Canada Facade Market

Canada Facade Market Size, Share, and COVID-19 Impact Analysis, By Product (Ventilated Facades, Non-Ventilated facades, and Others), By End User (Commercial, Residential, and Industrial), and Canada Facade Market Size Insights Forecasts to 2035

Report Overview

Table of Contents

Canada Facade Market Size Insights Forecasts to 2035

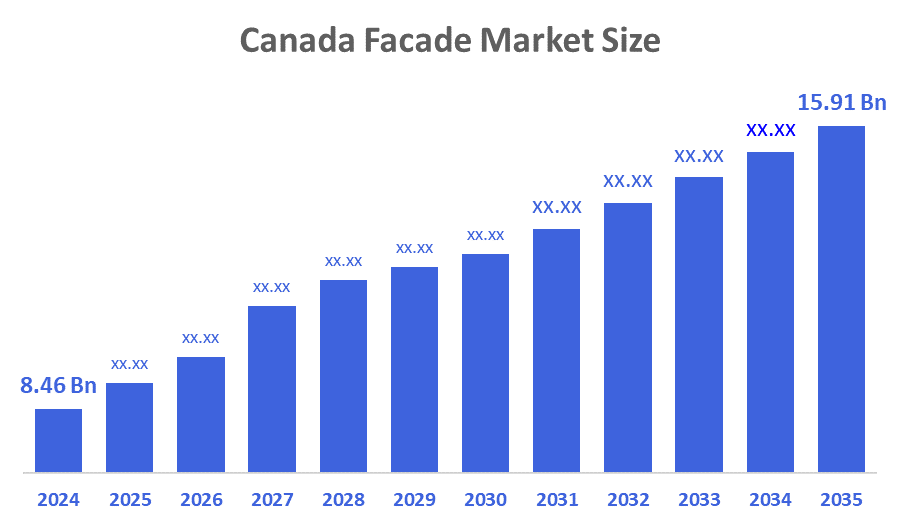

- The Canada Facade Market Size Was Estimated at USD 8.46 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.91% from 2025 to 2035

- The Canada Facade Market Size is Expected to Reach USD 15.91 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Canadian Facade Market Size is anticipated to Reach USD 15.91 Billion by 2035, Growing at a CAGR of 5.91% from 2025 to 2035. The market is driven by the need for high-performance curtain walls and non-ventilated envelopes that meet the NECB 2020-tiered efficiency requirements is rising due to Toronto and Vancouver's growing urban densification. Contractors are reducing exposure through prefabricated panels and price-escalation clauses, but supply chain constraints in architectural glass and aluminium continue to put pressure on bids.

Market Overview

A facade is the front or exterior face of a building, often the primary or most noticeable side. The building components of a structure usually define its personality and aesthetic appeal. Facades are made to improve a project's appearance while also taking into account functional aspects like light, ventilation, and resilience to the elements.

Cities in Western Canada that prioritize sustainability and green building techniques include Vancouver and Calgary. Cities like Toronto and Montreal, which are important hubs for residential and commercial development in eastern Canada, are increasing demand for facade solutions. Concerns regarding a $140 million contract given to a US-owned business were recently voiced by the Ontario Glass and Metal Association (OGMA) to Infrastructure Minister Kinga Surma and Ontario Premier Doug Ford.

The existence of both regional and multinational firms is what defines the Canadian facade industry. Key players, including Rockwool Rockpanel B.V., YKK AP Inc., Saint-Gobain Corporation, and others, are utilizing their existing brand recognition and vast product ranges to maintain market leadership.

Ecological facades that minimize energy usage and emissions of carbon become more and more significant as environmental consciousness develops. Sustainable renewable energy facade methods, like solar and wind turbines, are growing increasingly widespread. The introduction of sophisticated technologies, such as Building Information Modelling and digital fabrication, is expediting facade design and building processes, resulting to better effectiveness and expense reductions.

Report Coverage

This research report categorizes the market for the Canada facade market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada facade market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada facade market.

Driving Factors

The facade market in Canada is driven by the Ontario region within the anticipated time frame. The Ontario facade sector is being driven by increasing urbanization and the expansion of high-rise structures, particularly in the Greater Toronto Area. As of 2023, Ontario saw a 12.8% boost in high-rise building endeavors, and Toronto alone boasts the most operational building cranes in North America. Developers like Oxford Properties and Cadillac Fairview are investing more in smart façade solutions, such as integrated photovoltaic systems and dynamic glazing, which are driving technological advancements in the market.

Restraining Factors

The facade market in Canada is majorly restrained by Canadian purchasers rejecting 46% of manufacturer price hikes in 2024, forcing a transition to escalation clauses based on LME norms. Some fabricators rerouted supply through European rolling mills due to tariff uncertainties on U.S. imports, which increased lead-time risk in the face of tight project timetables. Over 80,000 jobs are unfilled in factories, and by 2035, 22% of the current workforce will have retired. Only 5,000 apprentices enroll in associated courses each year, although Ontario solely requires 100,000 more craftsmen to meet construction requirements.

Market Segmentation

The Canadian facade market share is categorised by product and end user.

- The ventilated facades segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian facade market is segmented by product into ventilated facades, non-ventilated facades, and others. Among these, the ventilated facades segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by an air cavity among the insulation and cladding layers of a facade enhances natural ventilation while lowering heat transfer. This results in lower energy use for heating and cooling in the winter and summer, which is consistent with Canada's rising emphasis on energy efficiency requirements and green building certifications such as LEED and Passive House requirements.

- The commercial segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the Canadian facade market is segmented into commercial, residential, and industrial. Among these, the commercial segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by increasing demand for effective and environmentally friendly building coverings. In an effort to enhance aesthetics, thermal insulation, and regulatory compliance, developers are progressively employing contemporary façade materials, including glass, aluminium, and composite panels.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada facade market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Flynn Group of Companies

- EllisDon Facades

- Northern Facades Ltd.

- Siber Facade Group Inc.

- PH Building Supplies Total Façade

- Aluplex

- YKK AP Canada

- Saint-Gobain Corporation

- AGC Glass North America

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2025, TORONTO, Mitrex, North America's largest manufacturer of Building-Integrated Photovoltaics (BIPV), partnered with Gensler, the global architecture and design firm, to develop its latest innovation, eFacade PRO+ with Honeycomb Backing.

- In October 2024, Saint-Gobain Canada launched CarbonLow wallboard, featuring up to 60% less embodied carbon.

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada Facade Market based on the below-mentioned segments:

Canada Facade Market, By Product

- Ventilated Facades

- Non-Ventilated facades

- Others

Canada Facade Market, By End User

- Commercial

- Residential

- Industrial

FAQ’s

Q: What is the Canadian facade market size?

A: The Canada Facade Market size is expected to grow from USD 8.46 billion in 2024 to USD 15.91 billion by 2035, growing at a CAGR of 5.91% during the forecast period 2025-2035.

Q: What is a facade, and its primary use?

A: A facade is the front or exterior face of a building, often the primary or most noticeable side. The building components of a structure usually define its personality and aesthetic appeal. Facades are made to improve a project's appearance while also taking into account functional aspects like light, ventilation, and resilience to the elements.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the Ontario region within the anticipated time frame. The Ontario facade sector is being driven by increasing urbanization and the expansion of high-rise structures, particularly in the Greater Toronto Area. As of 2023, Ontario saw a 12.8% boost in high-rise building endeavours, and Toronto alone boasts the most operational building cranes in North America.

Q: What factors restrain the Canadian facade market?

A: The Market is restrained by the Canadian purchasers rejecting 46% of manufacturer price hikes in 2024, forcing a transition to escalation clauses based on LME norms. Some fabricators rerouted supply through European rolling mills due to tariff uncertainties on U.S. imports, which increased lead-time risk in the face of tight project timetables

Q: How is the market segmented by product?

A: The market is segmented into ventilated facades, non-ventilated facades, and others.

Q: Who are the key players in the Canadian facade market?

A: Key companies include Flynn Group of Companies, EllisDon Facades, Northern Facades Ltd., Siber Facade Group Inc., PH Building Supplies Total Façade, Aluplex, YKK AP Canada, Saint-Gobain Corporation, and AGC Glass North America.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 174 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |