Canada Liquid Handling Technology Market

Canada Liquid Handling Technology Market Size, Share, and COVID-19 Impact Analysis, By Type (Manual, Semi-Automated, and Automated), By Product (Small Devices, Workstation, and Consumables), and Canada Liquid Handling Technology Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

Canada Liquid Handling Technology Market Insights Forecasts to 2035

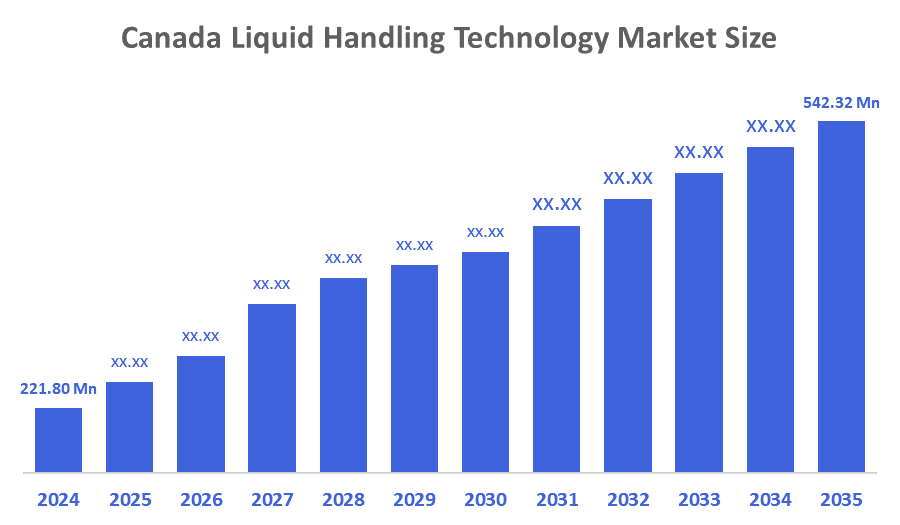

- The Canada Liquid Handling Technology Market Size was estimated at USD 221.80 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.47% from 2025 to 2035

- The Canada Liquid Handling Technology Market Size is Expected to Reach USD 542.32 Million by 2035

According to a research report published by Decision Advisior and Consulting, the Canada Liquid Handling Technology Market is anticipated to reach USD 542.32 million by 2035, growing at a CAGR of 8.47% from 2025 to 2035. The rising demand for laboratory automation, expansion in pharmaceutical and biotech R&D, and increased adoption of high-throughput screening for drug development and diagnostics are the primary drivers of the Canadian liquid handling technology market.

Market Overview

The Canadian liquid-handling technology market comprises instruments, systems, and automation solutions for precisely measuring, transporting, and dispensing liquids in laboratory and industrial settings. It refers to manual, semi-automatic, and fully automated technologies used in pharmaceutical, biotechnology, clinical diagnostics, and academic research. These systems support critical workflows in life sciences, drug development, genomics, and analytical testing by ensuring precision, repeatability, and high throughput while reducing human error and contamination. ? Pipettes, workstations, robotic arms, and protocol programming software, which is frequently combined with sensors, AI-driven controls, and laboratory information management systems (LIMS), are essential components.

The release of $134 million, including $30.8 million from the infrastructure operating fund, provides labs with modern instruments for biomanufacturing and sustainable materials, frequently combining liquid handling technology.

Report Coverage

This research report categorises the market for the Canada liquid handling technology market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada liquid handling technology market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada liquid handling technology market.

Driving Factors

The market development is driven by the high need for automated liquid handlers, pipettes, and dispensers. Further, these technologies are critical for efficient and accurate sample processing, which was necessary during the pandemic. The urgent demand for COVID-19 diagnoses, treatments, and vaccinations caused a significant rise in R&D initiatives. Additionally, these technologies were crucial in automating and optimising laboratory processes, which allowed scientists to process a lot of samples and carry out tests more effectively. The advancement of sophisticated liquid handlers plays a critical role in improving clinical research by cutting development costs and accelerating drug introduction. Besides, manufacturers have created innovative workstations that use various technologies to discharge droplets from the dispensing tool, addressing surface adhesion issues.

The $1.3 billion initiative boosts innovation in new technologies, enabling lab automation in academic and applied research settings.

Restraining Factors

Despite significant demand, the Canadian liquid handling technology market confronts important restrictions such as high equipment costs, technical complexity, and limited acceptance among smaller laboratories, slowing overall expansion.

Market Segmentation

The Canada liquid handling technology market share is classified into type and product.

- The semi-automated segment held a substantial revenue share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The Canada liquid handling technology market is divided by type into manual, semi-automated, and automated. Among these, the semi-automated segment held a substantial revenue share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. Semi-automated liquid handling systems are preferred over fully automated equivalents because they are less expensive. Furthermore, semi-automated liquid handling systems improve handling processes by significantly lowering the time and effort needed in repetitive jobs. This increased efficiency and throughput allow laboratories to handle higher sample numbers, boost productivity, and shorten research timeframes.

- The consumables segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Canada liquid handling technology market is segmented by product into small devices, workstations, and consumables. Among these, the consumables segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The high demand for sample inputs, as well as the frequent use of these items, leads to rising costs when laboratory professionals purchase consumables often. Furthermore, advances in research and development, the expansion of the biotechnology and pharmaceutical sectors, and the growing use of personalised medicine all contribute to increased consumable consumption.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada liquid handling technology market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CoolIT Systems

- Eppendorf Canada

- NCS Fluid Handling Systems

- Alfa Laval Canada

- Armstrong Fluid Technology

- Others

Recent Developments:

- In December 2025, BRANDTECH Scientific announced a strategic partnership with Copia Scientific to expand sales, service, and support for its Liquid Handling Station (LHS) across Canada. This collaboration enhances customer access to maintenance expertise and strengthens BRANDTECH’s reach in laboratory automation.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2035. Decision Advisior has segmented the Canada liquid handling technology market based on the below-mentioned segments:

Canada Liquid Handling Technology Market, By Type

- Manual

- Semi-automated

- Automated

Canada Liquid Handling Technology Market, By Product

- Small Devices

- Workstation

- Consumables

FAQ

- What is the projected market size and growth rate?

The Canadian liquid handling technology market was valued at USD 221.80 million in 2024 and is expected to reach USD 542.32 million by 2035, growing at a CAGR of 8.47% from 2025 to 2035.

- What are the main market drivers?

Rising demand for laboratory automation, expansion in pharmaceutical and biotech R&D, and adoption of high-throughput screening for drug development and diagnostics drive growth. Government initiatives like the $134 million CFI funding for lab instruments and $1.3 billion Budget 2025 innovation boost further support biomanufacturing workflows.

- What segments dominate the market?

By type, semi-automated systems held a substantial share in 2024 due to cost-effectiveness and efficiency in repetitive tasks, with a strong CAGR projected. By product, consumables dominate owing to frequent use in R&D, biotech expansion, and personalised medicine, followed by workstations and small devices.

- What are the key restraining factors?

High equipment costs, technical complexity, and limited adoption in smaller labs hinder broader expansion despite demand.

- Who are the major companies and recent developments?

Key players include Eppendorf Canada, BRANDTECH Scientific (via December 2025 partnership with Copia Scientific for Liquid Handling Station support), NCS Fluid Handling Systems, Alfa Laval Canada, and Armstrong Fluid Technology. Others like CoolIT Systems contribute to the competitive landscape through innovations and expansions.

- What applications does the technology serve?

It supports precise liquid dispensing in pharma, biotech, diagnostics, genomics, and academic research, integrating AI, LIMS, and robotic systems to minimise errors.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 202 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |