Canada Meat Extract Market

Canada Meat Extract Market Size, Share, and COVID-19 Impact Analysis, By Type (Chicken, Pork, Beef, Fish, Turkey, and Others), By Form (Powder, Liquid, Granule, and Paste), and Canada Meat Extract Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Meat Extract Market Size Insights Forecasts to 2035

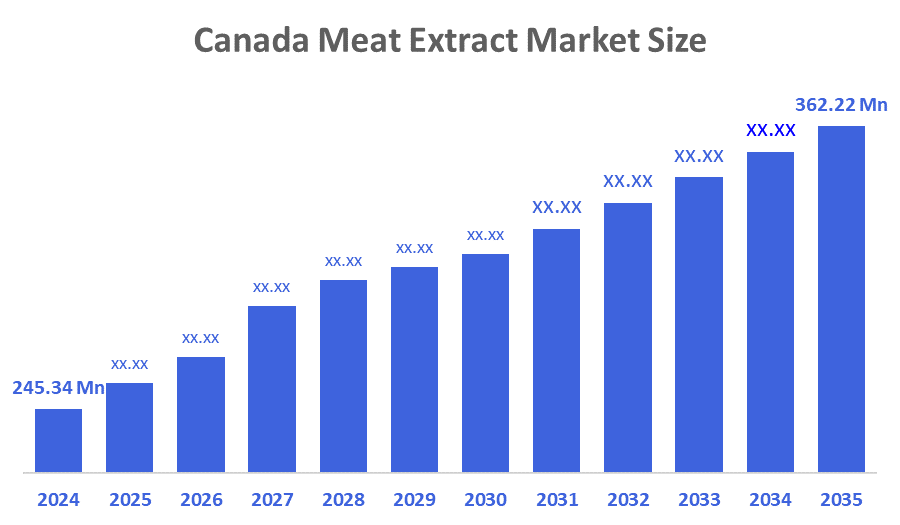

- The Canada Meat Extract Market Size was estimated at USD 245.34 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.61% from 2025 to 2035

- The Canada Meat Extract Market Size is Expected to Reach USD 362.22 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Canada Meat Extract Market Size is anticipated to Reach USD 362.22 Million by 2035, Growing at a CAGR of 3.61% from 2025 to 2035. The market growth is driven by shifting dietary trends, advancements, and R&D projects undertaken by large food companies. With an emphasis on innovation, investment, and regulatory adaptation, these launches and policy changes are influencing the market for meat extract in Canada.

Market Overview

The Canadian business for concentrated meat derivatives used as flavouring bases, nutritional supplements, and additives in soups, sauces, bouillons, prepared meals, and occasionally pharmaceuticals. It focuses on extracts from beef, pork, or poultry for industrial and culinary uses, which sets it apart from meat snacks or meat processing. Meat extracts tend to be used to add meaty flavours to an array of packaged and processed foods. Their companies often appear in sauces, soups, meat-based dishes, savoury snacks, coatings, and seasonings. It comes from concentrated meat stock. The increasing need for prepackaged and meal kits is being driven by the changing nutritional habits brought about by contemporary busy lifestyles, which have contributed to the industry's expansion.

Further, changing consumer preferences, innovations include concentrated, natural, and low-sodium formulations. Also, to maintain consumer accessibility and flavour integrity, major companies are investing in sophisticated extraction methods, clean processing, and durable packaging. The strategic initiatives are working with food manufacturers to create functional and ready-to-use culinary solutions.

Valuation of US$4,859.8 million in 2023, Canada was the largest, accounting for 34.7% of the global market share, to the US. In 2023, Canada exported 847.8 thousand tonnes of goods, equivalent to 38.8% of the world's total exports (2.2 million tonnes), making it the largest exporter.

Fresh or chilled bovine accounted for US$2.2 billion of Canada's total meat exports to the United States in 2023, followed by fresh or chilled swine at US$570.0 million and fresh or chilled bovine cuts at US$433.6 million.

Report Coverage

This research report categorises the market for the Canada meat extract market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada meat extract market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada meat extract market.

Driving Factors

The growing consumer demand for quick, need for high-protein, and high requirement natural food products as part of a more health-conscious lifestyle is driving the Canadian meat extract market. Further, the high need for functional foods and high-protein snacks from millennials drives market expansion, with the help of advancements in product formulation and flavour enhancement. Besides, the availability and uptake of meat extracts for culinary and seasoning applications are further increased by Canada's growing foodservice and retail industry. Additionally, market growth is fuelled by increased awareness of the nutritional advantages of meat extracts, such as their high concentration of vitamins, minerals, and amino acids. Further, business is driven by government support for clean-label and food safety products as well as investments in sustainable livestock farming.

The governments of Canada and local regulatory bodies of Ontario are actively promoting growth in the province's meat processing industry through a $10 million investment program designed to increase capacity, competitiveness, and food safety.

Restraining Factors

The fluctuating supply of raw materials, the public's views of health, legal obstacles, and rivalry from plant-based substitutes are the main factors limiting the Canadian meat extract market.

Market Segmentation

The Canada Meat Extract market share is classified into type and form.

- The chicken segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Canada meat extract market is divided by type into chicken, pork, beef, fish, turkey, and others. Among these, the chicken segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is broadly accepted and used in adding a rich, savoury umami flavour. Beef extract's growth is directly fueled by consumer demand for real, rich meat profiles in a range of dishes, from stocks and gravies to seasoned snacks and ready-to-eat meals. It is an essential ingredient for food manufacturers striving for consistent taste and quality because it can provide a strong, meaty foundation without requiring extensive cooking or processing.

- The powder segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The Canada meat extract market is segmented by form into powder, liquid, granule, and paste. Among these, the powder segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. It is highly soluble in water but insoluble in alcohol, and it has a unique scent that gives food items a meaty flavour. Nutrients like organic acids, vitamins, minerals, nucleotides, polypeptides, amino acids, creatinine, and creatine are all abundant in the powdered products. This is due to its growing use in food products as a flavour and nutrient enhancer, boosting the segment's strong growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Canada meat extract market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Maple Leaf Foods Inc.

- Olymel L.P.

- Cargill Meat Solutions (Canada)

- Sofina Foods Inc.

- Canada Beef (Industry Org.)

- Royal Delight Foods Ltd.

- Conestoga Meat Packers Ltd.

- Laval Meat Packers (Olymel subsidiary)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada meat extract market based on the below-mentioned segments:

Canada Meat Extract Market, By Type

- Chicken

- Pork

- Beef

- Fish

- Turkey

- Others

Canada Meat Extract Market, By Form

- Powder

- Liquid

- Granule

- Paste

FAQ

Q: What is the current and forecasted size of the Canadian meat extract market?

A: The market was valued at approximately USD 245.34 million in 2024 and is projected to grow at a CAGR of 3.61%, reaching around USD 362.22 million by 2035.

Q: What are the primary types of meat extracts in the market?

A: Major types include chicken, pork, beef, fish, turkey, and others. Among these, chicken held a substantial share in 2024 due to its broad acceptance for adding savoury flavour, followed by beef extracts, which are key for rich meat profiles.

Q: What are the main product forms in the market?

A: The market is segmented into powder, liquid, granule, and paste forms. The powder form dominated in 2024, favoured for its solubility and nutrient concentration.

Q: What are the key driving factors for market growth?

A: Growth is driven by shifting dietary trends toward high-protein and natural food products, advancements in product formulation and flavour enhancement, and expanding foodservice and retail industries in Canada. Increased consumer awareness of nutritional benefits such as vitamins, minerals, and amino acids in meat extracts supports market expansion. Government support for clean-label products and investments in sustainable livestock farming also contribute.

Q: What challenges does the market face?

A: Challenges include fluctuating raw material supplies, public health perceptions, regulatory hurdles, and competition from plant-based substitutes.

Q: Who are some key players in the market?

A: Key companies include Maple Leaf Foods, Olymel L.P., Cargill Meat Solutions (Canada), Sofina Foods Inc., Canada Beef (industry organisation), Royal Delight Foods Ltd., Conestoga Meat Packers Ltd., and Laval Meat Packers.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 212 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |