Canada Flavonoids Market

Canada Flavonoids Market Size, Share, and COVID-19 Impact Analysis, By Type (Anthocyanin, Flavones, Flavan-3-ols, Flavonol, Anthoxanthin, Isoflavones, and Others), By Form (Powder, and Liquid), and Canada Flavonoids Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Flavonoids Market Size Insights Forecasts to 2035

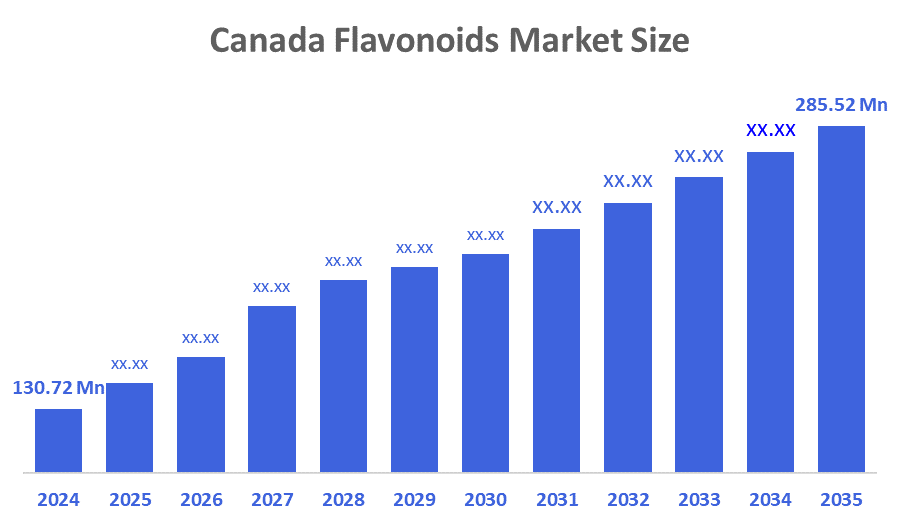

- The Canada Flavonoids Market Size was estimated at USD 130.72 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.36% from 2025 to 2035

- The Canada Flavonoids Market Size is Expected to Reach USD 285.52 Million by 2035

According to a Research Report Published by Decisions Advisors and Consulting, The Canada Flavonoids Market Size is anticipated to Reach USD 285.52 Million by 2035, Growing at a CAGR of 7.36% from 2025 to 2035. The industry is expanding due to an emphasis on preventive healthcare and the use of natural ingredients. The market saw a significant shift in the rise of flavonoid usage due to increased health consciousness, as these agents have anti-cancer capabilities to maintain cardiovascular health.

Market Overview

The Canadian flavonoids market is an industry that produces, extracts, and commercialises flavonoids for application in medicines, nutraceuticals, food and drinks, and cosmetics. Natural polyphenolic compounds with a variety of phenolic structures are called flavonoids. It is a biologically active molecule that gives pigment to fruits and vegetables like grapes, citrus fruits, peppers, onions, kale, and dill. Chalcones, flavones, isoflavonoids, flavanones, anthoxanthins, and anthocyanins are some of the most common flavonoids derived from plant barks, roots, stems and flowers. They possess anti-ageing, anti-oedema, antioxidant, and anti-inflammatory activities. Flavonoids smooth and moisturise the skin, prevent wrinkles, and stimulate collagen synthesis. Additionally, they can treat stomach ulcers, stop the formation of cancer cells, and shield the body from infections. They are utilised as feed additives to affect microbial activity, pH balance, and protein degradation. Another aspect driving growth is the changing consumer preference for high-end cosmetics and skin care products.

According to Alberta Health Services, flavonoids are linked to cancer prevention through a diet high in fruits and vegetables, with frequent consumption lowering the risk of chronic diseases. According to a 2025 study, increasing dietary flavonoid variety is associated with lower all-cause mortality and risk of chronic disease. Further studies show advantages for gut wellness, ageing, and brain health.

Report Coverage

This research report categorises the market for the Canada flavonoids market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada flavonoids market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada flavonoids market.

Driving Factors

One of the important reasons contributing to the market's favourable outlook is significant growth in the food and beverage industry. The rapid growth of the nutraceutical business has resulted in increased demand for flavonoids. Plant-derived flavonoids have gained popularity for their health advantages, which include antioxidant capabilities that help prevent chronic diseases. Additionally, the market is expanding due to the growing use of flavonoids in ruminant nutrition. Furthermore, advances in extraction technologies and formulation processes have increased the efficiency and efficacy of flavonoid manufacturing, making these compounds more accessible and appealing to food and supplement makers alike. The growing incidence of health conditions, as well as the need for quick, healthy meal options, has increased demand for flavonoid-rich goods in Canada. ?

The Innovation Fund provided support to broader biotech and life sciences industries, including agri-food biotech for innovative ingredients from residual biomass, with 357 notifications of intent totalling $3.56 billion in project expenses (requesting $1.35 billion). The Canadian Foundation for Innovation and Research (CFIR) provides seed money and research financing to early-stage biotech firms.

Restraining Factors

Despite a high demand for nutraceuticals, medicines, and functional foods, the high extraction costs, regulatory barriers, little consumer awareness, and supply chain volatility, these hurdles delay implementation.

Market Segmentation

The Canada flavonoids market share is classified into type and form.

- The flavan-3-ols segment held a substantial share in 2024 and is anticipated to grow at a notable CAGR over the forecast period.

The Canada flavonoids market is segmented by type into anthocyanin, flavones, flavan-3-ols, flavonol, anthoxanthin, isoflavones, and others. Among these, the flavan-3-ols segment held a substantial share in 2024 and is anticipated to grow at a notable CAGR over the forecast period. Flavan-3-ols often have the biggest market share due to their presence in common foods such as tea, fruits, and vegetables, as well as their known health advantages, particularly for cardiovascular and antioxidant support. The most prevalent subcategories in terms of volume and value are flavan-3-ols (like the catechins in green tea) and flavonols (like quercetin).

- The powder segment dominated the market in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The Canada flavonoids market is divided by form into powder and liquid. Among these, the powder segment dominated the market in 2024 and is expected to grow at a substantial CAGR during the forecast period. It is shelf-stable, easy to blend, and compatible with existing dry-mix infrastructure in food, beverage, and supplement applications. Liquid forms are essential for beverage and cosmetic emulsions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada flavonoids market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Advanced Orthomolecular Research Inc.

- Agri-Food Discovery Place

- Alaus Products & Productions Inc.

- BioNeutra North America Inc.

- Ceapro Inc.

- DYNAMIS

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2035. Decisioins Advisors has segmented the Canada flavonoids market based on the below-mentioned segments:

Canada Flavonoids Market, By Type

- Anthocyanin

- Flavones

- Flavan-3-ols

- Flavonol

- Anthoxanthin

- Isoflavones

- Others

Canada Flavonoids Market, By Form

- Powder

- Liquid

FAQ

- What is the current market size of the Canadian flavonoids market?

The Canadian flavonoids market was valued at USD 130.72 million in 2024 and is projected to reach USD 285.52 million by 2035, growing at a CAGR of 7.36% during the forecast period 2025-2035.?

- What are the main drivers of the Canadian flavonoids market?

The market is expanding due to rising health consciousness, increasing demand for natural and clean-label ingredients, growth in the food and beverage sector, and advances in extraction and formulation technologies. Flavonoids are also popular for their antioxidant, anti-inflammatory, and cardiovascular health benefits.?

- Which type of flavonoid has the largest market share in Canada?

Flavan-3-ols and flavonols hold the largest market share due to their prevalence in common foods like tea, fruits, and vegetables, and their recognised health benefits. Flavan-3-ols are particularly dominant in terms of both volume and value.?

- Which form of flavonoid (powder or liquid) is most popular in Canada?

Powder form dominates the Canadian market, accounting for the majority of sales due to its shelf stability, ease of blending, and compatibility with dry-mix infrastructure in food, beverage, and supplement applications. Liquid forms are important for beverages and cosmetics, but have a smaller share.?

- What are the key challenges facing the Canadian flavonoids market?

Challenges include high extraction costs, regulatory barriers, limited consumer awareness, and supply chain volatility, which can delay widespread adoption and innovation.?

- Which companies are key players in the Canadian flavonoids market?

Key companies include Advanced Orthomolecular Research Inc., Agri-Food Discovery Place, Alaus Products & Productions Inc., BioNeutra North America Inc., Ceapro Inc., and DYNAMIS.?

- What is the future outlook for the Canadian flavonoids market?

The market is expected to grow steadily, driven by consumer demand for natural and functional foods, increased awareness of health benefits, and ongoing innovation in product development and delivery systems.?

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 156 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |