Canada Eyewear Market

Canada Eyewear Market Size, Share, and COVID-19 Impact Analysis, By Product (Contact Lenses, Premium Contact Lenses, Mass Contact Lenses, Prescription Glasses, and Others), By Distribution Channel (E-Commerce, Brick & Mortar), By End User (Male, Female, Unisex), and Canada Eyewear Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

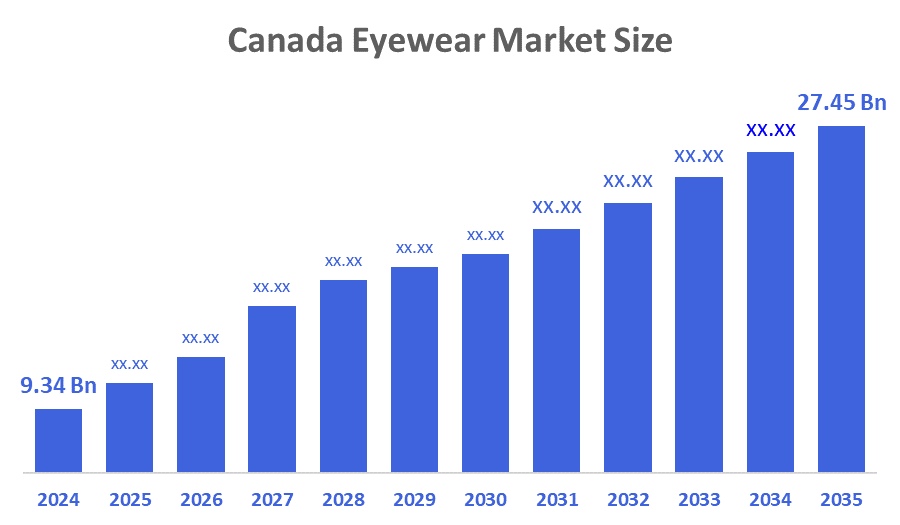

Canada Eyewear Market Size Insights Forecasts to 2035

- The Canada Eyewear Market Size Was Estimated at USD 9.34 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 10.3% from 2025 to 2035

- The Canada Eyewear Market Size is Expected to Reach USD 27.45 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Canadian Eyewear Market Size is anticipated to Reach USD 27.45 Billion by 2035, Growing at a CAGR of 10.3% from 2025 to 2035. The market is driven by the growing number of patients with visual impairments and the rising desire among consumers for eyewear as a fashion addition. Increasingly, industry participants are concentrating on strategic projects like mergers and acquisitions to meet the rising demand.

Market Overview

The purpose of eyewear is to protect the eyes, enhance vision, and create a fashion statement. The products that make up the worldwide eyewear market are contact lenses, sunglasses, and spectacles. Glasses, sunglasses, and contact lenses are examples of eyewear.

Canada is positioned as a rising leader in technology with government initiatives and financing programs that support wearable technology and augmented reality research and development in Canadian cities. Artificial intelligence is changing the industry by improving manufacturing procedures as well as product performance. With their fashionable, reasonably priced, and environmentally friendly eyewear options, chain businesses like Clearly and BonLook are prospering.

In August 2025, Canada imported C$43.8 million worth of eyewear and exported C$1.19 million, resulting in a $42.6 million negative trade balance. Between July and August of 2025, Canada's eyeglass exports increased by C$99.7k (9.13%) to C$1.19 million from C$1.09 million. Over that period, imports increased by C$847k (1.97%), from C$42.9 million to C$43.8 million.

Canada's top export destinations for eyewear in August 2025 were the United Arab Emirates (C$652k), the United States (C$145k), Czechia (C$133k), France (C$68.2k), and the Netherlands (C$56.8k). China (C$16.7M), the US (C$6.43M), Italy (C$6.27M), Thailand (C$5.49M), and Chinese Taipei (C$2.69M) accounted for the majority of Canada's eyewear imports in the same month.

Government involvement ensures the high-quality eyewear products are available, enhances awareness of the demand for vision care, and Government laws are on safety and quality standards for eyeglasses, which help to increase customer confidence and market growth.

Report Coverage

This research report categorizes the market for the Canada eyewear market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada eyewear market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada eyewear market.

Driving Factors

The eyewear markets in Canada are driven by the increasing frequency of myopia and presbyopia brought on by demographic shifts and digital screen exposure. improvements in lens design and material technology. Due to shifting lifestyles, increased disposable income, and greater health consciousness, consumers are more prepared to spend money on high-quality eyewear that provides outstanding comfort, durability, and design.

Restraining Factors

The eyewear market in Canada is majorly restrained by the increasing number of LASIK procedures, which permanently correct refractive defects and visual impairment; the complex regulatory environment and compliance issues; the rising number of people suffering from headache-causing digital eye strain; and the increased usage of digital gadgets.

Market Segmentation

The Canadian eyewear market share is categorized by product, application, and end user.

- The prescription glasses segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian eyewear market is segmented by product into contact lenses, premium contact lenses, mass contact lenses, prescription glasses, and others. Among these, the prescription glasses segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by the rising incidence of vision impairment; An ageing population and an increase in the prevalence of myopia in younger populations are further factors driving the demand for corrective lenses.

- The brick & mortar segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the Canadian eyewear market is segmented into e-commerce, brick & mortar. Among these, the brick & mortar segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by offering individualized consultations and in-person fitting. Customers value being able to try on frames, receive immediate assistance, and peruse a large assortment in-store. Physical stores are crucial for the sales of prescription eyewear since optical clinics and eye care specialists are still present in physical locations.

- The men segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian eyewear market is segmented by end user into male, female and unisex. Among these, the men segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by a large predilection for both fashionable and functional eyewear, resulting in significant sales of a variety of products, including contact lenses, sunglasses, and spectacles. This market has grown as a result of men's growing attention to fashion trends and increased knowledge of eye health.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada eyewear market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Eyes N Optics

- Clearly

- New Look

- FYidoctors

- McCormack Optometric centre

- Eyewear By Olga

- Alternative & Plan, “B”

- Groupe Aspex Inc

- Bonhomme a Lunettes

- Visique

- E Lunetier

- Eye level Optimal

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2025, FYidoctors, Canada's leading diversified healthcare organization, is proud to announced the launch of its first-ever Mobile Clinic, a fully-equipped, custom-built optometry clinic designed to bring advanced eye care directly to Canadians wherever they are.

In July 2025, New Look Vision Group, a leading North American optical retailer with over 475 stores in the US and Canada, announced a new partnership in Canada, bringing Affirm’s honest, transparent pay-over-time options to customers shopping at New Look Eyewear, Greiche & Scaff, Vogue Optical, IRIS, and more.

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada Eyewear Market based on the below-mentioned segments:

Canada Eyewear Market, By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Prescription Glasses

- Others

Canada Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

Canada Eyewear Market, By End User

- Male

- Female

- Unisex

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 286 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |