Canada Flooring Market

Canada Flooring Market Size, Share, and COVID-19 Impact Analysis, By Product (Ceramic Tiles, Porcelain Tiles, Carpet, Vinyl, and Wood & Laminate), By Application (Residential, Commercial, and Industrial), and Canada Flooring Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Flooring Market Insights Forecasts to 2035

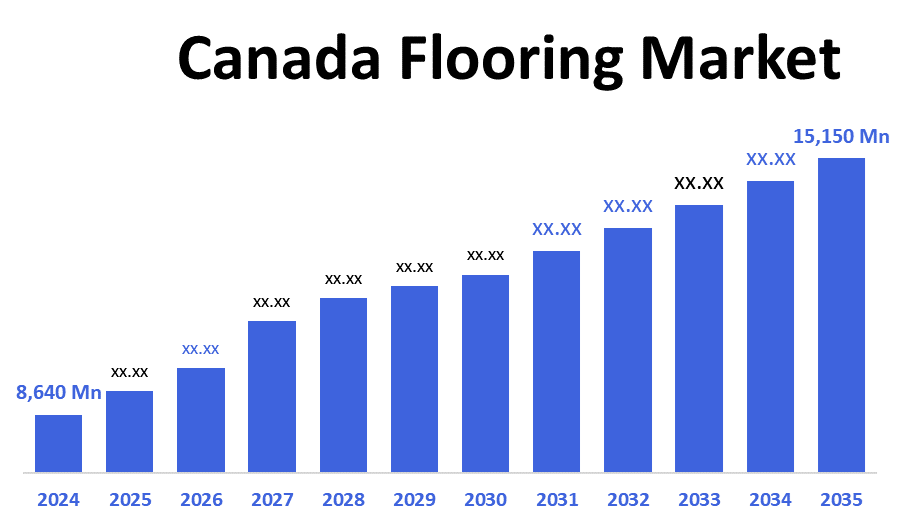

- The Canada Flooring Market Size was estimated at USD 8,640.22 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.24% from 2025 to 2035

- The Canada Flooring Market Size is Expected to Reach USD 15,150.35 Million by 2035

The Canada Flooring Market is anticipated to reach USD 15,150.35 million by 2035, growing at a CAGR of 5.24% from 2025 to 2035. The rising demand for visually appealing, high-quality, and long-lasting flooring options, along with evolving consumer preferences in flooring design, has contributed to the expansion of the flooring sector. The development of the construction industry, growing disposable income, and a heightened demand for environmentally friendly and sustainable flooring materials are propelling the market expansion.

Market Overview

The flooring industry in Canada refers to the sector devoted to the fabrication, distribution, and installation of floor coverings in residential, commercial, and industrial domains. It encompasses both conventional and contemporary materials, influenced by urban development, renovation trends, and sustainability objectives. Flooring is a category of surface material placed over the flooring and subfloor structure to create a flat and secure walking surface. Items are recognised for their durability against dents, scratches, and moisture, which makes them simple to clean and upkeep. Typical layer types include vinyl sheets, ceramic tiles, rubber, natural stone, wood, carpets, and rugs. The selection of materials is based on factors such as noise insulation, ease of maintenance, comfort, longevity, and expense. Common flooring options consist of vinyl tiles, ceramic tiles, carpets, as well as laminates, providing a tidy, durable, and attractive appearance to floors. Further, government incentives or statistics could influence the industry expansion. For instance, the Minister of Natural Resources is declared a Government of Canada investment exceeding $550,000 for the Hybrid Timber Floor System Project, which is spearheaded by EllisDon and DIALOG. The initiative receives funding from the Green Construction through Wood (GCWood) Program. This initiative promotes increased utilisation of wood in building and aids Canada’s shift towards a low-carbon economy.

Report Coverage

This research report categorises the market for the Canada flooring market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada flooring market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada flooring market.

Driving Factors

The market for Canada Flooring is primarily driven by constant innovation, particularly in creating sustainable and long-lasting flooring materials like rigid core vinyl, recycled rubber, and bio-based polymers. Innovations in technology, such as digital printing and better wear resistance in luxury vinyl tiles (LVT), have improved product selections and attracted consumers. Moreover, there is an increasing focus on eco-certifications and adherence to green building standards, prompting manufacturers to invest in sustainable flooring options to satisfy regulatory and consumer expectations. In addition, major manufacturers are addressing this trend by launching flooring solutions that emphasise environmental sustainability. In general, shifting consumer preferences, rising disposable incomes, urbanisation trends, and the continuous increase in construction projects nationwide are expected to drive market growth during the projected period.

Restraining Factors

Tariffs on foreign flooring materials have increased expenses for Canadian firms, which impacts the industry revenue. Variations in consumer spending and competition from eco-friendly and alternative flooring options also restrict market expansion. These difficulties together affect profitability and hinder the growth of flooring demand.

Market Segmentation

The Canada flooring market share is classified into product and application.

- The vinyl segment held a substantial share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Canada flooring market is segmented by product into ceramic tiles, porcelain tiles, carpet, vinyl, wood & laminate. Among these, the vinyl segment held a substantial share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. It is favoured for its cost-effectiveness, longevity, water resistance, and simple installation, particularly in home renovations and multi-family dwellings. Its moisture-resistant properties and durability are significant factors. Luxury vinyl tiles are perfect for both residential and commercial spaces.

- The residential segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canada flooring market is segmented by application into residential, commercial, and industrial. Among these, the residential segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. This industry encompasses various kinds of dwellings, including complexes, apartments, and minor houses. Moreover, government support for first-time homebuyers in both developing and developed nations has boosted the growth of the housing sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Canada flooring market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BC Hardwood

- Preverco

- Superior Hardwood Flooring

- Melmart Distributors Inc.

- A-1 Flooring Canada

- Flooring Canada Inc.

- Karndean Canada

- Tarkett Canada

- Plastex

- Steinbach’s Flooring Canada

- Others

Recent Developments:

- In January 2025, Flooring America's purchase of Flooring Canada was closely linked to the Canadian flooring industry. It signified a tactical unification under CCA Global Partners, intended to integrate branding, operations, and membership assistance throughout North America. CCA Global had acquired Flooring America; Flooring Canada had held a franchise agreement with the organisation, but was independently owned and operated. Flooring Canada comprised around 65 members and operated 74 stores, with retail sales reaching approximately $100 million (U.S.).

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. segmented the Canada flooring market based on the below-mentioned segments:

Canada Flooring Market, By Product

- Ceramic Tiles

- Porcelain Tiles

- Carpet

- Vinyl

- Wood & Laminate

Canada Flooring Market, By Application

- Residential

- Commercial

- Industrial

FAQ

- What is the present size of the flooring market in Canada?

The size of the market was around USD 8,640.22 million in 2024.

- What is the anticipated growth rate of the market?

The market is expected to increase at a CAGR of approximately 5.24% between 2025 and 2035.

- What will the market's size be by 2035?

The market is anticipated to hit USD 15,150.35 million by the year 2035.

- What are the key product categories in the market?

The market includes ceramic tiles, porcelain tiles, carpets, vinyl, and wood & laminate.

- What are the main uses of flooring featured in the market?

Uses encompass flooring for residential, commercial, and industrial settings.

- Who are the key participants in the Canadian Flooring Market?

Major firms consist of BC Hardwood, Preverco, Superior Hardwood Flooring, Flooring Canada Inc., Tarkett Canada, and others.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 168 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |