Canada Live Cell Imaging Market

Canada Live Cell Imaging Market Size, Share, and COVID-19 Impact Analysis, By Application (Cell Biology, Developmental Biology, Stem Cell and Drug Discovery, and Others), By Technology (Time-Lapse Microscopy, Fluorescence Recovery after Photobleaching (FRAP), Fluorescence Resonance Energy Transfer (FRET), High Content Screening (HCS), and Others), and Canada Live Cell Imaging Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

Canada Live Cell Imaging Market Insights Forecasts to 2035

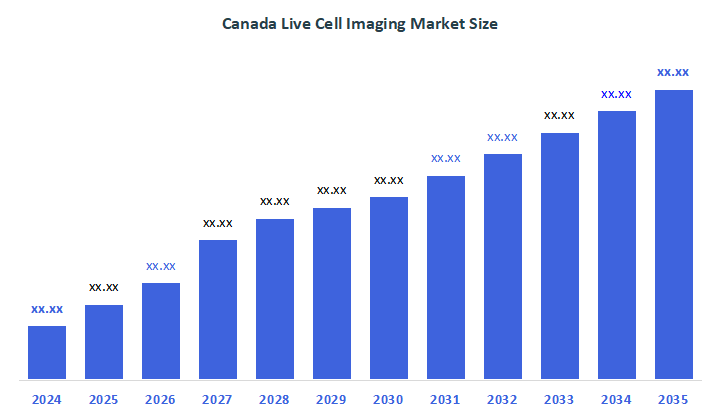

- The Market Size is Expected to Grow at a CAGR of around 6.50% from 2025 to 2035

- The Canada Live Cell Imaging Market Size is Expected to Reach at a significant share by 2035

According to a research report published by Decisions Advisors, the Canada Live Cell Imaging Market is expected to grow at a CAGR of 6.50% during the forecast period 2025-2035. The market for live cell imaging is expanding because it gives researchers a dynamic perspective on cellular processes as they naturally occur by enabling them to monitor and record the behaviour of living cells over time. The presence of major biotech key players and substantial R&D investment influences the market growth.

Market Overview

The subsector of the healthcare industry of Canada which devoted to the creation, production, and use of tools and technologies that allow for the real-time visualisation and analysis of living cells is referred to as the live cell imaging market. These imaging systems provide vital insights into cell biology, drug discovery, cancer research, immunology, and other life science domains by enabling researchers to examine cellular dynamics, interactions, and processes without destroying or repairing cells. Microscopes with fluorescence, confocal, phase contrast, or bright-field imaging capabilities and software for image acquisition, processing, and analysis are commonly used in live cell imaging. The adoption of live cell imaging technology and research capacity will be greatly accelerated by Canadian government incentives in 2025 that concentrate on health system modernisation, targeted grants for advanced imaging technologies, and investments in AI infrastructure.

Over a billion was set to support innovation and emerging technologies, including investments in AI infrastructure that is essential for advancements in imaging and life sciences, from the 2025 federal budget. For example, the Canada Foundation for Innovation (CFI) awarded $1.13 million to six researchers at the University of Victoria to purchase cutting-edge live cell imaging equipment.

Report Coverage

This research report categorises the market for the Canada live cell imaging market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada live cell imaging market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada live cell imaging market.

Driving Factors

The market growth is driven by the result of robust R&D efforts and cutting-edge technology infrastructure. The market is expanding due to several factors, including rising investments in cell-based research, technological developments in imaging systems, growing demand for drug discovery, growing demand for personalised medicine, increased government funding for life sciences, and automation of laboratory workflows. The fastest growing is because of growing initiatives, an ageing population, the need for better disease modelling, and rising live cell imaging demand. The market is expanding as a result of AI integration in live cell imaging. AI-driven technology enhances pathology imaging by quickly and precisely analysing vast amounts of data, spotting minute patterns and irregularities that human eyes miss.

In August 2024, QImaging launched a new all-in-one live cell imaging solution that combines EMCCD and sCMOS camera technologies to meet demanding fluorescence imaging requirements. Both faint fluorescence signals and rapid cellular events strengthen its role in advanced biomedical imaging.

Restraining Factors

The key variables limiting Canada's live cell imaging market are costly expenses, technical knowledge requirements, limited funding, legislative delays, and rivalry among competitors.

Market Segmentation

The Canada live cell imaging market share is classified into application and technology.

- The stem cell segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canada live cell imaging market is segmented by application into cell biology, developmental biology, stem cell and drug discovery, and others. Among these, the stem cell segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. To track the mechanisms of drug action and toxicity, scientists must be able to track stem cell differentiation, proliferation, and interaction with different substances. Investments in this field are also being driven by the increase in chronic illnesses and the demand for personalised medicine, since live cell imaging offers information that may result in more specialised treatments.

- The high content screening (HCS) segment dominated the market in 2024 and is expected to grow at a significant CAGR over the forecast period.

The Canada live cell imaging market is divided by technology into time-lapse microscopy, fluorescence recovery after photobleaching (FRAP), fluorescence resonance energy transfer (FRET), high content screening (HCS), and others. Among these, the high content screening (HCS) segment dominated the market in 2024 and is expected to grow at a significant CAGR over the forecast period. Increased use of automated platforms boosts HCS's scalability and efficiency, which improves its capacity for high-throughput screening and helps the HCS market expand. Advances in microscopy and the creation of new image analysis software have increased the flexibility and potency of HCS. Additionally, the creation of multi-parameter, high-content screening platforms,

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada live cell imaging market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Quorum Technologies Inc.

- Nanolive

- University of Calgary Live Cell Imaging Laboratory (LCI)

- Lunenfeld-Tanenbaum Research Institute (Nikon Centre of Excellence)

- Sartorius Canada

- Etaluma Inc.

- Others

Recent Developments:

- In August 2025, UBC Okanagan scientists developed a first-of-its-kind imaging technology that allows researchers to visualise and measure molecular forces inside living cells with unprecedented precision. This breakthrough could accelerate discoveries in cancer research, immunology, and tissue regeneration.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada live cell imaging market based on the below-mentioned segments:

Canada Live Cell Imaging Market, By Application

- Cell Biology

- Developmental Biology

- Stem Cell and Drug Discovery

- Others

Canada Live Cell Imaging Market, By Technology

- Time-Lapse Microscopy

- Fluorescence Recovery after Photobleaching (FRAP)

- Fluorescence Resonance Energy Transfer (FRET)

- High Content Screening (HCS)

- Others

FAQ

Q: What is the growth forecast for the Canadian live cell imaging market?

A: The market is expected to grow at a CAGR of approximately 6.50% during 2025-2035, reflecting strong expansion in adoption and revenue.?

Q: What applications drive the demand for live cell imaging in Canada?

A: Key application segments include cell biology, developmental biology, stem cell and drug discovery. The stem cell segment held a significant market share in 2024 and is projected to grow substantially, driven by the need for disease modelling, personalised medicine, and drug action research.?

Q: Which live cell imaging technologies are most prominent?

A: Technologies include time-lapse microscopy, fluorescence recovery after photobleaching (FRAP), fluorescence resonance energy transfer (FRET), and high content screening (HCS). HCS dominated the market in 2024 and is expected to continue rapid growth due to its scalability and ability to perform high-throughput screening with multi-parameter analysis.?

Q: What are the key growth drivers?

A: Market growth is fueled by robust R&D investments, advances in imaging technologies, rising demand for drug discovery, personalised medicine, and government funding supporting health system modernisation and AI infrastructure for life sciences. Integration of AI accelerates data analysis and improves cellular imaging precision.?

Q: What restrains the market growth?

A: Challenges include high costs, the need for specialised expertise, limited funding in some sectors, regulatory delays, and competitive market pressures.?

Q: Who are the major players in Canada’s live cell imaging market?

A: Key companies include Quorum Technologies Inc., Nanolive, University of Calgary Live Cell Imaging Laboratory, Lunenfeld-Tanenbaum Research Institute (Nikon Centre of Excellence), Sartorius Canada, and Etaluma Inc.?

Q: Any recent significant developments?

A: In August 2025, UBC Okanagan scientists developed a novel imaging technology to measure molecular forces inside living cells with high precision, facilitating advances in cancer research, immunology, and tissue regeneration.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 230 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |