Canada Healthcare Fraud Analytics Market

Canada Healthcare Fraud Analytics Market Size, Share, and COVID-19 Impact Analysis, By Solution (Descriptive Analytics, Predictive Analytics, and Prescriptive Analytics), By Delivery Mode (On-Premises, Cloud-Based), By Application (Insurance Claims Review, Pharmacy Billing Issue, Payment Integrity and Others), By End User (Public & Government Agencies, Private Insurance Payers, Third Party Service Providers, and Employers), and Canada Healthcare Fraud Analytics Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Healthcare Fraud Analytics Market Insights Forecasts to 2035

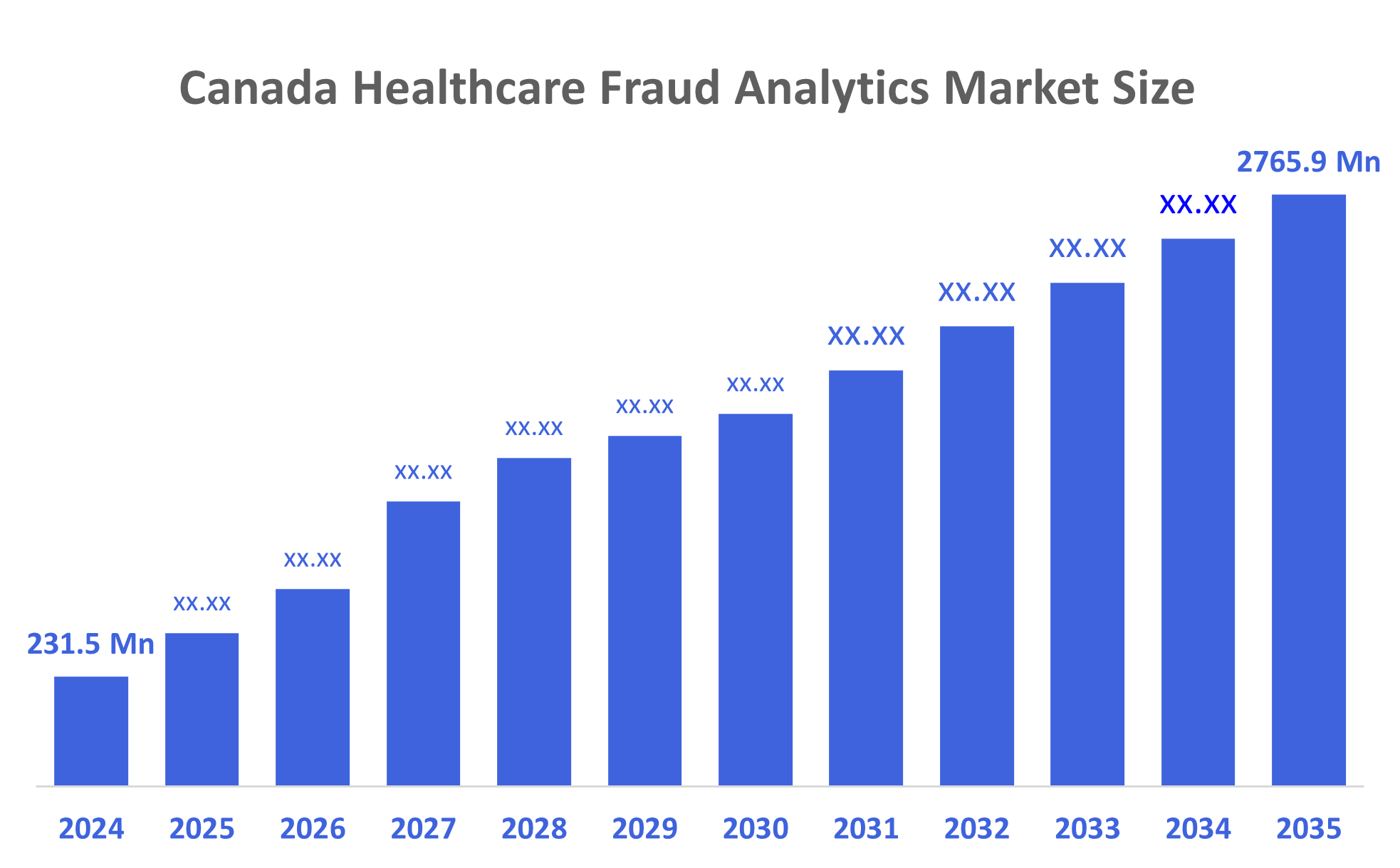

- The Canada Healthcare Fraud Analytics Market Size Was Estimated at USD 231.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 25.3% from 2025 to 2035

- The Canada Healthcare Fraud Analytics Market Size is Expected to Reach USD 2765.9 Million by 2035

According to a research report published by Decisions Advisors, The Canadian Healthcare Fraud Analytics Market Size is Anticipated to Reach USD 2765.9 Million by 2035, growing at a CAGR of 25.3% from 2025 to 2035. The market is driven by a rise in fraudulent healthcare activities, an increasing number of patients seeking health insurance, and the rising number of pharmacy claims-related frauds.

Market Overview

Robust legislation on patient privacy, digital health records, and medical security promotes the market's expansion. The increasing use of biometric identification for secure access to telehealth services and electronic health data is remarkable. Canada's focus on innovative medical technologies and data privacy laws has made it a significant player in the regional biometrics market. Medical facilities and IT companies working together to provide customized biometric solutions that adhere to strict regulations help the market.

The Canadian Life and Health Insurance Association (CLHIA) declared in May 2025 that it is utilizing artificial intelligence (AI) to detect theft more rapidly and is growing its initiative to pool claims data. The insurance industry's capacity to prevent fraud and guarantee the long-term viability of group benefits plans is being revolutionized by this cutting-edge technology. The Fraud Reporting System database of the Canadian Anti-Fraud Centre contains records on fraud and identity crimes.

99% of Canada's life and health insurance market is made up of companies that are members of the voluntary CLHIA. Nearly 30 million Canadians receive life insurance, annuities, and supplemental health insurance from these insurers, among other financial protection products. They employ around 180,000 Canadians and have over $1 trillion in assets in Canada.

According to the Canadian Anti-Fraud Centre (CAFC), about 5–10% of scams are recorded, although Canadians lost CAN$643 million to fraud in 2024, a nearly 300% rise since 2020. The CAFC, which is co-managed by the Ontario Provincial Police, Competition Bureau Canada, and Royal Canadian Mounted Police, collects fraud-related intelligence and supports enforcement and prevention initiatives.

Healthcare communication via social media is becoming more and more popular, which is one of the main reasons why the healthcare business is changing at such a rapid pace. A significant amount of healthcare data is routinely generated by the extensive network of healthcare leaders, influencers, patients, providers, organizations, and governmental bodies.

Report Coverage

This research report categorizes the market for the Canada healthcare fraud analytics market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada healthcare fraud analytics market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada healthcare fraud analytics market.

Driving Factors

The healthcare fraud analytics markets in Canada are driven by the number of individuals using different healthcare programs has grown dramatically over time. Due to several variables, including an ageing population, increased healthcare expenditures, and an increase in the burden of disease. Government initiatives and increased public knowledge of the benefits of insurance for health have been the main drivers of the sector's growth. Medical biometrics can improve patient safety, decrease fraud, and expedite government processes by increasing reliability and safety. Additionally, it supports improved health outcomes and personalization by helping hospitals integrate patient data.

Restraining Factors

The healthcare fraud analytics market in Canada is majorly restrained by the lack of interoperability standards, consistent data formats, and qualified staff, as well as the data restrictions in Medicaid services. restricted funds and limited resources. Healthcare organizations may oppose the adoption of new technology and procedures; incomplete data may make it more difficult to effectively identify fraud; and fraud detection systems may be expensive to implement.

Market Segmentation

The Canadian healthcare fraud analytics market share is categorized by solution, delivery mode, application, and end user.

- The descriptive analytics segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian healthcare fraud analytics market is segmented by solution into descriptive analytics, predictive analytics, and prescriptive analytics. Among these, the descriptive analytics segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by this area of analytics deals with the analysis and interpretation of historical data in order to obtain findings and give a succinct overview of past events and occurrences. This approach's main goal is to provide a thorough understanding of the dataset by examining its characteristics, structures, and patterns.

- The on-premises segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on delivery mode, the Canadian healthcare fraud analytics market is segmented into on-premises, cloud-based. Among these, the on-premises segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by due to the data protection and confidentiality offered by on-premises solutions are more dependable. Control of data infrastructure is typically preferred by organizations in order to adhere to even the strictest rules. The key to deployment is easier modification and interface with current systems, which allows healthcare providers to take charge of analytics solutions and customize them to meet specific operational processes and needs.

- The insurance claims review segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian healthcare fraud analytics market is segmented by application into insurance claims review, pharmacy billing issue, payment integrity and others. Among these, the insurance claims segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by refers to the methodical review and analysis of insurance claims in order to identify misconduct, fraud, or wastefulness in the healthcare industry. In order to spot irregularities and confirm the validity and necessity of the medical services they are paying for, insurance companies, government agencies, and other healthcare payers use claim review techniques.

- The public & government agencies segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the Canadian healthcare fraud analytics market is segmented into public & government agencies, private insurance payers, third-party service providers, and employers. Among these, the public & government agencies segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by the increased quantity of patients in government hospitals and federal institutions' increased vulnerability to fraudulent operations, particularly in developing nations with inadequate technologically advanced infrastructure, which are important factors contributing to the substantial proportion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada healthcare fraud analytics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Verafin

- Paytm Labs

- Ethoca

- Acuoty Tec

- Verifast

- nuData Security

- Merchant RMS Inc

- The Xpress Vault

- Owl.co.

- Trust Science

- Verifast

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2025, the Royal Canadian Mounted Police (RCMP) announced the launch of the Report Cybercrime and Fraud website, a new national system for individuals, businesses and organizations to report incidents of fraud and cybercrime.

- In April 2025, CARFAX Canada launched VIN Fraud Check, a new tool that alerts vehicle dealers if a vehicle's Vehicle Identification Number (VIN) contains data indicating potential fraud, or if it has been reported stolen in North America. VIN Fraud Check will now be available to vehicle dealers who access Vehicle History Reports through the CARFAX Canada dealer portal, at no additional charge.

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada Healthcare Fraud Analytics Market based on the below-mentioned segments:

Canada Healthcare Fraud Analytics Market, By Solution

- Descriptive Analytics

- Predictive Analytics

- Prescriptive Analytics

Canada Healthcare Fraud Analytics Market, By Delivery Mode

- On-Premises

- Cloud-Based

Canada Healthcare Fraud Analytics Market, By Application

- Insurance Claims Review

- Pharmacy Billing Issue

- Payment Integrity

- Others

Canada Healthcare Fraud Analytics Market, By End User

- Public & Government Agencies

- Private Insurance Payers

- Third Party Service Providers

- Employers

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |