical steels, particularly in specific applications. Although electrical steel can be recycled, Canada's infrastructure for doing so remains lacking.

Market Segmentation

The Canadian electric steel market share is categorised by product and application.

- The grain-oriented segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian electric steel market is segmented by product into grain-oriented, non-grain oriented. Among these, the grain-oriented segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by due to GOES's exceptional magnetic qualities, which make it the perfect material for high-efficiency generators, motors, and transformers. It may increase efficiency; GOES is frequently employed in the production of transformers, power generators, and other electrical equipment. The growing trend toward renewable energy sources and the rising demand for power in developing nations

- The transformers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the Canadian electric steel market is segmented into transformers, motors, inductors, and others. Among these, the transformers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by electrical steel has a strong magnetic permeability; it is an essential component for transformer manufacture. Due to they effectively and safely transfer and distribute electricity, transformers are crucial parts of power-generating, transmission, and distribution systems. The demand for transformers has increased due to the growth of decentralized power generation, the development of digital loads, and the complexity of electrical grids.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada electric steel market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Algoma Steel

- ArcelorMittal Dofasco

- Trans-Mit Steel Inc

- Tree Island Steel

- Alta Steel

- Electronic Craftsmen’

- CES Corporation

- Transgrid Solutions

- Code Electric

- Saint-Augustin Canada Electric Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, the Ontario government, in partnership with the federal government, announced an investment of $500 million to help Algoma Steel navigate changing market conditions and the impact of U.S. tariffs targeted at Canada’s steel sector.

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Canada Electric Steel Market based on the below-mentioned segments:

Canada Electric Steel Market, By Product

- Grain Oriented

- Non-Grain Oriented

Canada Electric Steel Market, By Application

- Transformers

- Motors

- Inductors

- Others

FAQ’s

Q: What is the Canadian electric steel market size?

A: The Canada Electric Steel Market size is expected to grow from USD 356.2 million in 2024 to USD 682.91 million by 2035, growing at a CAGR of 6.1% during the forecast period 2025-2035.

Q: What is electric steel, and its primary use?

A: Electrical steel, referred to as silicon steel or lamination steel, is an essential component used in the production of generators, electric motors, transformers, and other electrical devices. The manufacturing, research, and deployment of specialist steel products intended for use in electrical applications are the main objectives of the electrical steel market.

Q: What are the key growth drivers of the market?

A: Market growth is driven by energy-efficient alternatives, and electrical steel with improved magnetic properties is needed. Grain-oriented electrical steels (GOES) are particularly sought after for applications such as transformers. Canada's growing need for renewable energy infrastructure and power system development is driving growth in the electrical steel industry, particularly in grain-oriented steel for transformers.

Q: What factors restrain the Canadian Electric steel market?

A: The Market is restrained by the cost swings for these resources, which are frequently caused by market demand or disruptions in the global supply chain, raising the cost of production. As potential substitutes for batteries and transformers, innovative copper materials and rare-earth magnet technologies are being researched.

Q: How is the market segmented by product?

A: The market is segmented into grain-oriented and non-grain-oriented.

Q: Who are the key players in the Canadian electric steel market?

A: Key companies include Algoma Steel, ArcelorMittal Dofasco, Trans-Mit Steel Inc., Tree Island Steel, Alta Steel, Electronic Craftsmen, CES Corporation, Transgrid Solutions, Code Electric, and Saint-Augustin Canada Electric Inc.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 207 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |