Canada Freight Management System Market

Canada Freight Management System Market Size, Share, and COVID-19 Impact Analysis, By Component (Solutions, and Services), By End User (Third-Party Logistics (3PLs), Forwarders, Broker, Shippers, Carriers, and Others), and Canada Freight Management System Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Freight Management System Market Insights Forecasts to 2035

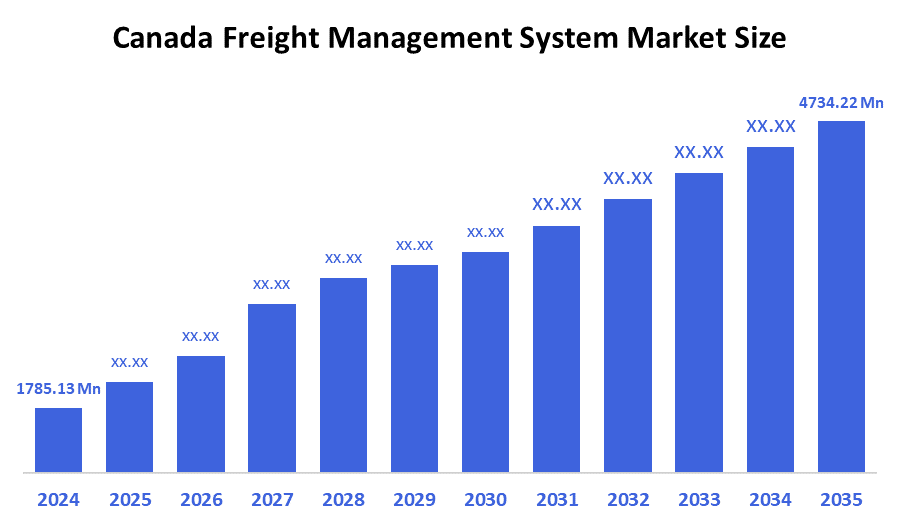

- The Canada Freight Management System Market Size was estimated at USD 1785.13 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.27% from 2025 to 2035

- The Canada Freight Management System Market Size is Expected to Reach USD 4734.22 Million by 2035

According to a research report published by Decision Advisior & Consulting, the Canada Freight Management System Market is anticipated to reach USD 4734.22 million by 2035, growing at a CAGR of 9.27% from 2025 to 2035. Advanced logistics infrastructure, increased e-commerce demand, widespread adoption of cutting-edge technologies, and a strong regulatory focus on sustainability and operational efficiency are the main drivers of the market growth.

Market Overview

The industry segment that offers digital platforms, software, and services intended to optimise freight operations, including planning, execution, tracking, and billing across various transportation modes, is referred to as the Canada freight management system (FMS) market. It offers ways to optimise logistics, cut expenses, and increase visibility for shippers, carriers, and other parties. Transport Transportation Management Systems (TMS), Warehouse Management Systems (WMS), Enterprise Resource Planning (ERP), Order Management Systems (OMS), and Supply Chain Management (SCM) platforms are just a few of the many software and service solutions that are included in the global freight management system market. A variety of component models, including software solutions, implementation services, and support and maintenance services, are used to implement these solutions. As businesses continue to invest in data analytics and cloud-based solutions for improved decision-making and cost control, the growth outlook is still encouraging. Market expansion is being strengthened by increasing trade volumes, cross-border e-commerce, and the demand for predictive logistics solutions.

The Canadian government has made large investments to improve the nation's infrastructure for the freight management system. These investments, which are funded by $6 billion spread over seven years through Budget 2025, concentrate on improving trade and transportation infrastructure, such as ports, railroads, highways, and digital infrastructure.

One important element is the $5 billion Trade Diversification Corridors Fund, which was created to enhance trade corridors in areas like the West Coast, Alberta, Quebec's Port of Saguenay, and the Great Lakes St. Lawrence.

Report Coverage

This research report categorises the market for the Canada freight management system market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada freight management system market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada freight management system market.

Driving Factors

The market for freight management systems (FMS) in Canada is mostly driven by the growing need for effective and economical supply chain operations in the context of growing e-commerce and international trade. The additional investment opportunities are presented by the expanding integration of blockchain for transparency, AI-powered predictive analytics, and automation technologies like driverless cars. Moreover, through encouraging digital transformation and environmental compliance in logistics, government initiatives centred on infrastructure development, trade facilitation, and sustainability further accelerate this growth. Furthermore, innovative freight management solutions are being developed and implemented more quickly thanks to strategic partnerships between technology companies and logistics providers. Emerging trade corridors are opening up new market growth opportunities for FMS providers to implement end-to-end solutions the help shippers and logistics companies.

Restraining Factors

High costs of implementation, challenges in collaborating with old systems, security risks, stringent rules, and obstacles to computerised adoption among smaller shipping businesses are some of the factors impeding the Canadian freight management system (FMS) market.

Market Segmentation

The Canada freight management system market share is classified into component and end user.

- The solutions segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Canada freight management system market is segmented by component into solutions and services. Among these, the solutions segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The wide adoption of all-inclusive software platforms that provide integrated freight analytics, route optimisation, and real-time shipment tracking across logistics networks is the primary driver for segment expansion. The market is dominated by the solution's capacity to handle important logistics operational challenges. It gave companies the means to streamline freight procedures from start to finish.

- The third-party logistics (3PLs) segment held a substantial share in 2024 and is projected to grow at a notable CAGR during the forecast period.

The Canada freight management system market is divided by end user into third-party logistics (3PLs), forwarders, broker, shippers, carriers, and others. Among these, the third-party logistics (3PLs) segment held a substantial share in 2024 and is projected to grow at a notable CAGR during the forecast period. This is due to the need for integrated logistics platforms and the trend toward outsourcing freight operations. Moreover, key businesses rely on 3PLs to manage their increasingly intricate supply chains, and advanced freight management systems that enable real-time shipment visibility, operational effectiveness, and cost optimisation across multimodal networks are being adopted.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada freight management system market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an in-depth analysis of the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for evaluating the overall competition in the market.

List of Key Companies

- CMI Group Inc.

- Scan Freight System (Canada) Inc.

- Purolator Inc.

- Day & Ross Inc.

- Challenger Motor Freight Inc.

- Manitoulin Transport

- Others

Recent Developments:

- In November 2025, ShipTime and the Canadian Federation of Independent Business (CFIB) will expand their long-standing partnership to provide enhanced shipping and logistics benefits for Canadian small businesses. The renewed collaboration announced their shared commitment to supporting entrepreneurs with cost savings, advocacy, and digital tools.

- In June 2025, ULS Freight announced the launch of advanced logistics solutions in Canada, aimed at streamlining shipping, reducing delays, and supporting growth across Canadian business sectors. The initiative expands their integrated network across air, sea, rail, and trucking, with digital tracking and optimised routing for every load.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2035. decision advisor has segmented the Canada freight management system market based on the below-mentioned segments:

Canada Freight Management System Market, By Component

- Solutions

- Services

Canada Freight Management System Market, By End User

- Third-Party Logistics (3PLs)

- Forwarders

- Broker

- Shippers

- Carriers

- Others

FAQ

Q: What is the market size and growth forecast for Canada’s Freight Management System?

A: The Canada Freight Management System market was valued at approximately USD 1,785.13 million in 2024 and is forecasted to grow at a CAGR of 9.27% to reach USD 4,734.22 million by 2035.

Q: What components constitute the market?

A: The market consists primarily of software solutions and support services. The solutions segment dominates due to its broad adoption of integrated platforms offering freight analytics, route optimisation, and real-time tracking capabilities.

Q: Who are the key end users?

A: Key end users include third-party logistics providers (3PLs), forwarders, brokers, shippers, and carriers, with 3PLs holding a substantial share due to the trend towards outsourcing freight management.

Q: What drives market growth?

A: Growth factors include rising e-commerce volumes, expanding international trade, and technological innovation involving AI, IoT, cloud computing, and automation to enhance supply chain visibility and efficiency. Government investments totalling $6 billion (Budget 2025) targeting trade infrastructure improvements also propel the market.

Q: What challenges hinder market growth?

A: High implementation costs, integration challenges with legacy systems, security concerns, regulatory complexities, and slow digital adoption among smaller entities constrain growth.

Q: Who are some major market players in Canada?

A: Leading companies include CMI Group Inc., Scan Freight System (Canada) Inc., Purolator Inc., Day & Ross Inc., Challenger Motor Freight Inc., and Manitoulin Transport.

Q: What are recent notable developments?

A: In November 2025, ShipTime expanded its partnership with the Canadian Federation of Independent Business (CFIB) to offer enhanced shipping logistics benefits for small businesses. ULS Freight launched integrated logistics solutions earlier in 2025, featuring digital tracking and route optimisation across multiple transport modes.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 197 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |