Canada Laboratory Filtration Market

Canada Laboratory Filtration Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Filtration Media, Membrane Filters, Filter Papers, and others), By Technique (Microfiltration, Nanofiltration, Vacuum Filtration, Ultrafiltration, and Reverse Osmosis), and Canada Laboratory Filtration Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Laboratory Filtration Market Insights Forecasts to 2035

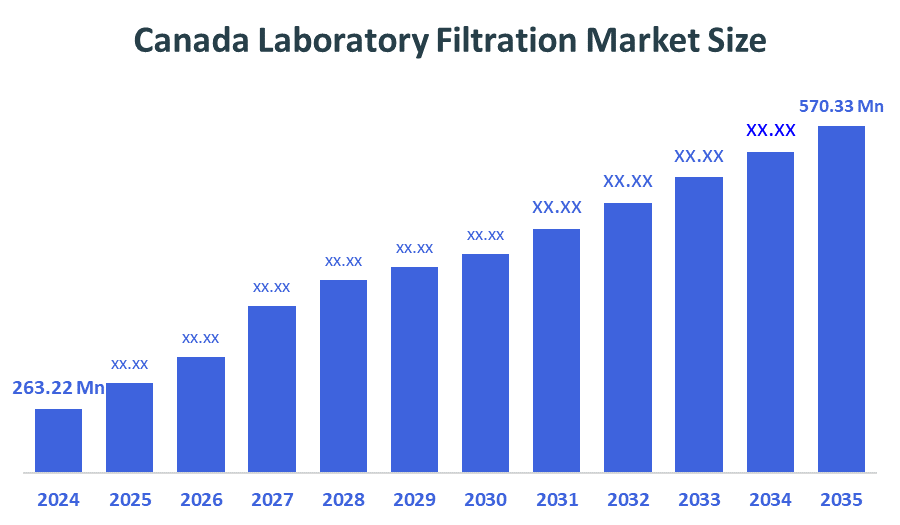

- The Canada Laboratory Filtration Market Size was estimated at USD 263.22 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.28% from 2025 to 2035

- The Canada Laboratory Filtration Market Size is Expected to Reach USD 570.33 Million by 2035

According to a research report published by Decision Advisors, the Canada Laboratory Filtration Market is anticipated to reach USD 570.33 million by 2035, growing at a CAGR of 7.28% from 2025 to 2035. The market expansion is driven by the rise in the production of biopharmaceuticals, stringent regulations, and the widespread use of cutting-edge filtration technologies in labs. Further, robust investments in life sciences research and the growing need for high-purity filtration solutions across industries are further factors contributing to the region's growing laboratory filtration market.

Market Overview

The market for laboratory filtration in Canada is a part of the scientific and industrial filtration business, which provides systems and products for laboratory-scale liquid and gas separation, purification, and clarification. Further, this technique is used to guarantee purity and sterility for drug discovery, development, and manufacturing, microbial analysis and removal, and water purification. A broad spectrum of filters, filter media (such as membranes, filter papers, and fibrous filters), filtration assemblies, and accessories are used in clinical laboratories, pharmaceutical manufacturing, biotechnology, quality control, research, diagnostics, and environmental testing. The primary factors driving the market expansion are the growing use of filtration technology in the food and beverage, biopharmaceutical, and pharmaceutical sectors, as well as the growing need for more effective filters. Filtration products include membrane filtration, air filtration, oil and gas filtration, bioburden reduction, and sterilised filtration. Pharmaceutical and biopharmaceutical companies are developing new technologies for large-scale filtration.

The investment of $2.8 billion for Laboratories is a strategy to construct contemporary, cooperative, and sustainable federal laboratory facilities.

Further, $63.2 million in contracts have been awarded to the Regulatory and Security Science (RSS) main project to build new lab facilities in Ottawa to support research in emergency preparedness, food safety, human, plant, and animal health, and border security. The main objective is to increase scientific capabilities and create jobs, and construct an environment

Report Coverage

This research report categorises the market for the Canada laboratory filtration market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada laboratory filtration market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada laboratory filtration market.

Driving Factors

The rapid growth of biopharmaceutical and cell-therapy manufacturing, which demands the use of sterile filtration technologies to ensure product purity and compliance with strict regulatory standards, is the dominant factor driving the laboratory filtration market in Canada. Furthermore, the need for precision filtration and microplate-based products is being driven by the genomics and proteomics workflows, which contributed to market expansion. The need for flexible, reasonably priced filtration assemblies is further increased by the expansion and outsourcing operations of Contract Development and Manufacturing Organisations (CDMOs) and Contract Research Organisations (CROs). The growth in the market is also supported by rising investments in biotechnology R&D and technological developments like nanofiltration platforms that allow for molecular-level separations.

More than 9,700 researchers and projects across Canada will benefit from more than $1.3 billion in federal funding announced in 2025. This includes infrastructure grants for research universities that bolster lab capacities and innovation programs that support advanced materials, biotechnology, and health research.

Restraining Factors

Despite substantial market growth, some factors hampered the revenue growth, such as, for businesses to thrive in this changing environment, a balanced growth environment requiring innovation, cost control, and regulatory cooperation is created by the obvious combination of financial, regulatory, technological, and sustainability challenges.

Market Segmentation

The Canada Laboratory Filtration market share is classified into product type and technique.

- The membrane filters segment held a significant share in 2024 and is anticipated to grow at a rapid pace over the forecast period.

The Canada laboratory filtration market is segmented by product type into filtration media, membrane filters, filter papers, and others. Among these, the membrane filters segment held a significant share in 2024 and is anticipated to grow at a rapid pace over the forecast period. Their wide range of applications in Canadian labs (protein purification, sterile filtration, and diagnostics) accounts for their dominance. Moreover, high demand from Quebec's and Ontario's biotech hubs. Besides, advanced diagnostics, biologics production, and biopharma R&D are the main drivers of growth. Further, the growing demand for high-value separations (enzymes, proteins, and viral vectors) is rising.

- The microfiltration segment held a substantial revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canada laboratory filtration market is divided by technique into microfiltration, nanofiltration, vacuum filtration, ultrafiltration, and reverse osmosis. Among these, the microfiltration segment held a substantial revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by its pore sizes, ranging from 0.1 to 10 micrometres are used in the flexible and popular microfiltration (MF) process to efficiently remove bacteria, particles, and suspended solids from fluids. It is crucial to the production of biopharmaceuticals to guarantee the sterility of medications, biologics, and vaccines, as well as to enable precise sample preparation for analytical techniques like spectroscopy and chromatography. It is used in water purification, food and beverage processing, and environmental testing, along with support of sterility regulations and the growing use of disposable filtration systems.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Canada laboratory filtration market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Filtration LAB

- Beckman Coulter Canada, LP

- Micronics Engineered Filtration

- ITR Laboratories Canada Inc.

- Hallmark Laboratories Inc.

- AMD Manufacturing Inc.

- Pall Corporation (Canada operations)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Canada laboratory filtration market based on the below-mentioned segments:

Canada Laboratory Filtration Market, By Product Type

- Filtration Media

- Membrane Filters

- Filter Papers

- Others

Canada Laboratory Filtration Market, By Technique

- Microfiltration

- Nanofiltration

- Vacuum Filtration

- Ultrafiltration

- Reverse Osmosis

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |