Canada Lithium-Ion Battery Market

Canada Lithium-Ion Battery Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Lithium Cobalt Oxide, Lithium Iron Phosphate, Lithium Nickel Manganese Cobalt, Lithium Manganese Oxide, Others), By Power Capacity (0-3000mAh, 3000mAh to 10000mAh, 10000mAh to 60000mAh, and More than 60000mAh), By Application (Consumer Electronics, Electric vehicles, Energy storage and Others), and Canada Lithium-Ion Battery Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Lithium-Ion Battery Market Insights Forecasts to 2035

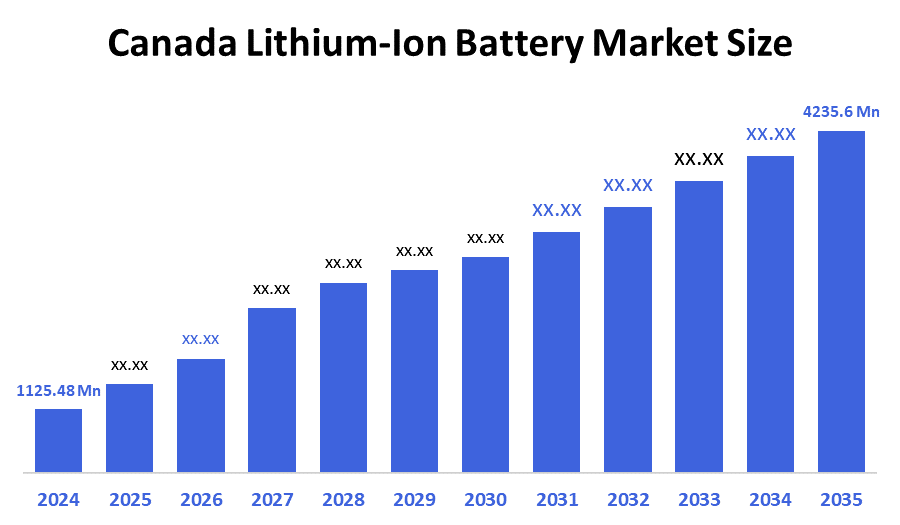

- The Canada Lithium-Ion Battery Market Size Was Estimated at USD 1125.48 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 12.8% from 2025 to 2035

- The Canada Lithium-Ion Battery Market Size is Expected to Reach USD 4235.6 Million by 2035

According to a research report published by Decision Advisior & Consulting, the Canadian Lithium-Ion Battery Market size is anticipated to reach USD 4235.6 Million by 2035, growing at a CAGR of 12.8% from 2025 to 2035. The market is driven by a number of factors, including government subsidies, the use of electric vehicles, energy storage requirements, and environmental restrictions. Increasing domestic battery production and mining investments.

Market Overview

A rechargeable battery that uses lithium ions to hold and discharge energy is called a lithium-ion battery. It is composed of an electrolyte, a separator, an anode, and a cathode. Since lithium-ion batteries are essential for preserving solar and wind energy, the industry is expanding due to increasing expenditures in green energy storage technologies.

Canada imported C USD109M and exported C USD19.8M worth of lithium-ion batteries in August 2025, leaving a USD89.5M negative trade deficit. Between July 2025 and August 2025, the exports of Lithium-Ion Batteries from Canada increased by C USD1.46M (7.95%), from C USD18.4M to C USD19.8M. During the same period, imports declined by C USD2.84M (-2.53%), from C USD112M to C USD109M.

In August 2025, Canada sold Lithium-Ion Batteries largely to the United States (C USD18.7M), Mexico(C USD785k), China (C USD80.2k), the Netherlands (C USD70k), and Uruguay (C USD59.6k). During the same month, Canada imported Lithium-Ion Batteries largely from China (C USD60.3M), the United States (C USD29M), South Korea (C USD3.33M), Malaysia (C USD3.3M), and Japan (C USD2.42M).

In Port Colborne, Ontario, Asahi Kasei Battery Separator Corporation began to develop a lithium-ion battery separator facility in November 2024. The facility is a joint venture with Honda and is slated to commence commercial production in 2027. It will produce 700 million square meters of coated separator yearly and create approximately 300 jobs in its initial phase. The coated separator eliminates short circuits in batteries, which is vital for electric cars.

Report Coverage

This research report categorizes the market for the Canada lithium-ion battery market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada lithium-ion battery market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada lithium-ion battery market.

Driving Factors

The lithium-ion battery market in Canada is driven by the over previous years five years, Canada’s battery manufacturing industry has witnessed a period of rapid growth driven by ongoing investment in fresh gigafactories, an increasing need from electric vehicle (EV) and energy storage sectors and targeted government subsidies at both federal and provincial levels. Top OEMs and battery businesses are reshaping locations like Ontario and Quebec, boosting supplier expansion and spiking regional job gains, albeit phased openings will stagger economic advantages. EV production, grid storage and device trends are supporting multi-year contracts and higher prices, allowing lithium-based products to outperform as automakers localize supply and consumers migrate to greener energy.

Restraining Factors

The lithium-ion battery market in Canada is majorly restrained by evidence that uncertified, poorly designed, or badly made batteries carry much increased risks of overheating, fire, and explosion due to a lack of suitable safety measures. It contains the product that causes a supply-demand mismatch, resulting in rising production costs and delays. The expanding need for lithium-ion batteries in several companies, including consumer electronics and automotive, exacerbates the disparity. Furthermore, the current separator technologies struggle to match the growing performance standards necessary for better stability and lifetime.

Market Segmentation

The Canadian lithium-ion battery market share is categorised by product type, power capacity, and application.

- The lithium iron phosphate segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian lithium-ion battery market is segmented by product type into lithium cobalt oxide, lithium iron phosphate, lithium nickel manganese cobalt, lithium manganese oxide, others. Among these, the lithium iron phosphate segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by due to their long cycle life, thermal stability, and environmental friendliness; lithium iron phosphate (LFP) batteries are widely used in Canada's renewable energy storage applications.

- The 10000mAh to 60000mAh segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on power capacity, the Canadian lithium-ion battery market is segmented 0-3000mAh, 3000mAh to 10000mAh, 10000mAh to 60000mAh, and more than 60000mAh. Among these, the 10000mAh to 60000mAh segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by electric automobiles and systems to store energy. This range is important due to supporting the transition to more environmentally friendly technology and supporting Canada's efforts to cut emissions of carbon.

- The electric vehicles segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian lithium-ion battery market is segmented by application into consumer electronics, electric vehicles, energy storage and others. Among these, the electric vehicles segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by the immediate electricity of automobiles for passengers, buses, and two-wheelers as governments and OEMs promote clean transportation. Storage of energy is growing into a growing business.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada lithium-ion battery market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Excell Battery Company

- Electrovaya

- Lynac Lithium Technology

- Engineered Power GP Ltd

- KPM Power Inc

- Grennlight Innovation

- Canbat Technologies Inc

- Lithium X

- Discover Energy System

- Electra Motor Co

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In October 2025, LG Energy Solution and Stellantis’ joint venture NextStar Energy plans to produce lithium-ion EV batteries to meet the rising global demand for electricity. NextStar aims to be Canada’s first large-scale lithium-ion battery production plant with its site in Ontario.

In June 2025, Electra Battery Materials Corporation and the Three Fires Group announced significant progress on the Aki Battery Recycling joint venture, the first Indigenous-led lithium-ion battery recycling initiative in Canada.

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Decision Advisior has segmented the Canada Lithium-Ion Battery Market based on the below-mentioned segments:

Canada Lithium-Ion Battery Market, By Product Type

- Lithium Cobalt Oxide

- Lithium Iron Phosphate

- Lithium Nickel Manganese Cobalt

- Lithium Manganese Oxide

- Others

Canada Lithium-Ion Battery Market, By Power Capacity

- 0-3000mAh

- 3000mAh to 10000mAH

- 10000mAh to 60000mAh

- More than 60000mAh

Canada Lithium-Ion Battery Market, By Application

- Consumer Electronics

- Electric vehicles

- Energy storage

- Others

FAQ’s

Q: What is the Canadian lithium-ion battery market size?

A: The Canada Lithium-Ion Battery Market size is expected to grow from USD 1125.48 million in 2024 to USD 4235.6 million by 2035, growing at a CAGR of 12.8% during the forecast period 2025-2035.

Q: What is a lithium-ion battery, and its primary use?

A: A rechargeable battery that uses lithium ions to hold and discharge energy is called a lithium-ion battery. It is composed of an electrolyte, a separator, an anode, and a cathode. Since lithium-ion batteries are essential for preserving solar and wind energy, the industry is expanding due to increasing expenditures in green energy storage technologies.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the over previous years five years, Canada’s battery manufacturing industry has witnessed a period of rapid growth driven by ongoing investment in fresh gigafactories, an increasing need from electric vehicle (EV) and energy storage sectors and targeted government subsidies at both federal and provincial levels.

Q: What factors restrain the Canadian lithium-ion battery market?

A: The Market is restrained by the evidence that uncertified, poorly designed, or badly made batteries carry much increased risks of overheating, fire, and explosion due to a lack of suitable safety measures. It contains the product that causes a supply-demand mismatch, resulting in rising production costs and delays.

Q: How is the market segmented by product type?

A: The market is segmented into lithium cobalt oxide, lithium iron phosphate, lithium nickel manganese cobalt, lithium manganese oxide, and others.

Q: Who are the key players in the Canadian lithium-ion battery market?

A: Key companies include Excell Battery Company, Electrovaya, Lynac Lithium Technology, Engineered Power GP Ltd, KPM Power Inc, Grennlight Innovation, Canbat Technologies Inc, Lithium X, Discover Energy System, and Electra Motor Co.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 212 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |