Canada High Purity Base Metals Market

Canada High Purity Base Metals Market Size, Share, and COVID-19 Impact Analysis, By Product (Copper, Aluminium, Lead, Zinc), By End User (Building & Construction, Industrial Machinery & Equipment, Consumer Machinery & Equipment, Electrical & Electronics, Transportation, and Others), and Canada High Purity Base Metals Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada High Purity Base Metals Market Insights Forecasts to 2035

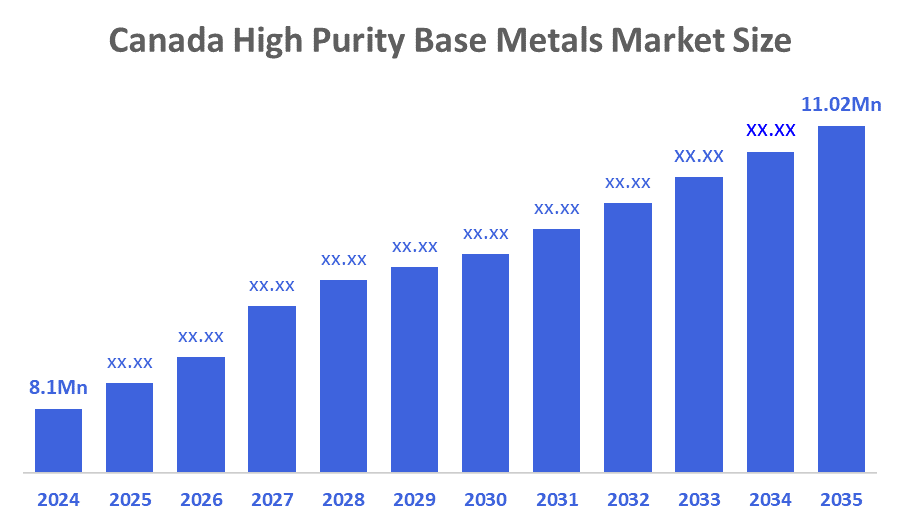

- The Canada High Purity Base Metals Market Size Was Estimated at USD 8.1 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 2.84% from 2025 to 2035

- The Canada High Purity Base Metals Market Size is Expected to Reach USD 11.02 Billion by 2035

According To a Research Report Published By Decisions Advisors & Consulting, The Canadian High Purity Base Metals Market Size Is Anticipated To Reach USD 11.02 Billion By 2035, Growing At a CAGR of 2.84% From 2025 to 2035. The market is driven by greater demand across a range of industries, including electronics, automotive, and aerospace, due to they are essential to the production of cutting-edge goods. Additionally, increasing funding for R&D projects to improve the caliber and attributes

Market Overview

Base metals, known as base metals, corrode, oxidize, or tarnish rather rapid when they come into contact with moisture or air. The market for high-purity base metals is expanding rapidly due to industry demands for materials with better performance, better conductivity, and increased chemical stability. Lead, copper, zinc, aluminium, and other base metals are purified by removing any impurities or other metals. In the electronics industry, high-purity aluminium is widely utilized in displays such as computers and televisions.

The proposed collaboration opens the door to the extraction of important orebodies rich in copper for our individual operations, which are otherwise lost to both businesses. The proposed 50/50 joint venture intends to access orebodies on each of our lands by utilizing Glencore's underutilized infrastructure.

Vale Base Metals and Glencore Canada announced in December 2025 that they had reached a deal to jointly assess a possible brownfield copper development project at their nearby Sudbury Basin sites. Vale Base Metals started running the second nickel processing furnace at the Onca Puma Mining Complex in southeastern Para, in September 2025. This greatly increased production capacity and better positioned the business for long-term growth and profitability.

The market for high-purity base metals is expected to grow steadily due to growing applications in high-tech sectors and encouraging developments in material sciences. The sector is well-positioned for robust future growth, with over 40% of R&D initiatives concentrating on improving purity levels and investigating new uses. The importance of these metals in next-generation technologies is highlighted by this trajectory.

Report Coverage

This research report categorizes the market for the Canada high-purity base metals market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada high-purity base metals market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada high-purity base metals market.

Driving Factors

The high-purity base metals market in Canada is driven by the as technology develops, the necessity for high-purity metals like copper and aluminium, in the production of semiconductors and electronic components, grows. To guarantee that metal used in a variety of uses fulfill exacting purity standards, governments and international organizations are enacting more stringent rules. Manufacturers are being forced by this regulatory environment to invest in high-purity base metal technology and improve their processes for manufacturing. As countries strive to transition to sustainable energy sources, there will likely be a greater demand for high-purity metals, particularly copper and silver.

Restraining Factors

The high-purity base metals market in Canada is majorly restrained by the strategic government actions, yet they face challenges, including high extraction costs and geopolitical risks. The necessity to build infrastructure is a drawback; the abundance of resources and technological progress are advantages.

Market Segmentation

The Canadian high-purity base metals market share is categorised by product and end user.

- The copper segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian high-purity base metals market is segmented by product into copper, aluminium, lead, zinc. Among these, the copper segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by due to its exceptional electrical conductivity and resistance to corrosion, making it a cornerstone in the electrical and electronics sectors. Its leading position is ensured by its stable demand and established supply systems.

- The electrical & electronics segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the Canadian high-purity base metals market is segmented into building & construction, industrial machinery & equipment, consumer machinery & equipment, electrical & electronics, transportation, and others. Among these, the electrical & electronics segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by the production of semiconductors, printed circuit boards, and connectors utilizes high-purity metals. This industry continues to grow due to the requirement for accurate and excellent electrical components.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada high-purity base metals market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ni-Met Metals Inc

- Purity Casting Alloys Ltd

- AP&C- a GE Additive

- Nord Precious Metals

- Emew Corporation

- The Metallic Group

- Globe Metal Recycling

- Fidelity PAC Metals Ltd

- Canada Nickel Company

- Alaska Energy Metals

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada High Purity Base Metals Market based on the below-mentioned segments:

Canada High Purity Base Metals Market, By Product

- Copper

- Aluminium

- Lead

- Zinc

Canada High Purity Base Metals Market, By End User

- Building & Construction

- Industrial Machinery & Equipment

- Consumer Machinery & Equipment

- Electrical & Electronics

- Transportation

- Others

FAQ’s

Q: What is the Canadian high purity base metals market size?

A: The Canada High Purity Base Metals Market size is expected to grow from USD 8.1 billion in 2024 to USD 11.02 billion by 2035, growing at a CAGR of 2.84% during the forecast period 2025-2035.

Q: What is a high purity base metals, and its primary use?

A: Base metals, known as base metals, corrode, oxidize, or tarnish rather quickly when they come into contact with moisture or air. The market for high-purity base metals is expanding rapidly due to industry demands for materials with better performance, better conductivity, and increased chemical stability. Lead, copper, zinc, aluminium, and other base metals are purified by removing any impurities or other metals.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the as technology develops, the necessity for high-purity metals like copper and aluminium, in the production of semiconductors and electronic components, grows. To guarantee that metal used in a variety of uses fulfill exacting purity standards, governments and international organizations are enacting more stringent rules.

Q: What factors restrain the Canadian high purity base metals market?

A: The Market is restrained by the strategic government actions, yet they face challenges including high extraction costs and geopolitical risks. The necessity to build infrastructure is a drawback; the abundance of resources and technological progress are advantages.

Q: How is the market segmented by product?

A: The market is segmented into copper, aluminium, lead, and zinc.

Q: Who are the key players in the Canadian high purity base metals market?

A: Key companies include Ni-Met Metals Inc., Purity Casting Alloys Ltd, AP&C- a GE Additive, Nord Precious Metals, Emew Corporation, The Metallic Group, Globe Metal Recycling, Fidelity PAC Metals Ltd, Canada Nickel Company, and Alaska Energy Metals.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |