Canada Gene Vector Market

Canada Gene Vector Market Size, Share, and COVID-19 Impact Analysis, By Type (Viral, and Non-Viral), By Delivery Method (In-vivo Gene Delivery, Ex-vivo Gene Delivery, and Others), and Canada Gene Vector Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Gene Vector Market Size Insights Forecasts to 2035

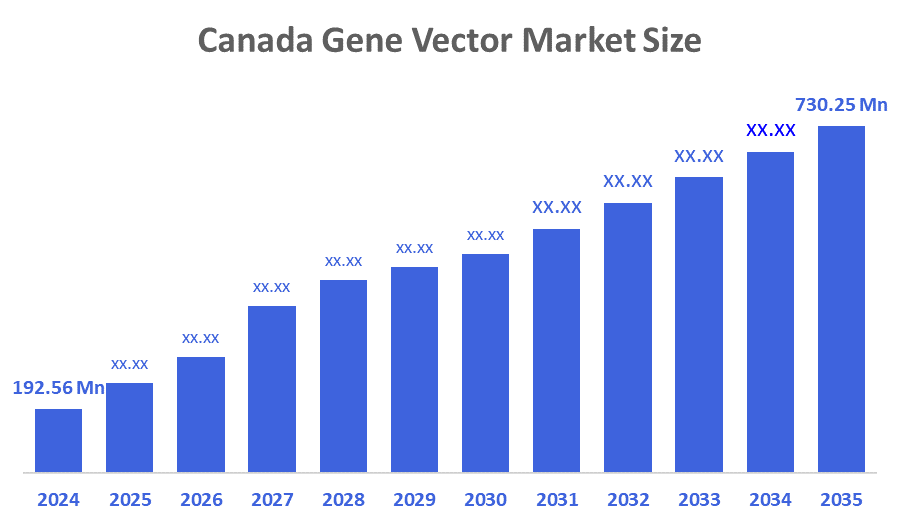

- The Canada Gene Vector Market Size was estimated at USD 192.56 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 12.88% from 2025 to 2035

- The Canada Gene Vector Market Size is Expected to Reach USD 730.25 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Canada Gene Vector Market Size is anticipated to Reach USD 730.25 Million by 2035, Growing at a CAGR of 12.88% from 2025 to 2035. The growing incidence of genetic illnesses, improvements in gene therapy, and a surge in R&D to develop novel gene delivery systems are the primary growth drivers. Further, the rising demand for personalised medicine and targeted therapies continues to rise.

Market Overview

The biotechnology sector in Canada that is devoted to the development, manufacturing, and application of vectors that transfer genetic material into cells, mainly for gene therapy, vaccine development, and research, is known as the gene vector market. Besides, regarding molecular biology, a gene vector is a DNA molecule (typically a virus or plasmid). It is employed as a means of introducing a specific DNA segment into a host cell as part of a recombinant DNA or cloning procedure. Gene vectors can be used in gene therapy to treat a variety of illnesses, including cancer, heart defects, infectious diseases, metabolic diseases, and neurodegenerative disorders. The marketplace for gene vectors is expanding rapidly as a result of strategic alliances, mergers and acquisitions, and improvements in vector engineering and production efficiency. In February 2025, the Government of Canada introduced the Canadian Genomics Strategy (CGS) with the goals of enhancing the nation's genomics leadership, boosting commercialisation, and stimulating economic growth in several industries. $175.1 million in federal funding over seven years. With applications in the treatment of cancer, chronic illnesses, and rare diseases, it will promote the development of personalised medicine, cutting-edge diagnostics, and innovative therapies, such as next-generation vaccines.

Report Coverage

This research report categorises the market for the Canada gene vector market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada gene vector market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada gene vector market.

Driving Factors

The market for Canada gene vectors is influenced by the need for gene vectors used in therapeutic applications to replace or alter damaged genes is rising as a result of the rising incidence of genetic diseases like sickle cell disease and cystic fibrosis. The industry is expanding more quickly thanks to quick developments in gene therapy technologies, such as effective gene delivery systems and CRISPR/Cas9 gene editing. The marketplace is further driven by rising approval and adoption of gene therapies worldwide, as well as growing investments in biopharmaceutical research and development. Furthermore, adaptable production capabilities are improved by strategic alliances and collaborations between biotech companies and contract manufacturing organisations (CMOs), which support the growing demand for clinical and commercial gene therapies. The development and expansion of the gene vector industry are further supported by regulatory support and a supportive policy environment in Canada.

Restraining Factors

The significant complexity and high expenses of manufacturing and regulatory compliance are the main factors limiting the growth of the Canadian gene vector market. The production of viral vectors, like AAV and lentivirus, is a specialised process that requires a lot of resources and is challenging to scale up while maintaining consistent quality and strict adherence to Good Manufacturing Practices (GMP).

Market Segmentation

The Canada Gene Vector market share is classified into type and delivery method.

- The viral segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The Canada gene vector market is divided by type into viral and non-viral. Among these, the viral segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This segmental growth is driven by its consequence of their proven effectiveness in delivering genetic material, which is demonstrated by their high transduction rates, steady gene expression, and suitability for a range of treatments. Moreover, robust adoption is the result of their crucial role in gene and cell therapies, such as CAR-T, vaccination, and treatments for rare diseases.

- The ex-vivo gene delivery segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period.

The Canada gene vector market is segmented by delivery method into in-vivo gene delivery, ex-vivo gene delivery, and others. Among these, the ex-vivo gene delivery segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period. This is because of its growing application in gene and personalized cell therapies, particularly CAR-T and other immune cell-based therapies. By altering the patient's cells outside of the body, the ex vivo technique offers more accurate control over gene integration, increased safety, and improved efficacy with rising investments in infrastructure for the production of cell therapies and developments.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Canada gene vector market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Deep Genomics

- TATUM Bioscience

- Modulari-T Bio

- Precision NanoSystems (PNI)

- Entos Pharmaceuticals

- Genevant Sciences

- iVexSol Canada

- Symvivo Corporation

- Others

Recent Developments:

- In November 2025, Azalea Therapeutics officially launched with $82 million in funding to pioneer precision in vivo genomic medicines using a novel dual-vector platform. The company's goal is to revolutionise the development and delivery of cell and gene therapies by precisely engineering therapeutic cells inside the patient.

- In July 2025, Myrtelle launched commercial-stage manufacturing of its first-in-class gene therapy for Canavan disease, partnering with Charles River and Viralgen to scale production and prepare for market entry. In addition to stopping the progression of the disease, this focused strategy may allow for genuine neural repair via remyelination.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada Gene Vector Market based on the below-mentioned segments:

Canada Gene Vector Market, By Type

- Viral

- Non-Viral

Canada Gene Vector Market, By Delivery Method

- In-vivo Gene Delivery

- Ex-vivo Gene Delivery

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 289 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |