Canada Hospital Furniture Market

Canada Hospital Furniture Market Size, Share, and COVID-19 Impact Analysis, By Product (Beds, Patient Lifts, Tables, Chairs, Stretchers, and Others), By Application (Physician Furniture, Patient Furniture, Staff Furniture), By Sales Channel (Offline, Online), By Material (Wood, Metal, and Plastic), and Canada Hospital Furniture Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Hospital Furniture Market Insights Forecasts to 2035

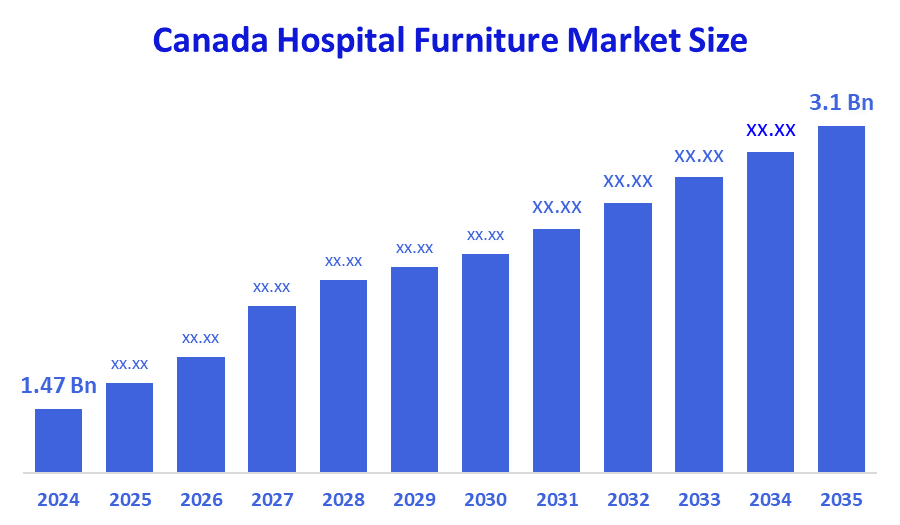

- The Canada Hospital Furniture Market Size Was Estimated at USD 1.47 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.02% from 2025 to 2035

- The Canada Hospital Furniture Market Size is Expected to Reach USD 3.1 Billion by 2035

According to a research report published by Decision Advisor & Consulting, the Canadian Hospital Furniture Market size is anticipated to reach USD 3.1 billion by 2035, growing at a CAGR of 7.02% from 2025 to 2035. The market is driven by technological developments in the hospital furniture sector, the ageing population, adherence to regulations, and the transformation of the healthcare delivery system. These factors have encouraged the industry to keep innovating, leading to a variety of specialised and patient-focused hospital furniture solutions made to satisfy the changing demands of patients and healthcare providers.

Market Overview

The term hospital furniture refers to a broad category of specialized furnishings and equipment intended for use in medical facilities, including clinics, hospitals, nursing homes, and medical centers. Growing need for sturdy, ergonomic, and contemporary healthcare furniture to improve staff productivity and patient comfort. Another important factor is the growing development of healthcare infrastructure, which is supported by both public and private initiatives. Technological innovations that impact market expansion include modular furniture and antibacterial surfaces.

Between October 2023 and September 2024, Canada imported 9,683 furniture shipments. These imports were delivered to 557 Canadian consumers by 529 foreign exporters, representing a 27% increase over the previous year. Between October 2023 and September 2024, the world shipped 9,683 pieces of furniture to Canada. These exports, which were made by 529 exporters to 557 Canadian buyers, represented a 27% increase over the previous year.

In November 2023, Arizona-based seating and case goods company Plural Studios was acquired by KITCHENER, Ontario-based Stance Healthcare, expanding its U.S. footprint.

Government financing for hospital building and renovation has led to a gradual growth in the Canadian hospital furniture market. In 2025, it is anticipated that incentives for long-term care and rehabilitation facilities will raise the market for reclining couches, stretchers, and adjustable beds. Significant development potential is presented by the rising demand for IoT-enabled and smart hospital furniture.

Report Coverage

This research report categorizes the market for the Canada hospital furniture market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada hospital furniture market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada hospital furniture market.

Driving Factors

The hospital furniture markets in Canada are driven by the infrastructure expansion of hospital buildings and upgrade works for healthcare amenities. quality and compliance are the priorities to improve the patients' outcomes, including lower interruptions and rising satisfaction. To enhance healthcare services in developing countries, government and private healthcare institutions are allocating large amounts of money. Due to the increase in healthcare services and the need for advanced hospital furniture such as patient beds, operating tables and examining tables importance is rising.

Restraining Factors

The hospital furniture market in Canada is majorly restrained by the expensive nature of specialized and cutting-edge hospital furniture; import taxes and shipping expenses drive up costs even more, limiting access to necessary hospital furniture. Many hospitals in low-income countries rely on homemade or reconditioned alternatives, which may not match international quality standards, supply chain interruptions, and limitations of essential supplies, resulting in manufacturing holdups and increased prices.

Market Segmentation

The Canadian hospital furniture market share is categorised by product, application, sales channel, and material.

- The beds segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian hospital furniture market is segmented by product into beds, patient lifts, tables, chairs, stretchers, and others. Among these, the beds segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by population ageing and a rise in the prevalence of long-term conditions. The rise of healthcare infrastructure and hospital admissions is also encouraging this market expansion. Furthermore, there is a rising demand for contemporary hospital beds with state-of-the-art medical instruments as medical expertise prioritize patients' comfort and safety.

- The patient furniture segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the Canadian hospital furniture market is segmented into physician furniture, patient furniture, and staff furniture. Among these, the patient furniture segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by growth in the prevalence of chronic illnesses, which leads to an increase in hospital admissions, long-term care patients, and the demand for specialist furnishings to meet their particular needs.

- The offline segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian hospital furniture market is segmented by sales channel into offline, online. Among these, the offline segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by enabling medical professionals to physically evaluate hospital furniture's operation and quality. Additionally, the particular character of hospital furniture procurement is catered to in the offline purchasing process through individualized consultations and direct meetings with sales professionals.

- The metal segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on material, the Canadian hospital furniture market is segmented into wood, metal, and plastic. Among these, the metal segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by due to the increasing demand for metal furniture due to its superior durability and comfort. Stainless steel also has antimicrobial qualities for use in operating rooms and medical equipment. Therefore, it is also anticipated that the widespread use of metal-based furniture equipment drive the growth of this market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada hospital furniture market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Krug

- Stryker

- Meditek

- Heritage Office

- Accent Environments

- Canada Care Medical

- Superior Home Health Care

- Afra Furniture

- Spec Furniture Inc

- HealthCentric

- Tri City Home Medical Equipment

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In March 2025, Exact Furniture announced Techni+Contact Canada Ltd. as its official distributor for the Pro AV/IT market in Canada. This partnership, effective March 2025, marks a new chapter in providing quality audio-visual furniture with expanded access for customers to source Exact’s products in Canada.

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the Canada Hospital Furniture Market based on the below-mentioned segments:

Canada Hospital Furniture Market, By Product

- Beds

- Patient Lifts

- Tables

- Chairs

- Stretchers

- Others

Canada Hospital Furniture Market, By Application

- Physician Furniture

- Patient Furniture

- Staff Furniture

Canada Hospital Furniture Market, By Sales Channel

- Offline

- Online

Canada Hospital Furniture Market, By Material

- Wood

- Metal

- Plastic

FAQ’s

Q: What is the Canadian hospital furniture market size?

A: The Canada Hospital Furniture Market size is expected to grow from USD 1.47 billion in 2024 to USD 3.1 billion by 2035, growing at a CAGR of 7.02% during the forecast period 2025-2035.

Q: What is hospital furniture, and its primary use?

A: The term hospital furniture refers to a broad category of specialized furnishings and equipment intended for use in medical facilities, including clinics, hospitals, nursing homes, and medical centers.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the infrastructure expansion of hospital buildings and upgrade works for healthcare amenities. quality and compliance are the priorities to improve the patients' outcomes, including lower interruptions and rising satisfaction. To enhance healthcare services in developing countries, government and private healthcare institutions are allocating large amounts of money.

Q: What factors restrain the Canadian hospital furniture market?

A: The Market is restrained by the expensive nature of specialized and cutting-edge hospital furniture; import taxes and shipping expenses drive up costs even more, limiting access to necessary hospital furniture. Many hospitals in low-income countries rely on homemade or reconditioned alternatives, which may not match international quality standards, supply chain interruptions, and limitations of essential supplies, resulting in manufacturing holdups and increased prices.

Q: How is the market segmented by product?

A: The market is segmented into beds, patient lifts, tables, chairs, stretchers, and others.

Q: Who are the key players in the Canadian hospital furniture market?

A: Key companies include Krug, Stryker, Meditek, Heritage Office, Accent Environments, Canada Care Medical, Superior Home Health Care, Afra Furniture, Spec Furniture Inc., HealthCentric, and Tri City Home Medical Equipment.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 175 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |