Canada Healthcare Enterprise Resource Planning Market

Canada Healthcare Enterprise Resource Planning Market Size, Share, and COVID-19 Impact Analysis, By Function (Inventory and Material Management, Supply Chain and Logistics Management, Patient Relationship Management, Finance and Billing, and Others), By Deployment (On-Premises and Cloud-Based), and Canada Healthcare Enterprise Resource Planning Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Healthcare Enterprise Resource Planning Market Insights Forecasts to 2035

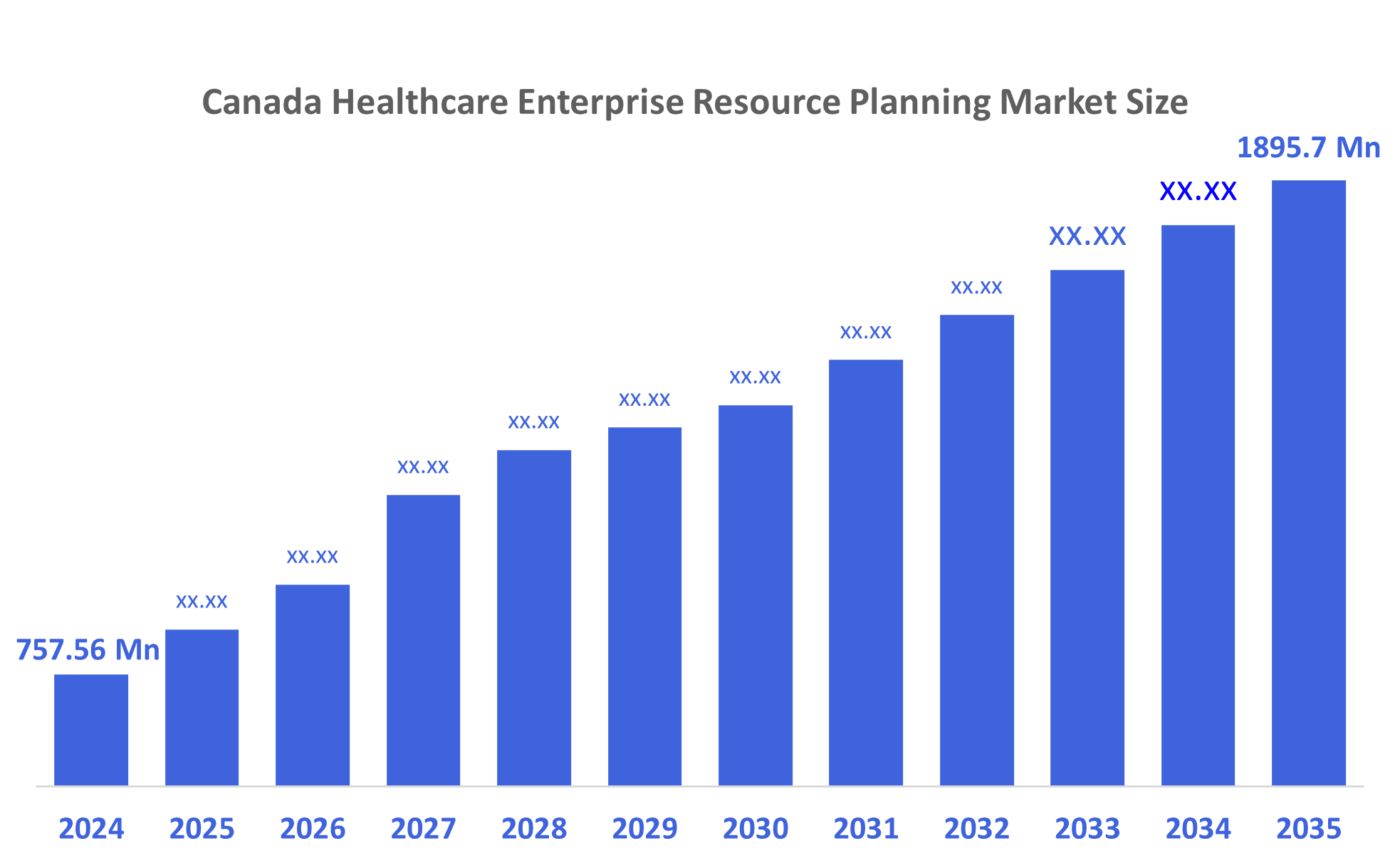

- The Canada Healthcare Enterprise Resource Planning Market Size Was Estimated at USD 757.56 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.7% from 2025 to 2035

- The Canada Healthcare Enterprise Resource Planning Market Size is Expected to Reach USD 1895.7 Million by 2035

According to a research report published by Decision Advisors, the Canadian Healthcare Enterprise Resource Planning Market Size is Anticipated to Reach USD 1895.7 Million by 2035, growing at a CAGR of 8.7% from 2025 to 2035. The market is driven by increased cost, inefficient hospital service management, labour scarcity, and an expanding patient population; healthcare companies are under pressure to implement technology solutions. As more people become aware of the advantages of implementing enterprise resource planning systems, such as superior care delivery options, the removal of back-end manual tasks, and lower operating costs

Market Overview

A comprehensive software program created to oversee and integrate crucial healthcare activities, including financial, supply chain management, human resources, patient data, and administrative procedures, under a single digital platform, is referred to as the healthcare enterprise resource planning market. Enterprise resource planning facilitates billing integration, medical supply monitoring, patient record management, and regulatory compliance in Canada's healthcare industry. Hospitals employ it to enhance patient outcomes and back-office productivity. Enterprise resource planning next is an open-source, cloud-based enterprise resource planning for healthcare companies that deal with fluctuations in supply and demand. one of the healthcare industry's most reliable systems is Microsoft Dynamics 365.

Efficient connectivity between enterprise resource planning systems and other business apps is important to Canadian businesses. Despite its strength, the enterprise resource planning market is governed by a complicated web of laws, regulations, and certifications. Financial firms must adhere to the Canadian Institute of Chartered Accountants Guidelines for data security, whereas healthcare organizations must comply with the Personal Health Information Protection Act.

Healthcare providers are encouraged to improve and deploy enterprise resource planning systems through public health funding schemes. Opportunities include growing telehealth and remote patient monitoring, although local and international vendors are still fiercely competitive.

Leading supply chain management software provider Tecsys Inc. announced that A.M.G. Medical Inc., a prominent Canadian producer and distributor of home healthcare and medical professional products, began its end-to-end digital transformation journey in September 2022 by deploying Tecsys' cloud-based Elite Distribution enterprise resource planning and Elite WMS, Tecsys' reliable warehouse management system.

Report Coverage

This research report categorizes the market for the Canada healthcare enterprise resource planning market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada healthcare enterprise resource planning market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada healthcare enterprise resource planning market.

Driving Factors

The healthcare enterprise resource planning market in Canada is driven by a need to facilitate a smooth interface with electronic health records (EHRs), guaranteeing that medical professionals have instant access to precise patient data. By optimizing staff scheduling, bed management, and equipment utilization, all of which are particularly crucial in Canada's high-demand hospitals, it enhances resource allocation. Healthcare administrators can estimate patient demand, track performance KPIs, and improve overall care delivery quality with the help of enterprise resource planning's integrated analytics. Over the next five years, the market is expected to expand at a CAGR of roughly 6.5% as hospitals and clinics implement enterprise resource planning systems to streamline operations and comply with legal regulations.

Restraining Factors

The healthcare enterprise resource planning market in Canada is majorly restrained by stringent regulatory compliance for adopting healthcare enterprise resource planning. Strict access controls and regular security assessments are required for HIPAA compliance. Lack of a connected AI-integrated system to generate healthcare information, utilization of high-tech innovation, and ever-increasing healthcare costs, due to risks of cybersecurity issues.

Market Segmentation

The Canadian healthcare enterprise resource planning market share is categorised by function and deployment.

- The finance and billing segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian healthcare enterprise resource planning market is segmented by function into inventory and material management, supply chain and logistics management, patient relationship management, finance and billing, and others. Among these, the finance and billing segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by transparency and efficiency are supported by these systems, which integrate front-end revenue activities with back-end tasks like claims handling. They enable comprehensive financial management, including risk assessment, ledger administration, and real-time monitoring, which propels the segment's expansion.

- The on-premises segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on deployment, the Canadian healthcare enterprise resource planning market is segmented into on-premises and cloud-based. Among these, the on-premises segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by having a high revenue share, which provides advantages including improved security, less reliance on suppliers, and little upkeep. Often called shrink-wrap deployment, it involves cost reductions, remote access, and direct software installation on corporate PCs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada healthcare enterprise resource planning market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise resource planning rise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Group Conseil ERA

- MediSolution

- Hcareers

- Apps. health

- Phoenix Systems

- Services Progressifs

- ERP Rise eSolutions

- ProjectLine Solutions Inc.

- Odoo

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2025, Multiview Financial Software, a leading provider of enterprise resource planning rise resource planning solutions (enterprise resource planning) solutions for healthcare, announced it had been named a preferred technology partner of OCHIN. Aiming to bolster the financial stability of community health centers and hospitals in OCHIN’s network and ensure high-quality healthcare access for all.

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Canada Healthcare Enterprise Resource Planning Market based on the below-mentioned segments:

Canada Healthcare Enterprise Resource Planning Market, By Function

- Inventory and Material Management

- Supply Chain and Logistics Management

- Patient Relationship Management

- Finance and Billing

- Others

Canada Healthcare Enterprise Resource Planning Market, By Deployment

- On-Premises

- Cloud-Based

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |