Canada Genomics Market

Canada Genomics Market Size, Share, and COVID-19 Impact Analysis, By Application (Functional Genomics, Epigenomics, Pathway Analysis, Biomarker Discovery, and others), By Technology (Sequencing, PCR, Flow Cytometry, Microarrays, and other technologies), and Canada Genomics Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Genomics Market Size Insights Forecasts to 2035

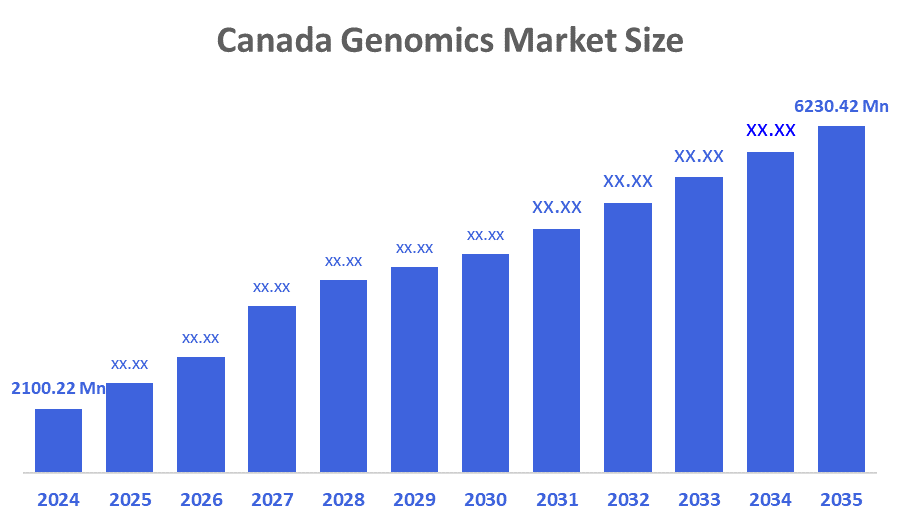

- The Canada Genomics Market Size was estimated at USD 2100.22 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.39% from 2025 to 2035

- The Canada Genomics Market Size is Expected to Reach USD 6230.42 Million by 2035

According to a Research Report Published by Decisions Advisors and Consulting, The Canada Genomics Market Size is anticipated to Reach USD 6230.42 Million by 2035, Growing at a CAGR of 10.39% from 2025 to 2035. The rising demand for personalised medicine, gene therapy, drug discovery, rising cancer rates, and a notable surge in consumer genomics demand are all factors contributing to the genomics market's expansion. As genomics is used more frequently in environmental sciences and agricultural biotechnology, the market's growth prospects should increase. Further, technologies like environmental genomics and genomic-assisted breeding are becoming more and more popular.

Market Overview

The ecosystem of products, services, and applications that use genome analysis to spur innovation in industrial biotechnology, healthcare, agriculture, and the environment is referred to as the Canadian genomics market. The involvement of analysis, interpretation, and commercialisation of genomic data is made possible by sequencing platforms, bioinformatics tools, consumables, and services. The ability of genomics to prevent, manage, and treat diseases has been demonstrated by scientific backing. Medical precision has gradually replaced traditional treatment methods in the healthcare industry shift has been fueled by exceptional clinical properties. Further, enhancing genomics market research capabilities, the integration of artificial intelligence (AI) and machine learning (ML) in genomics refers to the major market trends. The accuracy of predictive modelling is improved by this trend, which results in accepted market projections for genomics. The demand for genomics is directly impacted by the use of CRISPR gene editing technology, which indicates a dramatic change in therapeutic applications.

The Government of Canada officially launched the Canadian Genomics Strategy in February 2025 to strengthen innovation, accelerate commercialisation, and foster economic growth across genomics-driven industries. The Canadian Genomics Strategy, which is supported by a $175.1 million federal investment spread over seven years, beginning in 2024–2025. It will encourage the creation of novel therapeutics, including next-generation vaccines, personalised medicine, and advanced diagnostics that can be used to treat chronic illnesses and rare diseases.

Report Coverage

This research report categorises the market for the Canada genomics market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada genomics market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada genomics market.

Driving Factors

Major government funding and national precision health initiatives, like the Canadian Genomics Strategy, are the main drivers of the Canadian genomics market. In domains like cancer and rare diseases, this high-level investment positions Canada as a leader in personalised medicine by accelerating the development of sizable national genomic datasets and facilitating the translation of research into clinical practice. Concurrently, the market is driven by the quick drop in Next-Generation Sequencing (NGS) technology costs, which makes high-throughput sequencing more affordable for research and diagnostics. The increased frequency of genetic and chronic illnesses, along with the ease of access to technology, guarantees a consistent and expanding need for genomic tools. Also, there is a high need for fields like environmental science and agriculture, which influence market growth as well. The market participants are putting a lot of effort into partnerships, growth, acquisitions, and significant financial outlays in order to further research into rare diseases and support drug development.

Genome Canada announced that the Government of Canada has invested $81 million in the Canadian Precision Health Initiative (CPHI). Over $6 million in funding and $12 million in co-investments for five significant projects have been announced by Genome Canada.

Restraining Factors

The high cost of sequencing technologies, the lack of reimbursement support, and the difficulties in incorporating genomics into standard clinical practice are the main obstacles facing the Canadian genomics market. Adoption is also slowed by strict regulatory requirements and worries about data privacy. Furthermore, a lack of qualified genomics and bioinformatics specialists impedes market expansion by causing research and clinical implementation bottlenecks.

Market Segmentation

The Canada Genomics market share is classified into application and technology.

- The functional genomics segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The Canada genomics market is segmented by application into functional genomics, epigenomics, pathway analysis, biomarker discovery, and others. Among these, the functional genomics segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. The segment's dominance can be ascribed to studies that seek to comprehend a specific phenotypic manifestation of a particular illness. Functional genomic technology serves as the foundation for many gene therapies for cancer. Single-cell RNA sequencing is capable of analysing CRISPR/Cas9 functional genomics screens and provides profound insights into the levels of gene expression in individual cells.

- The sequencing segment held a substantial market share in 2024 and is projected to grow at a notable CAGR during the forecast period.

The Canada genomics market is segmented by technology into sequencing, PCR, flow cytometry, microarrays, and other technologies. Among these, the sequencing segment held a substantial market share in 2024 and is projected to grow at a notable CAGR during the forecast period. The segment growth is driven due to its vital role in interpreting the genetic information contained in DNA and RNA, and sequencing technology is the largest technological segment. The discovery of genetic mutations and variations, sequencing offers crucial insights that propel its prominence in genetic research, personalised medicine, and diagnostic applications.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Canada genomics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Genome Canada

- Deep Genomics

- TATUM Bioscience

- Modulari-T Bio

- DPAncestry

- Others

Recent Developments:

- In May 2025, Protein Industries Canada announced $15 million in new investments for genomics and artificial intelligence (AI) programs to accelerate innovation in Canada’s agrifood sector. In addition to generating new economic opportunities, this full value-chain approach will increase the selection of ingredients made in Canada, bringing the nation one step closer to achieving its $25 billion agrifood growth potential.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada genomics market based on the below-mentioned segments:

Canada Genomics Market, By Application

- Functional Genomics

- Epigenomics

- Pathway Analysis

- Biomarker Discovery

- Others

Canada Genomics Market, By Technology

- Sequencing

- PCR

- Flow Cytometry

- Microarrays

- Other technologies

FAQ

Q: What was the size of the Canada Genomics Market in 2024?

A: The market size was approximately USD 2,100.22 million in 2024.

Q: What is the expected market size by 2035 and the CAGR?

A: The market is expected to grow to USD 6,230.42 million by 2035, at a CAGR of about 10.39% during 2025-2035.

Q: What are the key applications in the Canadian genomics market?

A: Primary applications include functional genomics, epigenomics, pathway analysis, and biomarker discovery, among others. Functional genomics dominated the market in 2024 due to its role in understanding disease phenotypes and applications in gene therapies.

Q: Which technologies segment the market?

A: The genomics market is segmented into sequencing, PCR, flow cytometry, microarrays, and other technologies. Sequencing held a substantial share in 2024, driven by its critical role in genetic information interpretation for personalised medicine and diagnostics.

Q: What are the major factors driving the genomics market growth in Canada?

A: Growth is driven by government funding and precision health initiatives, such as the Canadian Genomics Strategy with $175.1 million investment; decreasing cost of next-generation sequencing; growing prevalence of genetic and chronic diseases; and expanding use of genomics in environmental and agricultural sciences.

Q: What are the key challenges restraining market growth?

A: Restraining factors include the high cost of sequencing technologies, lack of reimbursement mechanisms, integration challenges of genomics into clinical practice, regulatory complexities, and a shortage of skilled genomics and bioinformatics professionals.

Q: Who are some key players in the Canadian genomics market?

A: Noteworthy organisations include Genome Canada, Deep Genomics, TATUM Bioscience, Modulari-T Bio, DPAncestry, and others.

Q: What recent developments are notable in the Canadian genomics market?

A: In May 2025, Protein Industries Canada announced $15 million in investments focusing on genomics and AI programs to boost agrifood innovation, contributing to Canada’s economic growth in genomics applications.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 284 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |