Canada Healthcare Distribution Market

Canada Healthcare Distribution Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Pharmaceuticals, Medical Devices, Consumables, and Over-the-Counter Products), By Distribution Channel (Wholesalers, Retail Pharmacies, Hospitals, and E-commerce), By End User (Hospitals, Clinics, Patients, and Nursing Homes), By Therapeutic Area (Cardiovascular, Oncology, Diabetology, Respiratory, and Neurology), and Canada Healthcare Distribution Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Healthcare Distribution Market Size Insights Forecasts to 2035

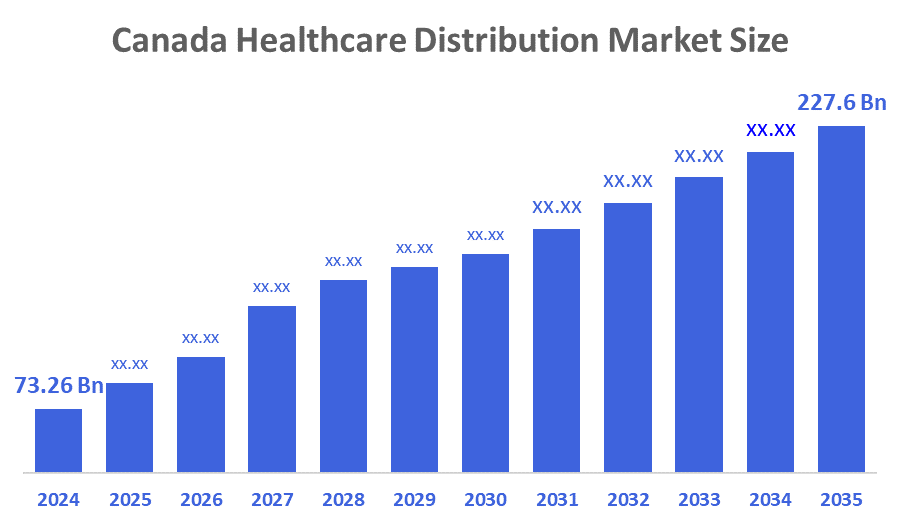

- The Canada Healthcare Distribution Market Size Was Estimated at USD 73.26 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 10.85% from 2025 to 2035

- The Canada Healthcare Distribution Market Size is Expected to Reach USD 227.6 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Canadian Healthcare Distribution Market Size is anticipated to Reach USD 227.6 Billion by 2035, Growing at a CAGR of 10.85% from 2025 to 2035. The market is driven by government investments in bolstering healthcare infrastructure, growing healthcare spending, and the emergence of specialist medications. The market's growth in Canada is anticipated to be significantly accelerated by the digital transformation of distribution procedures and expansion into underserved areas.

Market Overview

The healthcare distribution market supplies and distributes medical products, including pharmaceuticals, medical instruments, gadgets, and supplies. It contains clinics, pharmacies, hospitals, and other healthcare facilities in addition to formulation and distribution. More sophisticated supply chain specifications, increased digitization, and strengthening backing from strategic healthcare investors and private equity. Healthcare distribution firms are enhancing patient interaction, last-mile connection, and logistics as the complexity of medications, biologics, and medical devices continues to rise.

The most cutting-edge distribution center in Ontario was opened by Walmart Canada in October 2025, a major step toward improving consumer and community service.

In a $1.6 billion all-cash transaction in 2024, Canada Andlauer Healthcare Group expanded its healthcare logistics division. AHG operates 9 distribution centers and 22 branches across Canada, offering services related to third-party and specialized transportation solutions for the healthcare sector. In 2024, the company reported C$650 million in revenue, more than half of which was from its ground transportation business.

Pharmaceutical exports from Canada to the rest of the world grew by 38% between 2019 and 2024, while imports grew by 35%. With 31% of imports and 76.8% of exports in 2024, the US is Canada's largest trading partner.

As of December 2023, the top ten Canadian pharmaceutical companies made acquisitions totalling $20.71 billion, or around 48.1% of the Canadian market. In Canada, 80.5% of sales by value and 23.4% of prescriptions by quantity are brand-name products. The manufacturing industry employed over 35,000 people on average in 2024; over the previous five years, employment has increased by about 15.1%.

Enhancement of supply chain resilience through logistical technology and procedures. Consumer demand for pharmaceuticals has increased due to population growth, necessitating an increase in industry output levels.

Report Coverage

This research report categorizes the market for the Canada healthcare distribution market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada healthcare distribution market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada healthcare distribution market.

Driving Factors

The healthcare distribution markets in Canada are driven by enhanced patient outcomes and access. Canada's public and private sectors are dramatically raising healthcare spending. The demand for effective distribution of medications, gadgets, and diagnostics is being driven by this expense. To handle unique goods, distributors are growing their cold chain facilities and using cutting-edge logistical solutions. Distribution of specialized drugs is becoming more and more necessary due to the growing significance of personalized therapy. Modern inventory management methods maximize stock levels and minimize waste. The effectiveness of healthcare distribution in Canada is being improved by supportive government policies and regulatory frameworks. Governments are requiring that safety and storage regulations be followed more strictly.

Restraining Factors

The healthcare distribution market in Canada is majorly restrained by the developing and setting up a robust healthcare distribution system requires several resources. High maintenance costs, Middle- and low-income countries are especially cornered, given their low financing ability to develop a healthcare distribution system. The growing burden of high operating costs, combined with complex and varying regulatory requirements across regions. The health marketing sector is facing new difficulties due to the expansion of specialist health products. Businesses must create new supply networks to support the distribution of speciality medications.

Market Segmentation

The Canadian Healthcare Distribution market share is categorised by product type, distribution channel, end user and therapeutic area.

- The pharmaceuticals segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian healthcare distribution market is segmented by product type into pharmaceuticals, medical devices, consumables, and over-the-counter products. Among these, the pharmaceuticals segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by the constant need for novel therapeutic approaches and prescription drugs. established presence and a significant level of prescription drug use among consumers. This group offers a wide range of therapeutic drugs that treat various medical conditions, ensuring consistent demand.

- The wholesalers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on distribution channel, the Canadian healthcare distribution market is segmented into wholesalers, retail pharmacies, hospitals, and e-commerce. Among these, the wholesalers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by essential in making ensure that hospitals, pharmacies, and other healthcare facilities have access to medications. Serving as essential middlemen between manufacturers and healthcare providers. Effective stock management and prompt delivery of medical supplies are made possible by their wide distribution networks and well-established connections with healthcare facilities.

- The hospitals segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian healthcare distribution market is segmented by end user into hospitals, clinics, patients, and nursing homes. Among these, the hospitals segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by hospitals are the backbone of the healthcare system, functioning as critical access points for patients requiring various services, including surgeries, emergency care, and long-term treatments. Their dominant market position is characterized by well-established supply chains capable of managing complex inventory demands.

- The cardiovascular segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on therapeutic area, the Canadian healthcare distribution market is segmented into cardiovascular, oncology, diabetology, respiratory, and neurology. Among these, the cardiovascular segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by heart disease frequency with an ageing population. since heart-related disorders are very common and require ongoing pharmaceutical care. Antihypertensives and cholesterol-lowering medications are among the many items in this category, which are backed by reputable distribution networks that guarantee prompt delivery.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada healthcare distribution market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BioScript Solutions

- Kohl & Frisch Limited

- Andlauer Healthcare Group

- Switch Health

- Health PRO Procurement

- SRx Health Solutions

- Meditek

- Imperial Distributors Canada Inc

- Metro Supply Chain

- Canadian Hospital

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2025, Bayer Canada announced a new partnership with Mint Pharmaceuticals Inc. for the distribution of ADALAT XL 30 mg tablets in Canada. ADALAT XL is indicated for the management of chronic stable angina and the management of mild to moderate essential hypertension.

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada Healthcare Distribution Market based on the below-mentioned segments:

Canada Healthcare Distribution Market, By Product Type

- Pharmaceuticals

- Medical Devices

- Consumables

- Over-the-Counter Products

Canada Healthcare Distribution Market, By Distribution Channel

- Wholesalers

- Retail Pharmacies

- Hospitals

- E-commerce

Canada Healthcare Distribution Market, By End User

- Hospitals

- Clinics

- Patients

- Nursing Homes

Canada Healthcare Distribution Market, By Therapeutic Area

- Cardiovascular

- Oncology

- Diabetology

- Respiratory

- Neurology

FAQ’s

Q: What is the Canadian healthcare distribution market size?

A: The Canada Healthcare Distribution Market size is expected to grow from USD 73.26 billion in 2024 to USD 227.6 billion by 2035, growing at a CAGR of 10.85% during the forecast period 2025-2035.

Q: What is healthcare distribution, and its primary use?

A: The healthcare distribution market supplies and distributes medical products, including pharmaceuticals, medical instruments, gadgets, and supplies. It contains clinics, pharmacies, hospitals, and other healthcare facilities in addition to formulation and distribution.

Q: What are the key growth drivers of the market?

A: Market growth is driven by improved access and results for patients. Both the public and private sectors in Canada are significantly increasing their healthcare spending. This cost is driving the need for efficient distribution of drugs, devices, and diagnostics. Distributors are expanding their cold chain facilities and employing state-of-the-art logistical solutions to handle unique items.

Q: What factors restrain the Canadian healthcare distribution market?

A: The Market is restrained by the several resources needed to create and implement a reliable healthcare delivery system. Due to their limited capacity to finance the development of a healthcare distribution system, middle- and low-income countries are particularly vulnerable to high maintenance expenses.

Q: How is the market segmented by product type?

A: The market is segmented into pharmaceuticals, medical devices, consumables, and over-the-counter products.

Q: Who are the key players in the Canadian healthcare distribution market?

A: Key companies include BioScript Solutions, Kohl & Frisch Limited, Andlauer Healthcare Group, Switch Health, Health PRO Procurement, SRx Health Solutions, Meditek, Imperial Distributors Canada Inc., Metro Supply Chain, and Canadian Hospital.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 259 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |