Canada Lubricants Market

Canada Lubricants Market Size, Share, and COVID-19 Impact Analysis,†By Product Type (Automotive Engine Oil, Passenger Car Motor Oil, Heavy Duty Engine Oil, Motorcycle Oil, Industrial Engine Oil, Transmission and Gear Oils, and Others), By End User (Automotive, Marine, Aerospace, Heavy Equipment, and Others), and Canada Lubricants Market Insights Forecasts to 2035

Report Overview

Table of Contents

Canada Lubricants Market Size Insights Forecasts to 2035

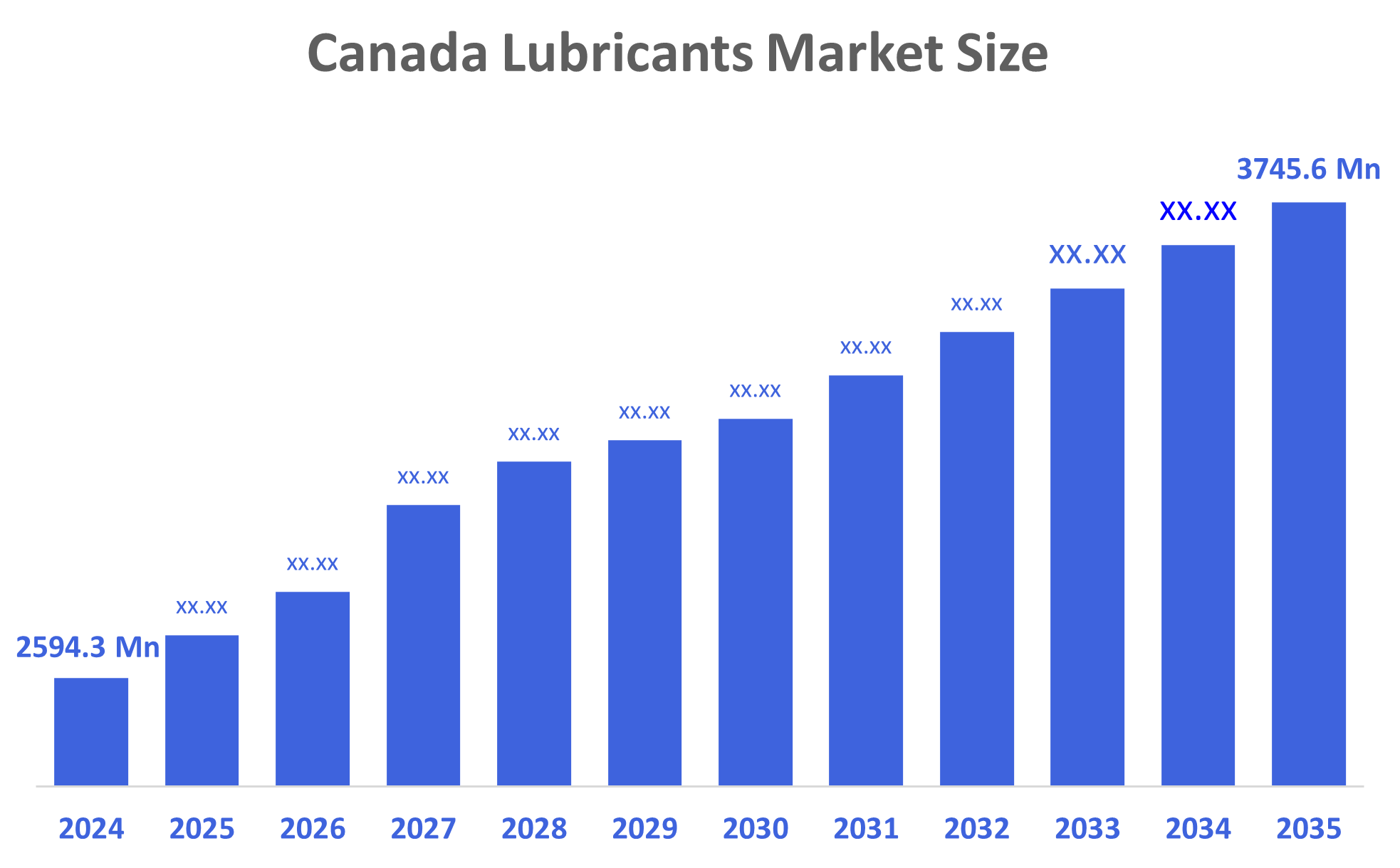

- The Canada Lubricants Market Size Was Estimated at USD 2594.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.4% from 2025 to 2035

- The Canada Lubricants Market Size is Expected to Reach USD 3745.6 Million by 2035

According to a research report published by Decisions Advisors, The Canadian Lubricants Market Size is Anticipated to Reach USD 3745.6 Million by 2035, Growing at a CAGR of 3.4% from 2025 to 2035. The market is driven by characterised by rising industrial activity is driving up demand for high-performance lubricants, which are intended to improve machinery functionality and decrease downtime.

Market Overview

Lubricants are substances used between components that move to enhance engine and equipment performance by lowering wear, friction, and heat production. By reducing friction and heat among moving parts, lubricants are crucial for reducing wear and halting corrosion. The automotive sector, the need for transportation, and growth in manufacturing are some of the causes driving Canada's continually growing lubricant market.

The 2024 asset acquisition by Canadian natural resources alone raised the demand for lubricants by 122,500 boe/d of extraction capacity, requiring calcium-sulfonate greases and compressor oils based on Group II in the Fort McMurray pits. The GDP of Canada increased by almost 2% every quarter throughout the first half of 2024. According to Statistics Canada, there were 483287 new motor vehicle registrations nationwide in the third quarter of 2024. Despite a 5.5% slowing from the second quarter of 2024, this is a 5.7% year-over-year growth.

Sixty percent of Canada's lubricant market is dominated by ExxonMobil, Shell, and Petro-Canada. Additionally, Castrol, Fuchs, TotalEnergies, and other corporations have a sizable market share.

Engine oil is utilized in high-temperature and high-pressure applications; its large volume requirements and short drain interval make it the most popular product type. The aerospace and defence industries have a great need for high-performance lubricants that can withstand high temperatures, high pressures, and challenging operating circumstances.

Report Coverage

This research report categorizes the market for the Canada lubricants market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada lubricants market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada lubricants market.

Driving Factors

The lubricants market in Canada is driven by new automobile registrations are predicted to rise in 2024, and after-sales networks are growing to meet the need for repair. approximately the course of three years, the manufacturing sector, which accounts for approximately CAD 174 billion of the GDP, hopes to boost productivity by 2.5% to 9.9%. With effect from March 31, 2025, the ILSAC GF-7 specification requires reduced volatility and enhanced low-speed pre-ignition safety, hence directing consumers toward synthetics. After the upgrader debottlenecking, Canadian Natural Resources plans to increase oil-sands output to 600,000 barrels per day in 2024, due to capital budgets of CAD 30 billion. growth in mining and oil-sands activities.

Restraining Factors

The lubricants market in Canada is restrained by the particularly in business and maritime applications, standard lubricants significantly reduce pollution and disposal issues. Water and soil can become contaminated by lubricant spills and inappropriate disposal. As a result, the cost of producing lubricant is impacted by changes in the price of crude oil. Strict adherence is necessary for preserving market access and safety, with different criteria for different uses and regions.

Market Segmentation

The Canadian lubricants market share is categorised into product type and end user.

- The automotive engine oil segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian lubricants market is segmented by product type into automotive engine oil, passenger car motor oil, heavy-duty engine oil, motorcycle oil, industrial engine oil, transmission and gear oils, and others. Among these, the automotive engine oil segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by automotive engine oils retained 39.38% of Canada's lubricants market share in 2024, underscoring the segment’s historic weight even as electrification advances. Move to synthetic lubricants, such as synthetic lubricants and synthetic esters, due to their better performance at high temperatures and high pressures.

- The automotive segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the Canadian lubricants market is segmented into automotive, marine, aerospace, heavy equipment, and others. Among these, the automotive segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by the automotive is the largest segment with a revenue share of 56.2% in 2024. In sectors like manufacturing, minerals extraction, development, power generation, and agriculture, they are actively engaged in heavy machinery-intensive operations. Lubricating and replenishing the oil in engines, differentials, axles, and other components is part of routine car maintenance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada lubricants market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lubrigard Ltd

- Petro-Canada Lubricants

- Lubricon Industries Canada

- Lubecore International

- Imperial Oil

- Lubracation Engineers of Canada

- LubeCorp Manufacturing Inc.

- Applied Lubrication Technology Inc

- Petro Lubes Inc.

- Prism Flow Products Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2025, Petro-Canada Lubricants, a brand under HF Sinclair, introduced its next-generation SUPREME product line in response to the new ILSAC GF-7 and APL SQ performance standards for passenger car motor oils.

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada Lubricants Market based on the below-mentioned segments:

Canada Lubricants Market, By Product Type

- Automotive Engine Oil

- Passenger Car Motor Oil

- Heavy Duty Engine Oil

- Motorcycle Oil

- Industrial Engine Oil

- Transmission and Gear Oils

- Others

Canada Lubricants Market, By End User

- Automotive

- Marine

- Aerospace

- Heavy Equipment

- Others

FAQ’s

Q: What is the Canadian lubricants market size?

A: The Canada Lubricants Market size is expected to grow from USD 2594.3 million in 2024 to USD 3745.6 million by 2035, growing at a CAGR of 3.4% during the forecast period 2025-2035.

Q: What is a lubricant, and its primary use?

A: Lubricants are substances used between components that move to enhance engine and equipment performance by lowering wear, friction, and heat production. By reducing friction and heat among moving parts, lubricants are crucial for reducing wear and halting corrosion.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the new automobile registrations are predicted to rise in 2024, and after-sales networks are growing to meet the need for repair. approximately the course of three years, the manufacturing sector, which accounts for approximately CAD 174 billion of the GDP, hopes to boost productivity by 2.5% to 9.9%.

Q: What factors restrain the Canadian lubricants market?

A: The market is restrained by the particularly in business and maritime applications, standard lubricants significantly reduce pollution and disposal issues. Water and soil can become contaminated by lubricant spills and inappropriate disposal. As a result, the cost of producing lubricant is impacted by changes in the price of crude oil.

Q: How is the market segmented by product type?

A: The market is segmented into automotive engine oil, passenger car motor oil, heavy-duty engine oil, motorcycle oil, industrial engine oil, transmission and gear oils, and others

Q: Who are the key players in the Canadian lubricants market?

A: Key companies include Lubrigard Ltd, Petro-Canada Lubricants, Lubricon Industries Canada, Lubecore International, Imperial Oil, Lubracation Engineers of Canada, LubeCorp Manufacturing Inc., Applied Lubrication Technology Inc., Petro Lubes Inc., and Prism Flow Products Inc.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 195 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |