Canada Healthcare Contract Manufacturing Market

Canada Healthcare Contract Manufacturing Market Size, Share, and COVID-19 Impact Analysis, By Type (Pharmaceutical, Medical Devices, and Therapeutic Area), By End User (Medical Device Companies, Pharmaceutical & Biopharmaceutical Companies, and Others), and Canada Healthcare Contract Manufacturing Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Healthcare Contract Manufacturing Market Size Insights Forecasts to 2035

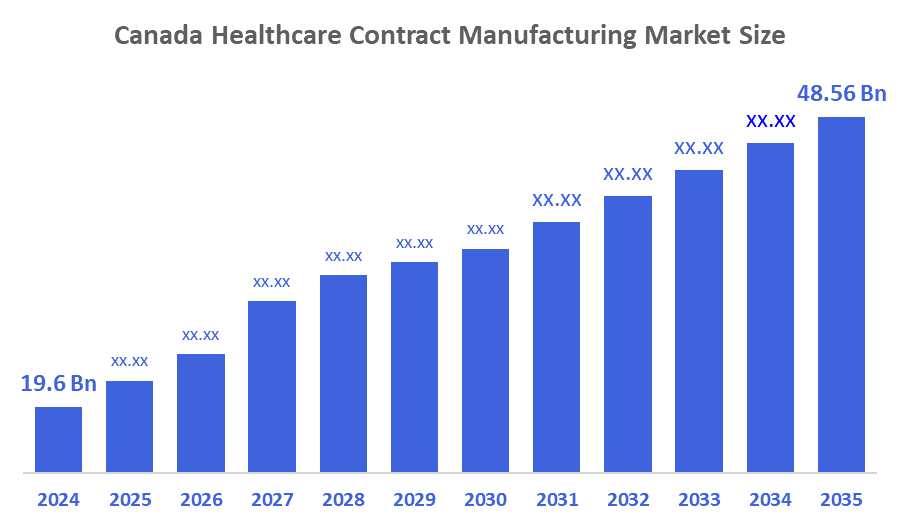

- The Canada Healthcare Contract Manufacturing Market Size Was Estimated at USD 19.6 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.6% from 2025 to 2035

- The Canada Healthcare Contract Manufacturing Market Size is Expected to Reach USD 48.56 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Canadian Healthcare Contract Manufacturing Market Size is anticipated to Reach USD 48.56 Billion by 2035, Growing at a CAGR of 8.6% from 2025 to 2035. The market is driven by the growing outsourcing of pharmaceutical manufacturing and the elderly population's increased incidence of chronic illnesses. The market for biologics and biosimilars is expanding, regulations are becoming more complicated, and biologics utilized in clinical settings are profitable.

Market Overview

Healthcare contract manufacturing is contracting with specialized third-party manufacturers to handle the production of pharmaceuticals, biologics, and medical equipment. CMOs in Canada offer everything from large-scale commercial manufacture to formulation, clinical trial materials, and API production.

In 2023, Canada shipped $5.16 billion worth of optical, photographic, and medical equipment to the United States, along with $6.75 billion worth of pharmaceutical supplies. 80% of medical devices sold in Canada are imported. In addition to consumables, patient aids, orthopedic and prosthetic equipment, and dental equipment, diagnostic equipment is in high demand.

The United States is Canada's top exporter of medical devices, accounting for over 45% of its imports. Other significant import sources are the UK (5.3%), Germany (8.6%), and Switzerland (13%).

The increasing need for reasonably priced pharmaceutical and medical device manufacturing, the rise in OEM outsourcing, and the need to optimize supply chains. Expanding biologics and biosimilar pipelines, along with technological advancements in manufacturing methods, further improve prospects.

Report Coverage

This research report categorizes the market for the Canada healthcare contract manufacturing market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada healthcare contract manufacturing market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada healthcare contract manufacturing market.

Driving Factors

The healthcare contract manufacturing markets in Canada are driven by pharmaceutical businesses that are progressively outsourcing manufacturing in order to cut down on capital expenditures for manufacturing infrastructure, regulatory knowledge to guarantee compliance, and shorten approval times. The growing biotech sector raises the need for specialist contract manufacturing services, a focus on supply chain resilience, and healthcare items due to the ageing population.

Restraining Factors

The healthcare contract manufacturing market in Canada is majorly restrained by the scarcity of skilled technical personnel in manufacturing, quality control, and regulatory affairs; the need for large capital investments; the complexity of regulations; the expense of compliance; the reliance on international trade; and the difficulties associated with technological integration.

Market Segmentation

The Canadian healthcare contract manufacturing market share is categorized by type and end user.

- The pharmaceutical segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian healthcare contract manufacturing market is segmented by type into pharmaceutical, medical devices, and therapeutic area. Among these, the pharmaceutical segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by its hold on a crucial place in the sector since they have expert knowledge of intricate manufacturing procedures, accurate formulation, API synthesis, and quality assurance. Instead of producing a variety of goods, they provide a whole spectrum of services, from pre-clinical medication discovery to the commercialization of various dosage forms.

- The pharmaceutical & biopharmaceutical companies segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the Canadian healthcare contract manufacturing market is segmented into medical device companies, pharmaceutical & biopharmaceutical companies, and others. Among these, the pharmaceutical & biopharmaceutical companies segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by CDMOs provide highly specialized knowledge and advanced infrastructure that are necessary for several difficulties related to pharmaceutical manufacture.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada healthcare contract manufacturing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Biodextris

- BioVectra

- Bora Pharmaceutical Services Inc

- Center for Commercialization of Regenerative Medicine

- Corealis Pharma

- Dermoalab Pharma

- Norgen Biotek Corporation

- Omniabio

- Toronto Research Chemicals

- Pharmascience Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2025, OmniaBio Inc., is a contract development and manufacturing organization (CDMO) pioneering the manufacturing of cell and gene therapies (CGT) with robotics and artificial intelligence, and BrainChild Bio Inc, a clinical-stage biotechnology company developing Chimeric Antigen Receptor T-cell therapies to treat solid tumors in the central nervous system, announced their collaboration aimed at manufacturing BrainChild Bio's pivotal clinical trial therapeutic candidate BCB-276.

- In August 2025, Bora Pharmaceuticals Co., Ltd., a leader in pharmaceutical manufacturing, announced plans for significant investments to expand its manufacturing and packaging capabilities at its facility in Maple Grove, Minnesota.

- In December 2024, Aramis Biotechnologies Inc., a Quebec City-based company specialized in plant-based biomanufacturing of innovative vaccines, and Biodextris Inc., a Montreal-based CDMO specialized in cGMP complex biologic products, announced the signing of an agreement. This strategic partnership leverages the expertise of both companies to ensure efficient downstream manufacturing of clinical materials for Aramis’ leading product candidate, a seasonal influenza vaccine with the potential to enhance protection for at-risk populations.

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada Healthcare Contract Manufacturing Market based on the below-mentioned segments:

Canada Healthcare Contract Manufacturing Market, By Type

- Pharmaceutical

- Medical Devices

- Therapeutic Area

Canada Healthcare Contract Manufacturing Market, By End User

- Medical Device Companies

- Pharmaceutical & Biopharmaceutical Companies

- Others

FAQ’s

Q: What is the Canadian healthcare contract manufacturing market size?

A: The Canada Healthcare Contract Manufacturing Market size is expected to grow from USD 19.6 billion in 2024 to USD 48.56 billion by 2035, growing at a CAGR of 8.6% during the forecast period 2025-2035.

Q: What is healthcare contract manufacturing, and its primary use?

A: Healthcare contract manufacturing is contracting with specialized third-party manufacturers to handle the production of pharmaceuticals, biologics, and medical equipment. CMOs in Canada offer everything from large-scale commercial manufacture to formulation, clinical trial materials, and API production.

Q: What are the key growth drivers of the market?

A: Market growth is driven by pharmaceutical businesses that are progressively outsourcing manufacturing in order to cut down on capital expenditures for manufacturing infrastructure, regulatory knowledge to guarantee compliance, and shorten approval times. The growing biotech sector raises the need for specialist contract manufacturing services, a focus on supply chain resilience, and healthcare items due to the ageing population

Q: What factors restrain the Canadian healthcare contract manufacturing market?

A: The Market is restrained by the scarcity of skilled technical personnel in manufacturing, quality control, and regulatory affairs; the need for large capital investments; the complexity of regulations; the expense of compliance; the reliance on international trade; and the difficulties associated with technological integration.

Q: How is the market segmented by type?

A: The market is segmented into pharmaceutical, medical devices, and therapeutic area.

Q: Who are the key players in the Canadian healthcare contract manufacturing market?

A: Key companies are Biodextris, BioVectra, Bora Pharmaceutical Services Inc, Center for Commercialization of Regenerative Medicine, Corealis Pharma, Dermoalab Pharma, Norgen Biotek Corporation, Omniabio, Toronto Research Chemicals, and Pharmascience Inc.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 269 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |