Canada Healthcare Supply Chain BPO Market

Canada Healthcare Supply Chain BPO Market Size, Share, and COVID-19 Impact Analysis, By Payer Service (Sustainability Services, Order Management, Inventory Management, Transport Management, and Manufacturing Management), By End User (Biotechnology and Pharmaceutical Companies, Medical Device Companies, and Others), and Canada Healthcare Supply Chain BPO Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Healthcare Supply Chain BPO Market Size Insights Forecasts to 2035

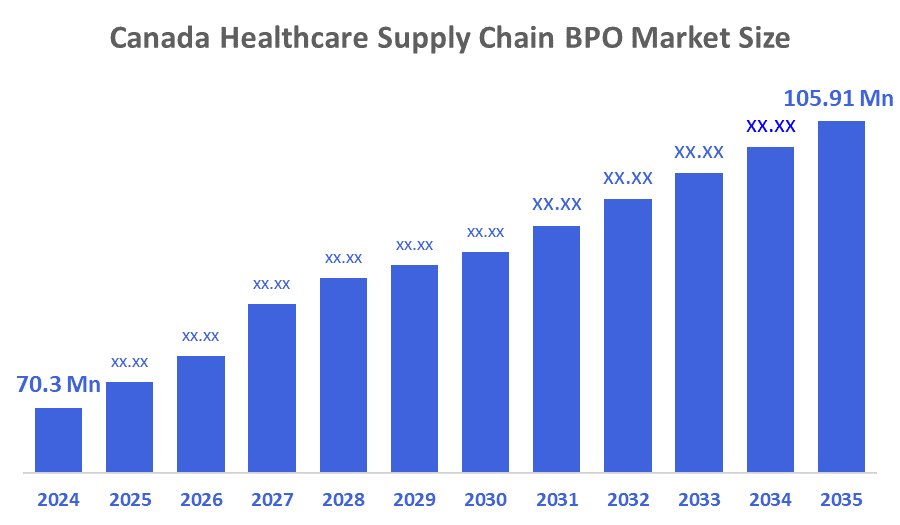

- The Canada Healthcare Supply Chain BPO Market Size Was Estimated at USD 70.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.8% from 2025 to 2035

- The Canada Healthcare Supply Chain BPO Market Size is Expected to Reach USD 105.91 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Canadian Healthcare Supply Chain BPO Market Size is anticipated to Reach USD 105.91 Million by 2035, Growing at a CAGR of 3.8% from 2025 to 2035. The market is driven by increased efforts by healthcare providers to lower costs and enhance the quality of the supply chain, along with the growing need for an effective inventory management system. The rise in chronic illness rates is increasing the need for medications, medical supplies, and healthcare services, which makes supply chain management more difficult.

Market Overview

A detailed analysis of the present and potential future state of this industry vertical is included in the healthcare supply chain BPO market research report. A wealth of data based on historical and current trends in several industry verticals is also included in the report to assist in identifying potential areas for growth.

A hospital's supply chain expenses usually account for 25–30% of its overall operating budget, which makes it a top target for cost-cutting measures. BPO providers can save procurement costs by 5–15% by using their specialized knowledge and technological platforms for better vendor negotiations, demand aggregation, and process standardization.

Frontline healthcare workers' participation in procurement decisions and automated and interoperable supply data enable data-driven and collaborative leadership while reducing the likelihood of future supply disruptions. Canada has strict privacy regulations, such as Ontario's Health Information Protection Act and PIPEDA. Canada's healthcare BPO industry is driven by technological innovation. AI and RPA are used by businesses to increase billing accuracy, expedite claims, and automate administrative duties.

By facilitating more precise, efficient, and economical processes, technological developments are propelling the healthcare supply chain BPO market's notable expansion. Advanced AI models will be incorporated by the market to improve demand forecasting and reduce stock discrepancies. It will give procurement teams up-to-date information for accurate order planning.

Report Coverage

This research report categorizes the market for the Canada healthcare supply chain BPO market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada healthcare supply chain BPO market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada healthcare supply chain BPO market.

Driving Factors

The healthcare supply chain BPO markets in Canada are driven by growing its business by contracting with outside companies to do its ancillary tasks to cut costs, transactions, and active processing. Growing pressure to lower healthcare delivery costs, the rise in cardiovascular disease, and the expansion of seasoned healthcare BPO service providers are the main drivers of the market's expansion. It is anticipated that the outsourcing services will offer a number of chances for the healthcare IT industry to capitalize on the growing demand for healthcare services. Furthermore, the primary drivers of market expansion are the growing number of people seeking insurance and the healthcare system's consolidation.

Restraining Factors

The healthcare supply chain BPO market in Canada is majorly restrained by data security, as businesses entrust sensitive data to outside sources, and there is a significant risk of data breaches. Considering that 60% of small businesses shut down within six months of a data breach, it is clear how serious security lapses may be. Reliance on external vendors may result in a loss of control over crucial operations, making it more difficult to maintain consistency and quality. Another problem is adhering to rules.

Market Segmentation

The Canadian healthcare supply chain BPO market share is categorised by payer service and end user.

- The order management segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian healthcare supply chain BPO market is segmented by payer service into sustainability services, order management, inventory management, transport management, and manufacturing management. Among these, the order management segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by an essential role in improving order precision, optimizing stock, and ensuring timely delivery. Healthcare firms are outsourcing order management responsibilities to address the growing demand for cost-effective and efficient solutions while streamlining operations. These procedures can be outsourced to lower errors, enhance patient care, and guarantee compliance with legal standards.

- The biotechnology and pharmaceutical companies segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the Canadian healthcare supply chain BPO market is segmented into biotechnology and pharmaceutical companies, medical device companies, and others. Among these, the biotechnology and pharmaceutical companies segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by the need for efficient distribution of sensitive products, complex supply chains, and regulatory restrictions. For the majority of their procurement, inventory, logistics, and compliance management, these businesses rely on outsourcing. This segment's place in the healthcare supply chain BPO market is being cemented by the growing demand for specialist supply chain solutions brought on by the growing demand for pharmaceutical and biotech products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada healthcare supply chain BPO market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tecsys Inc.

- Borderworx Logistics

- Martal Group

- SureCall Contact Centers

- FlairsTech

- Veta Virtual

- Agents Republic Inc.

- BitWide

- Koala Customer Care

- Virtual Gurus

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In September 2025, Tecsys announced that the Toronto Stock Exchange had approved the renewal of the company's normal course issuer bid (NCIB).

In June 2025, Tecsys announced the launch of TecsysIQ, a cloud- native intelligence layer that helps healthcare organizations unify fragmented data. TecsysIQ delivers a modern analytics foundation that accelerates the development of AI-enabled applications and data-driven decision-making that improve patient care and strengthen health system performance.

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada Healthcare supply chain BPO Market based on the below-mentioned segments:

Canada Healthcare Supply Chain BPO Market, By Payer Service

- Sustainability Services

- Order Management

- Inventory Management

- Transport Management

- Manufacturing Management

Canada Healthcare Supply Chain BPO Market, By End User

- Biotechnology and Pharmaceutical Companies

- Medical Device Companies

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 288 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |