Canada Mammography Workstation Market

Canada Mammography Workstation Market Size, Share, and COVID-19 Impact Analysis, By Modality Type (Multimodal, and Standalone), By Application (Diagnosis Screening, Advance Imaging, Clinical Review, and Hair Samples),†and Canada Mammography Workstation Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

Canada Mammography Workstation Market Insights Forecasts to 2035

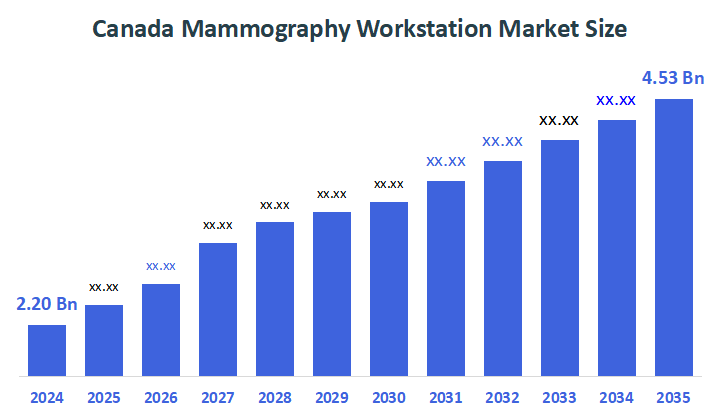

- The Canada Mammography Workstation Market Size was estimated at USD 2.20 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.79% from 2025 to 2035

- The Canada Mammography Workstation Market Size is Expected to Reach USD 4.53 Billion by 2035

According to a research report published by Decisons Advisors, the Canada Mammography Workstation Market is anticipated to reach USD 4.53 billion by 2035, growing at a CAGR of 6.79% from 2025 to 2035. Growing awareness of the value of early detection is one of the main causes of this growth, which has led to a rise in the use of cutting-edge diagnostic technologies. The growing prevalence of breast cancer is one of the main factors driving the market expansion for mammography workstations.

Market Overview

The market for mammography workstations in Canada is the business of medical imaging technology devoted to specialised computer systems and software that facilitate advanced mammography imaging for breast cancer screening, diagnosis, and clinical review. Mammography is a kind of specialised system used for breast imaging. Cancer can be detected with low-dose X-ray imaging before the patient experiences any symptoms. It is widely recognised as a type of non-invasive medical test that physicians regularly use to identify and treat medical conditions. A mammography workstation allows doctors to view, manipulate, assess, and store images from a variety of common radiography modalities, including breast ultrasound, MR, and CR mammography. Women's awareness and the high rate of female employment in developed economies lead to a higher rate of system penetration, which greatly boosts market growth.

A $250,000 CAD research grant competition for precision oncology, including targeted diagnostics like mammography screening technologies, has been announced by the Breast Cancer Canada association. This innovation in breast cancer detection and individualised care with substantial investment.

In 2024, the Canadian government set aside $500,000 to accelerate the revision of breast cancer screening guidelines, with an emphasis on increasing screening access and accuracy. This encourages the use of cutting-edge imaging workstations and artificial intelligence tools in mammography.

Report Coverage

This research report categorises the market for the Canada mammography workstation market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada mammography workstation market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada mammography workstation market.

Driving Factors

The growing incidence of breast cancer and increased knowledge of early detection and screening initiatives are driving the Canadian mammography workstation market. Moreover, digital mammography, 3D tomosynthesis, and AI-powered computer-aided detection (CAD) tools are examples of sophisticated technological developments which is driving market expansion. Further, primary focus on the use of advanced mammography workstations in hospitals and diagnostic facilities is propelled by rising investments in healthcare infrastructure, government-sponsored screening programs, and a move toward patient-centric diagnostics. The market is expanding due in part to the rising need for integrated, portable, and user-friendly imaging solutions.

Alberta committed $5.5 million in 2025 to cancer screening programs, including improved mammography technology to support better patient care and quicker diagnoses. Further, increased financing for imaging services is part of Ontario's 2025 health budget, which will further facilitate access to cutting-edge mammography equipment in clinics and hospitals.

Restraining Factors

The market for mammography workstations in Canada is hampered mainly by high expenses for equipment, regulatory hurdles, an acute lack of qualified workers, and concerns about the confidentiality of information and compatibility with current hospital IT systems.

Market Segmentation

The Canada mammography workstation market share is classified into modality type and application.

- The multimodal segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The Canada mammography workstation market is divided by modality type into multimodal, and standalone. Among these, the multimodal segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. It has benefits like improved radiological performance and better patient care. Furthermore, these workstations facilitate the integration of images from various modalities, such as 2D, 3D, and tomosynthesis, which enables clinicians to effectively compare and analyse a variety of imaging data. Additionally, new sophisticated features like flexible reading protocols and high-resolution displays increase their uptake.

- The advance imaging segment held a significant share in 2024 and is projected to grow at a rapid pace over the forecast period.

The Canada mammography workstation market is segmented by application into diagnosis screening, advance imaging, clinical review, and hair samples. Among these, the advance imaging segment held a significant share in 2024 and is projected to grow at a rapid pace over the forecast period. This segment is driven by the widespread use of sophisticated imaging technologies and the regular introduction of new products that provide improved visualisation and interpretation capabilities. Additionally, novel imaging workstations facilitate modalities like 3D mammography and contrast-enhanced imaging, which help radiologists more successfully identify subtle lesions and complicated cases.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Canada mammography workstation market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hologic

- GE Healthcare

- Siemens Healthineers

- FUJIFILM

- Canon Medical Systems

- Carestream Health

- Others

Recent Developments:

- In October 2024, Southlake Regional Health Centre added three state-of-the-art mammography machines to expand breast cancer screening capacity. This upgrade allows Southlake to screen 1,500 more women annually, with over 11,700 already screened in 2024, and includes advanced biopsy capabilities to improve diagnostics. Additionally, two of the new devices have biopsy capabilities, which shorten the time required to finish a mammogram and enhance detection and diagnostic capabilities.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2035. Decisons Advisors has segmented the Canada mammography workstation market based on the below-mentioned segments:

Canada Mammography Workstation Market, By Modality Type

- Multimodal

- Standalone

Canada Mammography Workstation Market, By Application

- Diagnosis Screening

- Advance Imaging

- Clinical Review

- Hair Samples

FAQ

Q: What defines mammography workstations?

A: Mammography workstations are specialised medical imaging systems that allow clinicians to view, assess, and manipulate breast imaging data from various modalities, such as 2D, 3D, and tomosynthesis, to support early breast cancer detection and diagnosis.

Q: What are the main market segments?

A: The market is segmented by modality type (multimodal and standalone) and application (diagnosis screening, advanced imaging, clinical review, hair samples). Multimodal workstations dominate due to better radiological performance and patient care benefits.

Q: What drives market growth?

A: Growth is spurred by increasing awareness of early detection, government screening programs, technological advancements, including AI-powered CAD tools, and healthcare infrastructure investments supporting breast cancer diagnostics.

Q: What are the challenges?

A: High equipment costs, regulatory hurdles, shortage of trained professionals, data privacy concerns, and issues with integration into hospital IT systems restrain market growth.

Q: What are recent government investments?

A: Alberta committed $5.5 million in 2025 toward cancer screening programs with mammography upgrades. Ontario’s health budget also increased funding for imaging services to improve access to advanced equipment.

Q: Who are the key companies?

A: Major companies in this market include Hologic, GE Healthcare, Siemens Healthineers, FUJIFILM, Canon Medical Systems, and Carestream Health.

Q: What are recent notable developments?

A: Southlake Regional Health Centre added advanced mammography machines in 2024 to increase screening capacity, featuring biopsy capabilities that enhance diagnostic accuracy and reduce procedure time.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 230 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |