Canada Household Kitchen Appliances Market

Canada Household Kitchen Appliances Market Size, Share, and COVID-19 Impact Analysis, By Fuel Type (Cooking Gas, and Electricity), By Technology (Conventional, and Smart Appliances), By End Use (Commercial, and Residential), and Canada Household Kitchen Appliances Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Household Kitchen Appliances Market Size Insights Forecasts to 2035

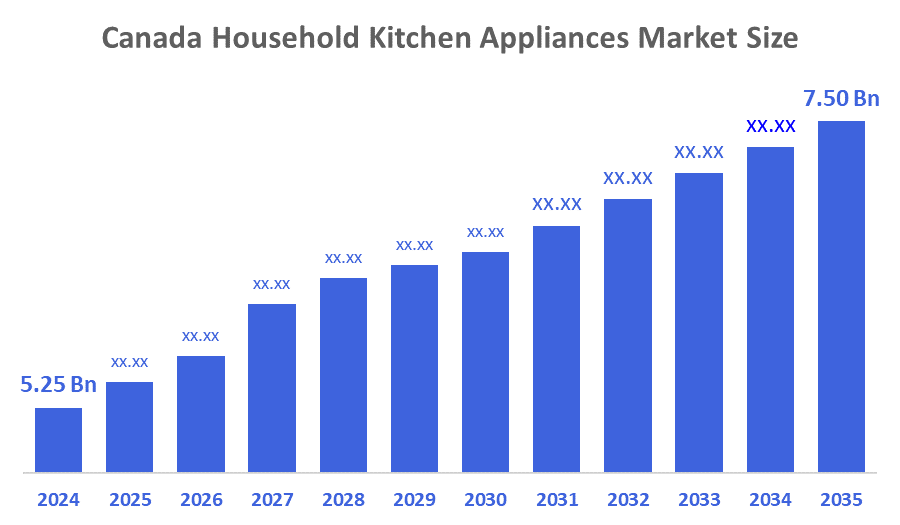

- The Canada Household Kitchen Appliances Market Size was estimated at USD 5.25 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.84% from 2025 to 2035

- The Canada Household Kitchen Appliances Market Size is Expected to Reach USD 5.25 Billion by 2035

According to a Research Report Published by Decisions Advisors and Consulting, The Canada Household Kitchen Appliances Market Size is anticipated to Reach USD 5.25 Billion by 2035, Growing at a CAGR of 3.84% from 2025 to 2035. The market is expanding rapidly due to factors like growing urbanisation, quick-service restaurant demand, the growing use of smart and energy-efficient technologies, changing consumer preferences for convenience, and ongoing innovation by major manufacturers. Customers' growing health consciousness, which includes washing and sanitising clothing, is driving up demand for cleaning supplies.

Market Overview

The manufacturing, distribution, and retail of large and small kitchen appliances used in Canadian homes are all covered in the Canadian household kitchen appliances market. It includes merchandise offered both online and offline, including coffee makers, blenders, microwaves, dishwashers, ovens, refrigerators, and other cooking and food preparation appliances. Large appliances like refrigerators, ovens, cooktops, microwaves, dishwashers, and fridges belong in this category, as are smaller kitchen appliances like mixers, food processors, toasters, coffee makers, and blenders. Electric appliances for kitchen air circulation, alongside related mechanical or electrical devices that make kitchen operations more convenient and effective, are also sold in this market.

The Ontario government introduced the Home Renovation Savings Program, which offers rebates of up to 30% for home energy upgrades. The province's Save on Energy programs offer financial incentives and rebates for installing energy-efficient appliances. This program, which aims to lower energy consumption and utility bills while promoting sustainable living, includes impending rebates for energy-efficient appliances like freezers and refrigerators.

Report Coverage

This research report categorises the market for the Canada household kitchen appliances market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada household kitchen appliances market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada household kitchen appliances market.

Driving Factors

The market for Canadian household Kitchen Appliances is primarily driven by the strong demographic shifts, changing consumer lifestyles, and technological innovation. Further, rapid adoption of smart and connected appliances (IoT and AI integration) is largely due to consumer demand, especially from younger, tech-savvy urbanites novel technology with features like remote control and energy-saving modes that improve efficiency and convenience, which boost the market growth. The growing demand for long-term cost savings is fueled by government incentives and growing environmental consciousness, which intensifies this drive for industry expansion. In addition, the number of new households in key cities is constantly growing due to immigration and urbanisation, which, when combined with rising disposable incomes and a persistent trend of kitchen renovations, creates strong purchasing power and steady demand.

In May 2022, Samsung announced that its personalisation strategy expanded significantly into the Canadian market with the release of the customizable Bespoke Kitchen Appliance lineup, which includes the new Bespoke French Door Refrigerator. For instance, the new Bespoke dishwasher, range, and over-the-range microwave, the new Bespoke French Door Refrigerator join the expanding Bespoke family of Samsung appliances in Canada. It comes in three-door, four-door, and four-door with Family HubTM configurations.

Restraining Factors

Despite potential long-term energy savings, the market is challenged by the comparatively high initial purchase cost of contemporary kitchen appliances, price fluctuations for raw materials like steel and plastics also raise manufacturing costs, ongoing supply chain disruptions and logistical limitations that put pressure on margins.

Market Segmentation

The Canada household kitchen appliances market share is classified into fuel type, technology and end use.

- The electricity segment held a significant share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Canada household kitchen appliances market is differentiated by fuel type into cooking gas and electricity. Among these, the electricity segment held a significant share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The electricity segment plays a crucial role in the growth direction of the Canadian household kitchen appliances market, which is driven by consumer preferences for efficiency, regulatory standards, and sustainable product innovations.

- The smart appliances segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The Canada household kitchen appliances market is divided by technology into conventional and smart appliances. Among these, the smart appliances segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This trend is reinforced by partnerships between electronics companies and residential developers to incorporate smart home systems and smart kitchens into new housing developments. Additionally, consumers can adopt smart appliances more easily thanks to increased accessibility through online platforms run by well-known brands. This increase can be linked to homeowners' growing desire to equip newly constructed or remodelled kitchens with appliances that use cutting-edge smart technologies.

- The residential segment held a substantial market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canada household kitchen appliances market is segmented by end use into commercial and residential. Among these, the residential segment held a substantial market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because modern appliances are becoming more popular in homes across the globe. Compact, energy-efficient, and multipurpose products have become more popular as a result of rising apartment and homeownership rates brought on by urbanization and the expansion of the middle class. Automated appliances that work with smart home automation systems and provide convenience and control are among the cutting-edge technologies that households use. Further, the impact of lifestyle modifications, like the inclination for home-cooked meals and the focus on sustainability and health.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Canada household kitchen appliances market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Coast Appliances

- SharkNinja Canada Co.

- Napoleon Home Comfort

- General Electric Canada

- Whirlpool Canada

- Electrolux Canada

- Samsung Electronics Canada

- LG Electronics Canada

- Panasonic Canada

- Danby Appliances

- Others

Recent Developments:

- In February 2024, BORA and Whirlpool Corporation announced a joint offer of their high-end cooktop extractor systems and induction downdraft technology in the US and Canada. Moreover, to introduce BORA's European innovation into North American kitchens, the partnership will concentrate on Whirlpool's luxury brands JennAir and KitchenAid. This collaboration aims to transform the competitive environment rather than merely introduce new products with the ongoing trend toward high-end, design-driven, and energy-efficient kitchens by fusing Whirlpool's market reach with BORA's.

- In May 2023, LG Electronics Canada announced its new “In the Zone” lineup of kitchen appliances, designed to elevate cooking performance and seamlessly integrate into Canadian homes. The newest model in LG's kitchen range lineup is the Induction Slide-in Range with Air Fry and Air Sous Vide. The induction cooktop in this multipurpose slide-in range, which comes in stainless steel and smudge-resistant black stainless steel, provides speed-heating, accuracy, and responsiveness for extremely quick water boils and simmering without scorching.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada household kitchen appliances market based on the below-mentioned segments:

Canada Household Kitchen Appliances Market, By Fuel Type

- Cooking Gas

- Electricity

Canada Household Kitchen Appliances Market, By Technology

- Conventional

- Smart Appliances

Canada Household Kitchen Appliances Market, By End Use

- Commercial

- Residential

FAQ

- What is the current market size of the Canadian Household Kitchen Appliances Market?

The market size was approximately USD 5.25 billion in 2024.

- What is the expected market size and growth by 2035?

The market is expected to reach in 2035 up to USD 7.50 billion with a compound annual growth rate (CAGR) of 3.8%.

- What are the main market segments by fuel type?

The market is segmented by fuel type into cooking gas and electricity, with the electricity segment holding a significant share in 2024 and expected to grow substantially due to consumer preference and regulatory emphasis on energy efficiency.

- What are the technology segments in this market?

The market divides into conventional and smart appliances, with smart appliances dominating in 2024 and expected to experience robust growth due to increasing adoption of IoT-enabled, energy-saving, and remote-controlled kitchen devices.

- How does the market segment by end use?

End-use segmentation includes commercial and residential sectors, with the residential segment holding a substantial share in 2024 and showing significant growth potential driven by urbanisation, home renovations, and lifestyle changes favouring smart home setups.

- What are the key growth drivers for the market?

Drivers include rapid urbanisation, rising disposable incomes, adoption of smart and energy-efficient appliances, government incentives for energy savings, and changing consumer lifestyles emphasising convenience, sustainability, and health consciousness.

- What restrains market growth?

Restraining factors are the high initial cost of modern appliances, raw material price volatility, supply chain and logistics challenges, and market competition between local and international brands.

- Who are the major players in this market?

Key companies include Coast Appliances, SharkNinja Canada Co., Napoleon Home Comfort, General Electric Canada, Whirlpool Canada, Electrolux Canada, Samsung Electronics Canada, LG Electronics Canada, Panasonic Canada, and Danby Appliances.

- Are there recent notable developments?

Strategic partnerships and product launches like Whirlpool with BORA for high-end cooktop extractors and LG’s “In the Zone” kitchen appliance lineup reflect ongoing innovation and competitive dynamics.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 197 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |